Baris-Ozer

- 3 sources of passive Income

- $912.82 from dividends

- 35 stocks/units dripped in October

- Trailing 12-Month Portfolio Return +6.22%

S&P 500 12 Month Total Return -14.61% for October 2022

S&P/TSX Composite Index 12 Month -9.35% October 2022

Hey Hey Hey

The market decided to climb back up this month and then interest rates rose once again. The narrative hasn’t changed both Tiff and Powell have said they aren’t done raising interest rates in previous hikes. Unfortunately, Tiff played his cards first hoping Powell would follow suit with a .5% raise and the US raised theirs .75% essentially devaluing our dollar. Inflation for Canadians should rise on this move alone as it now costs us more to buy stuff in USD.

While I have been a believer that they would hike rates until the end of December and then pause, I’m now kind of questioning that. Governments continue printing new money in the form of inflation relief, which ultimately fuels even more inflation. Cracks are starting to form. In my opinion, we are in for some hard times in the coming months as I’ve mentioned in a previous post.

Raises

We had 1 Raise this month.

- AbbVie (ABBV) raised their dividend by 5% boosting our forward income by $19.60

AbbVie has treated us very well since we bought them for around 70 bucks. Some people seem disappointed by the lower raise but I think it’s a good move as they navigate the Humira issues.

Total Added Income from Dividend Raises in 2022 – $401.07

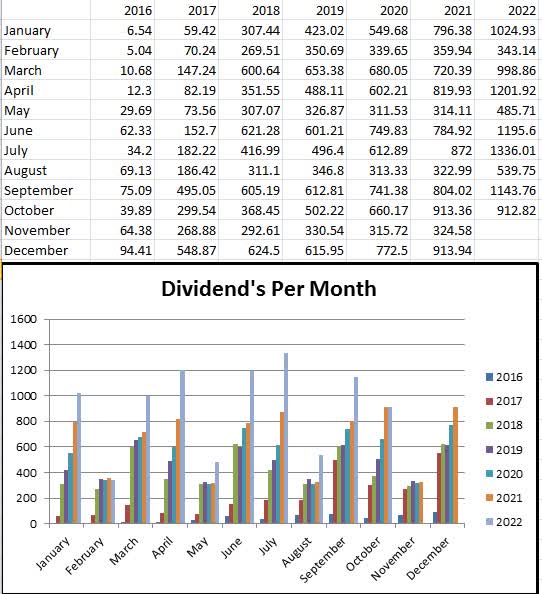

October 2022 Dividend Income

9 companies paid us this month.

| Stocks | October 2021 Dividends | October 2022 Dividends |

|---|---|---|

| Transcontinental (TCL.A:CA) | 27.68 (1 DRIP) | sold |

| TD Bank (TD) | 103.49 (1 DRIP) | sold |

| Bank Of Nova Scotia (BNS) | 93.60 (1 DRIP) | sold |

| RIT ETF (RIT:CA) | 65.75 (3 DRIPs) | sold |

| SmartCenters (OTCPK:CWYUF) | 32.99 (1 DRIP) | sold |

| Nutrien (NTR) (NTR:CA) | 28.13 | 31.58 |

| Restaurant Brands (QSR) (QSR:CA) | 74.32 | 105.33 (1 DRIP) |

| Cisco (CSCO) | 51.06 | 53.20 (1 DRIP) |

| Bell Canada | 139.13 (2 DRIPs) | 153.64 (2 DRIPs) |

| Aecon (ARE:CA) (OTCPK:AEGXF) | 0 | 114.52 (11 DRIPs) |

| Telus (TU) (T:CA) | 83.16 (3 DRIPs) | 136.46 (4 DRIPs) |

| Franco-Nevada (FNV) (FNV:CA) | 0 | 5.07 |

| TC Energy (TRP) (TRP:CA) | 116.58 (1 DRIP) | 157.50 (2 DRIPs) |

| Algonquin Power (AQN) (AQN:CA) | 97.47 (5 DRIPs) | 208.72 (14 DRIPs) |

| Totals | 913.36 | 912.82 |

35 stocks Dripped in October.

That’s a massive amount of dripped shares but both Algonquin and Aecon have plummeted this year, so it’s a good and bad thing. I’ll happily take these cheaper DRIPs though.

We see a slight dip in income year-over-year and this will actually get worse next quarter. I sold off all our financial stocks and REITs, as I said before I see bad times coming, especially in these sectors. I could be wrong though things dipped a bit and then came back up a doubling of interest rates in like 6-8 months in one of the world’s biggest housing bubbles that may eventually pop.

If you are interested check out our Previous Dividend Income Reports.

Our DRIPs (Dividend Reinvestment Program) added $41.92 to our yearly forward dividends this month. A beautiful thing.

Author

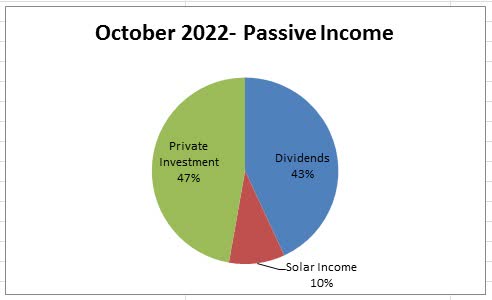

Other Income

Private Investment Payment – $1000.00

1k a month, straight to the HELOC.

Solar Panel Income

In September (we always get paid a month later), our solar panel system generated 729 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One (H:CA) (OTCPK:HRNNF) deposited $204.81 into our chequing account this month.

Last September, the system generated $232.99 so we are quite a bit lower this month. Not bad considering the last couple of months have been higher.

Total Income for 2022 – $2,102.38

System Installed January 2018

Total System Cost – $32,396.46

Total Income Received – $11,987.60

_____________________________________________

Amount to Break even – $ -20,408.86

Author

Total October 2022 Passive Income – $2,117.63

October 2021 Passive Income – $1,646.35

While the dividends are down, the passive income is up. A growth rate of 28.62% is very nice!

Author

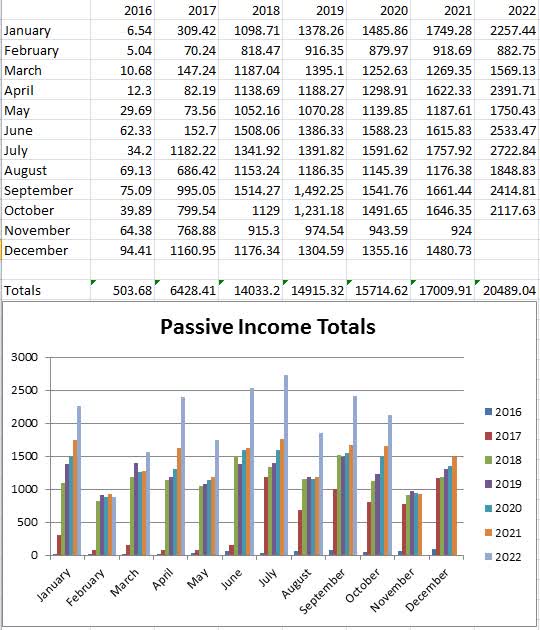

Totals For 2022

Dividends Year To Date Total – $9,182.5

Other Passive Income Year to date – $11,306.54

Total Passive Income for 2022 -$20,489.04

Year-End Goal – $25,000

Looks like we will fall short of our goal, but it’s all good. I set out a very lofty goal and we actually will be close to hitting it, that’s amazing.

October Stock Purchases

I’ve said it before but I always planned on growing our tech positions when the market pulls back. This month we added to 2 of our holdings after their generous raises last month.

Texas Instruments (TXN)

We added 6 more shares to our position at 154 and changed. This purchase added $29.76

Microsoft (MSFT)

If I could only pick one stock to hold for the next 10 years, this would be it. I have always wanted to increase our position size with them and plan to have them in my top 3 before spring next year. Tech is moving so fast and Microsoft is everywhere. If (I hope so) the Activision deal goes through, they will be an absolute powerhouse in the “metaverse”. I got a buddy who is big into tech healthcare and it’s amazing what is happening with the use of Microsoft products and virtual reality.

They also tend to raise the dividend by 10% per year as well. We added 4 more shares this month at 233 per share. Adding 10.88 to our forward income.

I liked Microsoft at 233 and like it a lot more at 215, this is most likely my next buy as well. Will it break 200?

Financial Goals Update

Charities

- We continue our monthly donation to The Nature Conservancy of Canada for $85.

Increase Dividends by $4285.81 this year. (bringing our forward income from dividends to $13,000 a year)

Unfortunately, I’m going to disregard this now. While we could have been really close to hitting this, things changed. I’m not as bullish on the market and with interest rates doubling in 6 months (and still growing), I decided to pay off all our HELOC which we used for investing. As long as the forward passive income is higher at year-end vs. the last year, it’s all good.

ETF Monthly Minimum Purchase of $250

- This month we added 8 more units of XAW ETF.

- Questrade is great because it offers free ETF trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

October 2022 Passive Income Conclusion

Overall a good month. Halloween was a lot of fun and camping well that’s always a blast. I’m glad to see the tech sector falling as it’s one sector of ours that needs some major pumping up. What sectors or positions have you been buying?

Wish you all nothing but the best, cheers.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment