Khanchit Khirisutchalual

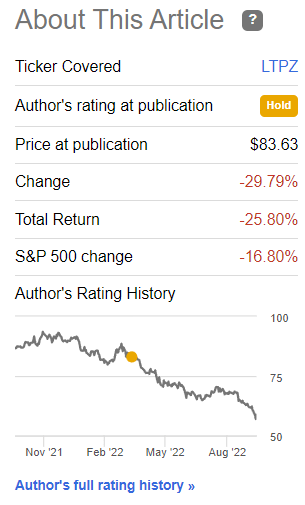

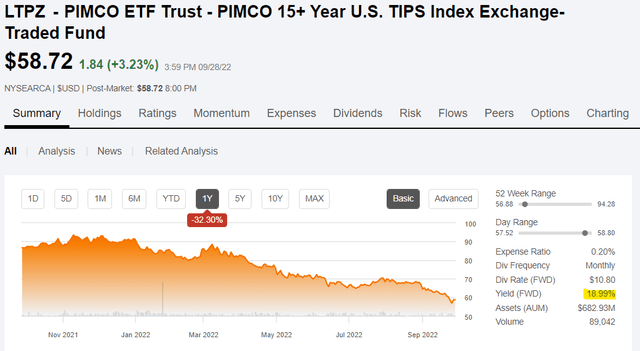

Earlier in the year I wrote about the PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (NYSEARCA:LTPZ), an index ETF investing in long-term treasury inflation-protected securities, or TIPS. LTPZ benefits from increased inflation, but is harmed from increased interest rates. Lower inflation and higher rates would be a particularly negative situation. As said situation seemed somewhat likely, I argued against investing in the fund.

Since then, interest rates have skyrocketed, courtesy of the Federal Reserve, while inflation remains elevated. One risk materialized, with LTPZ underperforming, more or less as one would expect.

LTPZ Previous Article

Conditions have materially changed since, so thought an update was in order.

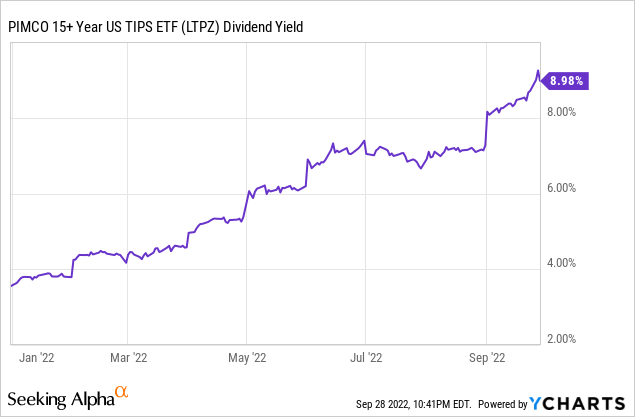

Skyrocketing inflation, rising interest rates, and lower bond prices have led to a significant increase in LTPZ’s dividend yield. The fund currently yields 9.0%, a massive yield, significantly higher than that of most broad-based asset class index ETFs, and almost fully-covered by underlying generation of income. The fund’s yield will plummet once inflation normalizes, which is almost certain to occur. At current prices, LTPZ should yield around 1.5% plus inflation, so 3.5% if inflation reaches the Federal Reserve target of 2.0%. Expected yields are a bit higher than average, but not significantly so.

In my opinion, LTPZ is currently fairly valued, and makes for a reasonable investment opportunity. Won’t label the fund a buy as its value proposition is a bit niche, and funds with more stable dividend yields are a better match for most investors, but the fund is fine as is.

TIPS Overview

Quick explanation of how TIPS, the fund’s underlying assets, work. Feel free to skip this section if you already know all about these securities.

Treasuries, including TIPS, are the safest assets in the world, backed by the full faith and credit of the U.S. governments. Treasuries offer investors ultra-safe, dependable, albeit low, interest rate payments and dividends.

TIPS have the added benefit that their dividends, capital, and returns, are protected against inflation. This is because their face value and coupon rate payments are indexed to the Consumer Price Index, or CPI, an inflation index, for positive values of said index. In simple terms, TIPS returns are roughly equal to their interest rate plus inflation.

Let’s explain the above with a quick example.

Say you invest $1,000 in TIPS at a 1% yield, equivalent to an interest payment of $10 per year.

If inflation increases to 10%, so would the value of your investment and interest. Your investment would increase in value from $1,000 to $1,100, while your interest payment would increase from $10 to $11.

Total returns would be equal to $100 plus $11, effectively equivalent to inflation plus interest rate (10% + 1%). Returns are generally distributed to investors in the form of dividends.

Higher rates of inflation would lead to greater gains and vice versa.

Deflation, on the other hand, has no effect on the value of your investment, interest, or shareholder returns/losses.

If inflation decreases to -10%, your investment would retain its $1,000 value, and your interest payment would remain at $10. This holds true for all rates of deflation.

With the above in mind, let’s have a look at LTPZ.

LTPZ – Overview and Analysis

LTPZ is an index ETF investing in long-term TIPS, with average maturities of 20 years, and average yield of 1.5% plus inflation. The fund has the same characteristics, benefits and drawbacks of TIPS and long-term bonds. Let’s have a look at these.

LTPZ – Benefits and Positives

Effective Inflation Hedge

LTPZ’s underlying holdings are all indexed to inflation, and so see higher dividends, prices, and returns when inflation is high and rising.

As most readers are well aware of, inflation is surging, reaching a 40-year high earlier in the year. Inflation is elevated due to skyrocketing demand from improved economic fundamentals, supply issues from supply chain disruptions, lingering effects from pandemic-era lockdowns, and the Ukraine War. Surging inflation means significantly increased TIPS yields, resulting in higher income for LTPZ, and higher dividends for the fund’s shareholders. The fund currently sports a trailing-twelve-month yield of 9.0%, an incredibly strong figure.

As can be seen above, LTPZ’s dividends have seen strong growth all year, as inflation continues to increase. Fully accounting for said growth would mean much higher dividend yields. As an example, annualizing the fund’s latest dividend payment, as SA does, would lead to a massive 19.0% yield.

LTPZ’s strong dividends are fully-covered by the interest and capital gains generated from its TIPS holdings, both of which are strongly dependent on inflation remaining elevated. As such, I would not consider the fund’s strong dividends themselves to be a benefit, and would focus on the inflation exposure instead.

Moving forward, LTPZ’s dividends should almost certainly decrease, as inflation will almost certainly normalize, sooner or later. The Federal Reserve targets a long-term inflation rate of 2.0%, significantly below the current 8.3% rate. The Federal Reserve has indicated that current inflation rates are excessively elevated, and will hike rates until inflation is under control. Although there is some debate about the speed and effectiveness of Federal Reserve policy, it seems clear that current inflation rates are unsustainable, and that the relevant regulatory authorities will take action until these are brought to more sustainable levels. As such, inflation will almost certainly come down in the coming months.

Lower inflation should ultimately result in lower dividends for LTPZ, a significant negative for the fund and its shareholders. How much lower is dependent on how strongly, and quickly, inflation decreases, but one can still analysis the situation and make some educated guesses.

As per the U.S. Treasury, LTPZ’s underlying holdings, long-term TIPS with remaining maturities of around 20 years, have an average yield of 1.5% plus inflation. The Federal Reserve targets a long-term inflation rate of 2.0%. Assuming said target is met, LTPZ’s dividend yield should decrease to around 3.5% in the coming years. If inflation persists for longer than anticipated, as has been the case so far, the fund’s strong dividends should persist as well.

As a final point, TIPS yield are currently somewhat higher than they have been in the past. As per the U.S. Treasury, for the past decade long-term TIPS yield have averaged 0.6% plus inflation, while these same securities currently yield 1.05% plus inflation. It is a small difference, but not inconsequential, and one that benefits LTPZ and its investors.

Low Credit Risk

LTPZ exclusively invests in treasuries, the safest securities in the world, backed by the full faith and credit of the United States Federal Government. Credit risk is effectively nil, barring an unprecedented U.S. government default. LTPZ’s holdings are incredibly safe securities, a significant benefit for the fund and its shareholders.

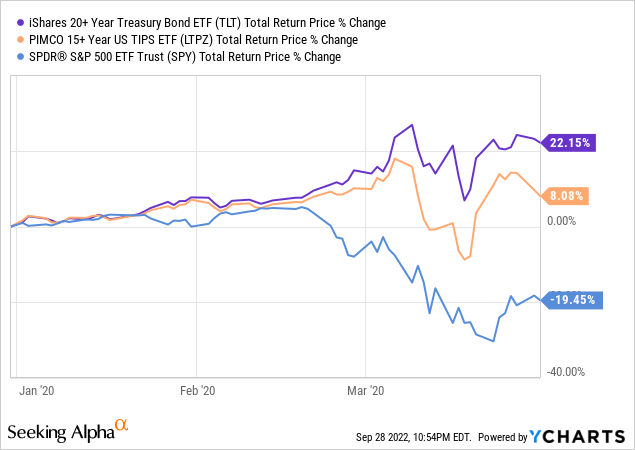

LTPZ’s holdings also outperform during downturns and recessions, due to a flight to quality effect. Investors know treasuries are safe, so they flock to treasuries when times are tough. Monetary policy also plays a role, as the Federal Reserve tends to lower interest rates during downturns and recessions, which boosts bond prices, leading to capital gains for bond funds, including LTPZ. Expect the fund to outperform during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic. LTPZ did lag behind normal long-term treasuries, probably the best-performing asset class during most recessions.

LTPZ – Risk and Negatives

Interest Rate Risk

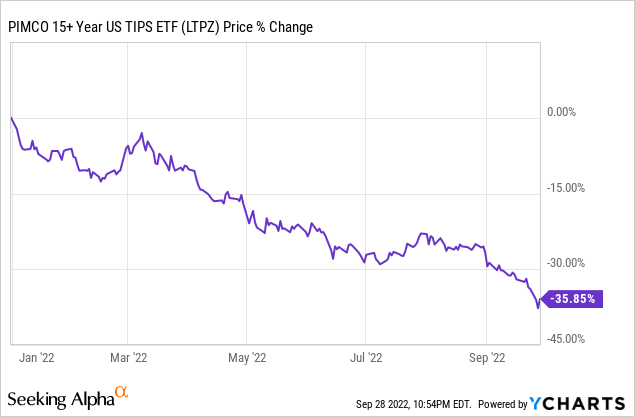

LTPZ invests in long-term TIPS which, as most long-term bonds, have quite a bit of interest rate risk. The fund itself has a duration of 20 years, so should see capital losses of 20% for every 1% increase in interest rates, a staggering amount. Long-term interest rates have risen by about 2% YTD, as per the 20Y treasury, so the fund should have seen capital losses of around 40.0% for the same. Realized losses came in somewhat lower at 36%, due to elevated inflation.

LTPZ’s significant interest rate risk could lead to outsized capital losses if interest rates were to continue to increase, a significant negative for the fund and its shareholders.

Inflation Risk

LTPZ’s holdings see stronger dividends and returns when inflation increases, a positive, but lower dividends and returns when inflation decreases, a negative. With inflation running at decades-highs, and with the Federal Reserve intent on crushing inflation, inflation will almost certainly decrease in the coming months, a negative for the fund and its shareholders. LTPZ could still offer reasonably good dividends if inflation were to remain elevated for longer than expected, a distinct possibility, but current dividend yields are almost certainly long-term unsustainable.

Conclusion

LTPZ offers investors exposure to long-term TIPS, securities which see strong capital gains, dividends, and returns when inflation is high. As inflation is currently elevated, the fund offers investors strong dividends and potential returns. As inflation normalizes, both should decrease. Assuming inflation decreases to the long-term target of 2.0%, LTPZ’s dividend yield should drop to around 3.5%, a bit higher than its historical average yield. Under these conditions, the fund seems reasonably valued, and is a fair investment opportunity.

Be the first to comment