Maria Vonotna

MGIC’s knock-it-out-of-the-park Q3.

The Houston Astro’s Yordan Alvarez was not the only one to hit a homer last week; I think MGIC’s Q3 qualifies, in many ways:

- MGIC reported Q3 EPS of $0.86, beating the average Wall Street analyst estimate of $0.53 by a whopping $0.33. OK, it wasn’t quite that good. MGIC benefitted from its often misleading “losses incurred” accrual accounting, by reversing $116 million of prior accrual expenses made when COVID hit. After then subtracting $12 million of debt buyback losses, MGIC generated operating EPS of $0.54.

- MGIC returned $125 million to shareholders through dividends, share repurchases and debt repurchases. That’s $0.41 per share, or a 12% annualized return.

- Despite the large capital return to investors, MGIC increased its excess regulatory capital since the beginning of the year from $2.1 billion to $2.6 billion.

- The number of delinquent loans MGIC is insuring fell to 25,878, down by 22% year-to-date.

- Insurance in force grew by 9% annualized during Q3 and year-to-date.

What’s not to like? Investors in fact don’t like MGIC much at all.

MGIC’s “A disaster is coming” valuation

MGIC sells at a 6 P/E

Even with this year’s bear market, the S&P 500 is currently at a 16 P/E. So MGIC’s relative P/E ratio is a sad 38%.

MGIC sells at an 88% price-to-book value

Note that the book value already includes a $1.50 per share writedown to its bond investments due to higher interest rates. It also doesn’t include the value of MGIC’s $294 billion of mortgage insurance in force.

Assuming MGIC should sell at a 10 P/E ratio, the current stock price implies that its current claims paid rate rises from $44 million a year at present to over $3oo million for many, many years ahead. A normal 12 P/E assumes that multi-year claims payments rise to $400 million. Those assumed losses may not seem so impossible. After all, MGIC had losses in that range as recently as 2018.

But consider that for all the insurance MGIC wrote since 2010, it had to make only $119 million of claims payments. The 2018 claims paid were overwhelmingly from pre-’09 business. MGIC’s stock is pricing in about one-quarter of the company’s Financial Crisis losses. Is that reasonable? Not if we consider MGIC’s three huge protections:

- Underwriting standards

- Reinsurance

- The state of the US housing market.

Protection #1: Underwriting standards

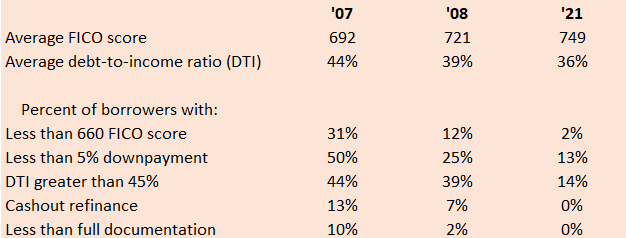

The table below compares MGIC’s lending standards in

- 2007, the origination year it generated its greatest losses ($5.4 billion)

- 2008, an origination year when it generated $1 billion in losses

- 2021, which represents 35% of its total risk today:

MGIC financial statements

Today’s lending standards aren’t subtly better, they are dramatically better. Let this table sink in a bit. Get in a comfortable yoga position (or have a more agile friend do so), take 10 deep breaths and look again. This table is important. There is a reason why MGIC’s claims payments from the last 12 years of insurance have been so low.

Protection #2: Reinsurance

MGIC keeps shifting significant portions of its mortgage default risk to other investors. The percent of its insurance book that is reinsured is 94% today compared to 74% at the end of 2015.

Protection #3: The state of the US housing market

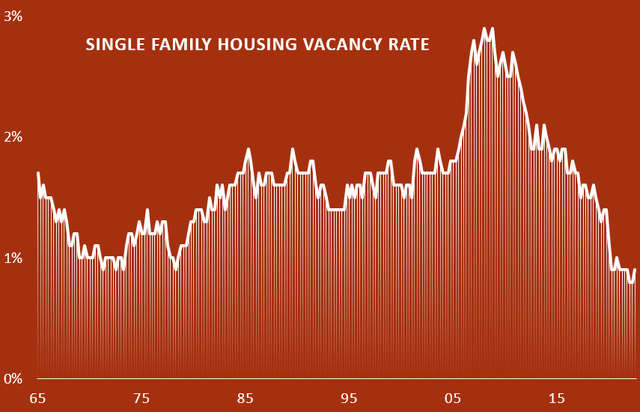

I’ve shown this chart in so many reports, I’m almost sick of it. I’m kidding, I never get sick of it, because it will make me a lot of money. It is the percent of US single-family homes that are vacant. This chart gives excellent insight into the supply/demand balance in the US:

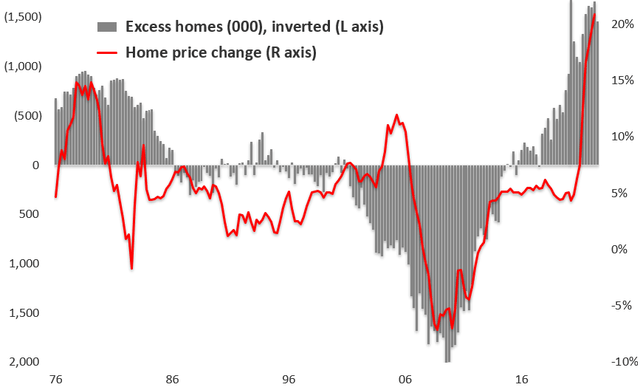

We sit at a record low! Compared to a record high in ’08. The US today is historically short of housing. Economic theory says that a supply shortage leads to higher prices. Does the theory actually work in the real world? Let’s see. I compared a version of the data behind the above chart with home prices. The version estimates the amount of housing units (homes and apartments) the US is long or short, compared to a normal 3.5% vacancy rate. Here’s what the comparison looks like:

Census Bureau, Federal Housing Finance Administration

The theory works! The housing supply/demand balance is a major driver of home prices. The ’20-’22 home price boom was explained by our severe housing shortage. And unless homebuilders start constructing like crazy (they are in fact now doing the opposite), it is hard to see how home prices are going to fall by anywhere near the amount they did from ’06-’11.

MGIC’s capital-light strategy is a huge win for shareholders

The negative of MGIC’s safer lending standards and greater purchase of reinsurance is clear. Safer lending means lower average premiums charged to homebuyers. More reinsurance means giving up more of those lower premiums to other investors. MGIC’s insurance premiums earned for Q3 ’22 were $252 million. It earned a nearly identical $250 million in Q3 six years ago! Shame on you, MGIC, for not growing.

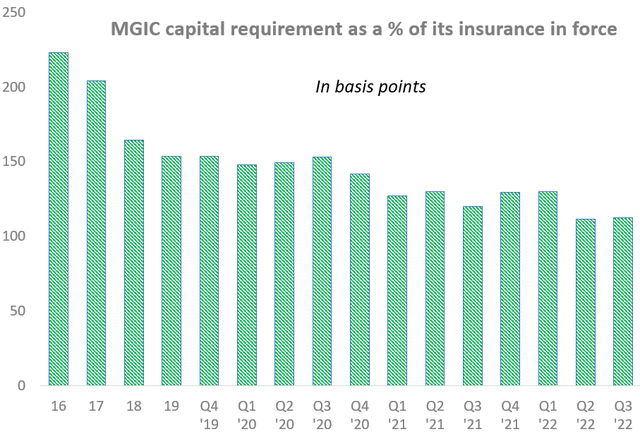

But you should consider the two positives of these changes. One is lower losses in any housing scenario. Remember the meager claims payments on the 2010 and forward insurance written? The second benefit is that MGIC has to hold far less capital against its lower risk business. A lot less capital, as this chart shows. The data is MGIC’s regulatory capital requirement as a percent of its insurance in force:

Its capital requirement is only half of what was in 2016! This is huge for shareholders. MGIC added $20 billion of new insurance in force this year. Yet its capital requirement declined by $300 million. So its $475 million in cash earnings this year to date is all free cash available to shareholders. MGIC paid shareholders $423 million this year so far through dividend and stock/debt buybacks. That’s over $1.30 a share, or a 10% return, for only three quarters. And unless MGIC’s losses actually do rise sharply, those significant returns to shareholders are likely for many years. I do note that management expects to hold on to more capital near-term until we all learn how weak the economy might get.

Wrapping up

Yes, we are in a housing recession that will last a while. No, it will look nothing like ’08, but more like the recessions prior to that. Yes, home sales and new home construction are declining. But that doesn’t mean large numbers of families will be tossed from their homes. Not unless either the Fed is determined to raise mortgage rates until that happens or the likely recession ahead is really bad. The most likely outcome is that interest rates are near their peak and that the coming recession will be normal or even mild.

If so, MGIC will be able to sustain $2+ EPS and its $15 book value will start rising soon. And its $13 stock price will look awfully cheap.

Be the first to comment