Kirillm/iStock via Getty Images

I’ve written many times that I think investing is a relativistic process, meaning that if an investor buys X, they eschew countless Ys by definition. It’s all well and good for me to write that in a purely theoretical sense, but it’s time to stress myself somewhat and actually compare two of my most recent, relatively painful investments. Both of these retail stocks have fallen dramatically relative to the overall market in a very short period of time, and this demands some attention. It’s time to work out whether or not the market has gotten ahead of itself on these names, and, to wonder on virtual paper which of these two laggards I prefer. It may also be the case that I take my lumps, sell, and go home. I may end up recommending neither.

In particular, I want to compare Victoria’s Secret (NYSE:VSCO) and The Gap Inc. (NYSE:GPS). I’ll be working out what to do with my own investments by answering the following question for all of you: if an investor were coming to this party for the first time today, which of these two stocks would be the better buy?

I know that my writing can be a bit tough to take for some readers. My jokes very often fall flat, I have the tendency to drone on about theory, and this may be tiresome to people who simply want actionable ideas. So in response to this I write “thesis statement” paragraphs at the beginning of each article. These give you more than what you’d glean by reading the title and bullet points, above, but also insulate you from the need to wander into the dark labyrinth of my mind. Here goes. I think Victoria’s Secret offers superior risk adjusted returns from this point for a few key reasons. While both stocks are trading at historical low valuations, the assumptions embedded in Victoria’s Secret stock are even more dour than The Gap’s. Additionally, Victoria’s Secret seems to be paying attention to their market in a way that The Gap isn’t in my view. To throw out a favourite quotation by a CNBC journalist, Victoria’s Secret is transitioning from “racy and exclusive” to “tasteful and inclusive.” I’ve got friends who decry this as a return to some form of puritanism, but I’m of the view that if the market likes it, the market likes it, and so we should get behind the move. While I think The Gap’s recent financial performance wasn’t as bad as it at first appears (more on that below), I think Victoria’s Secret is the clear winner here.

The Gap

The Gap has published financials since I last looked at the company, so I need to update my perspective on the firm. On the face of it, I can understand why some shining lights on Wall Street have downgraded the firm because things don’t look great.

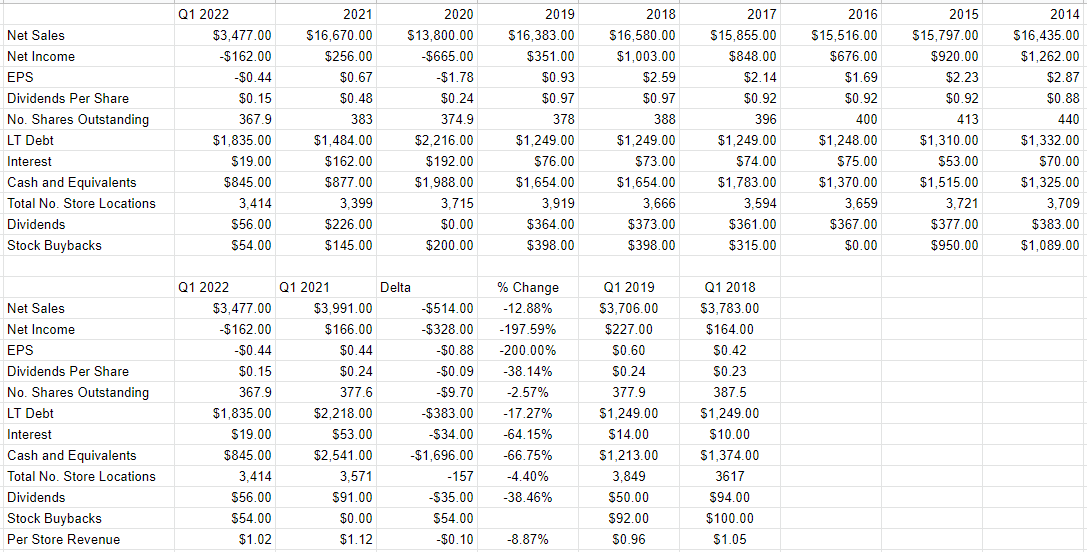

Specifically, relative to this time last year, revenue was down by 12.9%. Additionally, in spite of the fact that the company did a fairly good job of reducing operating expenses by $20 million (down by 7%), and net interest expense was lower by $34 million (down by 64%), net income swung from a positive $166 million to a negative $162 million. This is obviously troubling, but I think we’d be wise to put this drop in sales into some kind of a context.

There were 157 fewer stores during the most recent context relative to the same period a year ago, so I think it reasonable to suggest that that goes at least part of the way toward explaining the fall in revenue. Specifically, store count dropped by 8.9% over the year. That said, though, the relative performance was definitely light, given that per store revenue declined from ~$1.12 million per location to about $1.02 million per location. So, the performance during the first quarter was softer than it was during 2021, but performance was not as bad as it at first appears.

This prompts another question for us, though. How did 2021 stack up against trend? After all, if the first quarter of 2021 was atypically good, any comparison to it should be taken with a grain of salt. Conversely, if 2021 was itself a soft year, an even softer 2022 should give us pause. I thought I’d compare the first quarter of this year to the same period in both 2019 and 2018. During the first quarter of 2019, the company generated ~$3.7 billion and had 3,849 stores outstanding. During the first quarter of 2018, the company generated $3.783 billion and had 3,617 stores outstanding. Using the mathematical skills so violently imparted to me by the good sisters at Holy Spirit School many decades ago, I’m able to work out that revenue per store in 2019 was ~$960 thousand, and revenue per store in 2018 was about $1.05 million. This suggests to me that the $1.02 million generated per store in 2022 was hardly an outlier. In fairness, each of 2018, and 2019 were very profitable years for the company. 2018, for instance was the highest level of profits since 2014. That said, I think it fair to say that the first quarter of 2021 was more extraordinary than was Q1 2022. Please “put a pin” in this idea, because I’m going to come back to it later.

Switching over to the capital structure, it strikes me that things have improved on that score, which reduces the level of risk here in my estimation. Specifically, the level of long term debt has declined fairly massively by $383 million, or 17.27%. Although cash has declined precipitously (down ~$1.69 billion), the $845 million in cash remaining is sufficient to continue to fund both the current dividend and operations in my view.

The Gap Financials (The Gap investor relations)

The Gap Stock

My regular reader-victims know that I like to consider the stock and the company distinctly, because they’re very different things. The company takes various inputs (like labour, clothing and the like), adds value to them by displaying them in attractively lit, convenient locations, and then hopefully selling the products at a profit. The stock, on the other hand, aggregates the crowd’s views about the potential profit generating capacity of the company over time. The fact that we’re all here on this forum is an indication of the fact that we all believe that the stock is sometimes (often?) a poor proxy for the financial health of the underlying business. We believe that it’s quite possible that the stock is mispriced, otherwise we wouldn’t bother investing in anything other than index funds.

Remember when I asked you to “put a pin” in the idea that the per store revenue during the latest quarter was within trend, and that Q1 2021 was more outlier than Q1 2022? Well please remove that pin, because it’s time to think about the latest performance in the context of the stock itself.

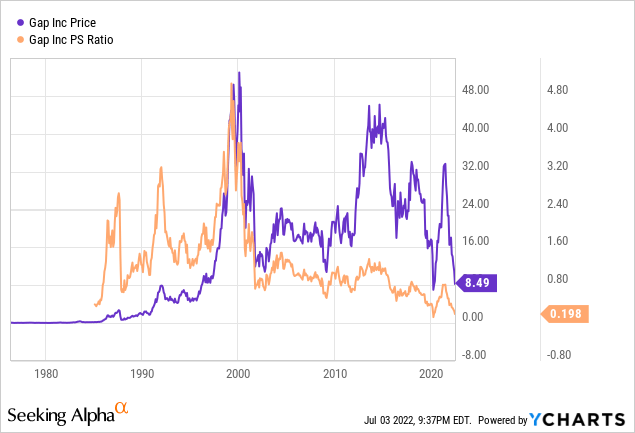

My regulars also know that I’m of the view that there’s a negative relationship between price paid and subsequent returns. I’m of the view that the higher the price paid, the lower the subsequent returns. This is why I try to buy shares when they’re most cheaply priced. As you may know if you subject yourself to my stuff regularly, I measure the cheapness (or not) of a company in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like sales, or net income, and the like. Before buying, I want to see a company trading at a discount to both its own history and the overall market. When we look at shares of The Gap, we see that they’re trading at an all-time low on a price to sales basis, per the following:

Please note that they’re cheaper now than they were during the depths of the great financial crisis.

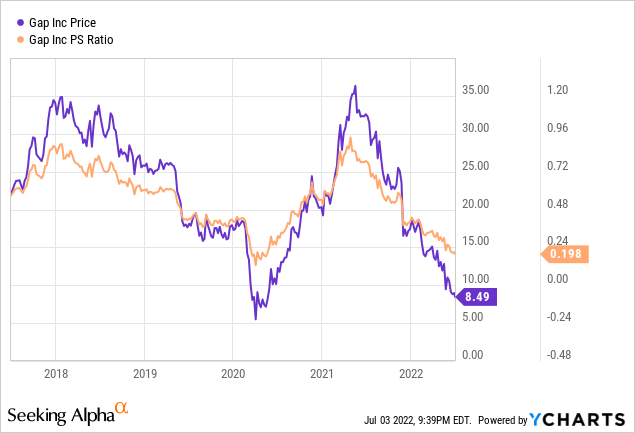

Zooming in more closely, I think it’s interesting to compare the current ratio of price to sales to 2018. Back in 2018, the shares were trading at a price to sales ratio of ~0.7. Remember that the per store revenue was at the time about $1.05 million. Today, the per store revenue was about $1.02 million, or down about 3% and yet price to sales rates have collapsed by about 71%, per the following:

In addition to looking at simple ratios, I also look at the assumptions embedded in price. I do this by isolating the “g” (growth) variable in a standard finance formula. I was first introduced to this idea in the great book “Accounting for Value”, written by Professor Stephen Penman, but other authors have suggested a similar strategy. For instance, you can have a look at Rappaport and Mauboussin’s book “Expectations Investing” for more on this approach. Anyway, the idea is that if we use some high school algebra, we can isolate what the market must be assuming about the long-term future of a given company. We then decide whether that assumption is too rosy or too pessimistic, and buy (or not) accordingly. Applying this approach to The Gap seems to suggest that the market is assuming that the company will be bankrupt in about 13 years. In my view, this is a stretch, and therefore it’s more likely than not that the shares are priced too pessimistically, and therefore represent fairly good value, and for that reason they constitute a buy.

Now Let’s Switch Gears & Take Another Look At Victoria’s Secret

It may come as a shock to some of my regular readers, but I actually don’t like repeating myself. Given that, Victoria’s Secret hasn’t published new financial results since I last wrote about them about a month ago, so if you’re interested in my take, I would recommend reading my previous work as nothing’s changed on that score. In case the effort involved in clicking on the previous article is too much, I’ll summarize as briefly as I can. If we strip out last year’s $75 million stimulus benefit, sales were basically flat from last year to this. Also, the alarming growth in inventory can be largely explained by longer transportation times and higher transportation inflation. The company has telegraphed to the market to expect no growth for the year. I also suggested that the introduction of the “love cloud” for instance, is a sign of a change of culture. To quote a writer for CNBC, the company is on the path to transitioning from being “racy and exclusive to tasteful and inclusive.” I’m generally favourably disposed toward all of this.

Victoria’s Secret Stock

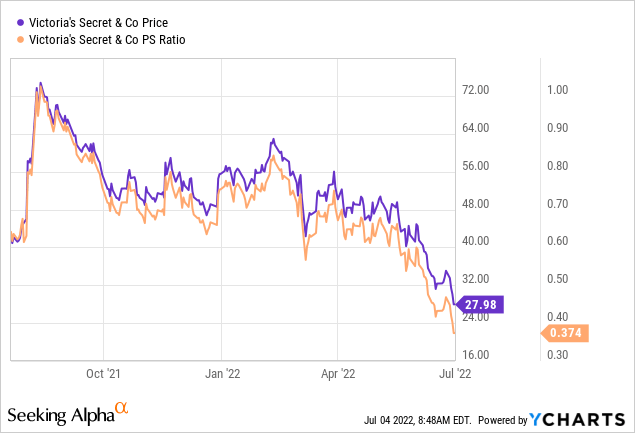

If you’ve read this far, you may remember that I consider the stock and the company very different things. For that reason, I review them separately. Victoria’s Secret doesn’t have much of a history of trading as a standalone entity, but I think it’s worth reviewing where the shares are relative to their admittedly short past. We see from the following that on a price to sales basis, the shares are trading at a record low. The market is paying $0.374 dollars for every $1 of sales at the moment, suggesting that the mood is quite dour.

When I apply the approach from “Accounting for Value” or “Expectations Investing” above to Victoria’s Secret stock, a similar story to The Gap emerges, but this time it seems the stock is priced for bankruptcy in only five years. This also strikes me as very pessimistic, and so my inclination is to buy more.

There Can Be Only One!

It’s now time for me to pick my favourite stock and now that I’ve reviewed each in turn, I find the exercise surprisingly easy. I think Victoria’s Secret is a clear winner here for two key reasons. First, the company is showing some signs of embracing the changing tastes of its market, and that is reflected in the fact that they were flat for the year during a very challenging time. Both stocks seem to be trading at all-time lows on a price to sales basis, so there’s no advantage there, but according to the methodology laid down by Penman, the market is treating Victoria’s Secret even more harshly, which I like a great deal. While I think The Gap is superior to Victoria’s Secret for those people seeking income (the former pays a reasonably sustainable dividend, while the latter doesn’t at present), there are superior income streams to The Gap, so that’s hardly a ringing endorsement in my view. If you’re an income investor, you’d be better off eschewing both names. So, while I’ll be holding both stocks, and I’m confident that the returns over the next two years will be positive, I think Victoria’s Secret has the potential for greater risk adjusted returns in my view.

In closing, I want to remind investors that the way we achieve outsized gains is by buying when others are irrationally selling. Think back to 2009 if you’re old enough. In March of 2009, did it make sense to buy the market when it was stuck in the slough of despond? Not really, as the news remained awful. In spite of that, the people who did buy when all of the news was bad did better over time. That’s the reason why investing is simple but not easy. You need to “buy low”, but in order to do that, you need to be willing to pull the trigger when others are fleeing the market. The people who are fleeing the market today aren’t fools. They’re doing so for very sound reasons. I think we need to acknowledge this, and be charitable toward them, as we buy from them.

Be the first to comment