anusorn nakdee/iStock via Getty Images

Investment Thesis

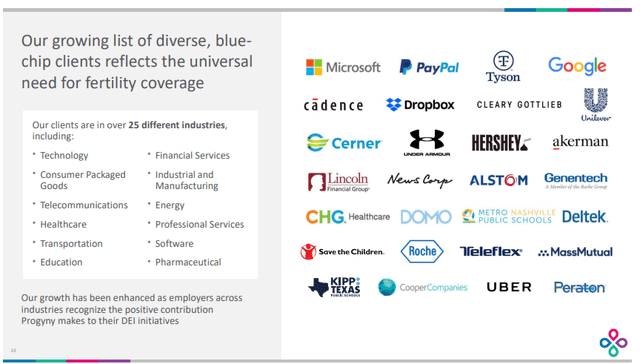

Progyny (NASDAQ:PGNY) is a benefits management company specializing in fertility and family building. Their client list already includes many prominent employers, and the client base is rapidly increasing (over 265 clients with at least 1,000 covered lives). Progyny currently has contracts to cover approximately 4.0 million employees and their partners. Infertility is a common occurrence, impacting one-in-eight couples, so I expect Progyny will continue to grow in the future. I believe Progyny is a great investment option because:

- Progyny’s growth is only just starting. The addressable market for fertility benefits is huge, because there is no effective solution at this point.

- Even though Progyny is a young and growing company, they are already profitable and cash flow positive ($14 M of operating cash flow). The profitability will only increase from now on.

- They are financially a very strong company with minimal debt ($8.4 M) and strong liquidity (current ratio at 2.4x)

Fertility Benefit Market Landscape

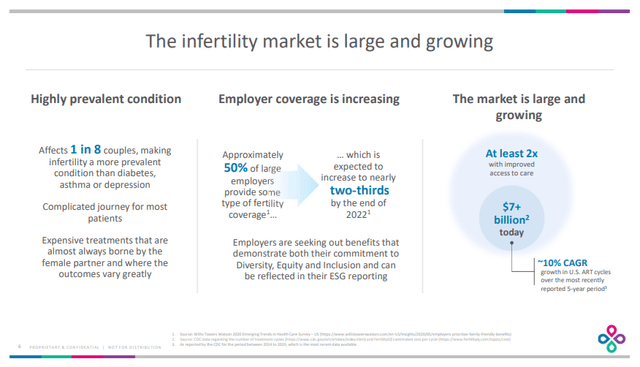

Infertility is a highly prevalent condition in the U.S. One in eight couples are affected by infertility, which is about 6.7 million people each year. In the past, infertility did not get much support or attention because of limited technology and a negative perception surrounding treatment. Many health care services and employee benefits did not cover infertility. However, that perception has been changing. More and more people see infertility as a disease that can be treated, and more employers are now starting to provide fertility benefits. Progyny is doing really a great job at taking advantage of this trend, and has been expanding their client base rapidly in the past several years.

Size of Infertility Market (Progyny Investor Relations) Progyny Clients Base (Progyny Investor Relations)

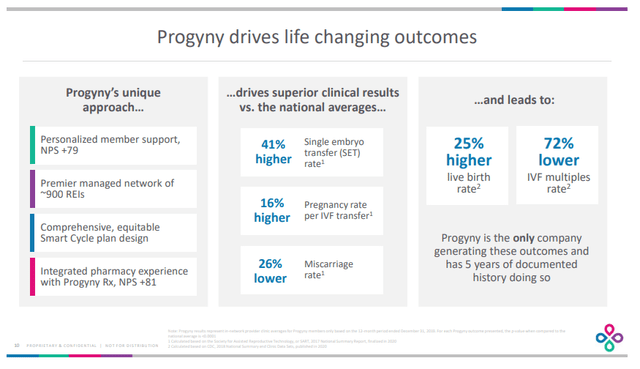

Progyny is effectively addressing three main challenges in the space: the lack of a comprehensive fertility benefit solution, large cost of maternity neonatal intensive care from multiple births, and the need for employers to find innovative ways to attract and retain high level talent.

Currently, patients following a conventional fertility benefit plan often make poor clinical decisions (e.g., transferring multiple embryos due to financial pressure) because of restrictive features of the benefit (e.g., lifetime dollar maximums). These poor choices typically result in greater costs for the employers. With their data-driven platform and differentiated benefits plan design, Progyny is delivering superior results against the national average. The results benefit both employees (higher success rates of a live birth) and employers (lower costs). With superior results and great marketing, Progyny is rapidly expanding their client base (47% growth in number of clients), and their revenue is growing rapidly as well (48% YoY).

Progyny’s Superior Outcome (Progyny Investor Relations)

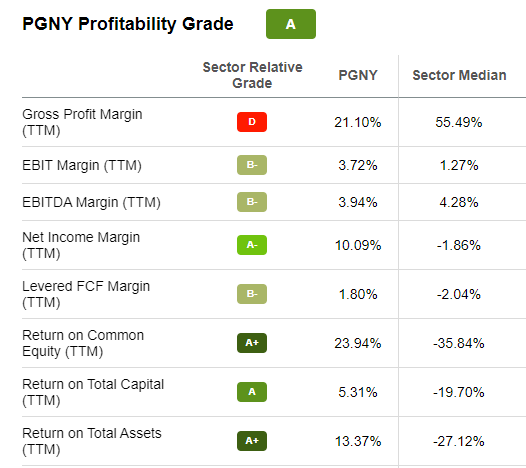

Strong Profitability and Cash Flow

Not only is Progyny growing at a fast pace, but they are also doing a great job at generating cash and maintaining profit margin. Their net income margin and return on common equity is high compared against sector medians, and clearly demonstrates that Progyny offers a superior business model against competitors. Management is doing a great job at deploying the company’s resources. Given that Progyny is still in an early stage (IPO on October 2019), it is very impressive to see this kind of profitability at this point. They turned operating cash flow positive in 2020. With exceptional revenue growth (80%, 5 year average) and well maintained profitability, I expect Progyny to continue to thrive in the future.

Profitability of Progyny (Seeking Alpha)

Financial Security

Progyny is a financially secure company as well. They have total cash of $105 M against total debt of $8.42 M, which gives them a net debt position of negative $97 M. This strong cash position, combined with already positive operating cash flow, will provide Progyny with plenty of resources to support their growth plan and marketing power to expand their client base. Additionally, their liquidity is well above the industry average. Their current ratio of 2.4x and quick ratio of 2.4x give peace of mind that they are nowhere close to financial distress. For such a young and growing company, it is great to see that they are managing their liquidity very well.

Cappuccino Stock Rating

The detail of the metrics can be found here.

| Weighting | PGNY | |

| Economic Moat Strength | 30% | 4 |

| Financial Strength | 30% | 5 |

| Growth Rate vs. Sector | 15% | 5 |

| Margin of Safety | 15% | 3 |

| Sector Outlook | 10% | 4 |

| Overall | 4.3 |

Economic Moat Strength (4/5)

Progyny has a well defined economic moat. Their platform and benefit design are clearly providing superior clinical results, which benefits both employers and employees. With the well defined economic moat, I expect them to successfully keep expanding their clients base and increase revenue.

Financial Strength (5/5)

Progyny is financial a very secure company. They have an ample amount of cash (over $100 M) with negligible total debt. Given the uncertain market environment and potential recession on the way, it’s great to see Progyny has strong cash and liquidity positions. Investors can have peace of mind in this category.

Growth Rate (5/5)

Progyny has been growing at a rapid pace in the past several years (80% revenue growth per year, 5 year average), and I expect them to continue this growth streak. Maybe not quite 80% per year, but 40-50% per year revenue growth is certainly within reason. Their superior clinical result and marketing plan will deliver strong growth.

Margin of Safety (3/5)

Because Progyny is a young company, and they do not have a long track record yet, the stock price will move up and down quite wildly, especially when the stock market is so volatile like now. The recent drop of stock price (~50% from the November high) provides a great opportunity for investors, but, as I expect market volatility to continue, it’s hard to assign higher than 3 in this category for a young growth company like Progyny.

Sector Outlook (4/5)

Overall health care sector will continue to grow as technology advances and the population ages. Particularly, the infertility market will grow at a stronger pace (~10% per year) than the overall health care market. It’s not exceptional growth like can be found in some of the tech sector, but it should be adequate to present a great growth opportunity for Progyny.

Risk

Progyny is enjoying a first mover benefit at this point, and I expect them to maintain their economic moat. However, any health care insurance companies with large financial and technological resources could always enter the market and disrupt Progyny’s growth. Also, compared to other types of healthcare companies, their technology is not protected through patents or government regulation. Therefore, it’s more vulnerable to disruptive technology.

Progyny’s valuation is pretty steep at this point. The P/E ratio of 52x and EV/EBITDA ratio of 120x are a lot higher than the sector median. Given their young age and rapid growth trajectory, it’s not uncommon to see such a high P/E ratio for a company like Progyny. However, the high valuation does expose an investor to greater stock price volatility, and a miss in revenue/profit expectations will result in a large stock price drop. Therefore, investors should keep that in mind.

Conclusion

Progyny is effectively addressing a need of both employers and employees. Perceptions around infertility are improving and employers are increasingly offering fertility benefits to compete in a tight labor market. There remains plenty of room in the market and Progyny has a promising growth trajectory. Their profitability and strong financial positions are impressive for such a young company. The company has a head-start in the field, which will help guard against a technological disruption or competition from other companies with major resources.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment