matimix/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Income Strategy Fund II (NYSE:PFN) as an investment option. The fund’s objective is “to seek high current income, consistent with the preservation of capital.” The fund achieves this by employing a multi-sector approach, investing in a diversified portfolio of floating and/or fixed-rate debt instruments in both investment-grade and junk level credit.

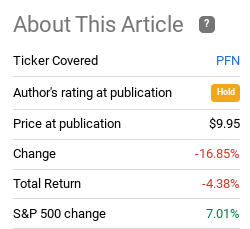

This is a fund I continuously have on my radar, along with most of the PIMCO CEF family. It has been a while since I covered PFN, the last time was in 2021 when I placed a “neutral / hold” rating on the fund. Looking back, this caution has been vindicated over time, with the fund generating a slightly negative return since publication:

Fund Performance (Seeking Alpha)

Given this reality and the wild ride the market has been on in 2022 so far, I thought it was time to give PFN a fresh look.

Importantly, there are some strong points to this fund – such as the valuable income stream and diversified portfolio which is keeping duration risk low. However, there are concerns as well. The fund’s premium to NAV remains elevated and leveraged loans are starting to see some signs of distress. While overall defaults are still historically low, readers should evaluate how much of a premium they want to pay for debt that is showing signs of deteriorating. As a result, I think a “hold” rating is still appropriate, and will explain why below.

The Premium Dilemma

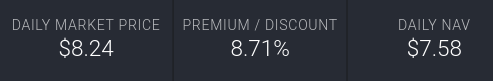

Consistent with my reviews on PIMCO CEF’s, I will begin this one by touching on the fund’s valuation. This is generally a sore spot for me with respect to PIMCO, and PFN is no different in this case. Pointedly, the fund looks pricey, sitting with a premium to NAV nearing the 9% mark:

PFN’s Valuation (PIMCO)

Simply, this is not a “crazy” valuation, but it is expensive. By comparison there are a number of PIMCO CEFs that trade for much more expensive valuations. So that is a supporting factor when considering PFN. Conversely, there are a few that trade for cheaper prices, so that balances out the value proposition somewhat.

Without going into too much detail, this level of premium is only valid to me if there are other compelling reasons to buy this particular fund. A 9% premium suggests investors are very confident in this option, but I am not sure that is entirely justified. Are there bright spots to consider? Absolutely. Are they worth paying 9% for underlying assets than their fair value? That is subjective, but most of the time I’d say no.

A key reason for this is that PFN does not generally trade at the same lofty premium valuations as other infamous PIMCO options. In fact, back in my 2021 review, PFN was traded with a premium around 5.5%. That wasn’t overly expensive, but it wasn’t exactly “cheap” either. And as past performance showed us that ended up not really being a bargain price for this fund (since PFN has seen a negative return in the interim). For me, this valuation story is not terrible, but it continues to suggest caution, supporting a “hold” rating.

High Yield Credit Has Pros And Cons

I want to now dig into PFN’s underlying holdings to give some background on why I am not wildly optimistic on short-term performance at these levels. As I mentioned, PFN has a fairly well-diversified holdings list. That said, the fund is still overweight the high yield credit sector. This specific area clocks in at over one-third of total fund assets:

PFN’s Holdings List (PIMCO)

This means investors in PFN should be very aware of what is going on in this space.

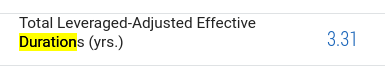

Fortunately, as with most sectors in the U.S. right now, there are some benefits to this exposure. On the one hand, it is helping keep PFN’s interest rate risk at a reasonable level. This is because high yield credit often comes with shorter-term maturities than IG-rated debt. Given that we are currently in a rising rate environment globally and domestically, this metric is favorable:

PFN’s Duration (PIMCO)

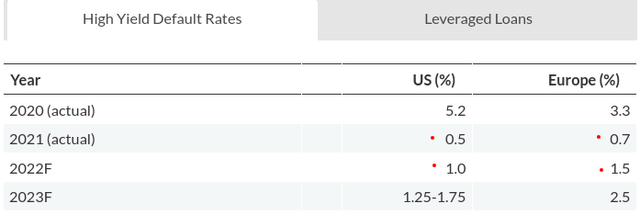

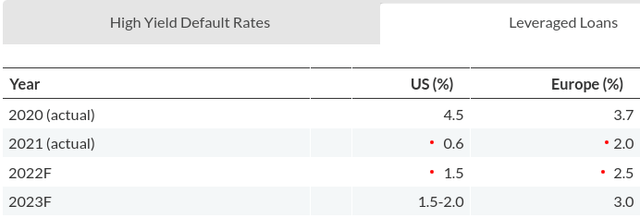

Another positive is that delinquencies and defaults have remained low. This is true of IG debt and also of junk debt. In fact, across both the U.S. and Europe (where PFN does have some exposure), high yield and leveraged loans have default rates below historical norms:

High Yield Default Rates (Fitch Ratings) Leveraged Loans Default Rates (Fitch Ratings)

There are two takeaways I have from these graphics that are both important. One, default rates are low across the board. This will help support underlying bond and loan values and allow PFN to keep pumping out its income stream. Two, readers probably noticed the rates have ticked up in 2022, and are expected to rise further in 2023 in both categories. This is a point of concern.

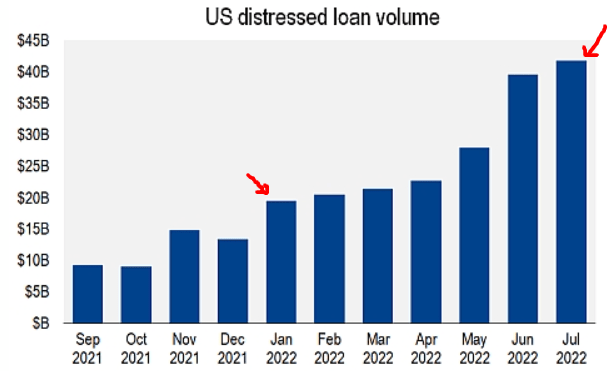

This suggests the broader consensus that there is room for caution right now. Default rates are expected to push higher, driven by recession fears, rising interest rates, inflation, and declining consumer and business sentiment. Are these figures terrible? No, and I certainly am not trying to be alarmist here. But we have to recognize there is merit to these forecasts. Distress ratios are suggesting that more loans are going to deteriorate and therefore fall into bankruptcy. (A security is considered “distressed” if it is headed towards bankruptcy, breaks an investor covenant or protection, or generally has a poor outlook). This would fulfill the prediction that default rates will climb.

To understand the significance, readers should realize the volume of distressed loans has been rising consistently throughout 2022. It has reached the point where volumes are now roughly double from where they started the year:

Leveraged Loan Volume in Distress (billions) (S&P Global)

Does this mean we need to flee the sector entirely? Of course not. Investing in higher yielding securities always comes with risk and we have to accept some level of delinquency and/or default across the space. But it does tell me that conditions are weakening, which once again makes me question the merit to paying a hefty premium for overweight exposure to this space.

Investors Are Getting Cautious

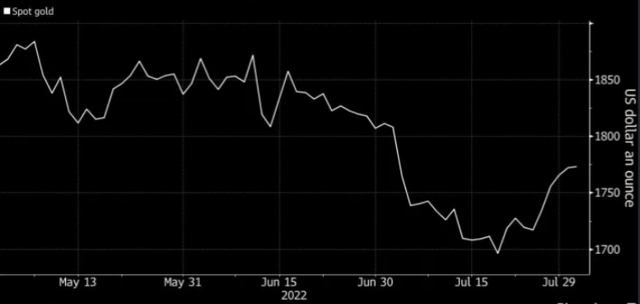

My next thought is more macro in nature and could be viewed as a reason for pessimism, or as a contrarian play. Simply, investors are starting to get cautious again after the recent equity rally we saw at the end of July. The short-term gains were nice, and helped put some at ease to be fair. However, there appears to be a general shifting back to risk-off sentiment as geo-political risks with Russia and China remain elevated, inflation has not gone down, and some traders may want to capture and protect the recent gains.

What this has added up to is an environment where risk may not be as rewarded as it has been very recently. For support, consider that as equities were rising over the last few weeks, gold rebounded sharply as well:

Spot Gold Price (Yahoo Finance)

This is important because gold (and other metals and commodities) are often seen as areas of refuge when economic conditions are deteriorating or at-risk. With gold rising, that suggests the mood of the market has shifted.

For additional support, consider that asset managers are also taking a more pessimistic view. The futures market is showing us that positions in the S&P 500 are now net short, a substantial change from the past two years:

Asset Manager’s Futures Positions (S&P 500) (Bloomberg)

At this point, readers may be questioning the relevance to PFN. After all, PFN does not invest in gold or the S&P 500. That is a fair point. But what I am trying to emphasize is that PFN does invest in riskier debt securities, and the market’s shift of late has been to shed risk.

The takeaway here really depends on the investor, their own risk tolerance, and broader market outlook. I personally like to take contrarian positions when the market seems to be leaning too aggressively one way or the other. That could be the case here, meaning that stocks and high yield debt products could be set up for a rally. But it could also mean this is a foreshadowing of more pain to come across risk-on assets. If that is the case, PFN will likely see some downside. This push-pull backdrop is another reason why I am advocating a cautious stance on PFN at the moment.

The Income Story Is Positive

My last area of focus has a much more positive slant. Through this review I have tried to present a balanced take on this fund. I don’t see a clear buy or sell signal, which supports a hold rating in my opinion. I don’t try to force an investment thesis where there isn’t one.

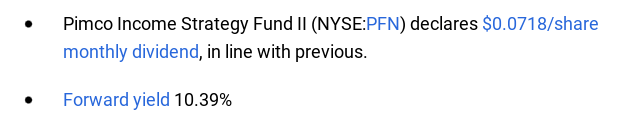

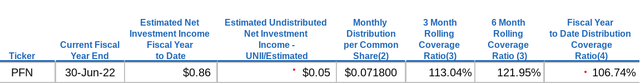

Yet, the biggest bright spot for PFN is probably the one investor’s in the fund care the most about. This is the income story. This past week, PIMCO reaffirmed current distribution levels across the CEF family, including PFN. This keeps the distribution constant and the current yield above 10%:

PFN’s Distribution and Yield (Seeking Alpha)

Certainly, this is good news. This is a very attractive yield and will continue to pique investor buying even if interest rates keep on pushing higher (which they probably will).

This is pretty much all good news. PFN has a double-digit yield and that yield is well supported by income at this time. The fund has a UNII balance that is worth almost a full month of distributions, giving it some cushion and breathing room if income metrics falter. For the time being, that doesn’t seem to be necessary since PFN is overearning its current distribution rate (coverage ratios are all over 100%). Therefore, the income backdrop is impressive, and probably the best attribute for the bulls to focus on at this juncture.

Bottom-Line

PFN has performed modestly over the past year and a half and I don’t see a compelling catalyst to change that in one direction or the other. The fund’s premium is nearing double-digits, which is a point of concern that suggests plenty of downside risk. Considering the high-yield credit market is coming under some pressure, now doesn’t seem to be the best time to overpay for this exposure. But, on the bright side, PFN’s income story remains largely intact, and the distribution is high and well supported. That merits at least a “hold” rating, in my view. Personally, I will keep an eye on PFN and look to see if the value proposition improves before diving in. I would use these applicable pros and cons to support being selective on entry positions at this time.

Be the first to comment