AlexSecret/iStock via Getty Images

Weber Inc. (NYSE:WEBR) owns the most valuable brands in the outdoor cooking industry. Besides, in a recent quarterly report, management announced a plan that would enhance future cash flow generation thanks to sale of assets and reduction in contractual obligations. In my view, if the plan is successful, we would be talking about a valuation of more than $12.3 per share. With that, let’s note that the stock is not for everybody. Under my most unlikely and pessimist case scenario, I obtained a valuation that is significantly lower than $12.3 per share. Inflation, debt obligations, covenant agreements, and a decline in online traffic could be a disaster for the stock. In my view, investors need to understand the risks well.

Weber Inc. Reports New Opportunities And A New Comprehensive Cash Flow And Cost Management Plan

With more than 70 years of operation, Weber presents itself as the first brand and the global category leader in outdoor cooking.

The company operates in the USA, Europe, Asia, and the Pacific region. The management has also announced that it has identified a significant number of opportunities in new regions.

We have an immense opportunity to expand our relationship with the more than 50 million dedicated Weber consumers worldwide, as well as grow our reach in the near and long-term. Source: Press Release

In my view, what will most likely interest investors is the new management plan recently announced for the years 2022 and 2023. I believe that management intends to reshape its balance sheet as well as to obtain cash to reduce its debt levels. Market participants will most likely appreciate the initiative, which includes significant cash generation for 2023.

To strengthen our financial position for fiscal year 2023 and beyond, we are introducing a comprehensive cash flow and cost management plan. The core components of this plan include the suspension of its quarterly cash dividend, a focused reduction of COGS and SG&A expenses, a reduction in force that removes management layers in the organization, and the tightening of global inventory levels and working capital positions. Management believes these actions will result in at least $110 million of cash benefit, net of restructuring costs, in fiscal year 2023, with run-rate benefits beyond that. Source: Press Release

WEBR Could Be Worth $9 Per Share Without The New Plan

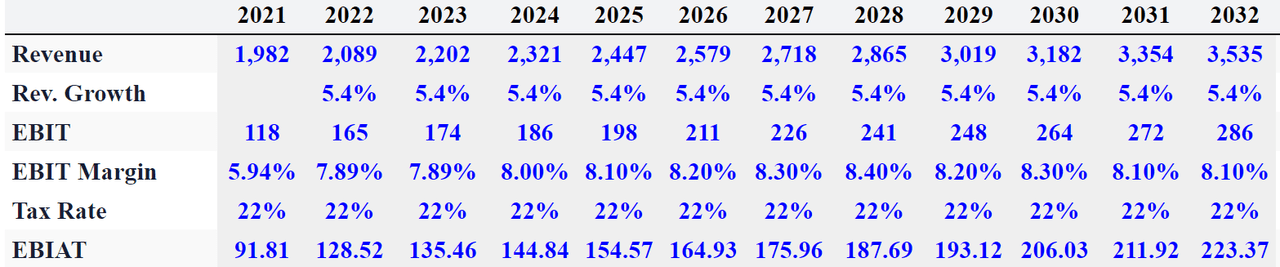

The Barbeque Grill Market size is expected to grow at close to 5.4% y/y. In this case scenario, I used this conservative figure to assess future sales growth.

The Barbeque Grill Market size was valued at USD 5,608.7 million in 2021 and is forecast to grow by 5.4% over the forecast period. Source: BBQ Grills Market Size, Share, Trends

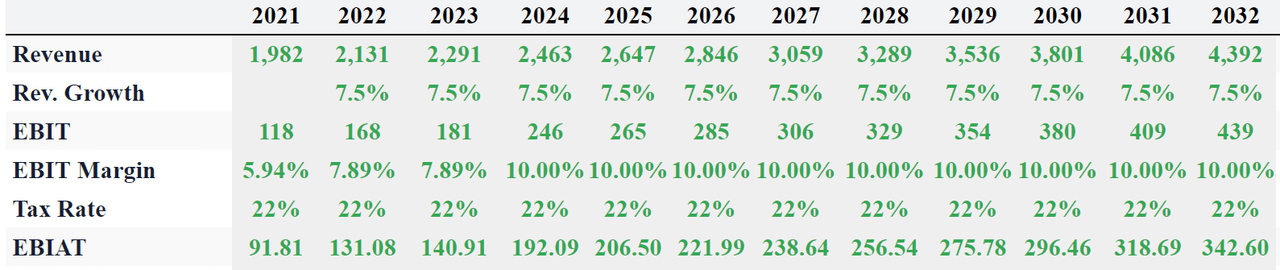

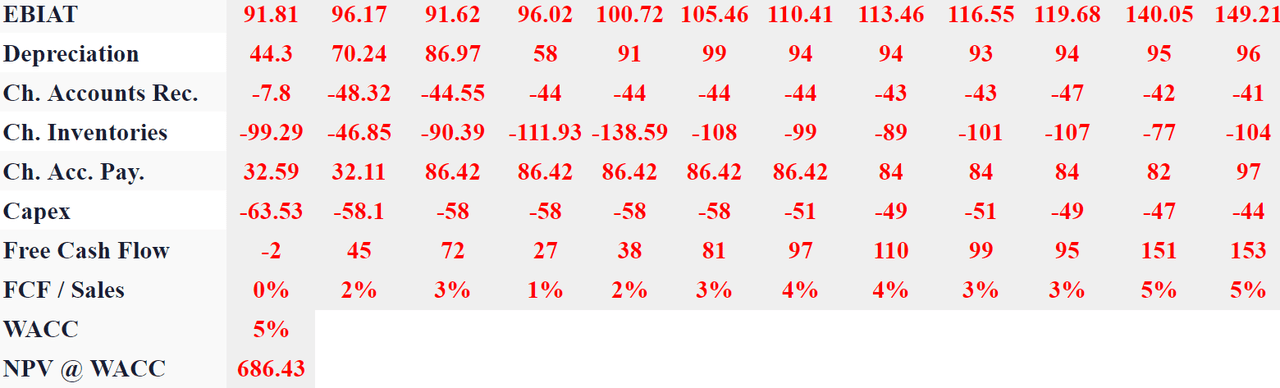

Under sales growth of 5% y/y and $2.089 billion in sales in 2022, 2032 sales would stand at $3.5 billion. If we also assume growing EBITDA margin thanks to economies of scale and new products and services, I believe that 2032 EBIT could stand at 8.105%. Now, with a conservative effective tax rate of 22.5%, 2032 EBIAT would be $223 million.

Author’s Work

Also, with conservative working capital and capex close to $58 million, free cash flow around $58.5 million appears reasonable. My FCF/Sales ratio would stand at about 4%-7%. I also used a discount of 5%. Finally, the NPV of future free cash flows would be close to 1.31 billion.

Author’s Work

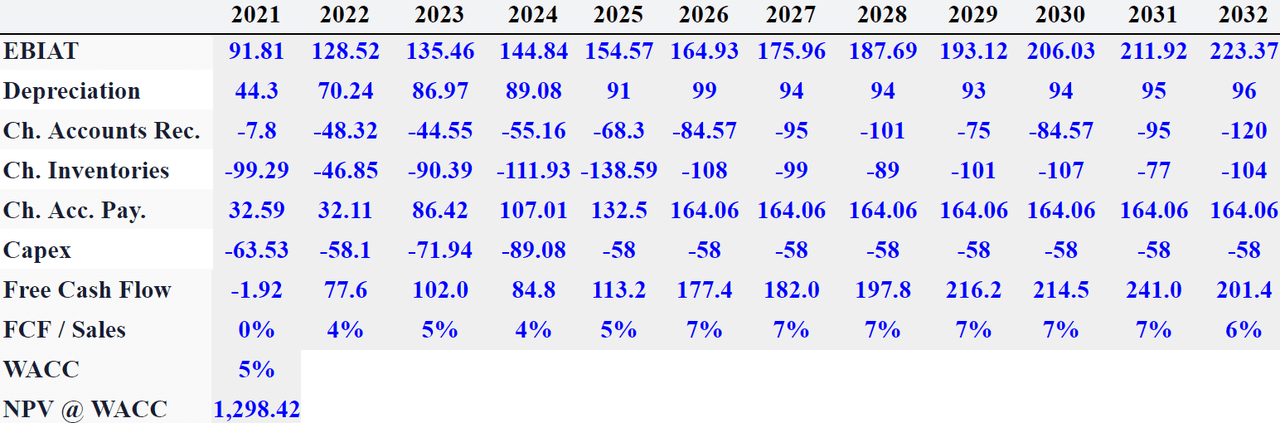

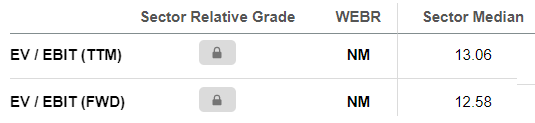

According to Seeking Alpha, peers trade at close to 13x EBIT. However, the new manufacturing facility in Poland will likely enhance future sales growth in Europe, and may push the multiples up. In this case, I used a valuation of 14.5x EBIT.

SA

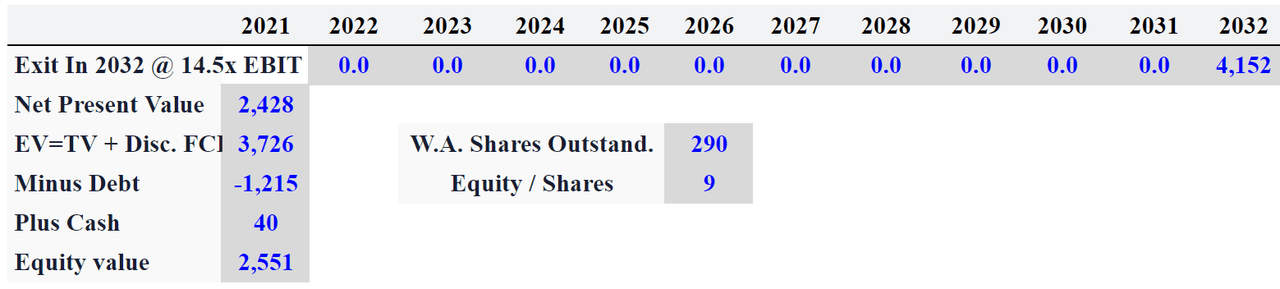

With a terminal EV/EBITDA multiple of 14.5x, the net present value of the terminal multiple would stand at almost $2.5 billion. The implied enterprise value would stand at $3.7 billion. If we subtract the long-term debt, and add cash in hand, the equity value stands at $2.5 billion. Finally, the equity per share would be $9 per share.

Author’s Work

Successful Resale Of Certain Assets And Divisions As Well As Acquisition Of Other Companies In Europe And Asia Would Imply A Valuation Of $12.3

Recently, traders learned that WEBR commenced to do several changes to the Board of Directors, and decided to run a restructuring program. The election of a new CTO, in July 2022, clearly indicated that something could happen.

According to the most recent quarterly release, the restructuring program would include disposal of certain assets and perhaps the sale of certain non-manufacturing and distribution divisions. In my view, if management successfully reshapes the organization, many new investors could become interested in the new company starting from 2023. In this case, I assume that everything will work as expected.

In addition, on August 12, 2022, the Board approved a restructuring plan, which included the termination of other senior executives, a workforce reduction of our non-manufacturing and distribution headcount by at least 10%, the termination of certain lease and other contractual obligations, and the disposal of certain other assets. We expect to substantially complete the restructuring plan by the first quarter of fiscal year 2023. Source: 10-Q

Sale of assets and divisions could bring a lot of cash to WEBR. In my view, if management is smart, it may decide to acquire competitors in Europe or Asia, which could generate significant sales growth. Assuming sales growth of 7.5% y/y, I believe that 2032 revenue of around 4.33 billion could work. Acquisitions could also increase the number of clients, and may push the EBIT margin up. In the best case scenario, I assumed an EBIT margin of 10%, so that 2032 EBIAT could reach $343 million.

Author’s Work

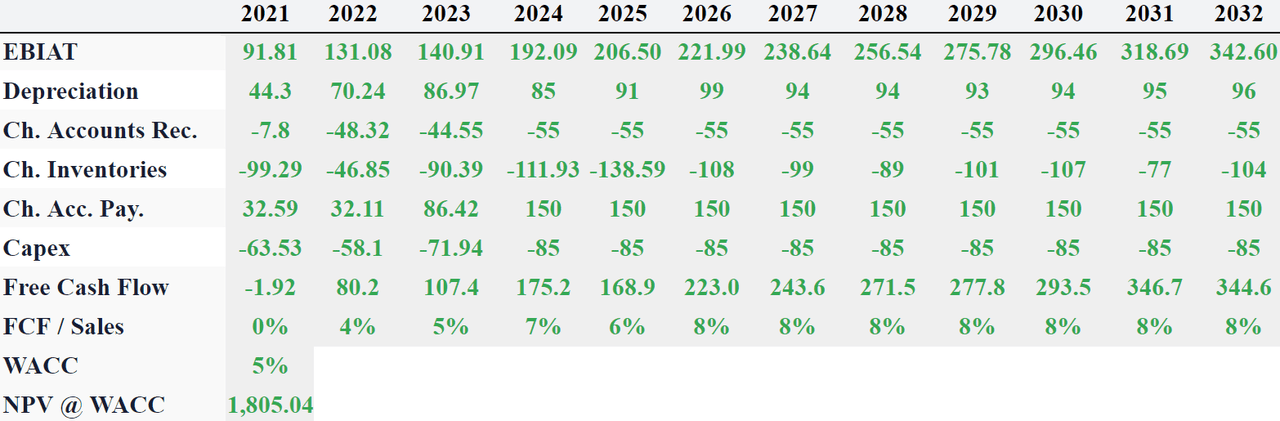

With capital expenditures around $85 million and growing D&A, I obtained FCF/Sales close to 8%. With a discount of 5%, the net present value of future free cash flow would be $1.805 billion.

Author’s Work

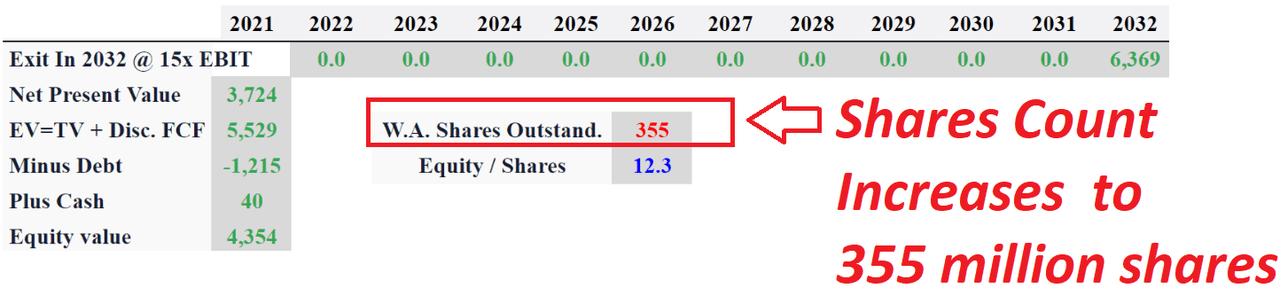

I assumed that the EV/EBIT will likely increase in the next ten years thanks to acquisitions, like that of RMC or June Life, Inc. In this case, with successful redesign of the business structure, I believe that an EV/EBIT of 15x could work. My results, assuming an increase in shares outstanding to buy other companies, would include an equity per share valuation of $12.3.

Author’s Work

If The New Plan Fails, The Implied Fair Price Could Even Reach $3.3 Per Share Or Lower

I am optimistic about WEBR’s future, but I believe that a bearish case scenario is necessary here. It is relevant to note that the company has a significant amount of debt, which may pose certain problems while trying to receive additional equity or debt financing.

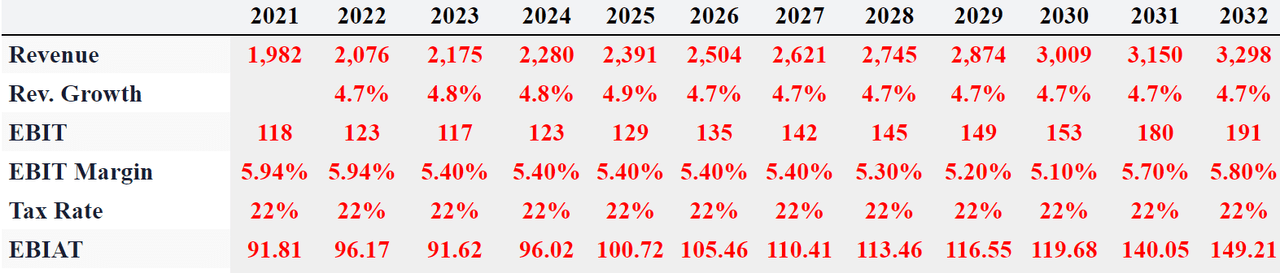

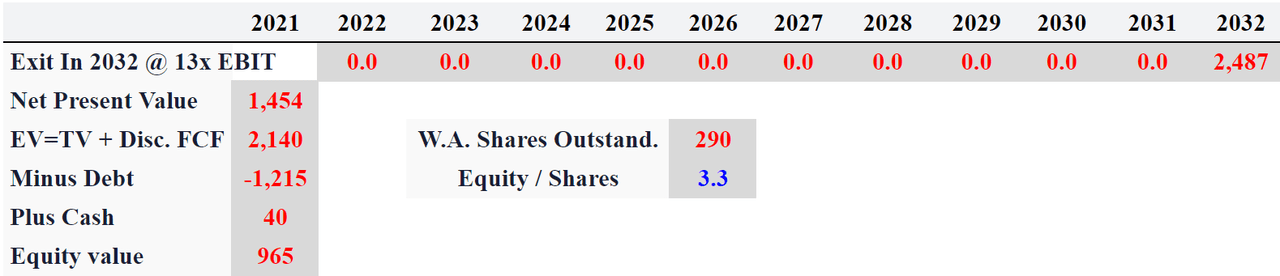

If we assume sales growth close to 4.7%, an EBIT margin around 5.4%, and effective tax of 22%, 2032 EBIAT would stand at $149 million. Notice that my figures are significantly lower than that in the previous case scenarios.

Author’s Work

Subtracting changes in working capital and reducing capital expenditures, the FCF/sales would be close to 2%-3% until 2030. With a WACC of 5%, the net present value of future free cash flow would be close to $686 million.

Author’s Work

Besides, with a terminal EV/EBIT multiple of 13x, the NPV of the terminal value would be $1.4 billion, and the implied enterprise value would stand at $2.1 billion. Finally, if we divide by the shares outstanding (290 million shares), the fair value would be $3.3 per share.

Author’s Work

Balance Sheet And Risks From Contractual Obligations

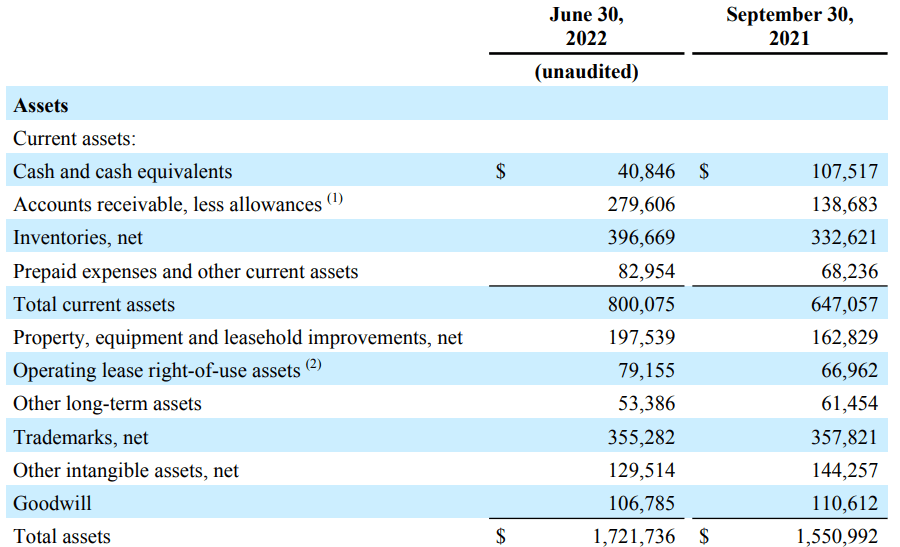

As of June 30, 2022, WEBR reported $40 million in cash, $1.7 billion in total assets, and an asset/liability ratio under one. Even considering that analysts out there are expecting free cash flow in the future, the balance sheet does not look that solid. In my view, management was smart in launching a new plan.

10-Q

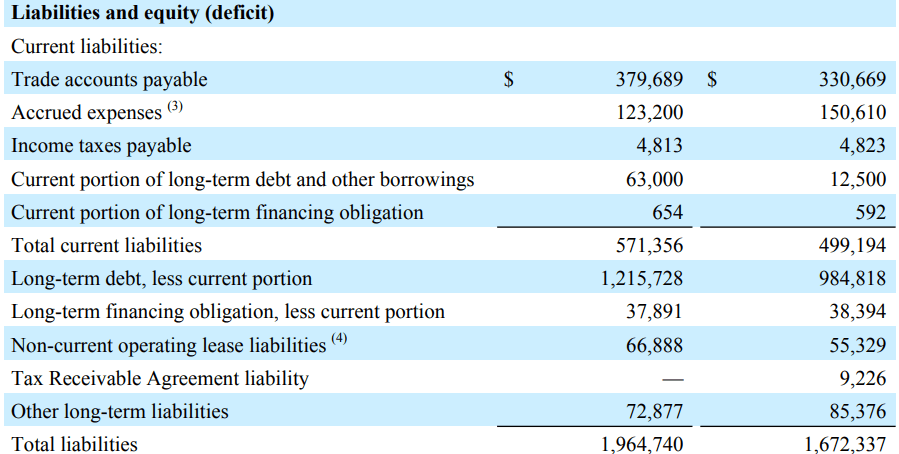

WEBR’s long-term debt is quite significant, which most investors will likely not appreciate. I believe that it is necessary for each investor to do due diligence on the company’s long-term obligations.

10-Q

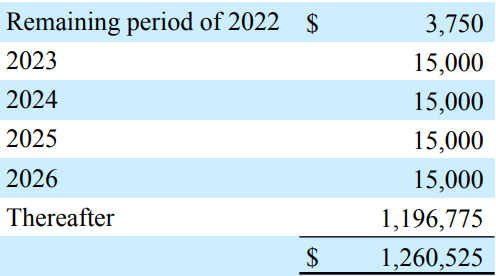

It is relevant to note that the company will have to pay most of its debt obligations after 2026. With that, if we assume 2026 FCF of $220 million, we would be talking about 5x-6x FCF. The total amount of leverage appears risky.

10-Q

Let’s mention that WEBR has operated for many years. In my view, management does not seem to be quite alarmed about the level of debt. Besides, in the most recent quarterly report, the company noted that WEBR receives debt financing to build up inventory in Q1 and Q2, and sells when demand picks up in Q3. Some investors may say that some of the debt is necessary to finance the company’s operations.

We typically borrow under our short-term revolving facility in the first and second fiscal quarters to fund working capital for building up inventory in anticipation of the higher demand we experience in the second and third fiscal quarters. While these investments drive performance during the primary selling season in our second and third fiscal quarters, they generally have a negative impact on cash flow and net income during our first and fourth fiscal quarters. Source: 10-Q

Covenant Agreements Could Impose Certain Actions, Which May Damage Future Sales Growth

Debt investors did require the company to sign certain covenant agreements. If the company does not pay some of its debts, these agreements may stop the company from making meaningful acquisitions or taking operating risks. As a result, WEBR may not be able to push sales growth up, which would lead to a decrease in the company’s fair valuation.

As of June 30, 2022, the Company was in compliance with all covenants in the Secured Credit Facility. However, the Company’s business is seasonal in nature with the highest level of sales of its products occurring in the second and third fiscal quarters; accordingly, the Source: 10-Q

Risks from Inflation Could Push The Share Price Down

WEBR may suffer significantly from the detrimental effects of inflationary pressures. Logistics costs, components, equipment, and even salaries may increase significantly. As a result, if customers don’t accept changes in the price of products, the company’s EBIT margin will likely decline. If journalists, social media personalities, and traders note the decline in profitability, the share price will likely decline.

Changing costs of inbound freight, materials, components, equipment, labor and other inputs used to manufacture and sell our products and logistics costs, in particular, have impacted and may in the future impact operating costs and, accordingly, may affect the prices of our products. We are involved in continuing programs to mitigate the impact of cost increases through identification of sourcing and manufacturing efficiencies where possible. However, we may not be able to fully mitigate or pass through the increases in our operating costs, and rising prices could also affect demand for our products. Additionally, rising inflation has negatively impacted retail traffic and may continue to do so in the future. Source: 10-Q

Slowdown In Retail Traffic Could Drive Revenue Growth Down

In the last annual report, WEBR reported a decrease in traffic, which is, in my view, a bit alarming. Further decrease in traffic will likely lead to a decline in revenue growth in 2022 and 2023, which would drive the EBIT down, and may affect the company’s valuation:

In recent months, there has been a slowdown in retail traffic, both in-store and online, which the Company believes is due to rising inflation, supply chain constraints, higher fuel prices and geopolitical uncertainty. These market factors are expected to continue and therefore continue to have a material adverse impact on our results of operation. Source: 10-Q

Conclusion

WEBR has operated for more than 70 years, and appears to be a valuable brand. In my view, the most recent plan could help the company retain cash in hand to make meaningful acquisitions in the coming years, and finance further international expansion. In my view, if the plan is successful, we would be talking about a fair price close to $12.3 per share. With that, let’s note that the stock may not be for very conservative individuals because the total amount of debt appears significant. If management cannot sell assets at a good valuation, and the new plan fails, I believe that the stock price could decline to $3.3 per share. In view, $3.3 per share is the worst outcome for the stock, but it could happen.

Be the first to comment