Nikada

In the Chinese language the word “crisis” can be divided into two words, one meaning “danger” and the other “opportunity.” Tencent Holdings Limited (OTCPK:TCEHY, OTCPK:TCTZF) is a technology holding company, which could be called “the Facebook of China” or even a tech focused Berkshire Hathaway. A $10,000 investment into Tencent in 2004 at its IPO would be worth over $7.9 million today. More recently, the company has borne the brunt of China’s regulators who recently slapped them with a fine related to 12 accusations of breaking anti-monopoly law; the stock dropped by ~3% on the news. Many people were expecting a billion dollar fine, such as the $2.75 billion Alibaba (BABA, OTCPK:BABAF) was slammed with in the prior year. However, it turned out the maximum fine for each case was just 500,000 yuan ($74,500), this basically means the total was just over $1 million, which is pocket money for most companies and especially Tencent. Alibaba is in the bulls eye of regulators, policy makers and negative news cycles, mainly due to the outspoken nature of founder Jack Ma, who criticized the Chinese financial system. But Tencent slips under the radar (despite being gigantic).

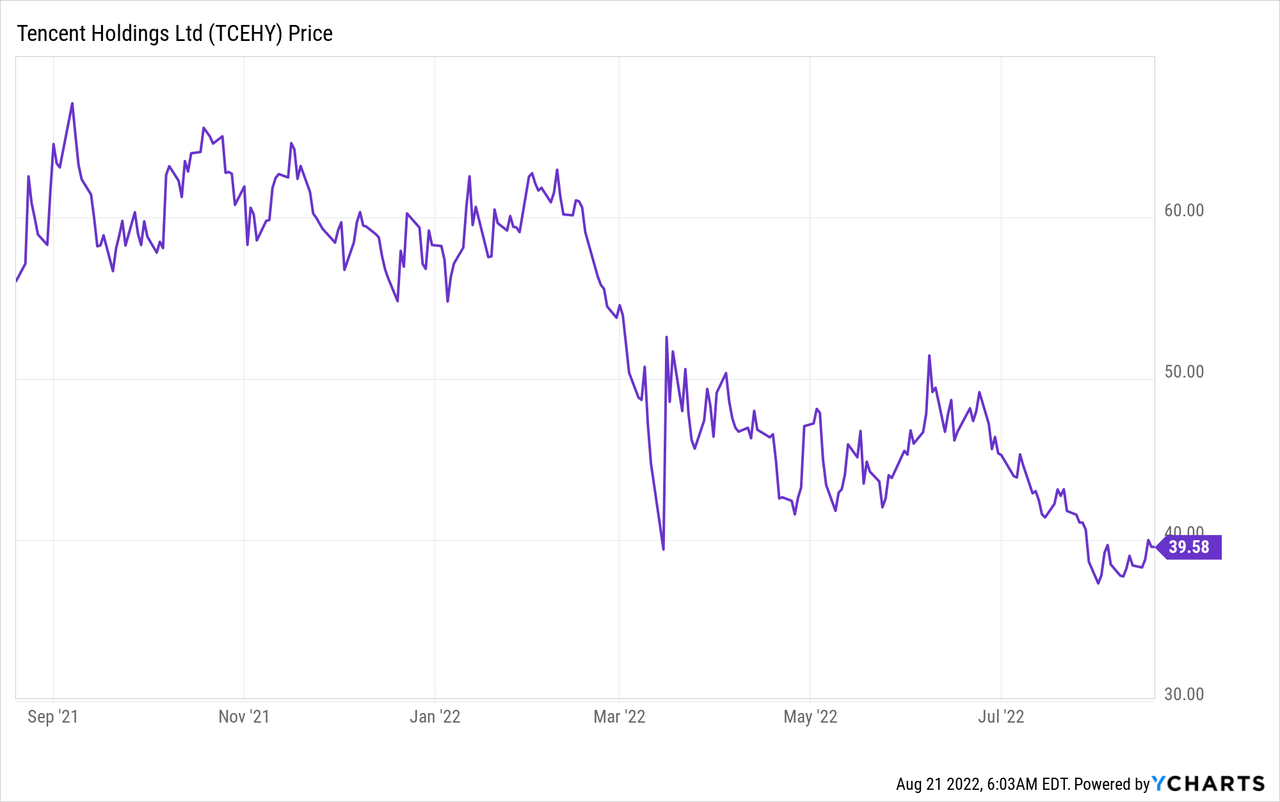

The stock price has been butchered by 56% from its all time highs and is now undervalued intrinsically. In this post, I’m going to review its astonishing business model, second quarter earnings report and even reveal a way to invest which avoids any potential U.S. stock market delisting issues, let’s dive in.

Diversified Business Model

In my last post on Tencent, I covered its diverse business model in lots of detail, here is a quick review.

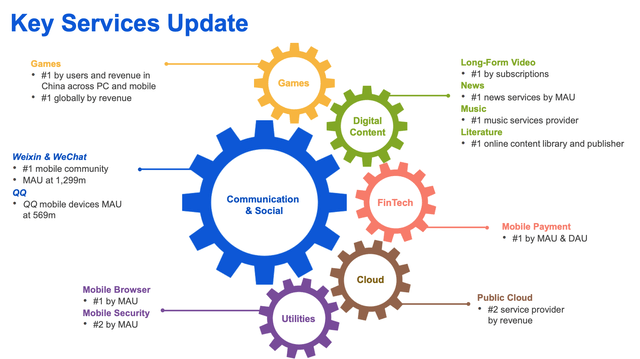

Tencent is the Chinese market leader in social media, gaming and many more tech powered areas. The company owns the number one mobile chat company (WeChat), which is like a “super app” version of WhatsApp with over 1.29 billion monthly active users, which is astonishing. To put things into perspective, the U.S. population is “just” 329 million and Facebook has ~2.93 billion monthly active users globally, not just in one country. In gaming, Tencent is the number one by users and revenue across both PC and mobile games. In addition to being the world’s largest gaming company globally by revenue.

Tencent also has the number one mobile payment platform, WeChat Pay. In addition, they have the second largest market share in the Public cloud with Tencent cloud.

If that is not enough Tencent Music, which is like the “Chinese Spotify” is the number one music streaming provider in the country. It’s music streaming segment has exclusive streaming rights with labels such as Universal Music Group, Sony Music Group and Warner Music Group Corp.

China has the world’s largest population with approximately 88% of its population or 1.22 billion online on mobile. The country also has a growing middle class and now rivals the U.S. as the next major superpower.

Tech Investment Giant

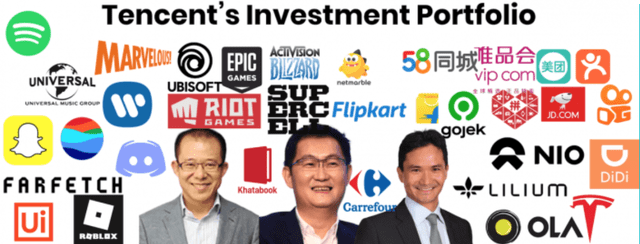

The reason I stated Tencent can be thought of as a “Tech Berkshire Hathaway” is due to its vast number of investments into leading technology companies. Tencent owns stakes in over 700 companies, with approximately 83 companies worth over $1 billion each! For example, Tencent owns approximately 5% of Tesla (TSLA) ($929 billion company), 18% of JD.com (JD) (The Amazon of China), 12% of Snapchat (SNAP), 40% of Epic Games, 15% of NIO (NIO), 6.8% of Spotify (SPOT), and many more.

Tencent Investments (Seeking Alpha Not Boring McCcormick)

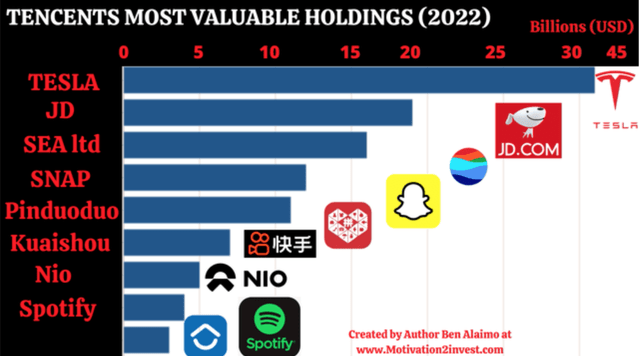

Below I have made a table with the approximate valuations for its most valuable holdings. Its Tesla stake is worth over $35 billion alone, and the company even owns 18.7% of Southeast Asian gaming giant Sea Limited (SE), after recently reducing its stake slightly.

Tencent top investments (created by author Ben at Motivation 2 Invest)

The beauty of Tencent’s business model is as the company’s core business generates huge sums of cash, its investment team invests a lot outside of China, which really does help to diversify the company internationally.

As of the second quarter of 2022, Tencent’s management reported its shareholdings in listed companies (excluding subsidiaries) was a staggering $90 billion (RMB602 billion).

Tencent’s Second Quarter Financials

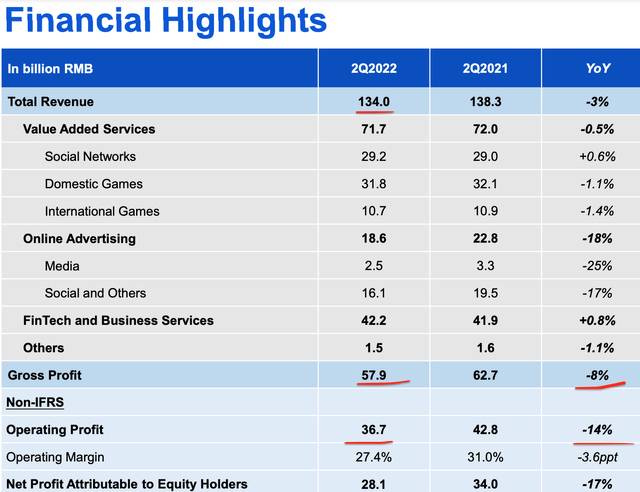

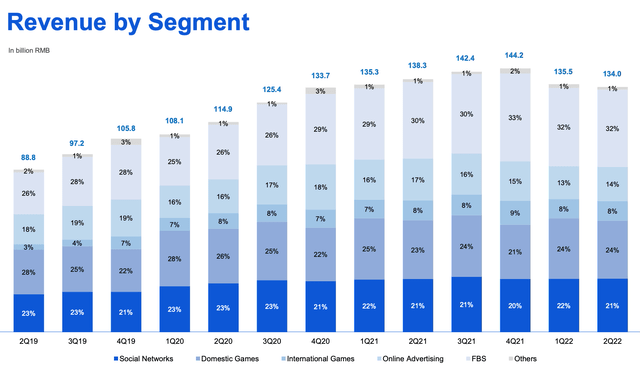

Tencent generated mixed financial results for the second quarter of 2022. Revenue was 134.03 billion Chinese Yuan ($19.78 billion) in Q2, which was less than the 134.6 CNY expected by analysts. Revenue was down 3% year over year and was the company’s first ever decline.

Gaming Challenges

Tencent’s total revenue decline was driven primarily by dip in gaming revenue. Domestic Gaming revenue which makes up 24% of its total revenue was down 1% year over year to RMB 31.8 billion ($4.7 billion). This was driven by fewer big game releases with just three mobile games launched in Q2. In addition, Chinese regulators issued a new rule which limited the amount of time children under 18 years old could play online games to just three hours per week and not during school days. Gaming addiction has long been an issue in China and Southeast Asia and many parents have cited growing concern. There have even been reports of people dying from gaming addiction. Regulators in China also froze new game approval between July 2021 and April 2022, which also impacted Tencent.

Therefore the company had to rely on its existing games to generate revenue such as League of Legends, Honor of Kings and more. Tencent’s breakthrough game “Rising” sold 2 million copies in the first month of early access on Steam, and thus it shows the demand is still strong in China for gaming. The company’s LoL Esports manager also topped the simulation game charts.

International revenue decreased by 1% year over year to RMB 10.7 billion ($1.6 billion) due to a global “normalization” in gaming spend after the pandemic boom. Other gaming companies such as Nvidia (NVDA) (graphics cards) and Microsoft (MSFT) with the Xbox also noted a decline in gaming revenue.

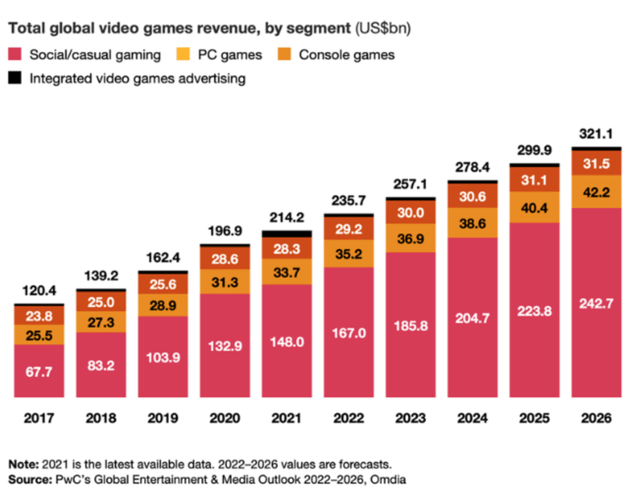

According to a study by PwC, the global gaming industry is worth $235.7 billion in 2022 and is forecasted to increase by over 36% to $321.1 billion by 2026. Therefore, I believe the current gaming revenue decline across many countries is just a cyclical adjustment, but the long term trend is up. This means a company such as Tencent has a long growth runway ahead.

Social Networks

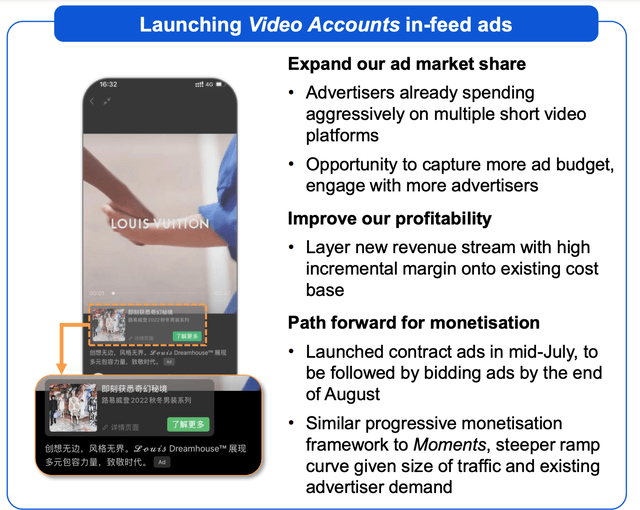

Social Network revenue edged up by 1% year over year to RMB 29.2 billion ($4.3 billion). This slight growth was driven by an increase in video live streaming and improved AI recommendation algorithms. Daily active creators and video uploads increased by 100%+ YoY, which drove increased content for users. The company noted advertisers are increasing spend on short form video platforms and Tencent aims to monetize this through advanced video ads such as the Louis Vuitton advert below.

Video Ads (Q2 earnings report)

Video subscription revenue increased Year over year driven by higher average revenue per user (ARPU), despite lower subscriptions of 122 million. Tencent Video released a drama series called “A Dream of Splendor” which was ranked number one in the industry. Tencent Music’s subscription revenue also increased year over year.

Metaverse?

As a leader in gaming and social networks, Tencent is poised to become an leader in the Metaverse. The company has already launched virtual experiences in the Super QQ Show. This enables you users to exist and interact as an avatar with others while doing community activities. The live audio chat feature also improves the richness of the experience which is a positive.

Tencent Metaverse (Q2 earnings report)

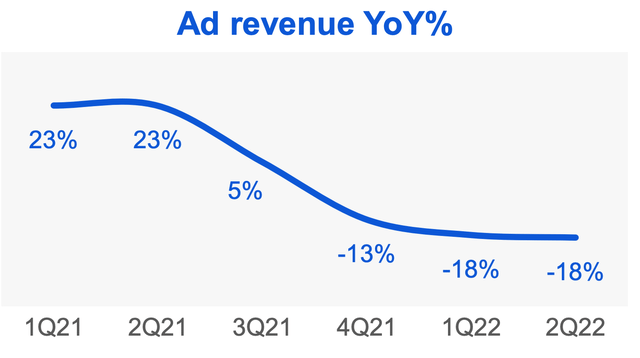

Advertising

In the second quarter of 2022, Advertising revenue was RMB 19 billion ($2.8 billion) this represented a decline of an eye watering 18% year over year. This was due to advertisers pulling back on spending in areas such as internet services, education and finance. The good news is this decline was most prevalent in first two months of the second quarter but did start to narrow thanks to the “618” Chinese shopping festival. The lockdowns in China and slowing economic growth have sparked fear into advertisers globally. However, it’s nice to remember the advertising market is cyclical and thus what goes around, comes around.

Fintech and Business Services

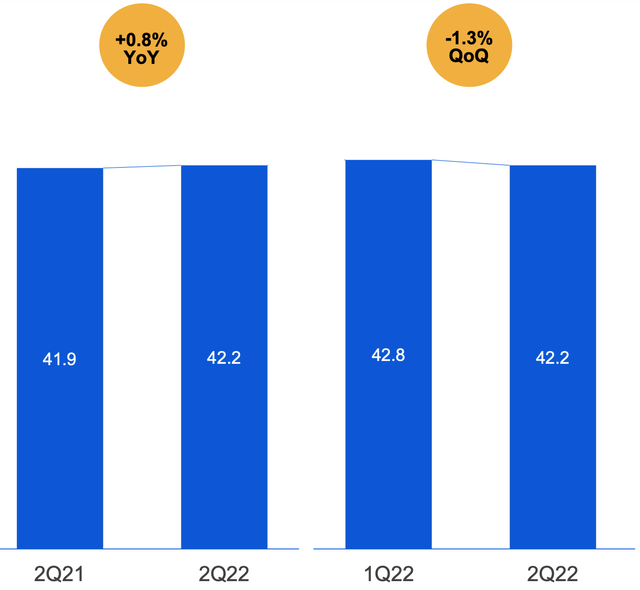

Fintech revenue increased by 0.8% year over year to RMB 42.2 billion ($6.2 billion). This basically flat growth was driven by lower consumer spending thanks to the resurgence of COVID in China and its hard lockdown policy. Approximately half of Tencent’s revenue closely contributes to, and benefits from, China’s economic activity. Therefore when the economy does well so does the company and vice versa.

Fintech Revenue (Q2 earnings report)

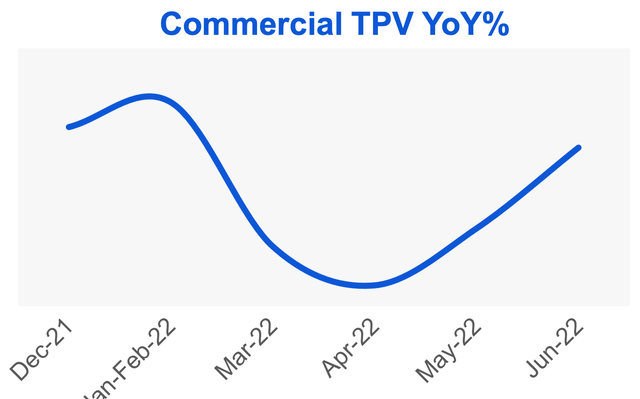

Commercial payment volume was also muted at the start of the second quarter before recovering, with year-over-year high teen growth in June.

Commercial Total payment Volume (Q2 earnings report)

Cost Cutting Measures

The company has migrated all of its domestic in-house services to Tencent Cloud in order to reduce costs and increase productivity. Management is also shifting its focus from sub-contraction of heavy projects to more internal products.

Tencent Financial Review (Q2 earnings report)

From the table above you can see Tencent generated Gross profit of RMB 57.9 billion ($8.5 billion) which was down 8% year over year. Its Operating profit (Non IFRS) was RMB 36.7 billon ($5.8 billion) also down 14% year over year.

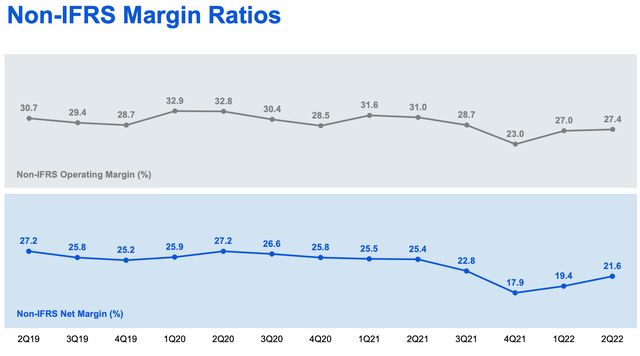

Therefore, the company had an Operating Margin of 27.4%, which was down from the 31% in the same quarter last year on a Non-IFRS basis. However, it should be noted that margins have improved sequentially since the fourth quarter of 2021, which is a positive sign.

Margin Ratios (Q2 earnings report)

I expect margins to recover over the next coming quarters as management has announced a series of strict cost-cutting measures. This includes cost control of Marketing programs, which has resulted in reduced Selling and Marketing Expenses by 21% year over year. The company has also closed down non-core businesses related to online education and reduced its headcount by ~5,000 people quarter over quarter.

Strong Cash Flow and Balance Sheet

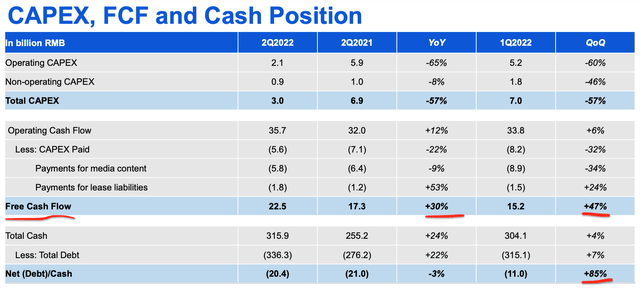

Thanks to the aforementioned cost cutting measures, Tencent has increased its cash flow by ~30% year over to RMB 22.5 billion ($3.3 billion) or a blistering 47% quarter over quarter.

Balance Sheet and Cash Flow (Q2 Earnings Report)

The company’s Net (Debt)/cash position has also increased by ~85% which is fantastic. Tencent has a total cash position of approximately RMB 315.9 billion ($46 billion) and paid a cash dividend of RMB 13 billion ($1.9 billion). In addition, management showed confidence and bought back a staggering 9.7 million shares at a cost of RMB 3.1 billion ($455 million).

Advanced Valuation

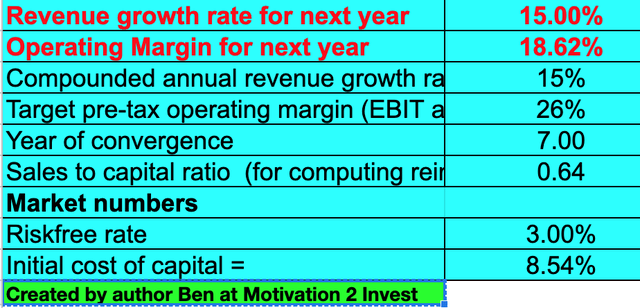

Valuing Tencent is notoriously difficult due to the complex and obscure nature of the company. It has over 700 investments and a venture capital arm. However, I have created what is probably one of the most accurate valuations online. I have plugged the latest financials in my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a very conservative 15% revenue growth per year over the next 5 years. As mentioned prior, the advertising market is extremely cyclical and gaming has also proven to be cyclical given the lockdown boom. On the downside of a cycle things can be terrible, but on the upside the growth can be astounding.

Tencent stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted managements cost cutting measures to continue to progress well and greater scale will cause margins to steadily increase to approximately 26% over the next 5 years. It should be noted these figures are based on GAAP numbers, whereas Tencent reports in the IFRS or Non IFRS accounting standard.

I have also estimated the company’s cost of capital to 8.54% based upon the country of the China and the software industry.

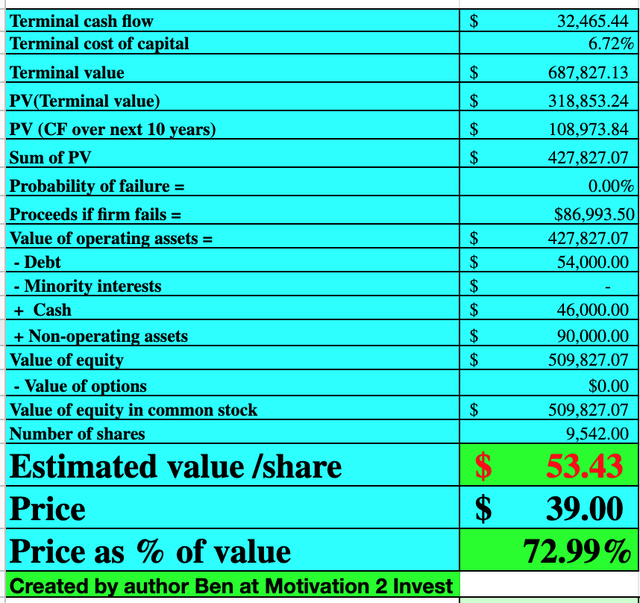

Tencent stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a conservative fair value of $53/share, which means the stock is at least 27% undervalued and represents a significant margin of safety.

This valuation also includes a $90 billion valuation adjustment for Tencent’s investments into public companies. However, it should be noted Tencent has investments into over 700 companies with many venture capital investments of unknown value and thus that would also boost the value of the company.

As an extra datapoint, Tencent is trading at a forward Price to Earnings (P/E) = 16.95, which is 52% cheaper than its 5 year average.

Risks?

Chinese stock Delisting

The first risk which may come to mind is the 2024 delisting of Chinese stocks which don’t comply with U.S accounting regulations from U.S exchanges. However, there are a couple of reasons why this is not an issue for Tencent. First, I believe Tencent does not trade on the New York Stock Exchange, it trades only on the over the counter or OTC exchange, you may have noticed the ticker symbol is TCEHY:OTC. Therefore, it will be pretty difficult to kick Tencent off an exchange if it’s not on it in the first place, one point Tencent. Secondly Tencent already has a primary listing in Hong Kong under the ticker HKG: 0700. This is something Alibaba is seeking to avoid issues with delisting from US exchanges, two points Tencent.

How to Invest into Tencent safely?

A safer option (and my favorite) method to invest into Tencent would be via Prosus (OTCPK:PROSF, OTCPK:PROSY), which trades on the Amsterdam Stock exchange. This is the tech arm of Naspers (OTCPK:NPSNY, OTCPK:NAPRF), which was one of the earliest and largest investors into Tencent. Prosus owns approximately 28.9% of Tencent stock, and they recently announced aggressive share buyback arbitrage program. The company believes Prosus is trading for less than Tencent on an equivalent basis and thus announced the simultaneous trimming of Tencent stock to fund its own buyback program. Therefore, via investing into Prosus you are effectively getting the protection of more stable European financial regulations and a double discount, win/win.

Final Thoughts

Tencent is a tremendous company which is diversified across growing industries such as gaming, social media, and the cloud. The company is poised to bounce back from the cyclical headwinds in its markets and rise higher long term. In the short term, volatility is expected due to Chinese regulators and gaming-specific regulations in the country.

Be the first to comment