Marcus Lindstrom

Investment Thesis

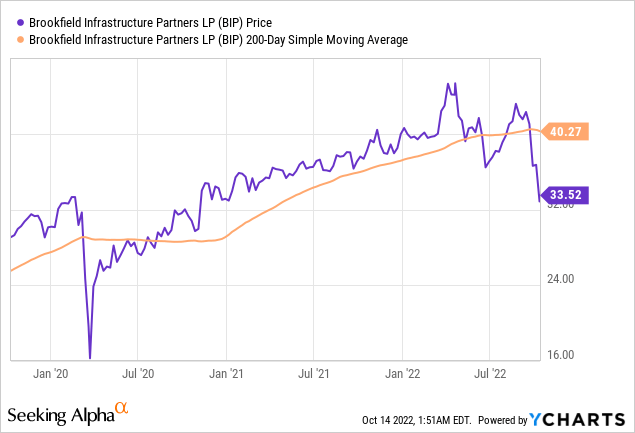

In the last month, Brookfield Infrastructure Partners L.P. (NYSE:BIP, NYSE:BIPC) has plummeted 20%, although there has been no news worth mentioning, apart from the things priced into all stocks, such as rising interest rates and recession worries. In my opinion, this kind of plunge is not justified. I think there is an excellent long-term buying opportunity for BIP in terms of historical valuations.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Warren Buffett

Why did BIP share drop so sharply?

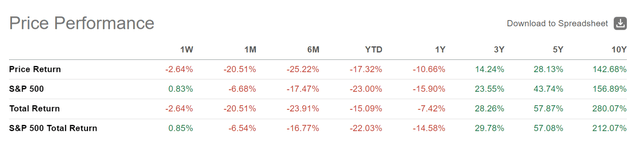

This question is not easy to answer, because there was no specific event, no news. Also, the short interest in the stock is very low. On a yearly basis, BIP still outperformed the S&P500, and also on an extended 10-year view. Underperformance occurred in the last six months and especially in the previous month.

Most likely, the reason is rising interest rates, as Brookfield is a highly leveraged company with currently $26B debt. However, there are several reasons to be relieved. First, a large amount of debt is arranged at fixed rates.

In countries where fixed-rate debt is available, approximately 90% of our borrowings have been fixed for an average duration of over eight years, with less than 1% maturing over the balance of the year.

Second, many inflation-linked contracts also increase revenues, as seen in the excellent Q2 results. From this point of view, the situation is not so bad; the downside of rising interest rates is limited, but since the reason for rising interest rates is inflation, revenues increase. Possibly the value of the real estate decreases, but since most of them are held anyway to generate cash flow, this does not play such a decisive role in my view. And there is also a positive side effect, because if Brookfield’s asset value decreases, so does everyone else’s, which could create more attractive deal opportunities.

Overall, Brookfield’s philosophy and goal are to be well-positioned for all cycles of the economy, and they have been doing that successfully for decades. Therefore, I do not doubt that this will continue to work in the future, especially since Brookfield is historically one of the less-volatile companies due to its global diversification and many stable cash flows.

Another reason for the pressure on the shares could be the assumed coming global recession. And this would undoubtedly impact the company’s profits, for example, in the transport sector, where they operate toll highways. The railroad lines could be less utilized due to less demand for raw materials transported. Many points can indeed be found here. Does that justify a 20% drop? I don’t think so. What does the company itself say?

The macroeconomic outlook has continued to evolve as central banks are making a concerted effort to tackle high inflation by way of substantial interest rate hikes. Consequently, these actions have increased the probability of recessionary conditions in many markets in which we operate. While an economic slowdown will generally have negative consequences for many companies, the highly contracted and regulated nature of the revenue frameworks at our assets should cushion the effects on Brookfield Infrastructure. Nonetheless we will continue to operate our businesses prudently, by monitoring inflationary cost pressures within our business and maintaining high levels of liquidity.

Recent results & financials

Funds from operations (FFO) for the quarter were $513M, or $0.67 per share, an increase of 30% compared to the previous year ($394M). The increase was primarily due to inflation-related contracts and contributions from acquisitions completed last year.

The strongest year-on-year increase of almost threefold was achieved in the midstream sector, which benefited from an acquisition in Canada. This sector alone contributed $170 million to FFO and took advantage of rising prices and good capacity utilization. The Heartland Petrochemical Complex in Alberta, which was part of the Inter Pipeline acquisition last year, will be added in the third quarter.

Commissioning at our Heartland Petrochemical Complex is progressing in-line with our expectations. During the quarter, we completed the startup of our polypropylene plant and shipped our first railcars of product to customers. The entire Heartland Complex is scheduled for an integrated start-up in the third quarter. Once fully in-service, approximately 70% of our volumes are contracted on a nine-year weighted average term. These agreements are structured to provide cash flow stability and eliminate direct commodity price exposure, similar to our other midstream operations.

The utilities and transportation sectors also benefited from inflation-linked price increases, generating 12% and 15% YoY more FFO, respectively. In general, it should be noted that BIP has a wide moat on a number of assets. Among other things, they operate an LNG terminal and railroads in the U.S., and a total of 5500km railroads in Australia under the name Arc Infrastructure. Such a vast network is unrivaled and vital for the transportation of essential goods.

Valuation

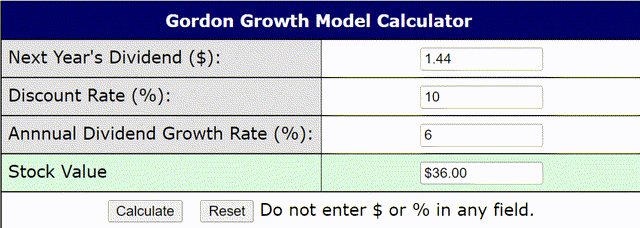

One possible valuation method in the case of steady dividend increases is the Gordon growth model, which measures the value by summing the values of all of its expected future dividend payments, discounted back to their present values. According to this method, the shares are trading slightly below fair value.

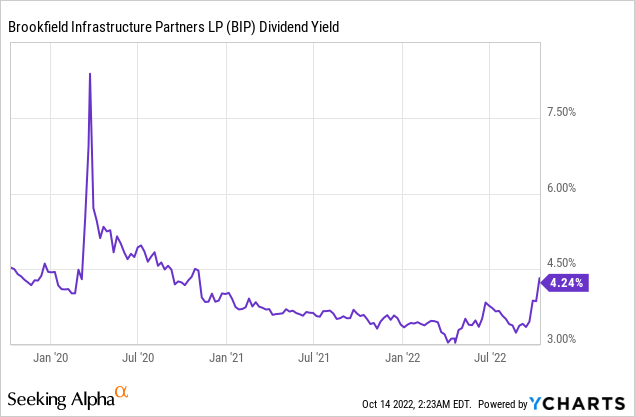

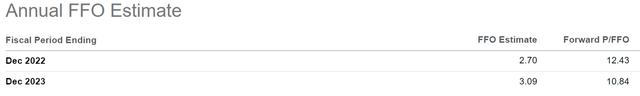

According to Seeking Alpha’s data, the forward P/FFO is quite favorable at 12.4, resulting in a dividend yield that we haven’t seen in about two years. For the next year, the P/FFO is estimated at 10.8. Although these numbers are not remarkably cheap, we are talking about a globally diversified business, which is also, to a large extent, inflation-protected. Given the current uncertain monetary and geopolitical times, such an investment is very attractive in my opinion. Especially for investors who also have high-risk positions in their portfolios.

Share dilution and insider selling

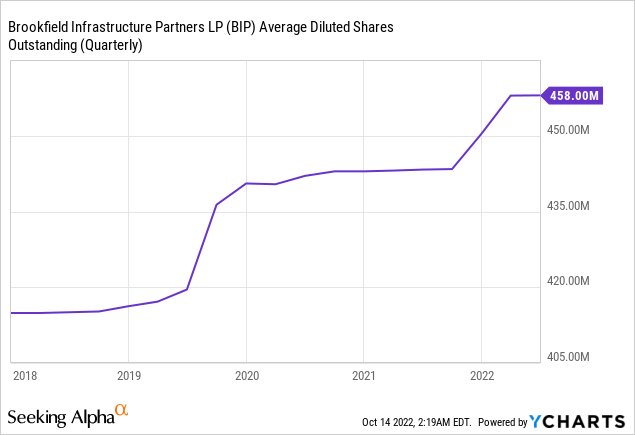

I always want to look at stock dilution and whether there is insider selling. There have been about 10% share dilution in the last five years. I have not found any information about insider sales. So overall, nothing spectacular here.

Conclusion

Brookfield is well positioned for all market cycles due to contracts often linked to inflation and long debt maturities covered by valuable assets and cash flows. From my point of view, there is no reason for a 20% drop. But it means that the stock is cheaper than it has been for almost two years, and you can now buy it at an attractive dividend yield. I don’t think the stock is massively undervalued. However, it is an excellent company at a now-fair price. From my point of view, a strong buy.

Be the first to comment