Akiromaru/iStock via Getty Images

Investment summary

After extracting a sizeable degree of upside from our LivaNova PLC (NASDAQ:NASDAQ:LIVN) position with a holding period of April 2020-January 2022, the investment debate has now shifted for the company. Investors are no longer rewarding top-line growth or company “narratives” in FY22 and are instead focused on profitability and earnings quality [not to mention the macro-landscape dominating play]. With that, we note LIVN displays a loose affinity to the equity premia the market is paying a premium for this year. Valuations are also unsupportive with a value gap to the downside. We rate LIVN neutral with a price target of $52.

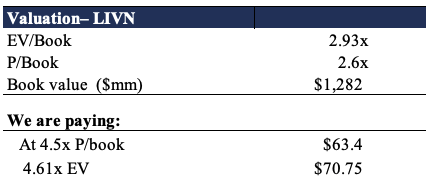

Exhibit 1. LIVN 6-month price action

Q2 earnings – little flesh to put on the skeleton

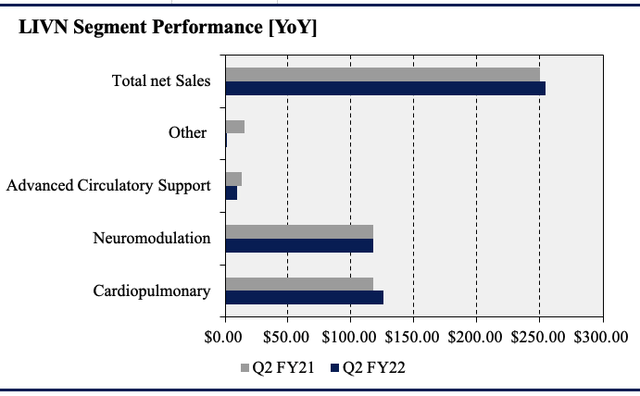

Second quarter revenue came in with a ~400bps YoY gain to $254 million that was also ahead of consensus. Gross margin came in ~500bps ahead QoQ to 75% and up more than 10 percentage points from Q2 FY22. Operations were strong across all segments. Cardiopulmonary (“CP”) turnover widened by ~14% YoY and was underscored by increased pace of oxygenator sales on the back of higher cardiac surgery volumes. It also reported strength in heart-lung machine sales across all areas.

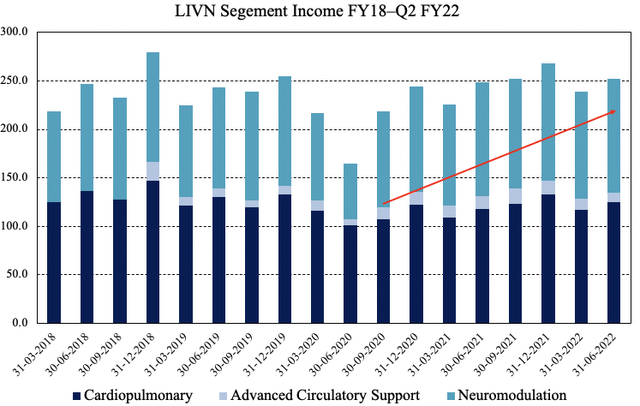

Meanwhile, neuromodulation (“NM”) stretched up by ~230bps with ex-US sales leading the way there. Finally, it saw a 29% headwind to its advanced circulatory support (“ACS”) segment as the Covid-19 tailwind provided by extracorporeal membrane oxygenation, also known as ECMO, starts to diminish. This had been a large upside driver for the company over the FY20/21′. As seen in Exhibit 2, segment income has continued to average up over the past two years to date, with an ever increasing share of sales mix distributed towards neuromodulation.

Exhibit 2. Recovery in segment income with increasing distribution of turnover allocated to neuromodulation

Data: HB Insights, LIVN SEC Filings

Data: HB Insights, LIVN SEC Filings

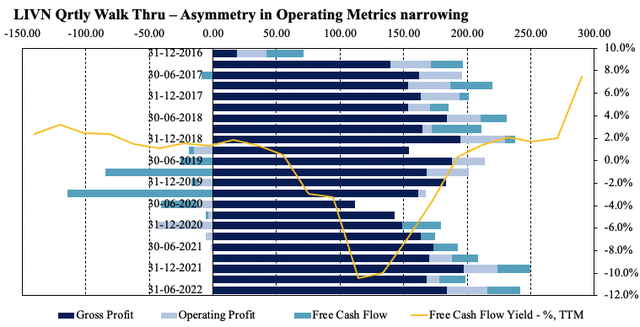

Moving down the P&L, GAAP operating income printed at $31.8 million, a complete reversal of Q2 FY21’s operating loss of ~$36 million. As seen in Exhibit 3, the asymmetry in LIVN’s operating metrics have shown considerable improvement since hitting a low point in Q2 FY20. At the same time, the company has grown FCF and operating income back above pre-pandemic levels. It therefore brings a high degree of fundamental momentum to the investment debate.

Exhibit 3. Quarterly operating metrics now stretching back up above pre-pandemic levels

Data: HB Insights, LIVN SEC Filings

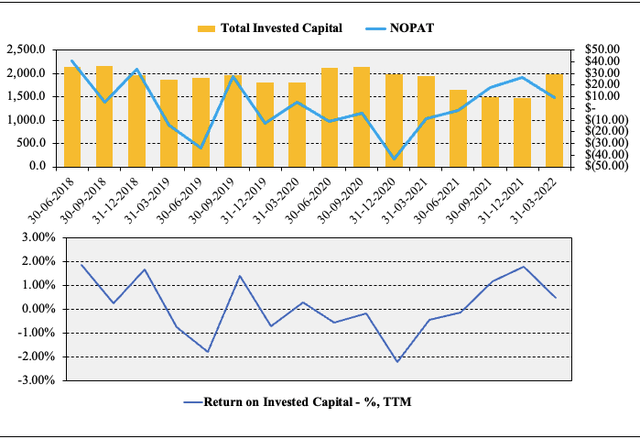

It brought the gains in operating income down to an EPS of $0.30, up from a loss of $1.15 a year prior. Profitability has also continued to stretch up in recent times and now presents as a springboard for the company to continue compounding capital towards its WACC of 8%. Here we examined how much net operating profit after tax (“NOPAT”) LIVN generated as a return on its invested capital. As seen on the chart below, NOPAT pushed up from lows in FY20 to pre-pandemic and now rests at pre-pandemic levels. As such, its return on investment has followed suit, but still rests ~7% behind the WACC [ROIC/WACC ratio of 0.125%]. We look for LIVN to generate a higher ROIC for more compelling value.

Exhibit 4. NOPAT return on investment continues to lift back towards pre-pandemic levels whilst average invested capital narrowing

Despite this, absolute levels of ROI are quite low and provides just 12.5bps of cover on WACC from Q2 FY22 results

Data: HB Insights, LIVN SEC Filings

Guidance revised upward

Despite the earnings upsides in Q2 LIVN management upgraded FY22 guidance. It now expects top-line growth of ~4-6%, calling for ~$1.1 billion at the top for this year (previously 3-5%). Note this figure excludes any impact of the divestiture of its heart valves business. It also bakes in a ~400-500bps forex headwind, in line with what we’ve seen from the industry so far.

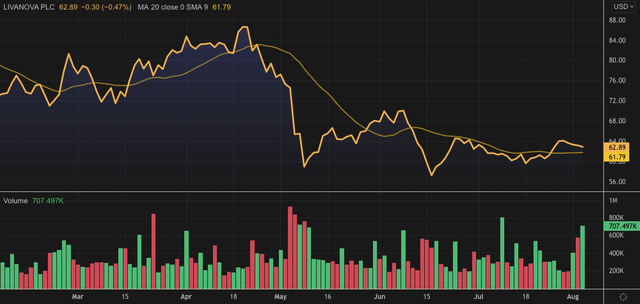

It expects to carry this down to EPS of $2.25-$2.45 for the year and projects adjusted FCF of $60-$80 million, a YoY gain of ~4% that matches projected revenue growth and lends a forward FCF turnover of ~7% and forward yield of ~2.3%. Our forward estimates for LIVN into FY24 are found in the table below. We forecast a period of bottom-line strength where earnings growth is set to outpace sales growth into FY24.

Exhibit 5. LIVN forward estimates modeled for strengthening bottom-line fundamentals that looks to outstrip sales growth

Valuation

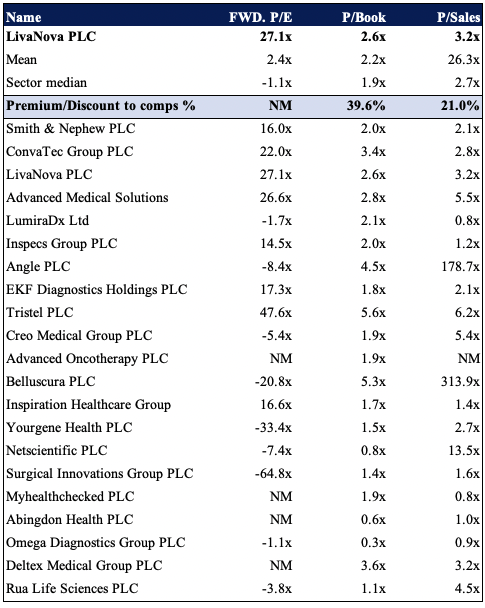

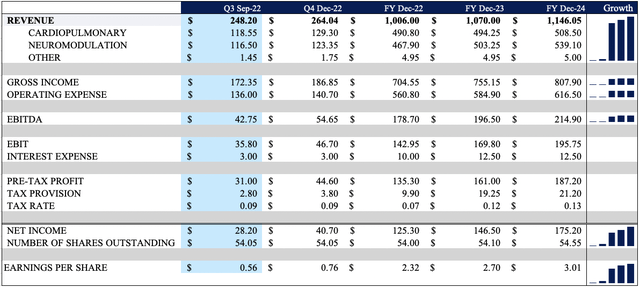

Shares are trading at a premium to the peer group across key multiples, as seen below. Noteworthy however is that shares are trading at a substantial premium at 27x forward P/E, suggesting that investors are expecting an above-market growth period for the company looking ahead. Moreover, the sector appears to be fairly valued at ~1.9x book value, yet, there still could be some price asymmetry on show.

Exhibit 6. Multiples and comps

Data: HB Insights

We are also paying 2.93x enterprise value (“EV”) to book value, as a cleaner measure of corporate value. Alas, we are theoretically paying ~$70 per share at this multiple, as tight as it may be on relative terms. Hence, there’s a value gap to the downside of ~12.5%. After adjusting for this amount LIVN looks fairly priced at $56 apiece.

Exhibit 7. Valuations are unsupportive of potential reversion to the upside – we’d be overpaying by ~$8 on this multiple as well.

Data: HB Insights Estimates

In short

LIVN continues to churn along with the asymmetry in operating metrics continuing to narrow. Whilst it secured a period of top-line and operating profit growth, investors have shifted focus onto bottom line fundamentals and measures of quality this year. With that, the company’s return on investment fails to meet our hurdle rate and needs to improve in order to shift its profitability narrative.

Valuations are also unsupportive and the stock price looks to be overvalued by ~12.5%. With that in mind we value the stock at $52 and look for other names within the medtech universe. Without a directional view on the market, we rate LIVN neutral.

Be the first to comment