JHVEPhoto/iStock Editorial via Getty Images

Price Action Thesis

This is a detailed price action analysis follow-up to our previous article on Pfizer Inc. (NYSE:PFE) in March. We had posited that Pfizer’s well-diversified pipeline and portfolio could help buffer against the impending decline in COVID vaccines revenue.

However, we didn’t pay sufficient attention to its price action analysis, which unveiled startling clues. A double top bull trap had formed in December 2021 as the market drew in buyers rapidly in a “final flush up.”

Subsequently, a series of potent bull traps followed, setting up its near-term resistance. Even though the price has retraced markedly from its resistance level, we don’t think the retracement has been completed.

The stock could likely stabilize at the current levels in the near term. But, we believe it represents an ongoing distribution phase, setting the stage for an eventual sharp selldown in PFE stock moving forward.

Therefore, we believe it’s apt for us to revise our rating on PFE stock from Buy to Hold.

We Missed The Double Top Bull Trap In December

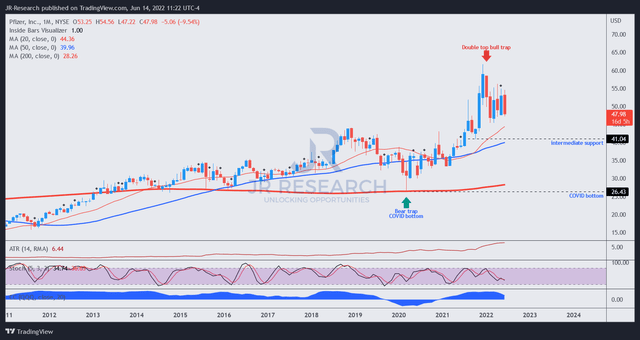

PFE price chart (monthly) (TradingView)

PFE stock has a secular long-term uptrend, as seen in its monthly chart above. In addition, the bear trap that occurred at the COVID bottom helped sustain its long-term support. After that, COVID vaccine stock euphoria set in as buyers piled into the leading mRNA COVID vaccine stocks, including BioNTech (BNTX) and Moderna (MRNA).

Notwithstanding, PFE stock has suffered much lesser damage in the subsequent sell-off than its pure-play biotech peers, given its well-diversified and profitable portfolio and pipeline.

However, a menacing double top bull trap formed in December 2021, which we believe had set up the stock for its subsequent distribution phase.

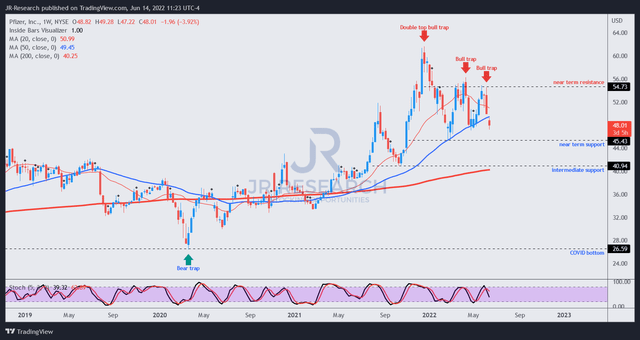

PFE price chart (weekly) (TradingView)

We believe investors should not understate the forward-looking ability of the market. However, given the timing of its December 2021 double top bull trap, it proved the market’s prescience that COVID vaccine stocks were hyped up too rapidly.

A Reuters report released on June 14 highlighted that “several European Union (EU) countries want to renegotiate contracts with COVID-19 vaccine makers as they say they don’t need as many shots given the improvement in the pandemic.” Therefore, the market had started to price in waning COVID demand and revenue since late last year.

Furthermore, a series of subsequent bull traps were seen in March, April, and June that validated its near-term resistance level. Therefore, we believe it represents the top of its current distribution range.

We highlighted its near-term support that could represent the bottom of its distribution range. However, given the formation and structure of its bull traps, we believe that PFE investors may face deeper retracement moving forward before a sustained bottom is found.

As a result, we posit that its near-term support to be breached after the distribution phase is completed. Subsequently, a steeper sell-off should ensue, with the stock likely finding support in the gap between its near-term and intermediate support.

Is PFE Stock A Buy, Sell, Or Hold?

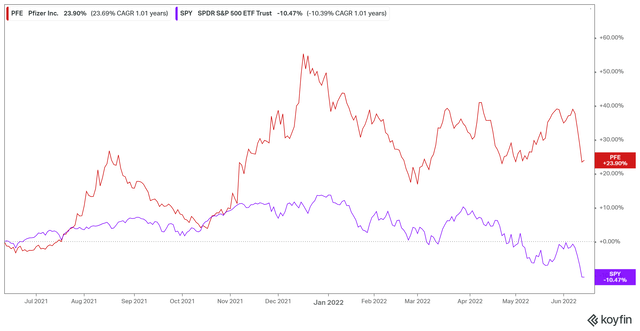

PFE investors have outperformed the SPDR S&P 500 ETF (SPY) over the past year, as the S&P 500 fell into a bear market recently. However, we think the dynamics could shift out of favor for PFE stock moving ahead.

The stock could be at a near-term bottom, so setting a Sell call here is likely unwise. However, investors sitting on huge gains from the COVID bottom could consider cutting exposure and reallocating to undervalued, beaten-down stocks.

Otherwise, investors can wait for a re-test of its near-term resistance to cut exposure, selling into rallies. Furthermore, we don’t encourage new investors to add positions at the current levels until we have seen a deeper retracement in PFE stock.

Notably, we believe the significant digestion from its bull traps has not occurred and therefore warrants caution.

As such, we revise our rating on PFE stock from Buy to Hold.

Be the first to comment