Arctic-Images/DigitalVision via Getty Images

A Quick Take On Agiliti

Agiliti (NYSE:AGTI) went public in April 2021, raising approximately $368 million in an IPO that priced at $14.00 per share.

The firm sells medical equipment products and services in the United States.

While AGTI has performed well through the pandemic and is growing profits, the stock appears to be fully valued on a generous forward earnings estimate.

Absent a significant catalyst, my outlook for the stock therefore in the near term is Hold.

Agiliti Overview

Minneapolis, Minnesota-based Agiliti was founded in 1939 to provide a wide range of medical equipment products and related services to the U.S. healthcare system.

Management is headed by Chief Executive Officer Tom Leonard, who has been with the firm since 2015 and was previously president of Medical Systems for CareFusion Corporation.

The company’s primary offerings include:

-

Onsite managed services

-

Clinical engineering services

-

Equipment rental and repair solutions

The firm has more than 7,000 hospitals, delivery networks and alternate site medical care providers, both privately-held and government owned.

Market & Competition

According to a 2020 market research report by IBISWorld, the U.S. medical equipment repair & maintenance market, which is a subset of the firm’s service offerings, is expected to reach $3.4 billion in 2021, representing an annual growth over prior year of 1.7%.

The market will have grown at an estimated 2.1% average annual growth rate from 2016 to 2021.

The main drivers for this expected growth are an increasing demand for medical services as the U.S. population ages due to the Baby Boomer generation retiring at an average rate of 10,000 per day.

Also, another market research firm, Prescient & Strategic Intelligence, puts the repair & maintenance market size much higher, at $8.3 billion in 2019 and growing at a CAGR of 9.2% from 2020 to 2030.

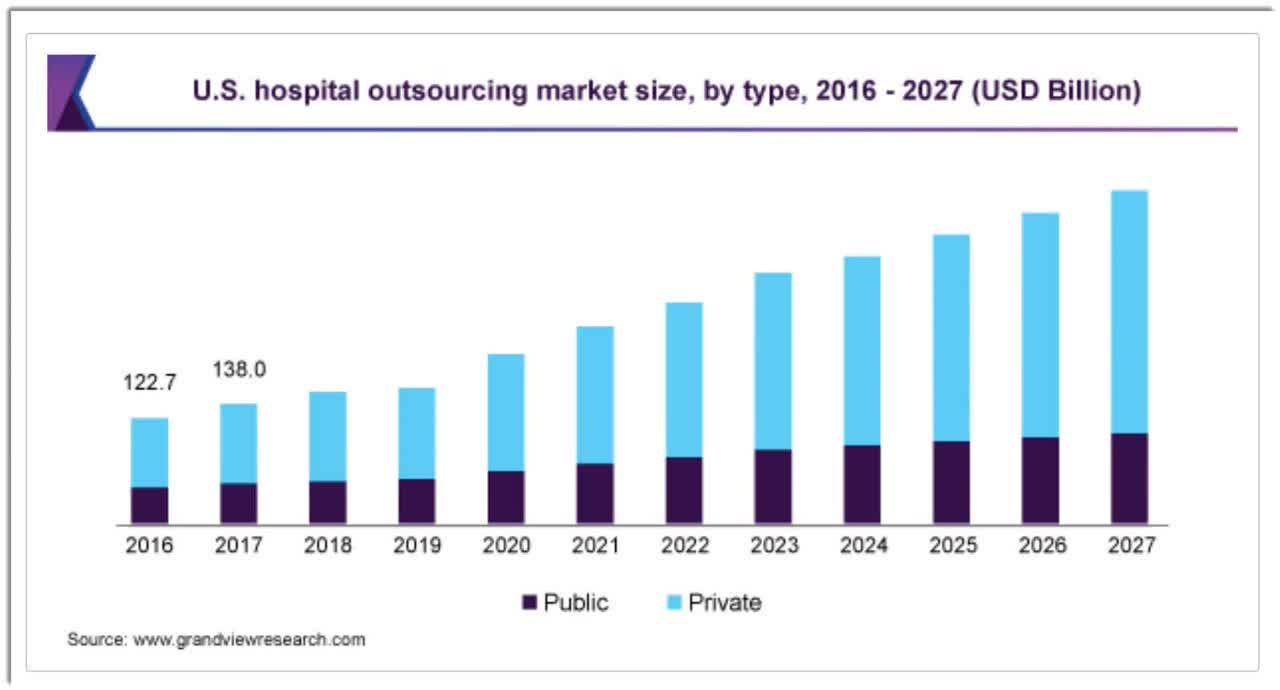

Grand View Research estimates the global hospital outsourcing market size at $271 billion in 2019 and expects it to grow at a CAGR of 10.4% from 2020 to 2027.

Below is a chart showing the historical and expected future growth of the U.S. hospital outsourcing services market:

U.S Hospital Outsourcing Market (Grand View Research)

Major competitive or other industry participants include:

-

Allscripts (MDRX)

-

Cerner

-

The Allure Group

-

Integrated Medical Transport

-

Sodexo (OTCPK:SDXOF)

-

Aramark (ARMK)

-

LogistiCare Solutions

-

Flatworld Solutions

-

Alere

-

ABM Industries (ABM)

Agiliti’s Recent Financial Performance

-

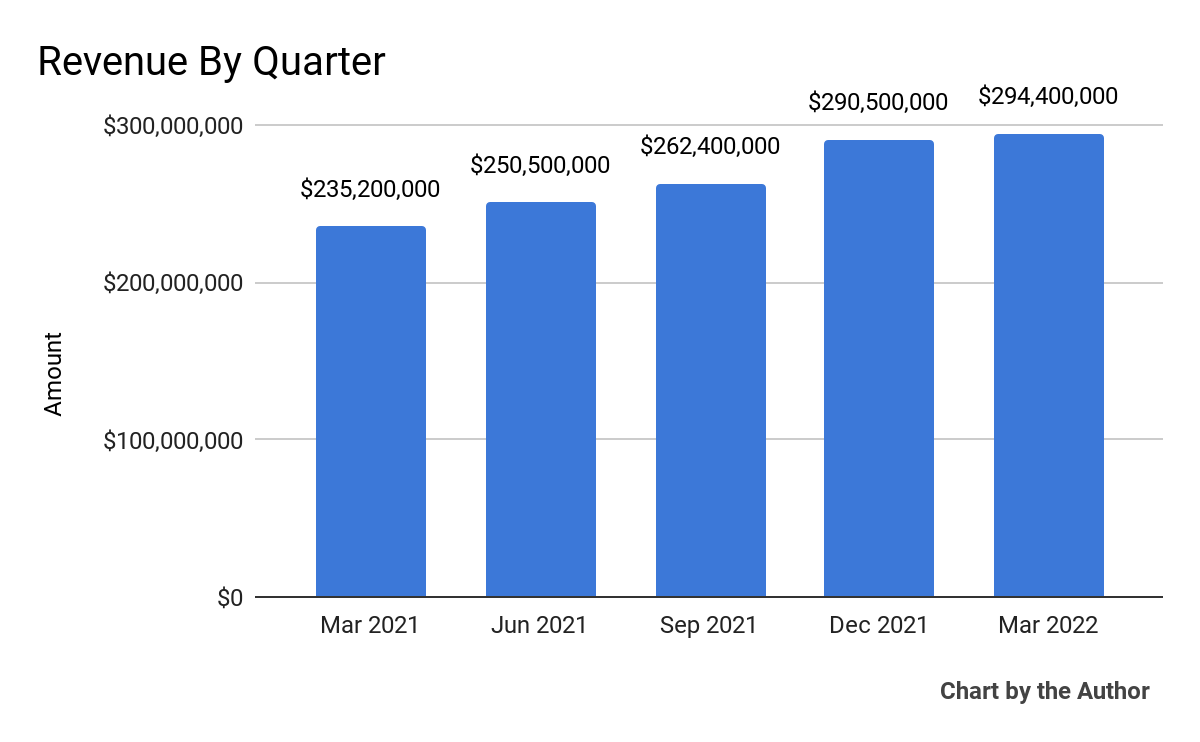

Total revenue by quarter has grown over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

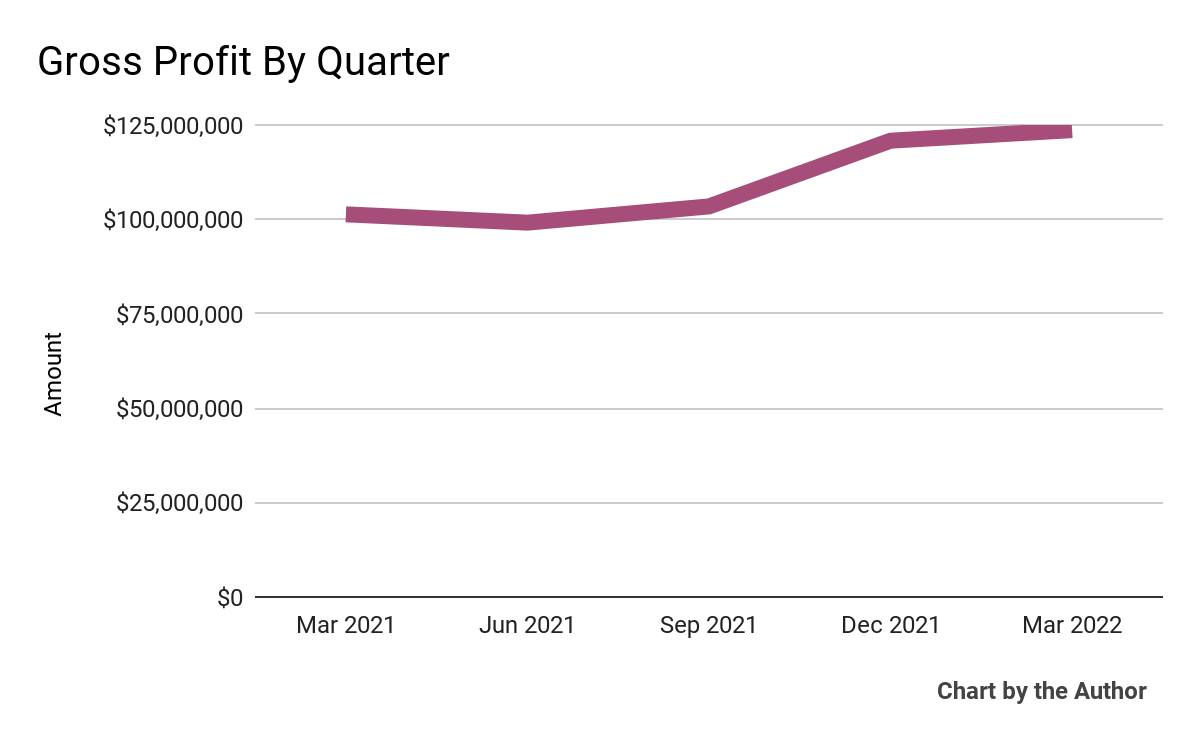

Gross profit by quarter has followed roughly the same trajectory as topline revenue:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

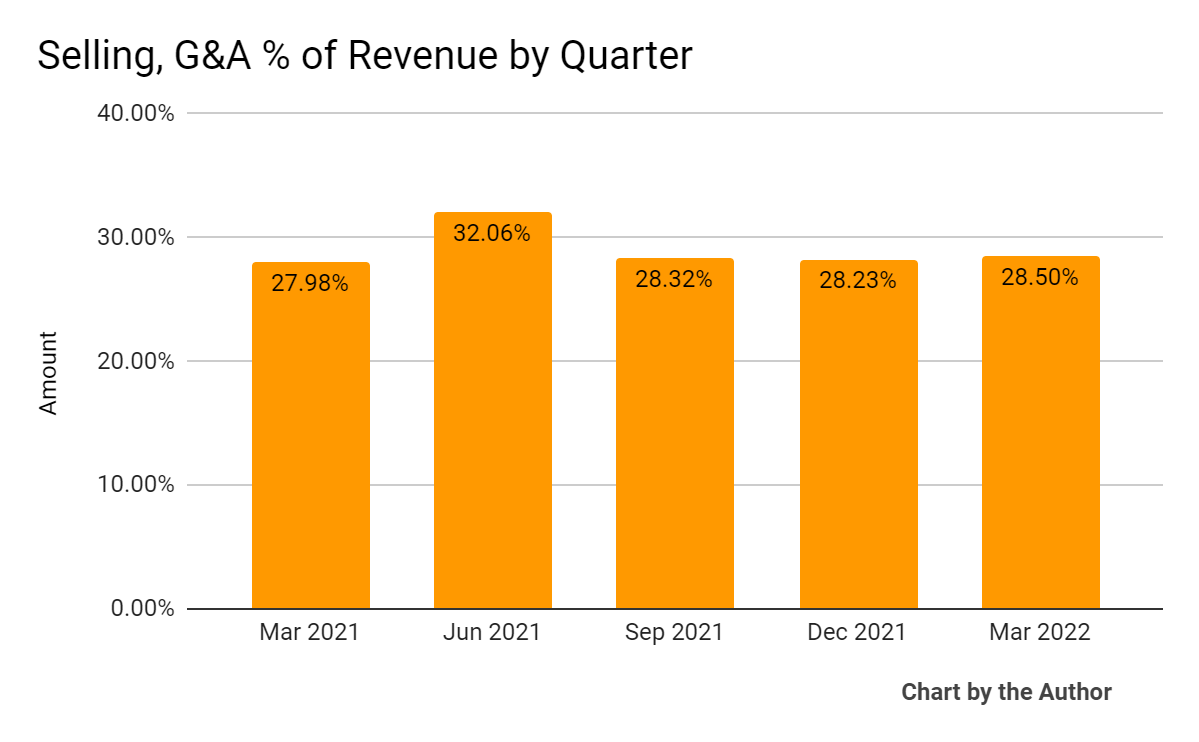

Selling, G&A expenses as a percentage of total revenue by quarter have been stable over the past 3 quarters:

5 Quarter Selling, G&A % of Revenue (Seeking Alpha and The Author)

-

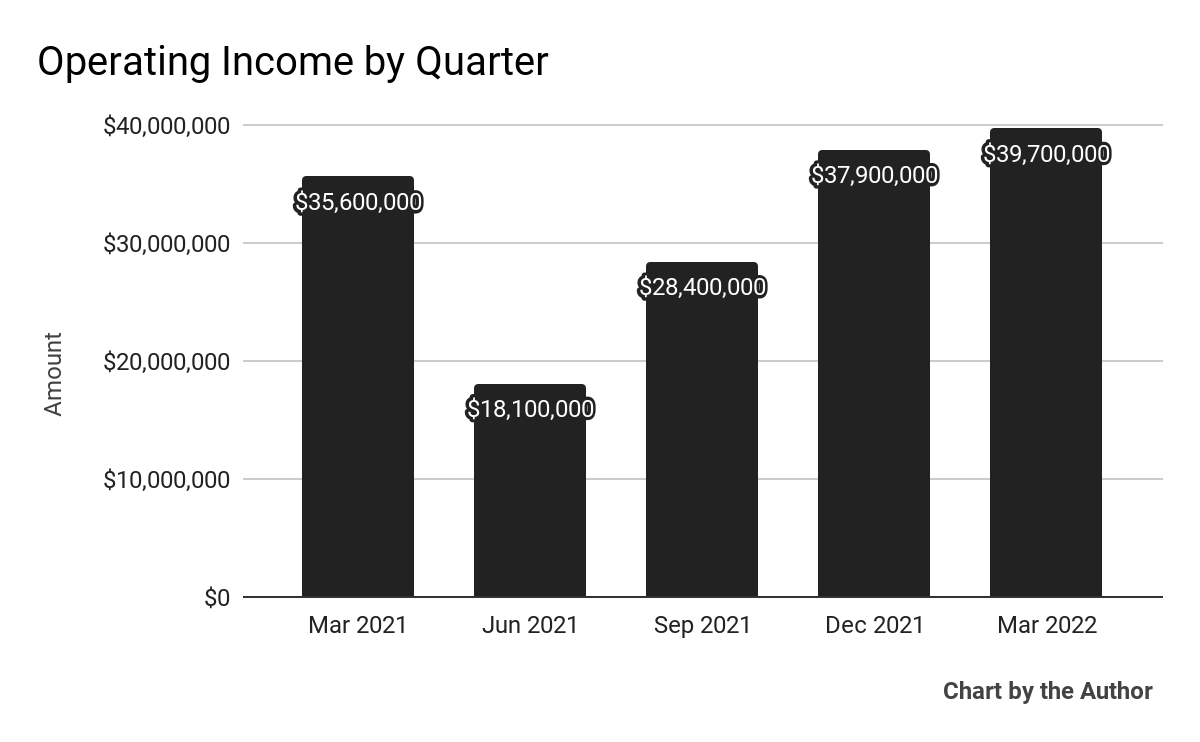

Operating income by quarter has grown in the past 3 quarters:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

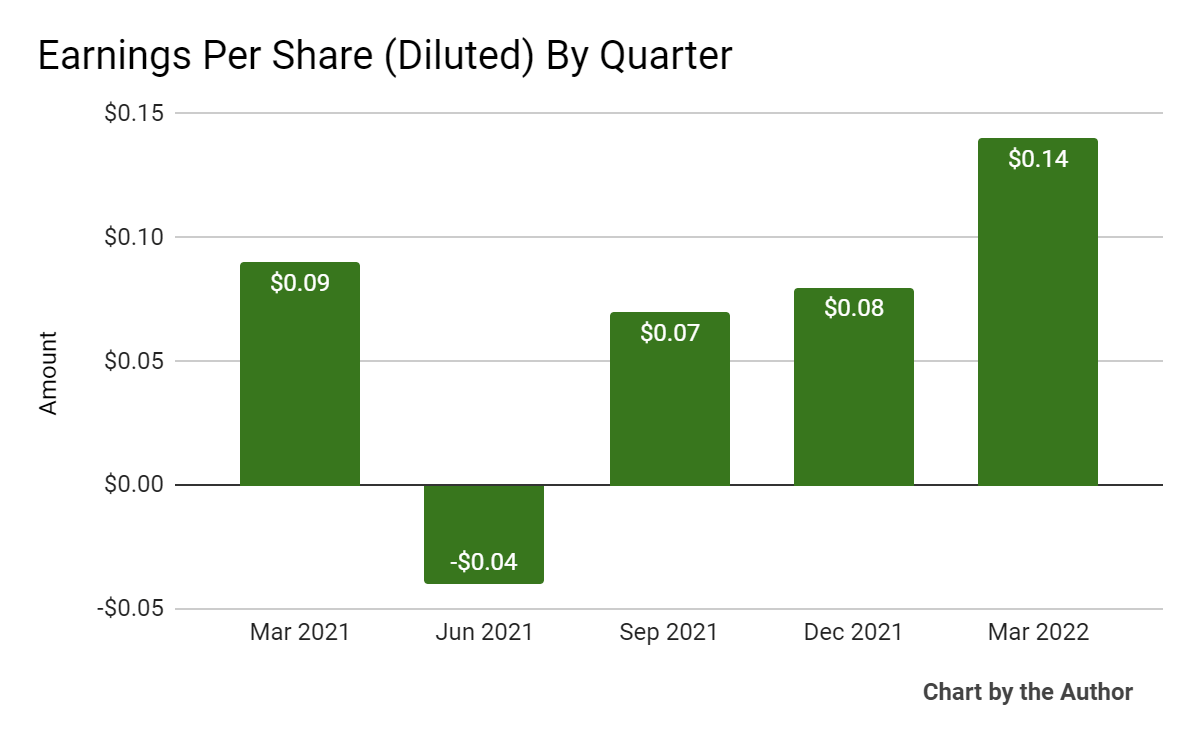

Earnings per share (Diluted) have followed approximately the same trajectory as that of operating income:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

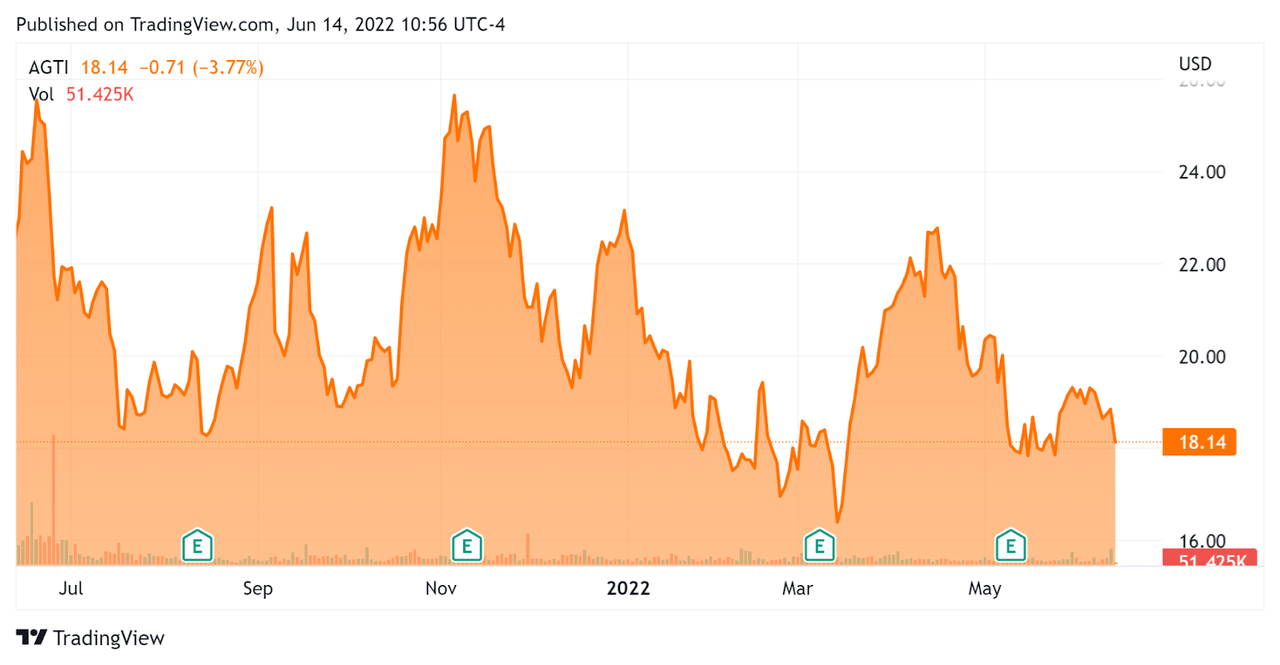

In the past 12 months, AGTI’s stock price has dropped 18.7 percent vs. the U.S. S&P 500 index’ fall of 11.8 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For AGTI

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$2,490,000,000 |

|

Enterprise Value |

$3,670,000,000 |

|

Price / Sales |

2.21 |

|

Enterprise Value / Sales [TTM] |

3.34 |

|

Operating Cash Flow [TTM] |

$214,530,000 |

|

Revenue Growth Rate [TTM] |

32.38% |

|

CapEx Ratio |

3.33 |

|

Earnings Per Share |

$0.25 |

(Source)

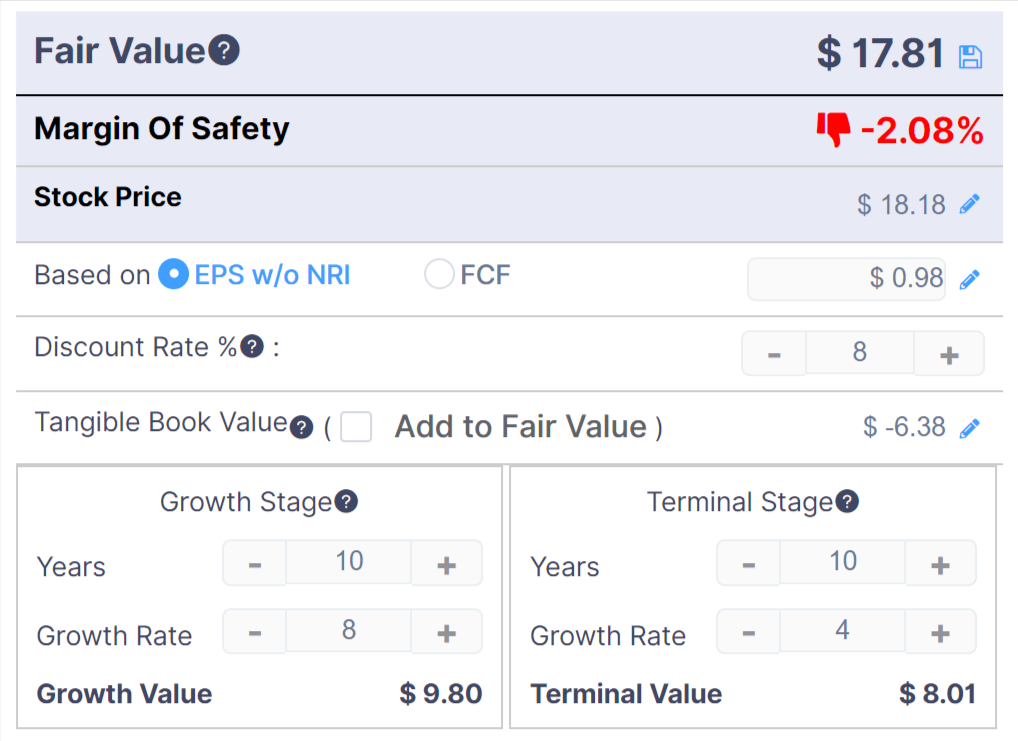

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $17.81 versus the current price of around $18.30, indicating they are potentially currently fully valued, with the given earnings, growth and discount rate assumptions of the DCF.

AGTI DCF Calculation (GuruFocus)

Commentary On Agiliti

In its last earnings call (transcript), covering Q1 2022’s results, management highlighted its capabilities to supplement client teams with its own, to provide relief for short-term staffing shortages.

Also, CEO Tom Leonard observed that healthcare facilities have generally acquired too much equipment which is underutilized and requires ongoing maintenance to remain in service.

The firm also has increased its assistance to state and federal entities to help manage and maintain their emergency medical devices stockpiles.

Recently, with the reduction of COVID-19 pandemic cases, client demand has shifted back toward a more normal focus as previously canceled or deferred surgical cases have resumed.

As to its financial results, Q1 2022 revenue grew 25% over the prior year’s results, although adjusted EBITDA figures were negatively affected by its recent acquisitions of Sizewise and Northfield Medical.

SG&A costs grew by 24%, primarily due to its 2021 acquisitions even after related synergies were figured in.

Looking ahead, management reaffirmed its full year 2022 guidance and said that it has a ‘significant advantage in hiring and retaining’ skilled professionals despite a challenging labor market. This is in part due to its competitive salary structure combined with incentive and equity ownership plans.

Regarding valuation, based on my DCF as described above the Valuation Metrics section, the stock appears fully valued at its present level.

The primary risk to the company’s outlook would be further outbreaks of Covid-19 virus variants, resulting in a shift in service mix and potential disruption to its operations, although I place a rather low probability for any major outbreak in the near term.

While AGTI has performed well through the pandemic and is growing profits, the stock appears to be fully valued on a generous forward earnings estimate.

Absent a significant catalyst, my outlook for the stock therefore in the near term is a Hold.

Be the first to comment