Автор

Readers know that I am a big fan of LNG and have been actively looking for LNG-related companies. I recently profiled Woodside Energy (WDS), one of the largest LNG producers in the world. In this article, I will shift my focus to a US-based LNG developer that has plenty of potential but not as advanced or well-known as Cheniere Energy, Inc. (LNG) or Tellurian Inc. (TELL). The company I want to explore is NextDecade Corporation (NASDAQ:NEXT).

NextDecade has an interesting LNG project that has good geography and scale. It also comes with plans for an integrated carbon capture and storage solution, differentiating NextDecade’s LNG cargoes from that of other export terminals. However, there simply isn’t enough public information regarding the economics of the SPAs and project financing for proper analysis and valuation. Until that information becomes available, investors are urged to stay on the sidelines on NEXT.

Background

NextDecade is a company focused on developing the Rio Grande LNG (“RGLNG”) Export Terminal, as well as a Carbon Capture and Storage (“CCS”) project at the terminal to minimize the carbon footprint of the project.

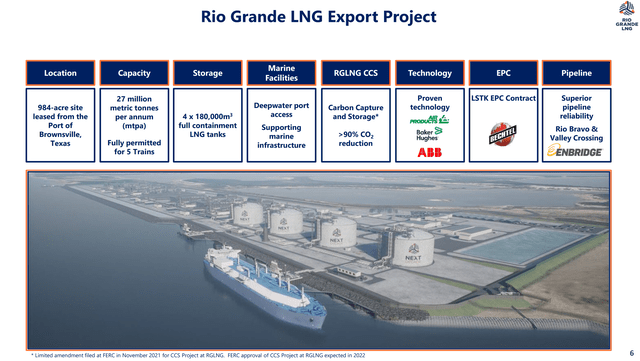

The RGLNG project is a fully permitted LNG export terminal, envisioned to ultimately have the capacity to export 27 mtpa of LNG through 5 liquefaction trains (Figure 1). The project is located at the Port of Brownsville, Texas, with deepwater port access and supporting marine infrastructure. It is designed to use proven liquefaction technology from Air Products and Chemicals (APD) and Baker Hughes (BKR). RGLNG will be supplied with natural gas from the Permian and Eagle Ford shale basins via the Rio Bravo Pipeline, a 4.5 Bcf/d pipeline to be built by Enbridge Inc. (ENB).

Figure 1 – RGLNG Highlights (NextDecade investor presentation)

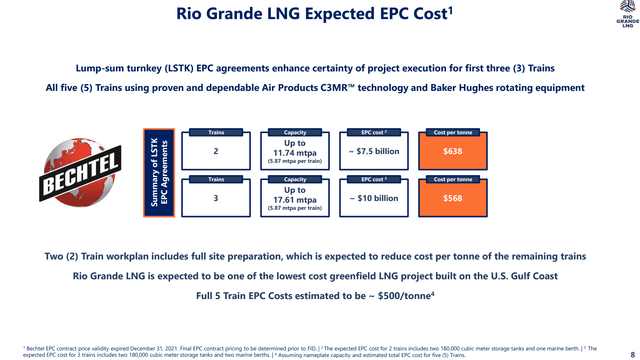

RGLNG has EPC agreements in place with Bechtel, one of the largest construction companies in the U.S. The agreements are structured as two Lump-sum turnkey (“LSTK”) EPC contracts, one for 2 trains and up to 11.7 mtpa capacity, and another for 3 trains and up to 17.6 mtpa. The lump-sum nature of the contracts protects NextDecade from potential cost overruns while the separation of the project allows for development in stages (Figure 2).

Figure 2 – LSTK EPC contracts (NextDecade investor presentation)

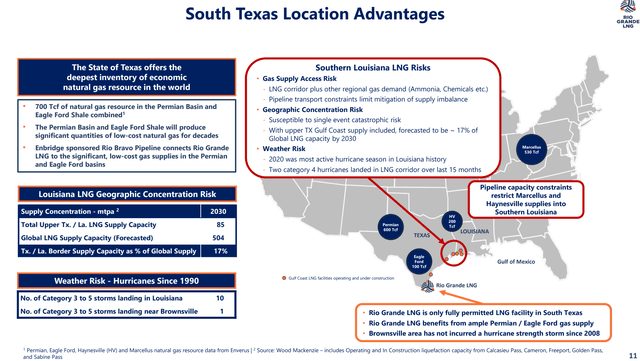

As mentioned above, RGLNG will connect LNG customers with the resource-rich Permian and Eagle Ford basins, which have a combined 700 Tcf of natural gas resource. At the same time, NextDecade believes RGLNG’s location in South Texas is a competitive differentiator as it avoids potential gas supply and concentration risk with other Upper Texas/Louisiana LNG operators. Furthermore, Brownsville is less susceptible to large-scale hurricanes, as the area has only experienced 1 hurricane of Cat 3 and above since 1990 versus 10 storms of Cat 3 and above in Louisiana (Figure 3).

Figure 3 – RGLNG geographical advantage (NextDecade investor presentation)

Unlike the first generation of LNG terminals that only charged a liquidation fee (“Tolling”), NextDecade appears to be more flexible in its commercial strategy. In its annual report, NextDecade described itself as offering “multiple LNG pricing options and flexible contract tenors (from 10-20 years), meeting the evolving needs of our customers and maximizing our total addressable market.”

For example, in its Sale and Purchase Agreement (“SPA”) with Shell, Shell will purchase 2mtpa of LNG from RGLNG on a Free On Board (“FOB”) basis with three-quarters of the volume indexed to Brent oil and one quarter indexed to U.S. domestic gas indices like Henry Hub. FOB means customers take title of the cargo at the export terminal, giving them flexibility to re-route cargoes as they see fit.

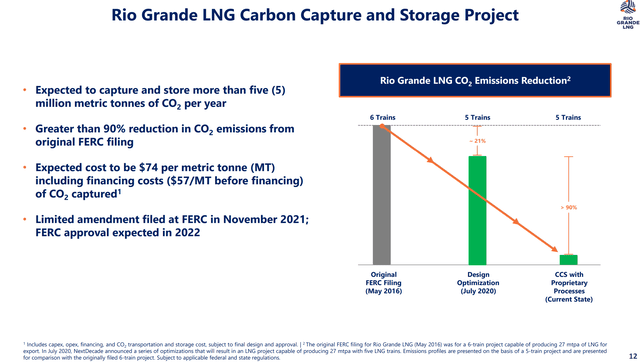

Carbon Capture Could Be Deciding Factor

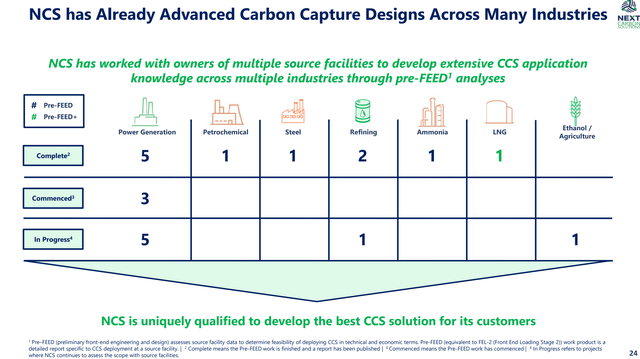

One of the most intriguing aspects of NextDecade’s Rio Grande LNG project is the design of an integrated Carbon Capture and Storage system (“CCS”). Through its fully owned subsidiary, NEXT Carbon Solutions (“NCS”), NextDecade offers end-to-end CCS solutions for industrial facilities such as power plants and heavy industrial factories. NCS combines proprietary processes with proven technology and equipment to perform carbon capture, and NCS has been deployed on 20 industrial projects to date (Figure 4).

Figure 4 – Next Carbon Solutions (NextDecade investor presentation)

For RGLNG, if approved by the regulator, NCS is looking to reduce the project CO2 emissions by more than 90% compared to standalone. This will make the RGLNG the LNG export terminal with the lowest carbon footprint, which could be a deciding factor for customers with strong ESG mandates.

Figure 5 – RGLNG with CCS expected to reduce 90% of CO2 emissions (NextDecade investor presentation)

Contracts Gaining Momentum

Despite flexible project economics and ESG credentials, customer contracting at RGLNG had hit a snag. Although RGLNG was approved by the regulator FERC in November 2019, NextDecade had not been able to sign any offtake agreements besides the 2mtpa Shell agreement originally signed in March 2019.

The problem, as mentioned in Michael Boyd’s analysis, was the collapse of LNG prices during the COVID-19 pandemic, which led to cargo cancellations and a hesitation by customers to sign long-term SPAs. However, Russia’s invasion of Ukraine has changed the calculus by many potential customers.

Since Russia’s invasion of Ukraine in February, RGLNG had been able to secure 6.25 mtpa of SPAs, bringing total SPAs signed to 8.25 mtpa, or 75% of the first 2 trains’ volumes. What is especially encouraging is that in July alone, 3mtpa has been signed in 3 separate agreements with China Gas, Guangdong Energy (formalizes HOA from March), and Exxon Mobil (XOM). So RGLNG certainly remains on track to announce FID in H2/2022.

Hard To Value NEXT

Admittedly, it is very difficult to value NextDecade, without more details on the SPAs signed and project financing costs. NextDecade currently has a $1 billion enterprise value (“EV”) with no operating assets and little cash, so it is basically a call option on the 27 mmtpa RGLNG project.

For comparison, Cheniere has an EV of $68 billion and operates the Corpus Christi and Sabine Pass LNG export terminals with combined capacity of 45 mtpa, with a 10 mpta expansion project at Corpus Christi that is close to FID. On an operating assets basis, Cheniere trades at $1.5 billion EV per 1 mtpa LNG while NEXT trades at $37 million per 1 mtpa potential, so NextDecade is basically trading at 2.4% the valuation of Cheniere, which seems reasonable given the significant risks to development.

Another data point we have is that Tellurian, developing the 27.6 mtpa Driftwood LNG export terminal, is trading at $1.9 billion EV, or $69 million per 1 mtpa potential. Tellurian is more advanced than NextDecade, as phase 1 of Driftwood with 11 mpta capacity is sold out and construction has begun. However, project financing is not yet secured, so it is reasonable for TELL to trade at a higher valuation than NEXT.

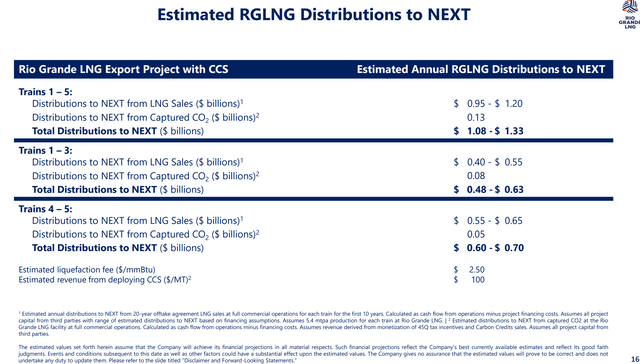

Also, figure 6 shows some indicative economics that RGLNG is expected to contribute to NEXT. Assuming all 5 trains are constructed at total EPC cost of $18 billion, RGLNG is expected to distribute $1.1 to $1.3 billion per annum to NEXT. On an unlevered basis, this does not appear to be a particularly attractive set of economics.

Figure 6 – Indicative RGLNG distributions (NextDecade investor presentation)

Ignoring the CCS project (which has its own set of capital expenditures), $1.1 billion returns on $18 billion in capital is 6.1% unlevered return. Companies typically show their most optimistic projections in marketing materials, so the true economics could be worse. Unless NEXT can finance a significant part of the $18 billion capex with very cheap debt, it is hard to see how RGLNG cash flows can be levered to attractive levels for equity holders.

For context, Cheniere’s senior debt has a 4.8% interest rate. It is highly unlikely that NEXT can finance RGLNG at interest rates more favourable than Cheniere given the risks involved. If we assume 60% of the $18 billion project is financed with debt at 5%, interest alone will cost $500 million, leaving $600 million in pre-tax distribution for the $6 billion in equity that will need to be raised, or sub 10% after-tax equity return.

Significant Risks Remain

Although recent SPA announcements have bolstered investors’ sentiment towards NextDecade, significant risks remain to the story. First, RGLNG will need to sign an additional 3 mtpa in offtakes before the first 2 trains are sold out and RGLNG can announce Final Investment Decision (“FID”). While recent SPA signings are encouraging, there is no guarantee that momentum will continue.

Secondly, even if enough SPAs are signed to FID phase 1, NextDecade still needs to finance the project. Phase 1 is expected to cost $7.5 billion, a large sum for a company with $1 billion EV and no operating assets. With interest rates rising (US 10-year treasuries were recently above 3%), financing the project at low rates may be more difficult. Also, the equity component of any financing will be hard to sell, given the economics mentioned above.

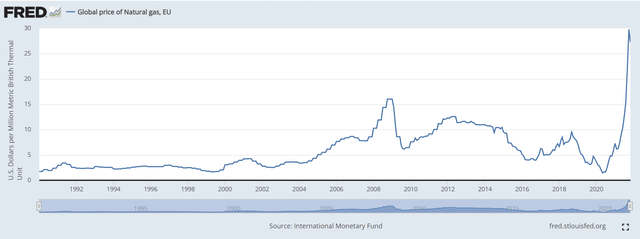

On the positive side, with European gas prices spiking to over $25 per mmbtu recently (Figure 7), NextDecade may be able to sign SPAs with more favourable economics. Unfortunately, we simply don’t know, as the SPA press releases to date are very vague.

Figure 7 – European gas prices spiking (St. Louis Fed)

Summary

In summary, NextDecade is an interesting name to keep an eye on as it closes in on sufficient SPAs to announce FID for the phase 1 of its Rio Grande LNG project. However, there is simply too much uncertainty at the moment surrounding RGLNG to properly analyze and value the project. Investors are encouraged to keep NEXT on their radar screen, as the company reveals more details on the economics of the signed SPAs and project financing.

Be the first to comment