style-photography/iStock via Getty Images

Investment Thesis

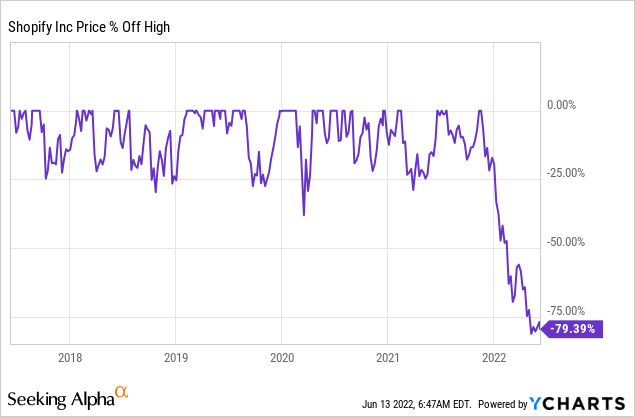

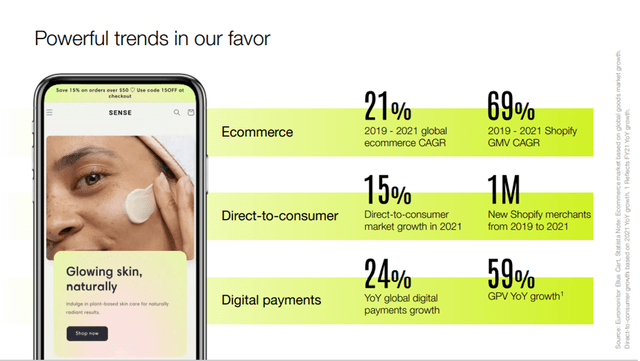

Shopify (NYSE:SHOP), a strong emergent player in E-commerce has traded at lofty valuations for an extended period of time. Having come down 79% from its most recent high, the question is whether it’s suitable for the individual investor’s risk profile, to dip their toes into the pool and pick up some Shopify stock. Growing its business on all fronts, displaying constant innovation, allowing to broaden and strengthen Shopify’s relevance to merchants within E-commerce, while growing its total addressable market as it goes along, I believe Shopify is here to stay. The numbers speak for themselves, with Shopify expected to reach $5.8 billion in revenue for FY2022, something a company doesn’t succeed with if it doesn’t hold relevance. Relevance, as most evident by the strong GMV growth, up from $7.7 billion back in 2015 to $175 billion by end of 2021. Trading at a FY2022 P/S ratio of roughly 8, I find that Shopify is now at a valuation, which it can grow into.

Introduction

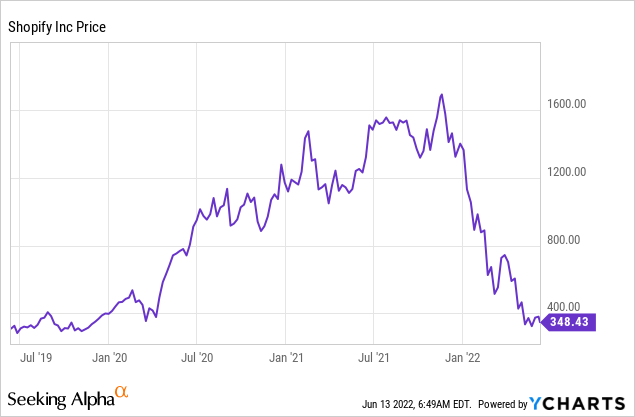

Back in May 2021 I published a bullish article concerning SHOP, as I had recently added to my position when the stock was trading at $1067 per share during a 26% pullback. The stock would eventually find its footing and climb all the way to $1762 per share. At that point in time, I mentioned that Shopify was trading at a valuation that could make your heart sink, but that I was bullish the company long term. I have a decade-long time horizon so volatility doesn’t bother me, however, I naturally didn’t foresee the stock would collapse by 79% from its most recent high, despite the extreme valuation when the company traded with a market cap of $200 billion. I didn’t add to my position beyond my purchase back in May last year, but that just changed as I’ve made use of the wipe-out to add at $334 per share within the last few weeks. The market cap now stands at $44 billion which is more reasonable, but still not cheap, meaning this stock requires you to have a time horizon counting multiple years to allow the thesis to play out. However, seen from my standpoint, this is a broken stock and not a broken company, and if management continues to execute, I believe today is a good opportunity to build one’s position. When it comes to high growth companies, I always utilize a dollar-cost averaging approach, which is also why Shopify is still only a minor position within my portfolio as I utilize drawbacks to build my position.

I used the following phrasing in my previous article, and starring at the graph above, I believe it deserves being repeated, as we all struggle with setting our emotions aside when starring at a situation developing like the one, we are in right now. Don’t forget, that despite having fallen almost 80% already, the stock can still take another large tumble, and none of us knows if that will turn out to be the case.

“My stance is, that the current sell-off presents an interesting opportunity, that only happens once or twice a year for Shopify as shown above. There is no knowing whether we will see another 10% or 25% reduction in share price, but if you are long Shopify, then you should be equally eager to add today as you were six or twelve months ago, but one might be challenged by basic psychology in order to overcome that mental state whispering “I might catch a falling knife here”.”

Despite being where we are right now, knowing we can still see another large leg down, we will most likely be challenged by loss aversion bias, and find it difficult to jump into the pool.

Last week, the FED and ECB (European Central Bank) both communicated stronger inflation than expected, with the ECB deciding to communicate a potential stronger hike than previously expected later this summer/early autumn, while also slashing its forward economic expectations for the Eurozone economies. Historically, when central banks need to hike interest rates at great speed, the market, in general, suffers over the coming twelve months, which is pure poison for the high-flying growth stocks, that are much more vulnerable to having their valuation reset, so we should all buckle up, as Shopify may not yet have found its bottom. As a matter of fact, as I’m writing this, we see a growing fear in the investor community, that central banks will fail to succeed with the “soft landing” approach. If we need another leg down however, I’ll treat that as an opportunity to keep on building my position. At the end of the day, it comes down to our own individual due diligence and trust in management on executing their vision.

If we zoom out just a little bit, Shopify is now trading close to the same price as it did at the bottom of the 2020 Covid-19 market crash, when the stock price closed at $332 per share on March 18th. Since then, Shopify has grown its revenue by 86% in FY2020 and 57% in FY2021, while still expecting to grow its revenue by roughly 30% for FY2022. Still, the interest rate environment is vastly different now, than back then, and as I also stated last time around. When interest rates are zero, everything becomes possible in an excel sheet in terms of valuation, as also evident by the stratospheric rise in the stock price compared to how quickly management can grow the fundamentals. Keeping the interest rate environment in mind, the current price compared to how the fundamentals have developed since last time the stock traded in this area, suggests to me, that we might be nearing a level, where the stock hopefully shouldn’t face too much further downside.

Q1-2022 Performance, Product Offering and Outlook

As already pointed out, Shopify is not growing at the pace we saw in FY2020 and FY2021, neither is it expected to do so in FY2023, as analyst consensus for next year is a growth rate at 30%. However, Shopify did have nine consecutive revenue beats stretching from 2019 until mid of last year, having missed Wall street’s expectations in Q3-2021, beating them again in Q4-2021, before missing expectations again in Q1-2022. In those most recent twelve quarters, Shopify has a much better track record of beating expectations in the quarters furthest away in time from today. However, if the company can regain its ability of beating expectations over the coming years, that upside related difference, may compound over time. In the recent twelve quarters, Shopify has beaten expectations by as little as 1.75% during Q3-2019 and by as much as 39% in Q2-2020. On the other side, the company has only missed expectations by 1.95% and 2.94% respectively.

Coming back to Q1-2022, observing the performance on a headline basis, this is how Shopify faired.

- GMV (Gross Merchandise Volume – total dollar orders facilitated via Shopify’s ecosystem) grew 16% YoY to $43.2 billion (31% growth in Q4-21)

- Revenue grew 22% YoY to $1.2 billion a miss of $40 million (41% growth in Q4-21)

- Subscription revenue grew 8% YoY to $345 million (26% growth in Q4-21)

- Merchant solutions revenue grew 29% YoY to $859 million (47% growth in Q4-21)

- Operating loss at $98 million (8% of revenue) vs. operating income of $118.9 (12% of revenue) a year ago

- Shopify holds $7.25 billion in cash and short-term investments on its balance sheet compared to total debt of $1.2 billion

- Shopify announced the acquisition of Deliverr, a fulfilment technology provider, operating an asset-light network of warehouses meant to ensure the ability for merchants to achieve fast delivery coast to coast. Deliverr will more than double Shopify’s current fulfilment team. Terms are a $2.1 billion deal paid for by 80% cash and 20% SHOP stock.

- Shopify SMB (small, medium businesses) total addressable market continue expanding at a current $160 billion, compared to $153 billion same time in 2021 and $78 billion same time in 2020

- Shopify share of US E-commerce at 10.3% compared to 8.6% YoY and 5.9% for same period in 2020

The uptick in subscription revenue reflects the influx of new merchants, while merchant solutions revenue is driven by the expansion in GMV.

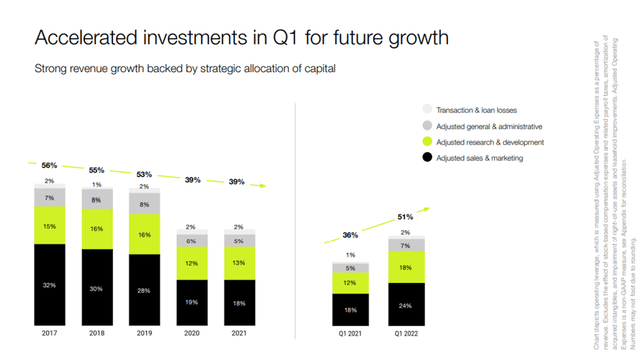

The Q1-2022 performance is not as stellar as same quarter a year ago, with management highlighting how the entire Covid-19 situation supercharged its GMV growth back then, due to lockdowns and stimulus checks. Management did address this normalisation back in Q4-2021 and this is also reflected in the forward outlook consensus amongst analysts. Shopify has also recently changed its terms and conditions in favour of its customer’s, meaning Shopify doesn’t get a slice of the partners first $1 million in annual revenue. This initiative was introduced during the summer of last year and is therefore also impacting growth in this current quarter. Furthermore, Shopify is investing aggressively in its ecosystem and has increased operating expenses significantly to $735 million compared to $440 YoY as a deliberate move to strengthen growth. This results in R&D expenses growing to 18% of revenue compared to 12% YoY while sales and marketing expenses grow to 24% of revenue compared to 18% YoY. This should all be part of driving stronger growth from second half of 2022 and onwards.

All of this may create a bit of headwind short-term but I’m not investing in Shopify for them to maximise profits short-term, I’m invested because I want them to grow the business to the greatest extent possible. This is not a business at scale, neither should it be at this point in its life cycle, meaning there is acceptance of prioritising growth worthy initiatives.

Not all is headwinds at the moment – Shopify continues to grow its share of US E-commerce. At the immediate look, 16% GMV growth can appear shabby, but it’s better than how both Etsy (ETSY) and Amazon (AMZN) faired during their Q1-2022, meaning that Shopify continues to eat the lunch of its competitors. I remember when Target (TGT) was severely under pressure back in 2018 due to concerns in the investor community that Amazon would rid the world of consumer company competitors, as there was simply no way to compete with Amazon when it came to E-commerce. Shopify doesn’t agree to this and has grown its GMV from $7.7 billion back in 2015 to $175 billion by end of 2021. Shopify has long since proved its relevance to the industry and its customers.

Shopify has a solid balance sheet, with substantially more cash than debt, and that is exactly the type of business I want to be invested in, when an economic storm might be on the horizon. This allows Shopify to continue investing in its business, and as a shareholder I can feel safe that the current debt burden doesn’t suddenly start causing trouble. This is a very important parameter, as the companies who get into trouble during difficult times, are the ones with a weak balance sheet. You can’t be a growth company burning cash, while having a weak balance sheet, it can only end badly if that’s the case.

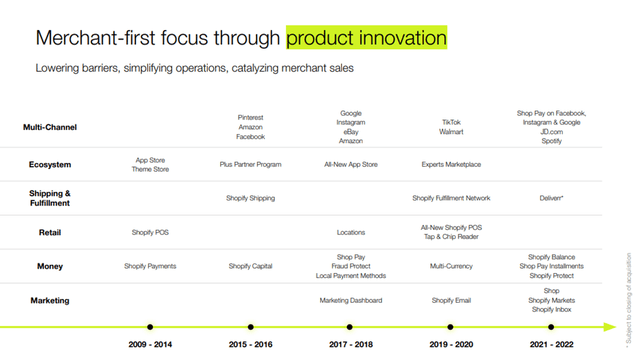

That is also exactly what management is doing, investing in innovation of new products, services, and partnerships as evident above via Deliverr, Shopify markets, Shopify balance and so forth, just counting a few of the recent additions. This is what drives a continued expansion in the total addressable market and also what strengthens Shopify’s moat while guarding itself from the intense competition in E-commerce.

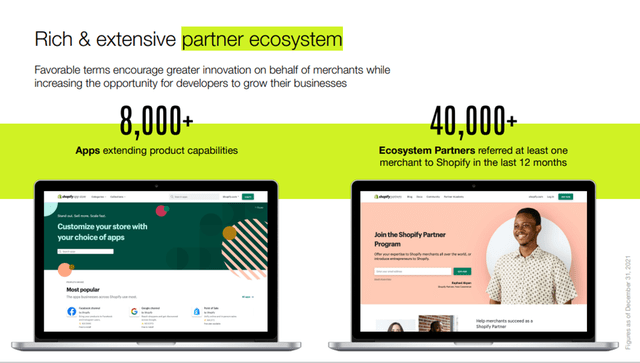

More than 8.000 apps are now part of putting products in front of consumers, such as via Facebook and Pinterest, as well as an extensive partnership ecosystem that drive value for Shopify. Shopify has often addressed this as a “merchant first” approach, and I believe it drives real value for both Shopify and its customers.

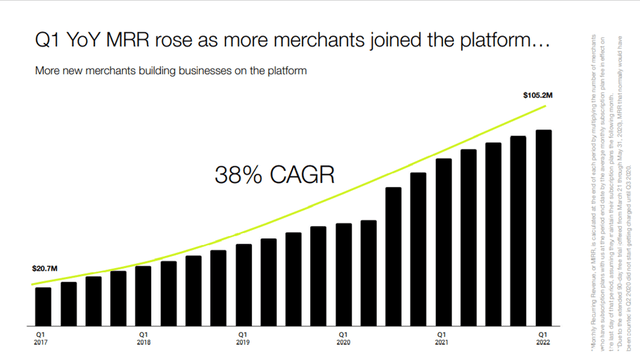

All of this adds together, allowing Shopify to have crossed the $100 million mark in terms of monthly recurring revenue (consisting of its subscription models Shopify Basic, Shopify Advanced and Shopify Plus). We see the clear bump as a result of the Covid-19 effect, however, the trend is going in the right direction. The key message here is, that Shopify is expanding its position quarter on quarter, year on year and while it’s in no way unique to Shopify to try and strengthen ones offering, it’s pleasing as a shareholder to observe the company is succeeding consistently. Remember, existing members are only willing to recommend Shopify to their peers because it creates value for them, otherwise they wouldn’t. With 40.000+ partners having recommended at least one new merchant to Shopify in the last year, Shopify is managing to create a lot of value for its customers.

Shopify After The Pandemic

There is an immediate need to address the elephant in the room, top-line growth. I already highlighted the 86% and 57% top-line growth experienced in FY2020 and FY2021, and those levels are behind us, at least for now. Continued product innovation can easily lead to increased revenue from the existing cohort of customers, time will tell.

Last year I raised the question to what extent the significant uptake in E-commerce was sticky beyond a reopening world. We now have the answer, and that period did play into a general elevation and acceleration of E-commerce. However, while it was unthinkable for Shopify to perform below Wall Street’s expectations in a given quarter back then, it is now a possibility as we are back to reality, in a world where not every quarter can be a revenue beat. Zooming out and observing the bigger picture, a set of very strong trends show themselves to the benefit of companies like Shopify, Amazon, ETSY and so forth. Having said that, shareholders will have to get used to whole new levels of growth having come out of the pandemic.

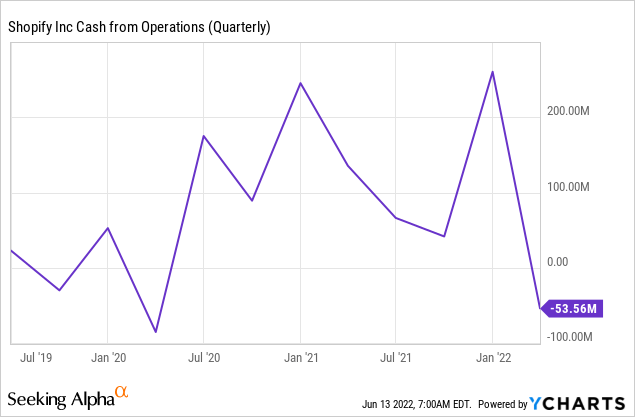

Here is perhaps the most important change to Shopify, which is that the company might not be able to generate the same positive cash flow as was the case during the pandemic. It comes down to how management want to prioritize, as they have communicated that they intend to reinvest all gross profit dollars back into the business to pursue expansion of services, geography, and other paths of growth. As I already mentioned, I’m perfectly fine with this as a shareholder, as I want to see the company grow and strengthen its moat as much as possible. Then we can discuss profitability down the road as the company matures, but we aren’t there yet. This is again where the strong balance sheet comes into play, giving management ample opportunity to time investments and decisions according to their will, and not the will of a given credit line. As shown in the previous breakdown of R&D and sales & marketing costs, Shopify has for a long period seen those costs trend downwards as a percentage of revenue, but management has made the conscious decision to invest more aggressively. Point being the company has already shown that it can operate a business in profitable territory.

Valuation & Risk

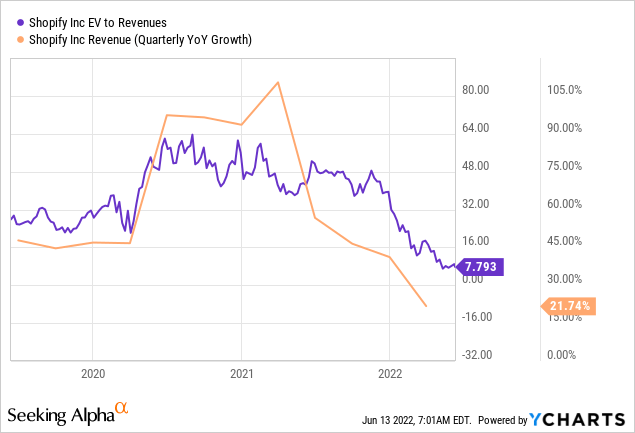

Shopify wasn’t your regular blue-chip bargain a year ago, and despite being down 74% YTD, it still isn’t. Shopify isn’t at scale and a measure such as P/E ratio doesn’t carry much value here – in fact, it’s borderline useless. However, to put the valuation into perspective, I believe looking at the P/S ratio gives some form of indication.

Currently, Shopify trades at the following P/S ratios according to Wall Street consensus expectations.

- FY2022 forward P/S of ~8 (Revenue exp of $5.8 billion)

- FY2023 forward P/S of ~6.2 (Revenue exp of $7.6 billion)

- FY2024 forward P/S of ~4.8 (Revenue exp of $9.9 billion – coverage by analysts is thin beyond 2023)

Seen from my standpoint, Shopify is now trading at a valuation which it can grow into. In fact, we have to go back all the way to 2016 to find another point in time where Shopify was trading at a lower P/S ratio, and with a FY revenue of $390 million back then, I believe it’s fair to say that Shopify has reached another maturity level as a business, today.

Another way to put the current valuation into perspective would be to compare it to the opportunity lying ahead. We of course need to keep some skepticism when management itself states the total addressable market is $160 billion, while expanding continuously. However, who is to say that Shopify can’t appreciate substantially from here on out? I don’t see a reason why Shopify can’t eventually turn into a triple-digit billion-dollar market cap company, eventually eclipsing it’s previous all-time high. Management has consistently grown Shopify into a much stronger business and the customer satisfaction is evident – Shopify is here to stay.

Measured on an EV to revenue multiple, and Shopify is trading well below what it used to prior to COVID-19. However, we can keep on displaying different valuation metrics, but at the end of the day, the current economic environment can easily end up putting pressure on companies such as Shopify for an extended period, potentially a very long time.

Despite still not being cheap, a haircut as large as the one Shopify has already suffered, does a lot to the valuation risk I discussed last year. However, when considering the development as given in the illustration above, we need to recognize that Shopify hasn’t found itself in a high interest rate environment before, so we can probably discard most of the historical comparison in the time to come. Further, that Shopify isn’t currently growing at the pace it used to, albeit still expected to grow 30% annually in the years to come.

No matter from what angle Shopify is viewed, it’s not a “cheap” company as per traditional metrics, but if one is only willing to initiate positions in “cheap” companies, then that person most likely wouldn’t be able to have acquired Visa (V), Mastercard (MA) or similar, as companies with great prospects typically are consistently “expensive”. It all comes down to the individual investor profile and willingness to accept risk. Personally, I’m a rather conservative investor, which is also why these high growth plays make up a smaller part of my portfolio despite my relatively young age.

In a situation such as the one we are currently finding ourselves in, I always go with dollar-cost averaging, as to avoid becoming overexposed to drawbacks in individual stocks. That is also why I just added another increment to my Shopify position.

Conclusion

Shopify is down 79% from its recent high but can still not be characterized as a cheap stock. Interest rate discussions remain on top of the global agenda, and concerns are mounting when it comes to whether central banks across the globe will manage to succeed with a “soft landing”. If they don’t, high growth and no profit stocks such as Shopify, will get the short end of the stick. A stock being down 80% doesn’t protect us from another big drawback, and valuation risks remain a topic as top-line growth is currently slower than in the previous years.

However, management continues to execute, driving long-term value for Shopify via expanding offerings, growing monthly recurring revenue, broadening its geographical footprint, all in an effort to strengthen Shopify’s competitive capabilities and advantages. Shopify is here to stay, and with 40.000+ ecosystem partners having referred at least one new merchant in the past twelve months, the value provided by Shopify to its customers, is evident.

Trading at a P/S ratio of roughly 8 for FY2022 and an expected FY2023 PS ratio of 6.2, Shopify can grow into its valuation. I’m a strong advocate for utilizing dollar-cost averaging when it comes to high growth companies, and therefore, I’ve only added another increment to my Shopify position at this current time, as I build my position slowly, and I do believe the current valuation is attractive in terms of going long Shopify.

Be the first to comment