J. Michael Jones/iStock Editorial via Getty Images

Brinker International Inc (NYSE:EAT) is a leading casual dining restaurant company with over 1,650 “Chili’s Grill & Bar” and 54 “Maggiano’s Little Italy” locations that are either company-owned or franchised. The challenge for Brinker over the past year has been ongoing operational disruptions through various Covid surges while also dealing with inflationary trends that have pressured margins. Indeed, shares of EAT are down by nearly 50% from its 2021 high against a subdued earnings outlook. That said, we see value in the stock at the current level considering the selloff has likely gone too far beyond fundamentals.

Investment Thesis

All indications are that restaurant traffic and demand for sit-down dining options have been strong despite concerns related to trends in consumer spending. It was only February when the CDC officially removed its indoor mask guideline which set the stage for what is a current “return to normal” theme across the economy including the more relaxed atmospheres at dining destinations that should be positive for comps.

Heading into the upcoming quarterly report, we see room for Brinker to outperform what is a low bar of expectations, particularly on the side of same-store sales. Efforts by the company to raise menu prices have likely offset rising costs and can be positive for earnings. A string of strong financial results this year can be a catalyst for EAT to rally higher.

EAT Fundamentals Recap

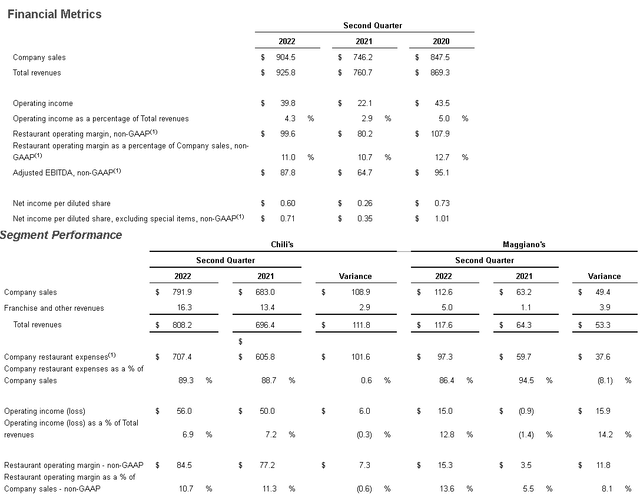

Going back to the company’s fiscal Q2 results released back in February, EAT earnings were highlighted by non-GAAP EPS of $0.71 which beat the consensus estimate by $0.20. Total revenue of $926 million climbed 22% year-over-year and was also ahead of estimates. This is in the context of a weak comparison period at the start of 2021. Comparable restaurant sales were up 17.7% y/y and also 3.5% higher against fiscal 2020 as a pre-pandemic benchmark.

The restaurant-level operating margin at 11.0% climbed from 10.7% in the period last year, although part of the reason the stock has been volatile is a sense that this metric could have been stronger at this point if not for the higher expenses.

For the core Chili’s segment which represents 87% of total sales, the operating margin declined by 60 basis points with management citing increased wages amid a tight labor market, as well as higher commodity costs that were only partially offset by top-line leverage. The smaller Maggiano operation supported the firm-wide result with a higher operating margin at 13.6% from 5.5% in the period last year benefiting from the restart of catering and banquet functions that were not offered in early 2021.

Overall, it was a solid quarter considering the circumstances. The key takeaway is that while the margins have disappointed, the company is profitable and generating higher cash flow. Adjusted EBITDA at $87.8 million in the quarter compares to $95.1 million for the quarter before the start of the pandemic in 2020.

The company noted that the Omicron wave into January ended up impacting the company through lower restaurant traffic which was observed across the industry. Nevertheless, management believes Chili’s has been able to outperform the industry in terms of same-store sales. From the earnings conference call:

Chili’s continued its trend of beating the industry marking the 16th consecutive quarter of traffic outperformance. This trend has continued into January, despite the Omicron spike. Our fundamental belief is that the key to healthy, sustainable growth is to have an increasing number of guests choosing us.

EAT Stock Forecast

Much of the weakness in the share price of EAT was through the second half of 2021 while the stock has been trading in a relatively tight range of around $35.00 for the last several months. The interpretation we have is that the stock sold off last year into a string of revisions to earnings estimates lower as the market was looking ahead at the inflationary cost pressures and labor market challenges. By this measure, EAT has already incorporated many of the near-term headwinds at the current price. We think the next move will be higher.

On a technical basis, we observe a “double bottom” chart pattern with EAT able to hold support right around a low of $30.00 both in late January and again during the initial Russia-Ukraine invasion selloff. The bullish case here is that the potential that the company posts a strong fiscal Q3 report expected later this month with a positive assessment from management regarding operating conditions into the current quarter can help the stock break out from this range.

The market narrative has been dominated by macro uncertainties including rising interest rates and persistently high inflation. As it relates to Brinker, we believe it can get some relief on the labor market side with the insight that the big hiring spree was done at the end of 2021 which included one-off expenses related to training and overtime. While the labor market remains hot, the impact on the restaurant industry has leveled off with more stable headcounts compared to the rush of rehiring during the reopening stage last year. We also see room for the company to push pricing higher to manage food cost inflation.

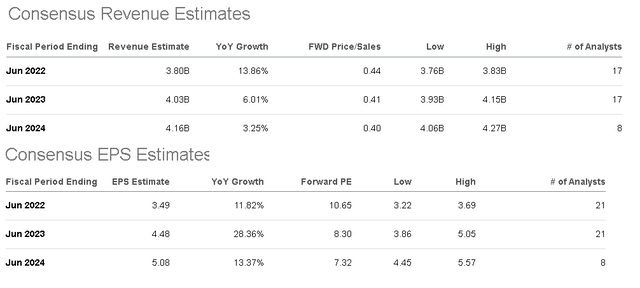

According to consensus, the market sees Brinker International’s revenue reaching $3.8 billion for fiscal 2022, up 14% y/y while leveling off to 6% by 2023. The forecast for EPS of $3.49 this year is expected to accelerate towards $4.48 next year implying earnings and margins momentum. There is a case to be made that if yet-to-be reported Q3 and Q4 results can outperform on the top line, the full-year EPS estimates may be too low.

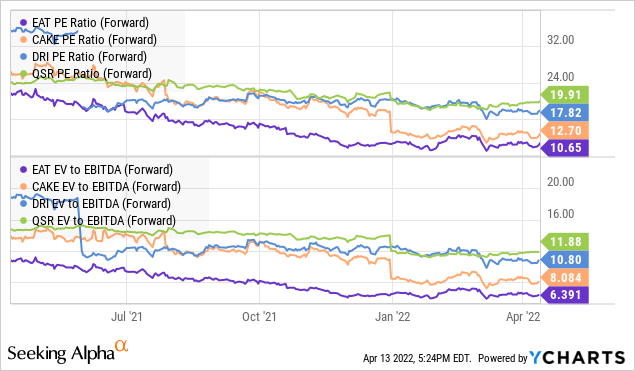

In terms of valuation, we believe the earnings multiples with a forward P/E of 11x and the 1-year forward ratio at 8.3x on the consensus 2023 EPS are attractive. We highlight that Brinker trades at a discount to a peer group of Cheesecake Factory Inc (CAKE) at 12x, Darden Restaurants Inc (DRI) at 18x, and Restaurant Brands International Inc (QSR) at 20x within this category of casual towards quick-service dining. EAT is also at a discount in terms of its EV to forward EBITDA ratio. While these companies have their differences, EAT looks like a good value pick amid overall solid fundamentals.

Final Thoughts

We rate EAT as a buy with a price target for the year ahead at $50.00 implying a 1-year forward P/E of 11x on the current consensus 2023 EPS at $4.48. Our thinking here is that there is room for the earnings multiple spread to converge with casual dining peers like Cheesecake Factory. The company’s strong trends in comparable restaurant sales are a testament to the strength of Chili’s brand and also customer loyalty. The company will continue to benefit from the consolidation of the broader industry with many independent restaurants permanently going out of business during the pandemic. A long-term growth strategy with an expanding footprint of new restaurant locations including internationally is positive for the outlook.

The main risk to watch would be a more concerning deterioration in consumer spending with the possibility of a broader economic slowdown. At the same time, we believe EAT within the restaurant industry can fare relatively well because they are still benefiting from this post-pandemic pent-up demand for travel and outside the home activities. The operating margin and same-store sales are the key monitoring points going forward.

Be the first to comment