Cumulus Media’s Board of Directors has decided to turn up the share buybacks. Tashi-Delek/E+ via Getty Images

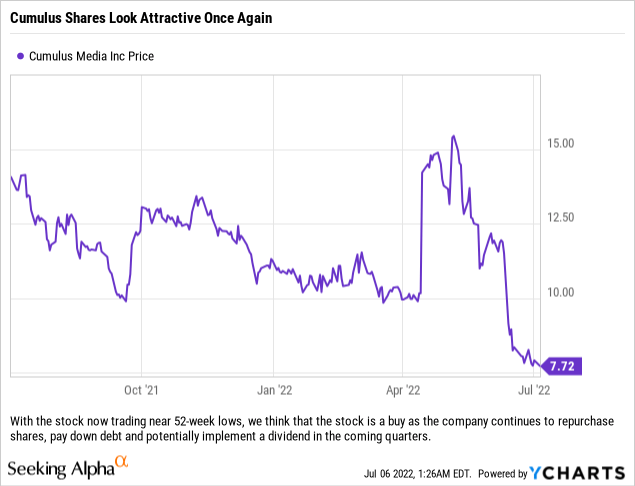

We last wrote about Cumulus Media (NASDAQ:CMLS) back in April (article located here), when we discussed that the company should fetch a higher takeover offer than was being offered by a consortium led by radio industry veteran Jeff Warshaw. At the end of the day, Cumulus Media’s Board of Directors agreed with this logic and did not accept the $15/share (potentially up to $17/share) offer and instead decided to initiate the return of capital programs ahead of schedule (previously the company stated that they would announce programs for the second half of 2022). We think that the Board and management team got some issues correct, and missed the mark on some other items.

Yes, the stock is down sharply from the big jump on the takeover interest, but so too is the stock market as a whole. Many peers have also seen their shares fall, but we still think that this name is attractive relative to peers as management has a few levers that they can begin to pull ahead of competitors. We will cover a few of them in this article.

The Buyback

In April, we laid out our thesis for purchasing Cumulus Media shares and discussed how we thought the company could increase shareholder value (and the share price) over the next 12-24 months. We stated that we believed “a share buyback plan of at least $50 million” was possible along with “a new dividend policy.” Our cash flow estimates for the current year, and upcoming year (FY 2023), must have been pretty spot on because the Board initiated a $50 million share repurchase program. So we nailed that portion of our buy thesis.

We did scratch our head over the decision to allocate $25 million of the $50 million share buyback program to a modified Dutch auction with the company offering to purchase shares at a price between $14.50/share and $16.50/share. Cumulus announced that they repurchased 1,724,137 shares at a price of $14.50/share, retiring roughly 8.7% of the outstanding shares on June 3, 2022. While we like the idea of buying back stock, we do prefer for buyback plans to focus on purchases over time and not being lumpy in nature (this plan became heavily front-loaded with this initial $25 million purchase). We understand Cumulus wanting to retire shares quickly and trying to support shares after declining a takeover offer, however, we do feel like it was a waste of shareholder capital and could even be viewed as a bail-out of sorts for those who were just speculators on a potential acquisition.

A Possible Dividend

On the conference call following the company’s earnings, the Q&A session featured a few questions, with one touching on the dividend issue. Basically, management said that the Board looked at all of their options and essentially views share buybacks as the best way to return capital to shareholders (and get the best bang for their buck) because they think that their stock is undervalued. We agree that the shares are undervalued, but we think that beginning a dividend policy would serve everyone well; shareholders, management and the Board.

After the completed buyback, the company should have just under 19 million shares outstanding. If we use 19 million shares for a baseline, the company could initiate a quarterly dividend of $0.03/share, for an annual dividend of $0.12/share, and only use $2.28 million total for dividends. The stock, at current prices, would yield 1.5% and provide some support to shares while also bringing in new buyers (dividend investors) looking for companies who pay a dividend and have room to grow it.

For perspective, Cumulus reported Q1 2022 EBITDA of $31.2 million, and trailing 12-month (or TTM) EBITDA of $157 million; more than enough to cover this small initial dividend and enable the company’s management to continue to pay down debt, repurchase stock and take advantage of opportunistic M&A transactions that may arise. If the company sees its business hold up through the rest of the year, and we suspect that it will with the political ad spend that will be occurring in the last two quarters of the year during the US midterms, then we suspect management will have to not only initiate a dividend but also increase the share buyback program.

Looking Forward

We continue to believe that this is a story that investors need to be following, even if they do not want to get long shares here. We have added to positions on this pullback and will continue to purchase shares in order to reach our full allocation for various portfolio types because although we recognize that a recession would impact the company’s revenues, earnings and cash flows, we think that management will continue down a path which will ultimately lead to greater shareholder returns; potentially due to another takeover offer emerging.

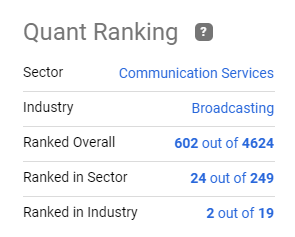

According to Seeking Alpha’s Quant Rankings, Cumulus Media stacks up pretty well:

Cumulus Media has pretty strong quant rankings. (Seeking Alpha)

Drilling down into the rankings, Cumulus Media is actually the highest-ranked radio broadcaster, with only TEGNA Inc. (TGNA), the local TV station operator, having a higher ranking. TEGNA’s ranking is aided by the fact that the company accepted a takeover offer from Standard General, LP – the hedge fund which also owns over 5% of Cumulus Media’s shares.

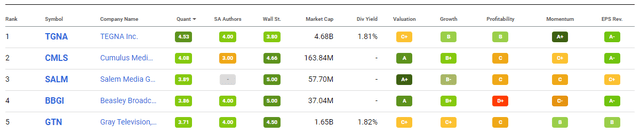

Cumulus Media’s Quant Rankings are strong, with many of the negative marks being due to the stock’s recent pullback. (Seeking Alpha)

While the company does face some headwinds moving forward, it also has some potential tailwinds which could develop, especially if certain advertising customers (namely auto dealerships) return to the airwaves to purchase inventory in line with historical norms. With the auto market appearing to be slowing, that might be possible in the next quarter or two in certain markets. This will be one of the key items to watch when Cumulus Media announces their quarterly results on August 4, 2022.

Summary

We stick by our estimated full value for the company of $25-$30/share, and although we could increase this due to the company’s repurchase of shares outstanding, we will hold off on that until after Cumulus reports earnings and provides guidance in about a month. We want to see what the company has to say about inflation and the slowing economy, as well as their opinion on how this will affect the business. At current prices, this implies that investors could see shares triple if management can execute on their business plan while also delivering on further programs to return capital to shareholders. This risk/reward scenario is why we think Cumulus Media remains a compelling long-term investment.

Be the first to comment