Amore al Arte/iStock via Getty Images

The VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ:ANGL) is an index ETF investing in Fallen Angels, downgraded corporate bonds. Fallen Angels tend to significantly outperform relative to corporate bond indexes, as forced selling causes these securities to trade with abnormally low prices and yields, leading to market-beating returns for shareholders. Fallen Angels, as most corporate bonds, see long-term benefits from rising interest rates, and so should see rising yields and returns in the coming years. ANGL is a buy, and one of the strongest corporate bond ETFs in the market today.

As an aside, the iShares Fallen Angels USD Bond ETF (FALN) is a very similar ETF, investing in the same niche, and with similar characteristics and investment thesis.

Fallen Angel Overview and Analysis

ANGL invests in Fallen Angels, a very specific type of corporate bond. To understand ANGL we must first understand what Fallen Angels are, and how they relate to other corporate bonds.

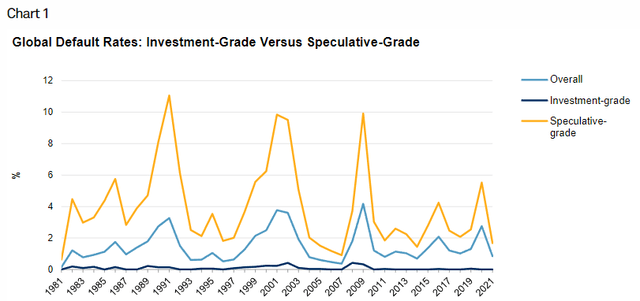

Corporate bonds are generally divided in two segments. Investment-grade bonds, issued by companies with solid financials and with low probability of default, and non-investment grade, issued by companies with weaker financials, and with comparatively higher probability of default. Defaults are rated for both bond segments, but non-investment grade bonds are materially riskier regardless.

S&P

Some institutional investors and index funds are constrained from investing in non-investment grade bonds, due to their high default rates, and so focus on investment-grade bonds. As an example, the Federal Reserve bought billions in corporate bond ETFs in 2020, almost all of which focused on investment-grade corporate bonds. The Federal Reserve’s largest holding was the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), the benchmark investment-grade bond ETF, with a massive $6B plus investment. The Federal Reserve also invested in some high-yield corporate bond ETFs, but amounts were significantly lower. As an example, the Federal Reserve invested tens of millions in ANGL, two orders of magnitude less than LQD.

Federal Reserve investment decisions were (mostly) based on legal, regulatory, and reputational concerns: can’t have a government entity investing in risky securities, doesn’t look good. Financial considerations are secondary: institutional investors won’t simply decide to focus on junk bonds because the yields are good. There are many other institutional investors with similar constraints, including many pension funds and similar. These create opportunities for arbitrage / above-average returns in the bond market. Fallen Angels are one such opportunity.

Fallen Angels are corporate bonds downgraded from investment grade to a non-investment grade credit rating, which occurs due to deteriorating financial, industry, and economic conditions. Before their downgrade, these securities were investment-grade, and so saw strong demand from institutional investors. Strong demand meant prices were high and yields were low. After their downgrade, strong demand turns into significant selling pressure, as institutional investors sell their downgraded bonds. Sellers are price-insensitive. LQD will sell their downgraded bonds at more or less whatever price it can get, because it is an index fund with clear, explicit investment rules, and it does not invest in non-investment grade bonds. Other institutional investors will follow suit.

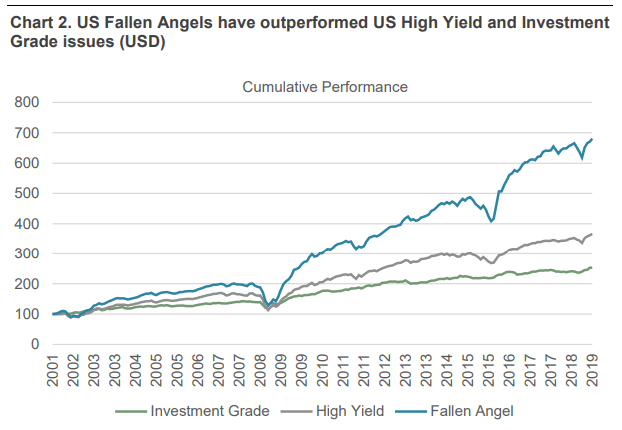

Significant selling pressure by price-insensitive sellers means prices go down by a lot, and by more than fundamentals, which presents something of an opportunity for investors. Lower prices mean higher yields, mechanically, and greater potential capital gains, assuming prices recover, so Fallen Angel investors should see strong, market-beating returns. That has indeed been the case, with Fallen Angels outperforming most relevant bond-indexes for decades, and by quite a large margin.

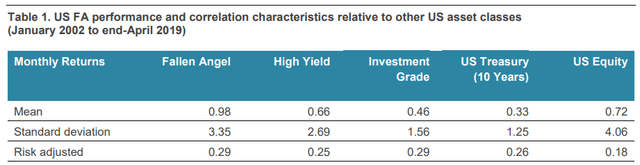

Russell Investment Services

Russell Investment Services

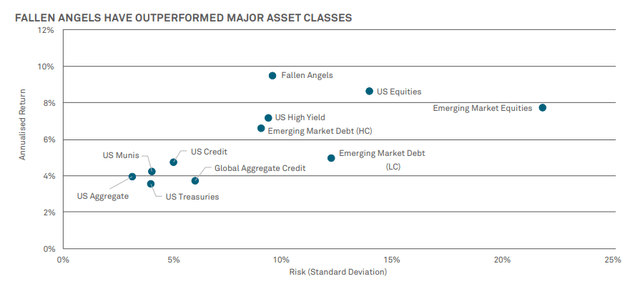

Fallen Angels significantly outperform non-investment grade corporate bonds while having comparable levels of risk and volatility. Due to this, and as can be seen above, Fallen Angels have stronger risk-adjusted returns than most other asset classes, including bonds and equities.

Russell Investment Services

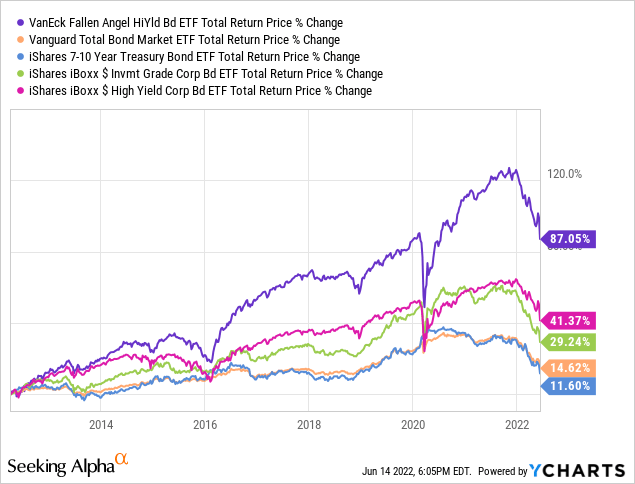

ANGL itself focuses on Fallen Angels, and so performs in-line with the above. The fund has significantly outperformed relative to all of its peers since inception, as expected.

ANGL’s entire investment thesis rests on the strong expected and realized performance of its underlying subasset class, Fallen Angels. I’ll be taking a closer look at the fund itself, but the above is basically the fund’s entire investment thesis.

ANGL – Basics

- Investment Manager: VanEck

- Underlying Index: ICE US Fallen Angel High Yield 10% Constrained Index

- Expense Ratio: 0.35%

- Dividend Yield: 4.61%

- Total Returns CAGR 10Y: 7.20%

ANGL – Overview

Strategy and Holdings

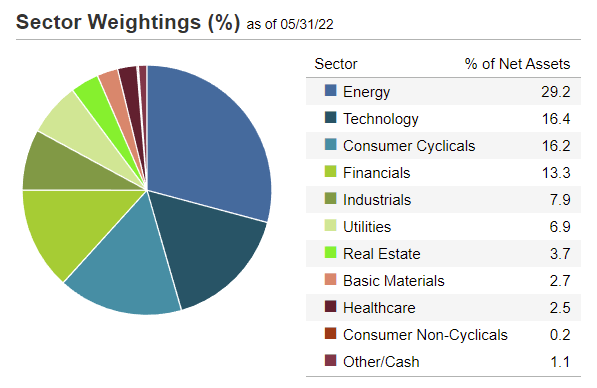

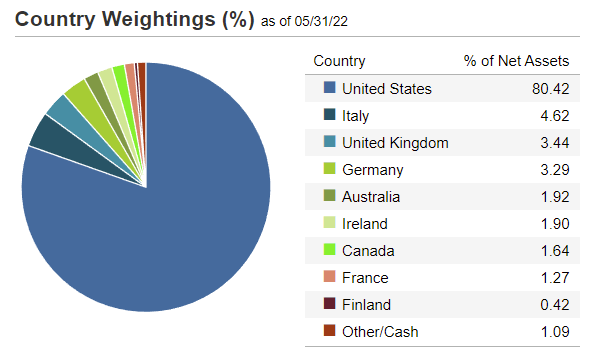

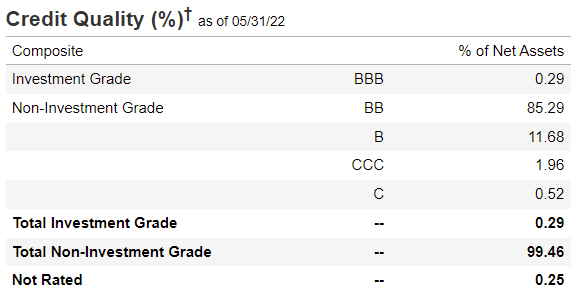

ANGL is an index ETF investing in dollar-denominated Fallen Angel corporate bonds. The fund tracks the ICE US Fallen Angel High Yield 10% Constrained Index, an index of these same securities. It is a broad index, which results in a reasonably well-diversified fund, with investments in 220 securities, and with exposure to most relevant industry segments. The fund focuses on U.S. issuers but has some exposure to dollar-denominated securities from other developed markets. The fund focuses on bonds rated BB, the highest non-investment grade rating, as is common for these funds.

ANGL’s diversification reduces portfolio risk and volatility and is a benefit for the fund and its shareholders.

ANGL Corporate Website

ANGL Corporate Website

ANGL Corporate Website

ANGL is somewhat overweight energy, with a 29% allocation to said industry. ANGL’s overweight energy position is, in my opinion, reflective of the fund’s entire strategy and investment thesis. ANGL is overweight energy as many energy corporations saw downgrades in 2020-2021, as the coronavirus pandemic led to significantly reduced energy prices. Energy prices have since recovered, as have industry fortunes, financials, and balance sheets. Improved fundamentals should lead to credit upgrades and higher energy bond prices, ultimately resulting in significant capital gains and returns for ANGL and its investors.

Besides the above, not much else stands out about the fund, its strategy, or holdings.

Dividend Analysis

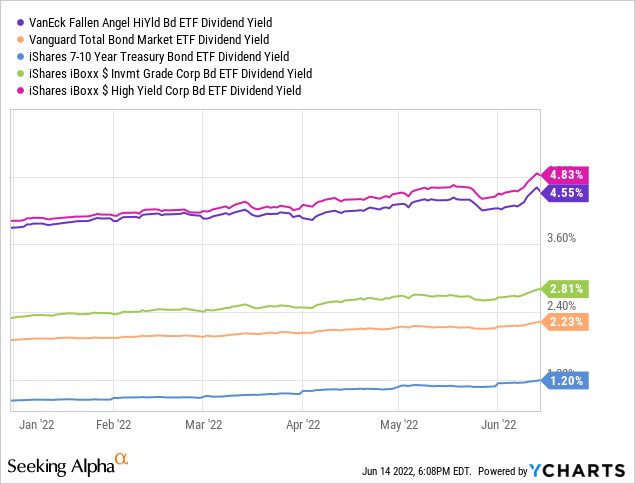

ANGL currently offers investors a reasonably good 4.6% yield. It is not a particularly strong yield on an absolute basis, but it is somewhat higher than that of most bond indexes. ANGL does yield slightly less than most non-investment grade corporate bond index ETFs, although the difference is not particularly material.

On a more positive note, ANGL’s underlying holdings generate more than 4.6% in income. The fund’s bonds have an average coupon interest rate of 5.4%, quite a bit higher than the fund’s dividend yield. ETFs almost always distribute any and all income to shareholders, so if ANGL’s underlying holdings generate 5.4% in interest, the fund’s yield should increase to around 5.4% in the coming months. ANGL’s dividend has seen some growth in the past few months, but fund distributions are somewhat volatile, so said growth could be a random spout of volatility.

ANGL’s dividend yield is reasonably good, but definitely not great, nor is it particularly high for a high-yield corporate bond ETF. Were the fund really shines is in its total performance. Let’s have a look.

Performance Analysis

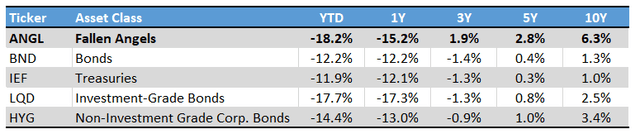

ANGL’s performance track-record is quite strong, with the fund significantly outperforming relative to all relevant bond sub-asset classes since inception. Outperformance has been entirely driven by higher capital gains, consistent with the fund’s strategy and holdings.

ETF.com – chart by author

On a more negative note, the fund’s performance has worsened in the past year, with the fund slightly underperforming relative to most of its peers for the same. In my opinion, performance will improve once economic conditions stabilize, allowing bonds to recover in price. That has been the case since the fund’s inception, and I do believe that the fund’s strategy remains as effective as ever.

ANGL’s strong performance track-record is a significant benefit for the fund and its shareholders, and the fund’s core investment thesis.

Conclusion – Strong Buy

ANGL invests in Fallen Angels, corporate bonds with a decades-long track record of market-beating shareholder returns. The fund is a buy, and one of the strongest corporate bond ETFs available in the market today.

Be the first to comment