Aksonov/E+ via Getty Images

Investment Thesis

Prior to the end of 2020, prospective investors in Pfizer (NYSE:PFE) – the US’ second largest pharmaceutical company by market cap – could have made the argument that the company was neither well-run, nor successful.

The company’s share price had been immobile for many years, offering no real value for investors, its dividend growth was unexceptional – having grown ~35% between 2015 and 2020 – and its dividend yield of ~4% – 4.5% offered similar value to a fixed income security, albeit with the significantly higher risk associated with equities.

Pfizer’s share count of 5.6bn – 2x more than any other “big Pharma” organization and the fifth largest of any listed company – does not materially affect the company valuation, but hints at historical mismanagement, and between 2012 and 2020, top line revenues at the company declined by 24%, from $54.7bn, to $41.7bn.

Taken together, the above does not seem to add up to a recipe for future success, although we now know that anybody who bought Pfizer stock at the beginning of 2020, when the stock price was ~$35, would have realized a 51% return on their investment – or around 2x the growth in value of the S&P 500 over the same period.

That is highly impressive for a major pharmaceutical with a current market cap valuation of $295bn – in fact it is the best performance for the period out of the “Big 8” US Pharma giants, in order of market cap – Johnson & Johnson (JNJ), Pfizer (PFE), Eli Lilly (LLY), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Gilead (GILD) and Amgen (AMGN).

Most people will understand the reasons why Pfizer has outperformed all comers during the pandemic era. Comirnaty, the COVID vaccine developed by the Pharma and its partner BioNTech (BNTX), was the most successful in terms of both efficacy and distribution, with 6 out 10 vaccinated people in the US receiving it, and hundreds of millions more overseas.

In 2021, Comirnaty earned $36.8bn of revenues worldwide, and Pfizer’s overall revenues increased by 92%, to $81.3bn, which by any company’s standards, is a truly staggering uplift. And it gets better.

At the end of 2022, Pfizer won approval for its COVID antiviral Paxlovid, after the therapy once again beat all-comers – including Merck’s much-hyped Molnupiravir – on efficacy, reducing risk of death in non-hospitalized, high-risk adults with Covid-19 by ~88%, compared to e.g. Molnupiravir’s 30% reduction.

Paxlovid is forecast by management to earn Pfizer $22bn in 2022, whilst Comirnaty is forecast to earn $32bn, meaning Pfizer’s total revenues in 2022 could be as high as $98 – $102bn and its adjusted diluted EPS $6.35 – $6.55 – up from $4.42 in 2021.

It is a stunning achievement from a Pharma that had struggled to grow revenues for the best part of a decade beforehand, and management rightly deserves all of the plaudits and praise for rapidly developing 2 crucial drugs in the fight against COVID. CEO Albert Bourla has been financially rewarded for Pfizer’s excellent 2021 by a compensation package reportedly worth $21m.

Bourla seems to have transformed Pfizer’s fortunes since becoming CEO in 2019, but nevertheless, the next phase of the company’s development – the period from 2023 to the end of the decade let’s say – looks more challenging.

That’s because, after 2022, when Pfizer could eclipse Johnson & Johnson as the largest global pharmaceutical company by revenue, revenues are likely to begin shrinking again if, as seems likely, mass COVID vaccination programs end, and cases of COVID fall, which could see sales of both Comirnaty and Paxlovid fall below $10bn each in 2022, and continue to decline in each subsequent year.

It shouldn’t be forgotten either that Pfizer’s development partner BioNTech played a critical role in the success of Comirnaty, and that Pfizer passes 50% of Comirnaty profits directly to the Germany-based messenger-RNA specialist.

In recent bullish notes on Bristol Myers Squibb and AbbVie, I have been able to show how management’s detailed planning, communicated clearly to investors, shows how the companies will continue to grow their top line revenues in the low-to-mid single digits until the end of the decade, even as key assets face patent cliffs that will decimate their sales over time.

Does Pfizer have a similar plan in place, or a similar pipeline ready to replace the falling revenues of Paxolvid and Comiranty if, as is expected and hoped, the pandemic ends and COVID infection rates and deaths fall to about the same level as e.g. influenza, with a few hundred thousand deaths per annum, as opposed to tens of millions?

It would be unfair to say that Pfizer’s COVID success happened more by accident than design, but equally, we should also ask the question as to whether management has capitalized on its success by putting in place a long term plan to maintain shareholder value.

That is the question I will try to examine in the rest of this post. So far, we have examined how Pfizer’s share price has gone from stagnant for years, to +63% across the past 12 months, thanks to its COVID vaccine and antiviral. Now let’s take a look at the rest of the company’s drug portfolio, pipeline, and strategy.

Pfizer’s Portfolio Performance Ex Comirnaty

Leaving aside Comirnaty, Pfizer’s biggest revenue drivers in 2021 were the blood thinner Eliquis (jointly marketed and sold with Bristol Myers Squibb) which earned $5.9bn of revenues – up 19% year-on-year; breast cancer therapy Ibrance, which earned $5.4bn, about the same as in 2020; pneumococcal vaccine Prevnar, which earned $5.2bn of revenues, down 11% year-on-year; JAK inhibitor Xeljanz (for auto-immune conditions), which earned $2.46bn, flat year-on-year; Vyndaqel/Vyndamax, which earned $2bn, up 55%; prostate cancer therapy Xtandi, which earned $1.12bn, up 26%; and tyrosine kinase inhibitor Inlyta (indicated for kidney cancer), which earned $1bn, up 26% year-on-year.

Together, these assets made up ~49% of Pfizer’s non Comirnaty / Paxlovid revenues of $44.4bn in FY21, and when we add in Pfizer’s Hospitals division revenues of $7.3bn – up 5% year-on-year, and biosimilars division, where revenues grew 51% to $2.34bn, 71% of Pfizer’s non-COVID related portfolio is accounted for.

Overall, Pfizer reported 6% annual growth ex-Comirnaty / Paxlovid. Bristol Myers, which earned $46.4bn revenues in FY21, drove 9% growth, so the 2 companies are comparable, although it is worth noting that BMY’s market cap valuation is nearly half that of Pfizer’s – $160bn, versus $297bn. In terms of earnings per share (“EPS”), BMY delivered GAAP EPS of $3.2, whilst Pfizer delivered $3.9.

That ought to serve as a sobering warning to Pfizer investors, since it indicates that without its COVID therapies, based on revenues and earnings, the company is neck and neck with another company that is valued at 50% less by the market.

Pipeline Promise Is Present, But Precise Impact Unknown

BMY management is also confident (again, please refer to my previous article on BMY) that it can find an additional ~$25bn in revenues from new products before the end of the decade, helping it to continue to grow revenues even while major products such as $12bn per annum Revlimid face loss of exclusivity (“LOE”).

In its Q421 and FY21 earnings presentation, Pfizer also says something similar, but whilst BMY can pinpoint exactly which assets will drive its growth (and by how much others’ sales will decline), Pfizer’s statement is more vague.

A statement reads that the company will “potentially generate at least $25bn in incremental 2030 risk-adjusted revenues”. Another statement refers to “potentially breakthrough assets”, whilst a third claims that its business development “is expected to contribute >$13bn to 2030 consensus revenue, which is below our internal expectations”.

That latter statement strikes me as somewhat odd, since it seems to suggest management takes more notice of analysts’ estimates of what its top line may look like in 2030 than its own internal estimates!

One thing that the Comirnaty success has provided Pfizer with is massive cash resources, which management ought to be using to future-proof the company either through R&D or strategic M&A. Pfizer says it increased R&D investment from $8.9bn in 2020, to $10.1bn in 2021 – quite low, given revenues increased by 92%, whilst its M&A activity has also been modest.

The $7bn purchase of Arena Pharmaceuticals appears to have paid off, since its lead asset, the S1P modulator Etrasimod has just met endpoints in a Phase 3 study in Ulcerative Colitis, potentially opening up a multi-billion dollar market, with several more similar sized markets targetable in anti-inflammatory.

Biosimilars is another area to get justifiably excited about, given both the growth of the division, and the growth of the industry as a whole, although that didn’t seem to stop Viatris (VTRS), which inherited some of Pfizer’s biosimilar assets after being spun out from the big Pharma’s UpJohn division, offloading them to Biocon Biologics, in double quick time.

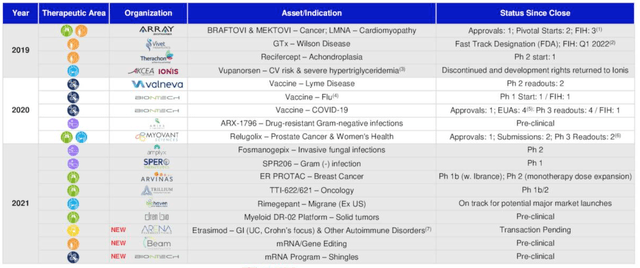

Even a $7bn outlay on Arena seems a little unambitious when we consider Pfizer’s present wealth, and when it is viewed in the context of e.g. Bristol Myers’ $77bn acquisition of Celgene, or AbbVie’s ~$67bn acquisition of Allergan. Pfizer’s business development activity, as we can see from the chart below, is not non-existent, but is not exactly overactive either, in my view.

Pfizer’s recent Business Development opportunities. (earnings presentation)

Referring to its pipeline, Pfizer also name-checks 5 development programs for which it has high hopes.

A next-generation breast cancer therapy, presently in Phase 1 trials; a vaccine candidate targeting Lyme Disease – a treatment market estimated to reach $2.6bn in size by 2028; a Duchenne Muscular Dystrophy gene therapy candidate for which Pfizer hopes to submit a Biologics License Application (“BLA’) to the FDA in 2023, although Phase 3 trials have experienced issues, and Sarepta Therapeutics has 3 DMD therapies on the market, and a gene therapy in mid-stage trials; a Cancer Cachexia candidate that will enter Phase 2 trials in the latter half of this year; and an oral small molecule, Danuglipron, which is expected to complete a Phase 2 study in early 2023.

These can all be considered important drugs targeting areas of unmet need with promising mechanisms of action (“MoAs”), but is there $25bn of revenues by 2030 in this 5-drug pipeline?

It seems unlikely (and these are the highlights, apparently), and again, compared to Bristol Myers, or AbbVie, which is confident enough to forecast for $15bn of sales from its auto-immune drugs Skyrizi and Rinvoq, $4bn peak sales for Vraylar in Major Depressive Disorder (“MDD”), and $2.6bn peak sales for Venclexta in leukemia, Pfizer’s pipeline appears less convincing. Its likely loss of revenues in the coming years, thanks to Comirnaty and Paxlovid, also seems likely to be far greater than its rivals.

Can Pfizer Become An MRNA / Vaccination Giant

One thing is for certain, and that is that Pfizer has a lot of options going forward thanks to its massive cash flow generation, and one of the areas the company is targeting is messenger-RNA therapeutics.

MRNA is the science behind the Comirnaty vaccine, and using MRNA to instruct the body to manufacture any desired protein is a powerful MoA that is likely to play a major role in the development of therapies against most types of diseases across the next decade or more. If we were being critical, however, Pfizer’s role in developing this medicine is still unclear.

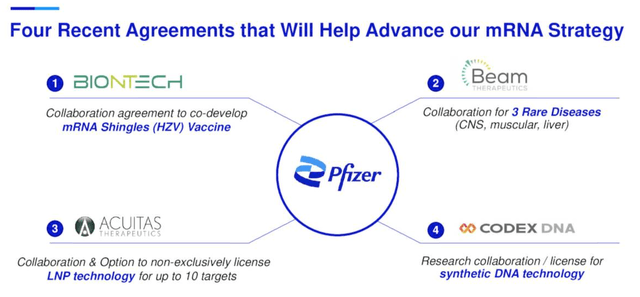

Pfizer’s 4 agreements helping cement its leading role in mRNA drug development. (earnings presentation)

Pfizer has clearly identified mRNA vaccines as a field it can be very active in, having already had tremendous success with its partner BioNTech, with whom it continues to collaborate.

With that said, however, vaccination markets are traditionally quite small – clearly, COVID was a massive outlier – and, when also splitting revenues 50/50 with BioNTech, and competing against Moderna (MRNA), which has >10 different mRNA vaccines for different viruses already in development, plus traditional vaccine specialists such as Sanofi (SNY) and GlaxoSmithKline (GSK), Pfizer is unlikely to be as dominant in these markets as it needs to be.

Influenza is an estimated ~$8bn market, RSV ~$3bn, CMV ~$5bn, HPV ~$3bn, and these are the largest current markets. A combined COVID flu vaccine could be lucrative, but it is hard to put a number on that opportunity at the present time, and Pfizer is not close to finalizing such a vaccine anyway.

If not vaccines, then Pfizer could arguably apply mRNA science to genetic disease – the partnership with Beam Therapeutics (BEAM), a genetic disease specialist suggests this is on Pfizer’s mind.

I have written about this deal in the past, praising Pfizer’s foresight in agreeing a $300m deal with Beam to develop drugs targeting genetic disease, with up to $1.3bn of milestones on the table, but Beam has not yet advanced any assets beyond the Phase 1 clinical trial stage, and therefore this tie-up is one for the future, not the present. Plus, there may be another issue looming.

Pfizer’s deal with Codex DNA – which again I have covered for Seeking Alpha – is another one for the future, not the present – witness the collapse in DNA’s share price this week on an underwhelming set of FY21 financials and 2022 outlook – and the Acuitas tie-up is interesting for a more cynical reason.

As I discussed in a note about Alnylam suing both Moderna and Pfizer for infringing patents relating to its lipid nanoparticle technology, Acuitas is allegedly suing another company accusing Pfizer of misappropriating its lipid nanoparticle technology – Arbutus (ABUS).

Lipid nanoparticle technology is beginning to emerge as a critical element of the mRNA drug development process. Without LNPs, strands of mRNA are degraded by the immune system before they reach the desired target. Without access to LNP technology, Pfizer may find it very difficult to compete in the mRNA space, and it is not inconceivable that Alnylam could win its case against Pfizer, which could cost Pfizer millions or even billions of dollars in compensation payments.

I have said before that Pfizer’s pivot to mRNA is probably the company’s best hope of building a product portfolio that can help it cope with the likely loss of COVID therapy revenues, but it is not a done deal.

Pfizer is reliant upon BioNTech, and perhaps lacks in-house expertise of its own, and it may not have the correct patent protection either. LNPs are arguably as important in gene therapy as they are in mRNA science, so even Pfizer’s partnership with Beam – which is also embroiled in patent disputes of its own around CRISPR/Cas9 technology – may not be as fruitful as first believed.

Conclusion – Arguably, Pfizer Has Not Made The Most Of Its Sensational COVID Wins – Things Could Get Tricky Valuation Wise

A few months I posted a bullish note on Pfizer making many of the same points I am making in this article – that the Pharma was somewhat unloved by investors for years before its sudden COVID vaccine success – that it was looking to pivot into vaccines and mRNA, that its cash generation was frightening etc. etc. but there is one key difference.

At that time, it felt as though the pandemic would continue to rage for potentially 2-3 more years, that new and more deadly strains could still emerge, and that as such, Pfizer’s COVID-related revenues would not decline nearly as rapidly as seems likely today.

Of course, a new strain of COVID may well emerge, and Pfizer remains in pole position to answer that call with new vaccines, but presently the company is anxiously waiting to hear if another booster dose may be required in the fall – an FDA Advisory Committee will discuss the matter imminently – and countries are running out of funds to allocate to vaccine purchases.

If COVID becomes an endemic disease and a private market emerges, it could be worth as much as $20bn per annum, I guesstimate, and perhaps Pfizer will claim 50% of that market or more. But even in that optimistic scenario, Pfizer’s revenues will fall from a 2022 high of ~$100bn, back down towards ~$50bn at breakneck speed, and as mentioned, that volume of revenue is consistent with e.g. Bristol Myers, which is valued at 50% of Pfizer’s current market cap valuation.

Where BMY and ABBV, as I have mentioned, have disciplined plans in place to drive revenues growth towards or beyond $60bn per annum by the end of the decade, Pfizer is travelling in the opposite direction – downward – which is the direction its revenues travelled in across most of the past decade.

MRNA technology is a momentous space in drug development, but arguably Pfizer itself doesn’t really have control of its own destiny here, since other companies have developed key technologies such as LNPs, and have patent protections in place, and it doesn’t own much of the technology.

In conclusion, although I don’t think Pfizer is necessarily a bad investment, thanks to a decent dividend yield and the prospect of Paxlovid and Comirnaty revenues continuing to add tens of billions to annual revenue generation, but I am not quite sure how the share price grows if revenues start to fall, as they almost inevitably will do.

Pfizer does not intend to complete any share buybacks in 2022 – although it has ~$6.5bn set aside for this purpose – and it seems to be acquisition shy despite its incredible cash generation.

As such, I can imagine a scenario in which the share price shrinks in tandem with top line revenues, and profitability may also shrink, given the very generous margins earned from Paxlovid and Comirnaty are surely likely to be challenged by both public and private markets going forward.

Be the first to comment