Marti157900/iStock Editorial via Getty Images

Investment Thesis

Last month, Conn’s, Inc. (NASDAQ:CONN) reported disappointing fourth-quarter earnings with both revenue and earnings per share falling short of investor’s expectations. The credit segment suffered a $1.1 million loss as the average balance of the customer receivable portfolio decreased by 10.2%. Gross margin in the retail segment contracted by 160 basis points as compared to the same quarter last fiscal year due to an increase in product and freight costs and margins are expected to remain under pressure due to ongoing issues related to the global supply chain disruptions. Looking forward, lower consumer spending, particularly for credit-constrained customers who are Conn’s core customer base as well as supply chain constraints will continue to impact the company’s top and bottom line in FY23. Before earnings, we started our coverage of the company with a neutral rating citing risks from global supply chain issues and rising interest rates. We would like to keep the stock at a neutral rating despite the recent correction and low valuations.

Last Quarter Earnings Analysis

Conn’s Inc. reported fourth-quarter results for FY ’22 late last month on March 29, 2022. Total revenue increased 9.4% year over year to $402.48 mn (missing the consensus estimate of $409.12M) driven by a 13% or $38.3 mn increase in retail sales which more than offset a decrease of $3.6 mn or 4.9% in credit revenue. The increase in retail revenue was primarily led by a 6.2% increase in same-store sales, an increase in repair and service agreement (RSA) commissions, and new store sales growth. The drop in credit revenue was due to a decrease of 10.2% in the average balance of the customer receivable portfolio, slightly offset by an increase in insurance commissions. Sales through eCommerce increased 131.8% to $24.1 mn. Gross margin in the retail segment contracted by 160 basis points as compared to the same quarter last fiscal year due to an increase in product and freight costs Adjusted SG&A expenses increased by $14.2 mn from the prior-year period due to higher variable operating expenses associated with sales growth, additional new stores, and an increase in advertising cost. Adjusted earnings per share of $0.33 fell short of the consensus estimate of $0.46 and decreased 64% year over year.

Retail Segment

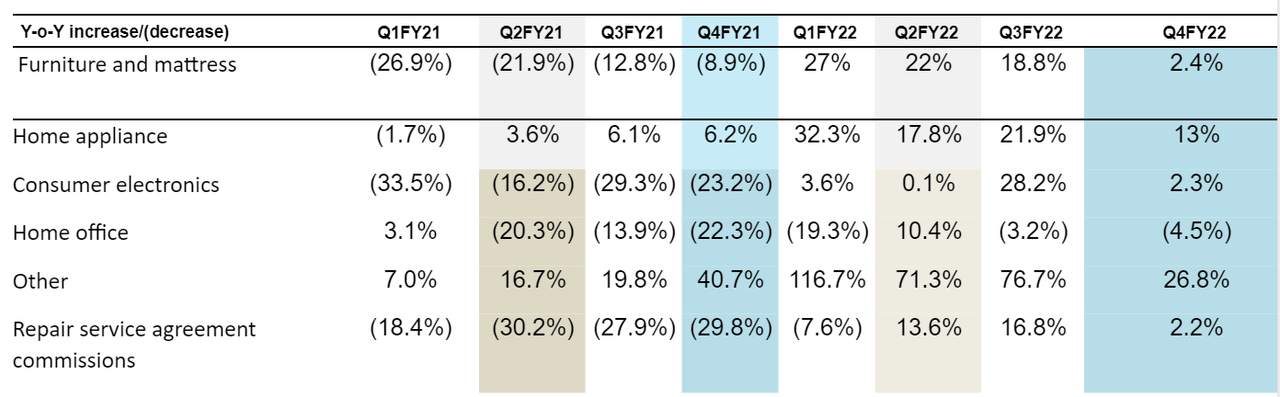

Within the retail segment, appliance category same-store sales increased 13% over the prior year driven by expansion in assortment, favourable in-stock position, e-commerce growth, and next-day delivery capability. The company expects to further expand its assortment, both in-store and online in the fiscal year 2023. Furniture and mattress same-store sales increased 2.4% over the prior year. The company’s focus in FY’23 will be to increase its furniture and mattress assortment online as well as introduce a new private label furniture brand. Within the consumer electronics category, same-store sales increased 2.3% primarily driven by higher TV, home theatre, and gaming sales. New store sales added 6.8% to the year-over-year increase in total sales growth.

Conn’s Same-store sales trend (Company Data, GS Analytics Research)

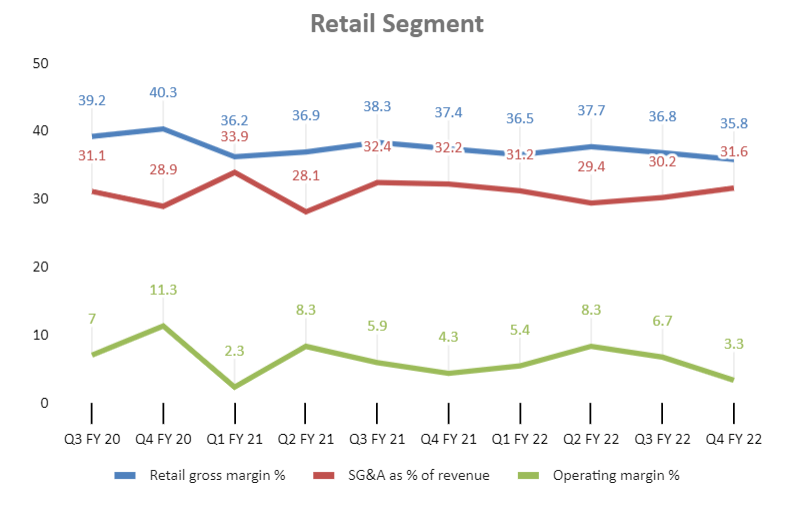

The retail segment gross margin for the fourth quarter decreased by ~160 basis points as compared to the same period last year primarily due to the increase in product and freight cost which has been a consistent theme over the past few quarters. SG&A expenses as a percent of total retail revenue were 31.6% in Q4 22 as compared to 32.2% in the same period last year. Looking forward we expect challenges such as global supply chain issues and higher international freight costs to persist throughout the fiscal year 2023.

Conn’s retail segment gross margin, SG&A and Operating Profit margins (Company Data, GS Analytics Research)

Credit Segment

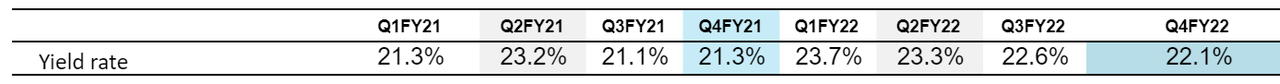

Finance charges and other revenue in the fourth quarter decreased 4.9% as compared to the fourth quarter of FY’21 primarily due to a 10.2% reduction in the average balance of the customer receivables portfolio. The Yield rate for the quarter increased to 22.1% as compared to 21.3% in Q421 but has been declining since the previous three quarters. The company reported a loss of $1.1M before taxes as compared to $4.4M income before taxes for the same period last fiscal year due to lower credit segment revenue, higher SG&A expenses, and a higher provision for bad debts, partially offset by lower interest expense.

Conn’s credit segment yield rate (Company Data, GS Analytics Research)

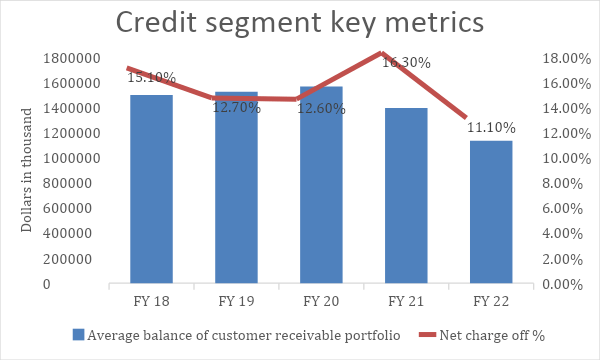

Net charge off as a percentage of average portfolio balance in this quarter was 9.8% compared to 14.1% for the same period last fiscal year. For full-year FY’ 22, net charge off was 11% as compared to 16.3% in FY’ 21.

Conn’s credit segment key metrics (Company Data, GS Analytics Research)

Outlook

In order to enhance its credit business, management announced strategic initiatives for the fiscal year 2023 which include launching an in-house lease-to-own platform, re-platforming its website, and preparing towards rebranding its business. In order to begin originating leases in-house, Conn’s has acquired a technology platform that will enable it to originate and service lease-to-own transactions in-house. Beginning in the first quarter of the fiscal year 2023, the company expects to incur additional costs related to the lease-to-own platform, and management expects it to adversely impact operating income by $15 million to $18 million in FY’23 and $25 million to $30 million in FY’24. On the revenue front, management has guided for low single-digit total revenue- growth with mid-single-digit retail revenue growth and a high single-digit decline in finance charges and other revenue due to an increase in promotional financing programs. However, we remain sceptical about revenue growth targets given the rising interest rates and the impact they will have on the company’s core customer base who usually depend on financing/credit to fund their purchases.

On the margin side, we expect FY 23 retail gross margin to be down from FY 22 due to supply chain woes. We also expect a further increase in SG&A expenses due to the opening of new stores and investment in a lease-to-own platform.

Valuation and Takeaway

Conn’s has corrected ~20% since we last covered it with the last quarter’s earnings release serving as a catalyst. The stock is now trading at ~$16.40, which is 10.1x its FY23 EPS estimates of $1.62. While the stock is not expensive it faces secular threat from both pure-play online players like Amazon (AMZN) as well as traditional Brick and Mortar retailers like Best Buy (BBY) which are focusing on their omnichannel initiatives. How much headway the company’s e-commerce business will make against these players is doubtful. Further, while the company is taking initiatives to increase its e-commerce and store sales, it needs upfront investment for these initiatives which might impact its profitability and there is limited visibility if these initiatives will be successful. There are also demand-side headwinds from rising interest rates.

Conn’s is in a very challenging business that faces significant competition from both online and offline retailers. Rising interest rates will pose a relatively greater threat for the company compared to its peers as Conn’s core customer base comprises low-income working individuals who typically earn between $25,000 to $60,000 in annual income and are dependent on financing for their purchases. Hence, we continue to have a neutral rating on the stock despite its low valuation.

Be the first to comment