Larry Crain/iStock via Getty Images

Thor Industries, Inc. (NYSE:THO) remains a force to reckon with amidst the disruptive impact of the pandemic. It has been unperturbed in the last two years and has become more promising. The solid fundamentals prove the consistency and sustainability of its growth and expansion. Also, its electronic RV concepts and eMobility strategy may become another growth catalyst.

However, the stock price does not move in line with the fundamentals. The steep decline in the stock market did not spare it. THO remains slow-moving and does not promise an instant rebound this month. At $83.57, it has already been cut by 20% from its starting price this year. Even so, the high undervaluation shows an opportunity for many investors. Its dividends are also promising, given the consistent increase over the years.

Company Performance and Financials

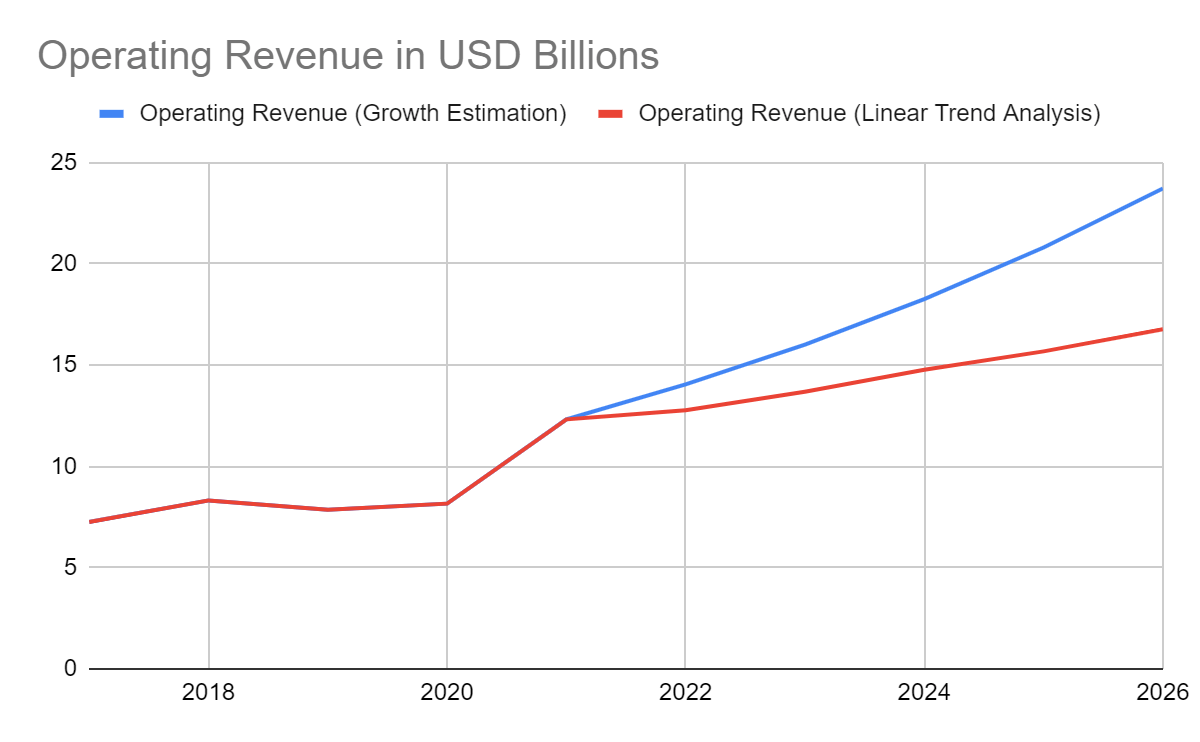

Thor Industries remains a durable figure in the RV industry. In its 3Q 2020, it faced the wrath of the pandemic as lockdowns affected its production and demand. But in 4Q 2020, it bounced back as the demand for travel rose along with the easing of Covid restrictions. The year ended with fruitful results as the operating revenue reached $8.17 billion, a 4% year-over-year increase. In my previous analysis, I estimated 2021-2025 revenues to increase to $10-12 billion, an average annual growth rate of 7.6%.

But, Thor surprised us even more. It proved its formidability with its strong performance in 2021, its most profitable year in history thanks to the robust demand for RVs and its growth capitalization on selective expansion. Also, it reconfigured its production plants while maintaining its inventory levels. The easing of Covid restrictions amidst increased vaccination also became its primary growth driver. The pent-up demand for camping and travel fueled up its operations. Brand loyalty and its strong ties with campsites like Care Camp also helped speed up its growth. Its revenue in all quarters amounted to $12.32 billion, a 51% year-over-year growth.

Operating Revenue (MarketWatch)

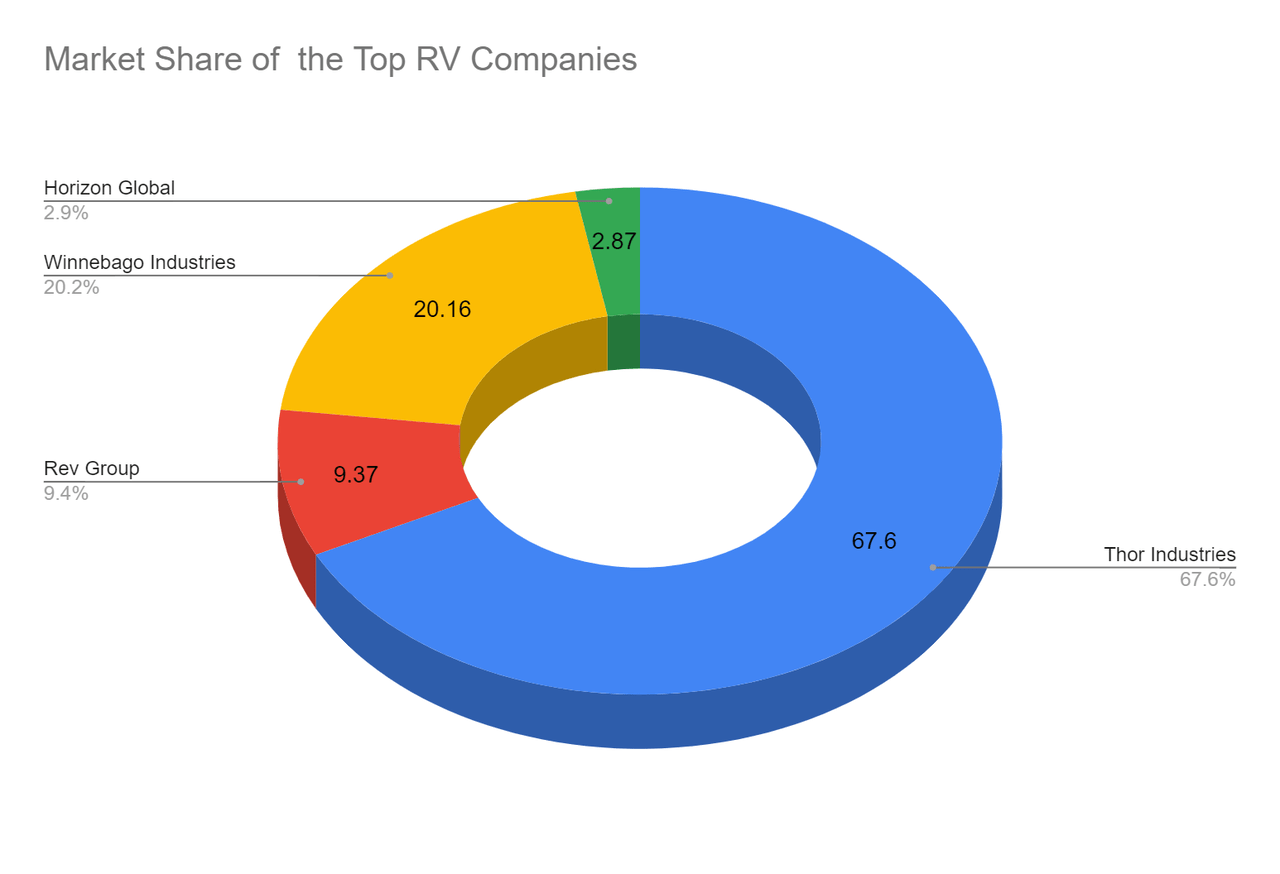

Thor continues to dominate the market. It currently holds 68% of the market share, with Winnebago in second with only 20%. With its acquisition of Airxcel, Thor may further strengthen and broaden its supply chain. The innovative growth may also help diversify its portfolio for more revenue streams. It seems to pay off quickly as the first two quarters of FY 2022 went well. Its core business and the products of Airxcel had increased demand.

Market Share of RVs (CSIMarket)

The diversification and broadening of the supply chain helped Thor manage its backlogs. Given this, its operating revenues in the first half amounted to $7.83 billion, a 49% increase in the previous year. The accumulated value was already 64% of the revenue in 2021. Note that the second half of FY 2022 is Spring and Summer, so more travelers may be enticed to purchase RVs or RV parts. Moreover, it has already unveiled its electronic RV concepts and eMobility strategies. The thing is, THOR is already an RV giant, but it continues to evolve. It remains ahead of its competitors showing that it has more growth opportunities. Using its average five-year revenue growth of 14%, the operating revenue in FY 2022 may amount to $14.04. It is still logical since the half-year amount is already 55%. The Linear Trend Analysis shows a more conservative estimation at $12.76 billion.

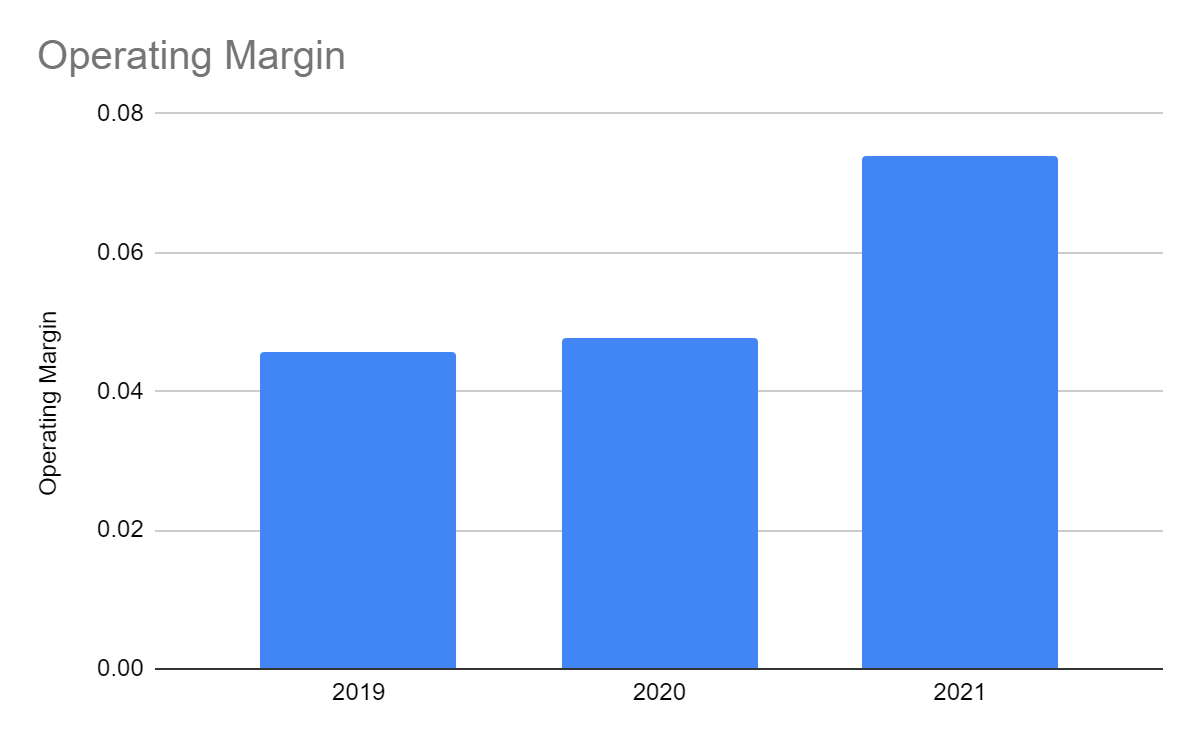

To measure and compare the efficiency of its core operations, we can use the operating margin. In 2021, its operating margin was 7.4%, a 54% increase from 2020. It was even higher than the 2017-2020 average of 6.8%. With that, it is safe to say that Thor benefited from the reopening of the economy. Its revenues grew while keeping its costs and expenses lower. As the company worked on resolving its supply chain challenges, it remained efficient and profitable.

Operating Margin (MarketWatch)

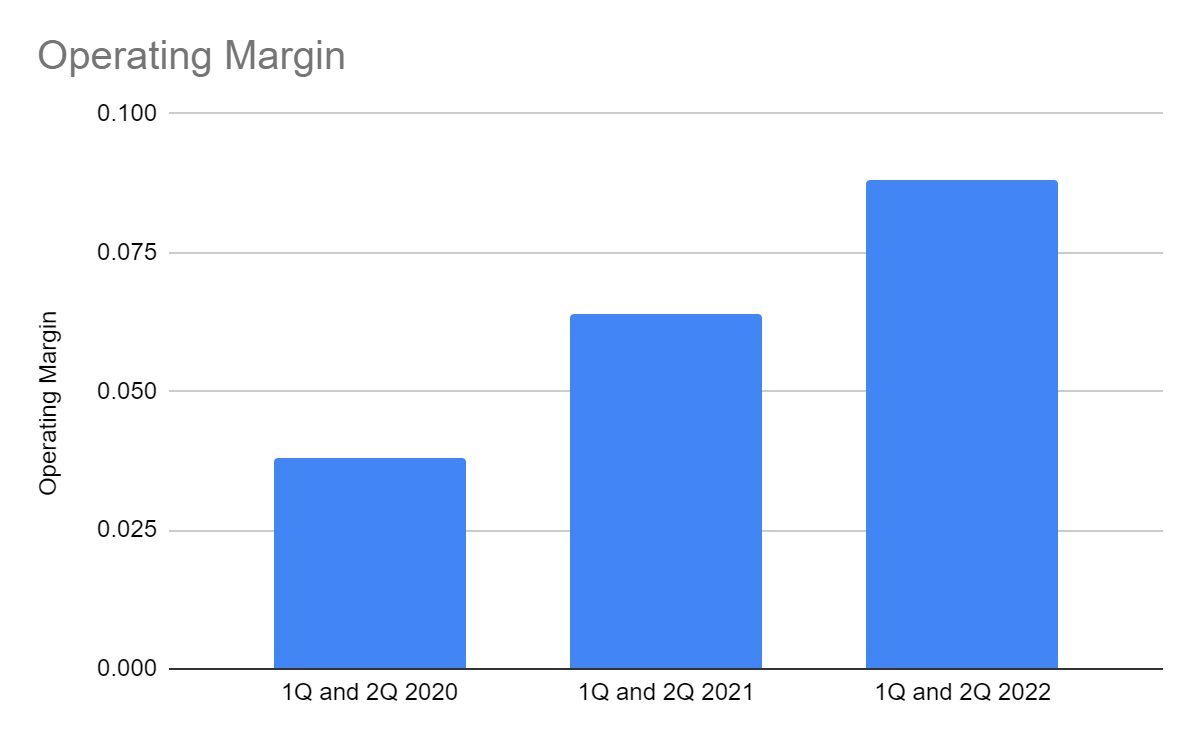

This year, Thor aims to expand further with recent acquisitions. The accumulated operating margin of 1Q and 2Q 2022 is 8.8%. This is way higher than 1Q and 2Q 2020 and 2021 at 3.8% and 6.4%, respectively. Indeed, Thor becomes more profitable and efficient as it expands. Also, it proves the effectiveness of its acquisition of Airxcel. It increased its operating capacity and revenue streams. The operating margin proves that Thor can capitalize on expansion and acquisitions.

Operating Margin (MarketWatch)

Thor’s increasing net income of $660 million in 2021 is almost 300% higher than 2020. The half-year 2022 net income of $508 million shows an acceleration in profitability. Both the core and non-core operations of Thor are efficient and profitable. The most recent Return on Asset (ROA) reached 10% or a $10 income for every $100 asset. The increasing ROA proves the sustainability of its profitability. As the company continues to expand, earnings continue to speed up. Also, it shows efficient asset management. Likewise, Free Cash Flow (FCF) remains high, which shows that the cash transactions led to more cash inflows. However, it must watch out for its borrowings that have ballooned in recent years. In 1Q 2022, the amount increased by over $600 million, but it decreased by $52 million in 2Q 2022. Hence, the company can expand its operations while covering its financial obligations.

What Will Drive Its Growth

Thor has the majority of the market share in RVs. This year, the company is expected to grow further. This estimation is attainable, given its impressive performance during the first half. These are some potential growth drivers of the company.

Spring Vacation

The pandemic has led to an upsurge in travel plans as more people stay in their homes. In the Spring of 2021, there were 18 million first-time RV travelers in the US. In the same survey, 66% of Americans preferred to travel and camp in an RV. It is no surprise that revenues in the RV industry, particularly in Thor, had an enormous growth.

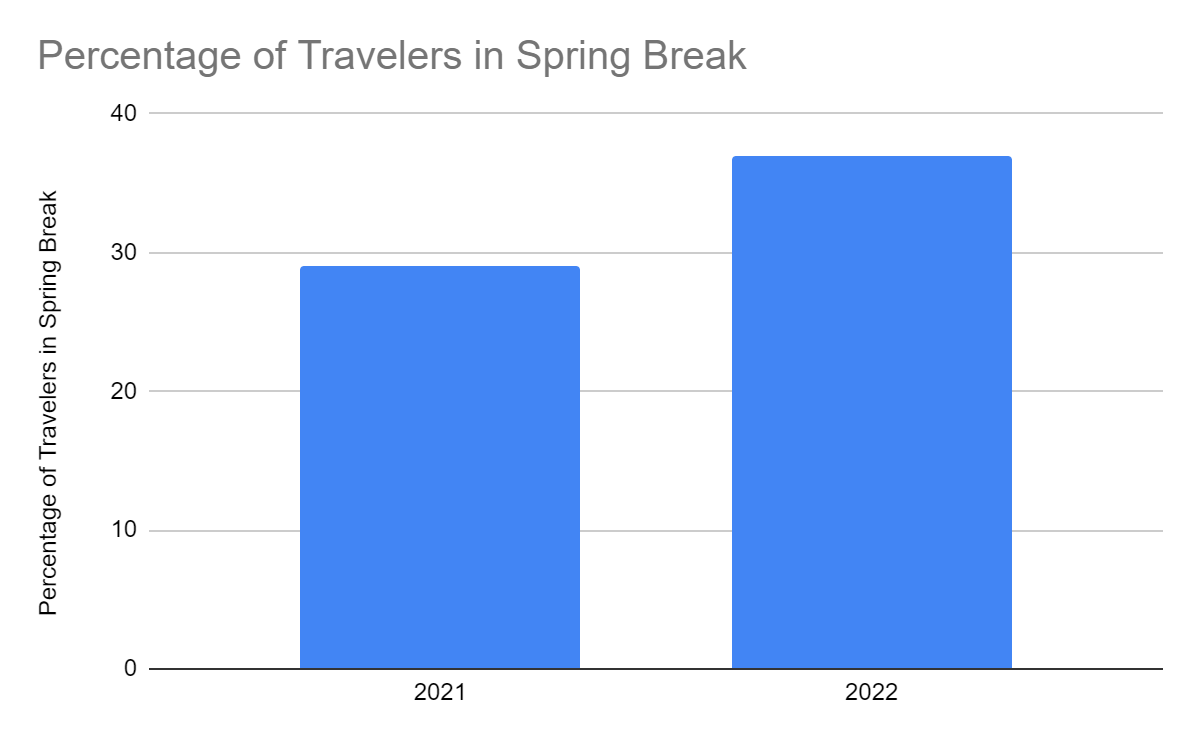

This year, Thor must anticipate higher 3Q and 4Q revenues and income as more travelers come back. The easing of Covid restrictions and increased vaccinations should make that possible. In a recent survey, 56% of Americans plan to travel this Spring. More specifically, 37% will travel during Spring break, an 8% increase.

Spring Travelers (vacasa)

We can match it with another recent RV survey. Among the respondents, 53% said they would consider renting an RV for their trip. Also, 45% of travelers listed RVs in their top three preferred accommodation types. Seventy percent of Millennials and 54% of Gen X plan to take a road trip or vacation by RV.

Expansion

Its acquisition of Airxcel proved fruitful, given the year-over-year growth in revenues and margins. It shows that it still has more capacity to expand its operations. The unveiling of its electronic RVs and eMobility strategies will become another growth catalyst. These will enable the company to be more innovative and extend to other parts.

Price and Dividends

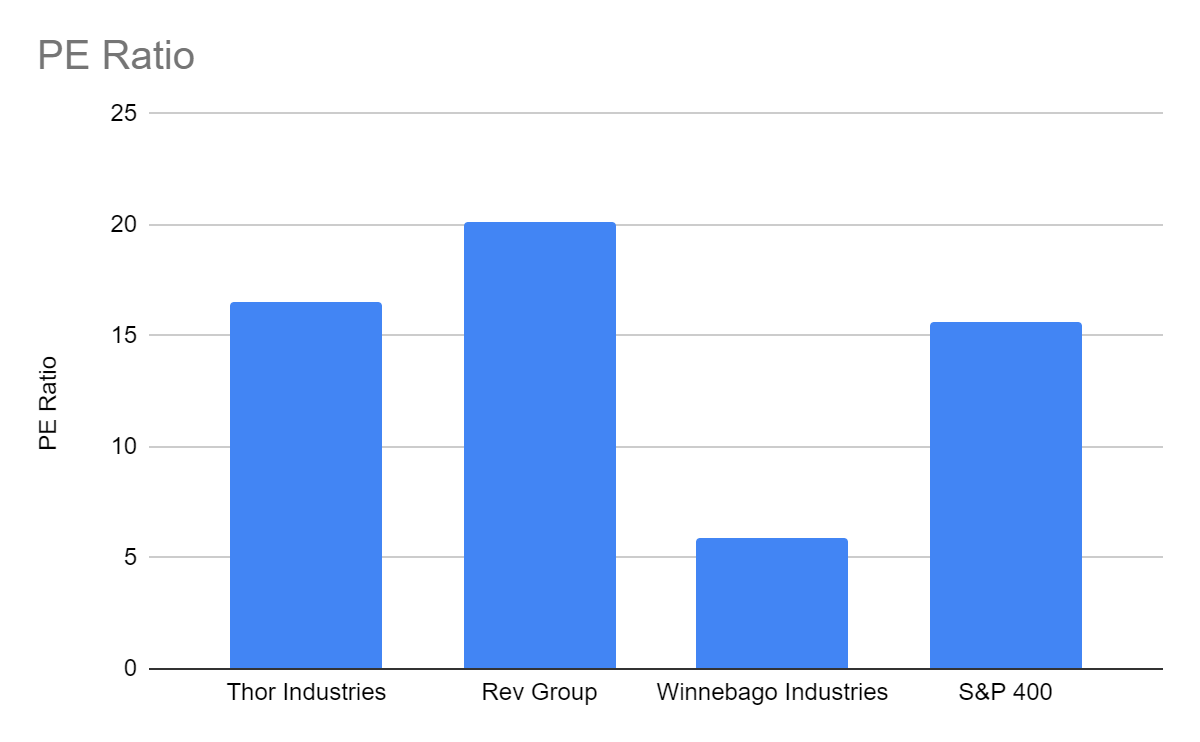

The price of Thor remains stagnant and does not show a promise of increase for the next few weeks. At $83.57, it already has been cut by 20%. The price has been downward since the first half of the previous year. But it was in November when the steep decrease became more evident. It appears to be undervalued with a P/E Ratio of 16.54, but it is slightly higher than the S&P 400 P/E Ratio of 15.58. The P/E Ratio of its primary competitors, Winnebago Industries, Inc. (WGO) and REV Group, Inc. (REVG), are 5.88 and 20.15. It means that the value of most of its S&P 400 and WGO in terms of earnings is better than THO. If I estimate the price based on the historical growth of EPS, I assume there will be a 24% upside in the current price, ranging from $92 to $105.

PE Ratio (Yahoo Finance)

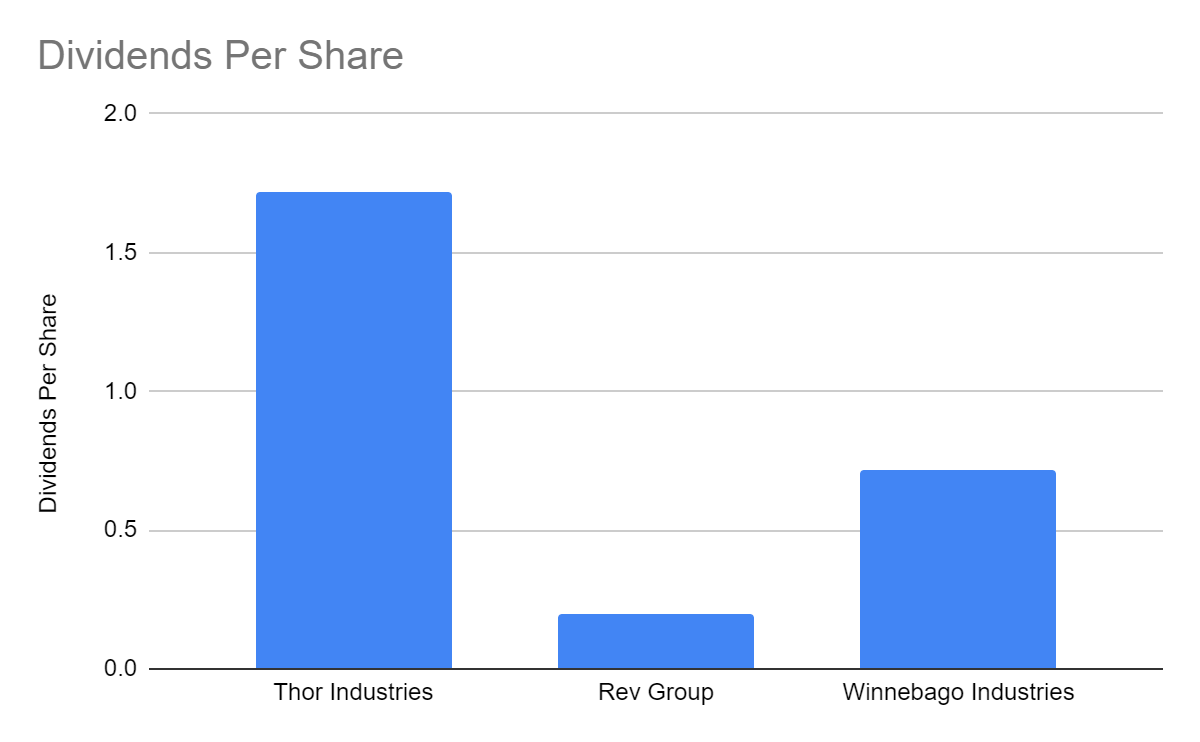

We may also use the Dividend Discount Model and the DCF Model to do price valuation better. Thor has been paying dividends for fourteen years, making it a Dividend Contender. Moreover, it did cut off its dividend payments despite the pandemic. The annual dividend growth has been 6.8% for the last five years. Relative to the current stock price, the dividend yield is 2.06%. It is still higher than the market basis points but lower than its five-year average. Even so, the price of THO remains enticing. Its dividend payments are set at $1.72 this year. To verify it, I will use the Dividend Discount Model.

|

Current Price |

$83.57 |

|

Average Dividend Growth |

0.05647680023 |

|

Estimated Dividends Per Share |

$1.72 |

|

Cost of Capital Equity |

0.07705834863 |

|

Derived Value |

$89.88976619 or $89.88 |

THO remains 7.3% cheaper, but external factors push the price downward. Even so, the dip makes it an attractive dividend stock.

Dividends Per Share (NASDAQ)

To know its capacity to sustain it, we must determine the Dividend Payout Ratio. In 2021, the annual ratio was only 14%. This year, the ratio as of the second quarter is only 9%. The company has a lot of means, but it may have to increase its payouts to entice more investors. Nevertheless, it shows its capacity to cover its payments, especially when borrowings are higher. It still takes a safer path to earnings. Also, it pays higher dividends compared to its RV peers.

The Bottom Line

THO does not show a promise of a price increase in the near future. It remains slow-moving, which may not attract investors. But given the lower price and solid fundamentals, it remains a buy. Also, its dividend payments increase while remaining capable of sustaining their expansion. With its impressive financial performance, Thor Industries may expand further without sacrificing efficiency. It may extend to other related niches while remaining profitable and sustainable.

Be the first to comment