Michael Vi

ASML (NASDAQ:ASML) reported strong earnings related to the past quarter and its order book was impressive, showing that future operating momentum is only expected to improve. Its valuation is quite cheap compared to its own historical multiples, therefore providing a good entry point for long-term investors.

Q3 2022 Earnings Analysis

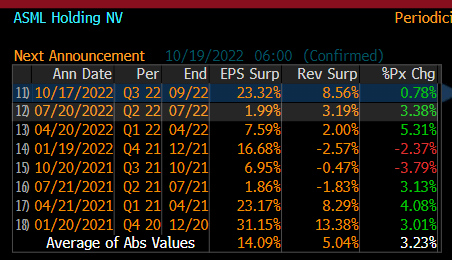

ASML announced today its quarterly results related to Q3 2022, reporting revenue of €5.8 billion in the quarter and net income of €1.7 billion. As can be seen in the next graph, these numbers were well above market expectations, which led to a positive share price reaction today. Indeed, this was the best quarter compared to analyst’s estimates since the beginning of 2021, showing that demand remains strong for its chip-making machines despite the current cyclical slowdown in the semiconductor industry.

Earnings surprise (Bloomberg)

In Q3 2022, ASML’s revenue amounted to €5.8 billion (+10.2% YoY), with net system sales reaching €4.3 billion and installed based management sales of €1.5 billion. Its gross margin was 51.8%, a slight improvement from the previous two quarters, but practically unchanged compared to Q3 2021.

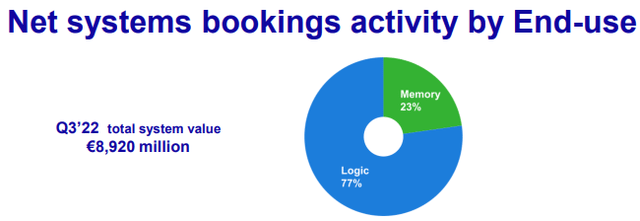

Its booking during the last quarter were €8.9 billion, setting a new quarterly record, showing that demand for its machines remains very strong, especially from logic customers (77% of total orders). This is justified by the semiconductor’s industry profile, as customers make their orders for new machines based on long-term capacity requirements as factories take several years to build, rather than considering short-term demand fluctuations.

However, such a strong number can be considered a surprise, given that in recent weeks some of its major customers, such as TSMC (TSM) and Micron (MU), downwardly revised their expected capital expenditures (capex) for the rest of this year and the first few months of next year. This could also lead to a downward revision of long-term plans for equipment purchases, but that was not the case, which shows confidence in the industry’s long-term growth prospects.

Investors should note that 2021 was a record year for ASML regarding bookings (€26 billion, compared to just €11 billion in 2020), thus some slowdown in new orders could be expected during 2022. However, ASML continues to enjoy strong bookings quarter after quarter, a situation that is only possible due to ASML’s technology leadership position, and the industry’s secular growth prospects over the next decade.

Regarding its business profitability, ASML’s operating margin was 33.5%, an improvement from the previous couple of quarters, but lower than its 36% operating margin reported in Q3 2021. Its net income was €1.7 billion in the quarter, representing a net profit margin of 29.4%.

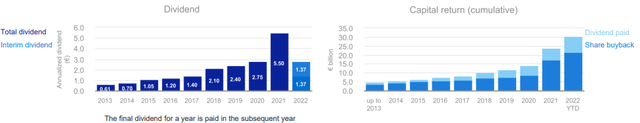

Due to a strong balance sheet with low levels of debt and a good cash flow generation capacity, ASML returned significant capital to shareholders during the last quarter, both through dividends and share buybacks.

During the past quarter, it paid a quarterly interim dividend in the amount of €1.37 per share, while the second quarterly payment of the same amount will be paid in November. This means that based on this quarterly frequency, its annual dividend is expected to be about €5.50 per share (unchanged compared to 2021, even though an increase is likely when the company announces its annual earnings next year), which means that, at its current share price, ASML offers a forward dividend yield of about 1.3%.

Beyond dividend distributions, ASML also performed share buybacks, for a total amount of €1 billion in Q3 2022. These purchases completed its current share buyback program, and a new one is expected to be announced next month at the company’s investor day event, given that ASML has a strong balance sheet and does not need to retain much cash and can therefore continue to provide an attractive shareholder remuneration policy in the near future.

Dividends + share buybacks (ASML)

Regarding its outlook, ASML said that it expects Q4 sales to be between €6.1-6.6 billion, a range that is above current market expectations, and full year revenue of $21.1 billion at the midpoint of its Q4 guidance range. This represents annual growth of about 13% YoY, which is also slightly above current sell-side expectations of annual revenue amounting to $20.6 billion.

Related to new U.S. restriction on chip companies businesses’ in China, ASML said they are not expected to have a meaningful impact on its sales next year. According to its CEO:

Based on our initial assessment, the new restrictions do not amend the rules governing lithography equipment shipped by ASML out of the Netherlands and we expect the direct impact on ASML’s overall 2023 shipment plan to be limited.

ASML generated some 15% of its revenue in China during the last year, thus if new U.S. restrictions included ASML’s operations, it could have a significant impact on the company’s revenue and earnings growth. However, the company also said that if, in the future, U.S. restrictions lead to an indirect effect of lower demand in China, the company thinks that demand elsewhere is so strong and higher than current supply, that ASML will shift equipment deliveries to other regions and its business will not be much affected by this issue.

Medium-Term Estimates & Valuation

As I’ve analyzed previously, I see ASML as one of the companies that is better positioned within the semiconductor industry to benefit from secular growth trends over the next decade, which are expected to support strong growth for its equipment and services for many years.

ASML updated its medium-term targets last year at its investor day event, expecting to reach revenue in the range of €24-30 billion by 2025. I see this as a quite conservative estimate, given that ASML will report some €21 billion in revenue this year, and demand for its machines is not showing any signs of weakness judging by its rising order book.

Therefore, I think that ASML is likely to upwardly revise its revenue range in the next month at its upcoming investor day, as its target seems to be already outdated. The market seems to agree, taking into account that current sell-side estimates expect ASML to report €31.9 billion in revenue by 2025.

As the weight of EUV revenue is expected to gradually increase over the coming years, given that 85% of its current order book is related to EUV machines, ASML’s business margins are also expected to increase, being another positive factor for its earnings growth. To some extent, this explains why ASML’s net income is expected to almost double from 2022 (€5.3 billion) to 2025 (€10.4 billion), while during the same period its revenues are ‘only’ expected to grow by 51% during the same period.

Despite these positive fundamentals and growth prospects, ASML’s share price has been on a downtrend in recent months due to some supply chain bottlenecks that are hurting its short-term growth rates and general stock market weakness, providing a good entry point for long-term investors.

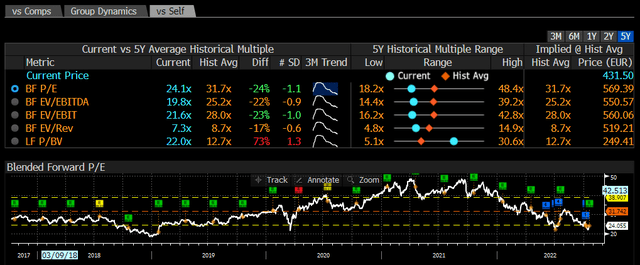

Based on its earnings for the next 12 months, ASML is currently trading at some 24x forward earnings, a much lower valuation than its peak multiple reached during 2021 at 74x forward earnings, and also significantly below its historical average over the past five years (close to 32x).

This valuation seems to be relatively undemanding for a company that has a leading position in the semiconductor industry and good growth prospects ahead, showing that there is a disconnection between its current share price and fundamentals.

Conclusion

ASML has a great business profile due to its leadership position in the semiconductor industry, a profile that was questioned in recent quarters as operating momentum decreased due to supply chain bottlenecks. Despite that, its order book continued to increase and reached a new record this quarter, showing that underlying demand for its machines remains quite high.

This means that ASML continues to be a great growth play and its shares are currently undervalued, providing a good entry point for long-term investors.

Be the first to comment