JohnnyGreig/E+ via Getty Images

Introduction

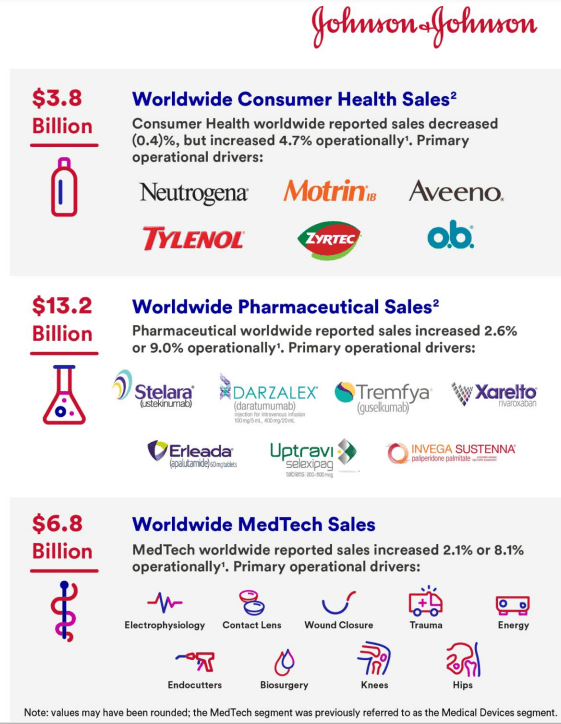

Johnson & Johnson (NYSE:JNJ) investors should be aware that due to the fact that the majority of revenues being earned abroad, the company will face significant headwinds as the dollar rises to extreme strength relative to most foreign currencies. At the same time, Japan-based Terumo (OTCPK:TRUMY, OTCPK:TRUMF) experiences the opposite effect as the yen reaches almost record-breaking weakness compared to most currencies. Therefore, it is more optimal to take advantage of forex to invest in Terumo rather than wait for JNJ’s continued relative underperformance. This article will point out recent data that suggest there are current forex risks at play for both companies and use historical data to emphasize the potential outcomes moving forward.

Q3 is Just the Beginning

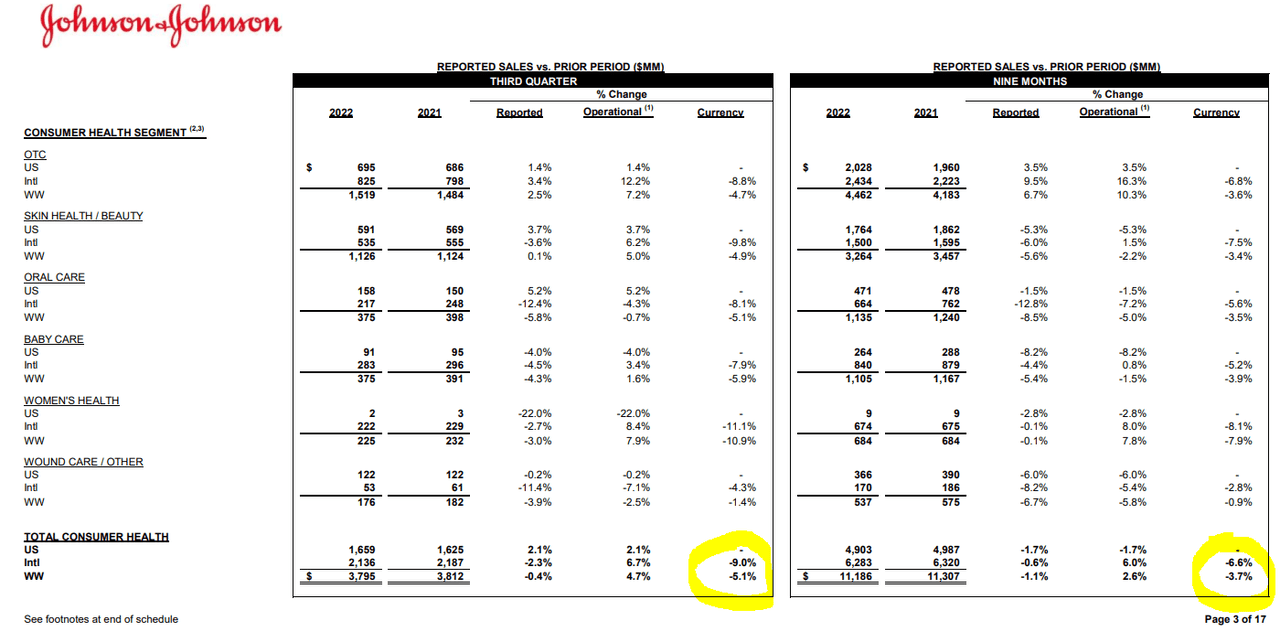

This morning, Oct 18th, JNJ reported their earnings, and we can see that forex is already a major headwind. Rather than allowing investors to see the direct effects right away, the data on currency effects is hidden on their IR website. However, the image below highlights how current currency exchange rates are causing international revenues to fall by 10% and total revenues to fall by 5.1%. We can also see that the most recent quarter is seeing currency effects accelerate from the first two quarters of the year, as shown with the 9 month data.

This is an unfortunate outcome, because JNJ is doing well to optimize their operations, and this quarter’s performance would have been great had the dollar remained at prior levels. However, the dollar continues its upward climb relative to the yen, euro, and pound sterling, and even JNJ can’t invest in ways to offset these forex headwinds. Thankfully, considering the euro and pound are down 20%, and the yen is down 30% YoY, JNJ has good risk-management already in place. This may prevent growth from going negative next quarter, but the situation does not look good at the moment.

JNJ 3Q22 Earnings

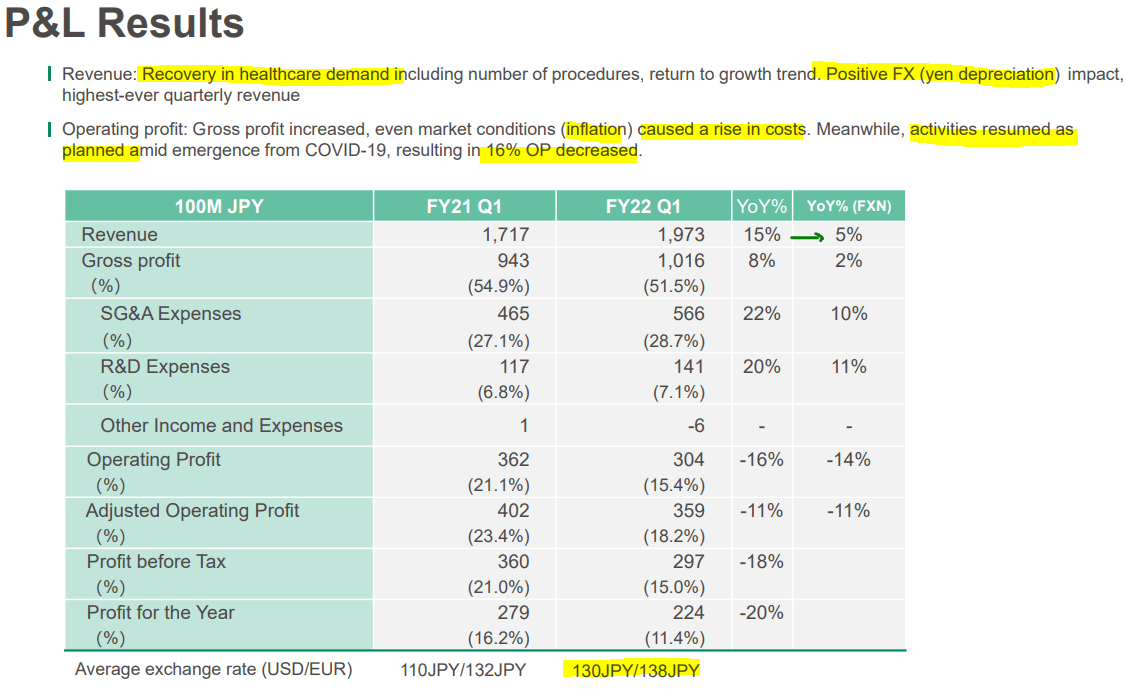

This contrasts with Terumo, which has the same recovery in healthcare demand as JNJ, but also has the benefit of the weak yen. As of the August earnings, Terumo was already experiencing a 10% boost to revenues, and this should be even higher next quarter. The strong forex benefits are thanks to Terumo’s global exposure of almost 50% revenues from the Americas and only 25% Japan.

As the environment that supports a weak yen continues to exist, Terumo will have years of beneficial tailwinds. Interestingly, while some may see that there are other issues such as inflation and decreased profitability, the historical data suggests that these problems are less influential on returns than the forex effects.

Terumo Investor Presentation

Why Terumo?

Before I dive into the historical data that supports my argument for investing along with forex cycles, I will quickly discuss why I chose Terumo as the foreign investment to complement the giant JNJ. The main reason is that both are diversified healthcare giants, with exposure to both basic supplies and modern technologies.

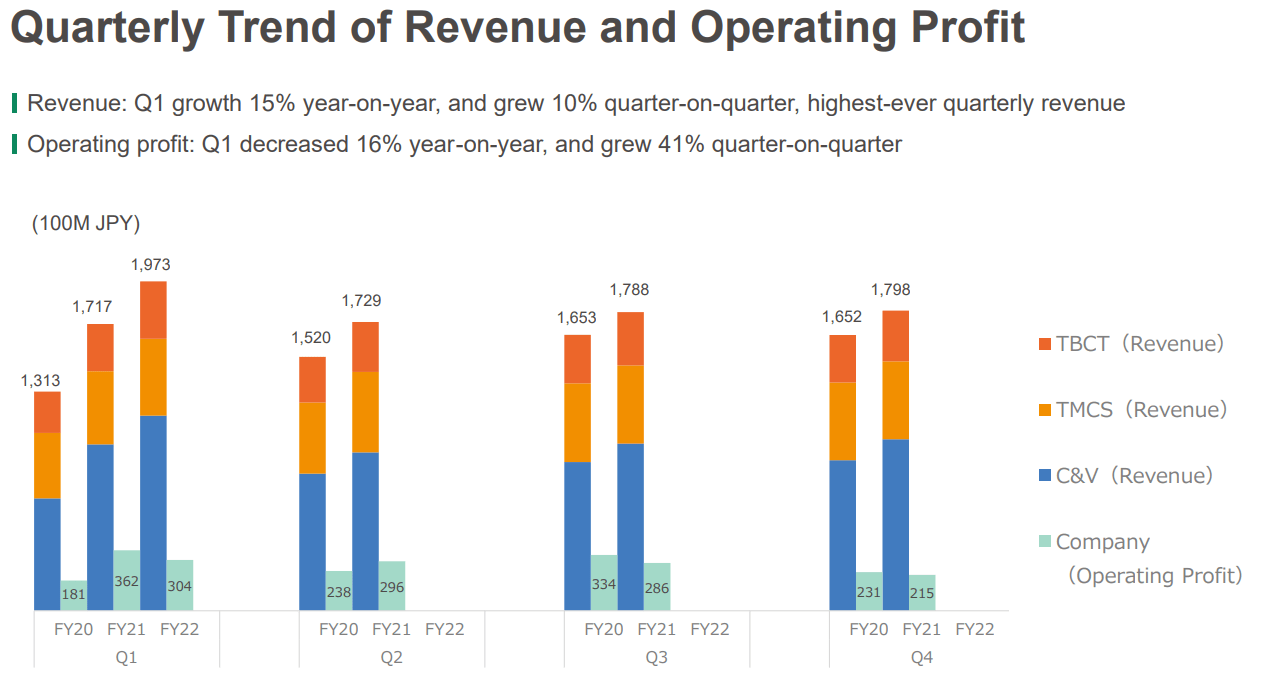

Terumo itself is divided into three parts, which mostly equate to JNJ’s medical tech segment:

-

TBCT – or Blood and Cell technologies, revolves around transfusion, purification, and creation of blood components (blood donation, platelets, cell therapy, etc.).

-

TMCS – or Medical Care Solutions, includes providing general clinical equipment, consumables (including contract manufacturing), and solutions, mostly in Japan.

-

C&V – or Cardiac and Vascular, the largest segment, which includes devices and solutions that revolve around cardiothoracic issues (blood monitors, heart and lung bypass solutions, stents, grafts, etc.).

Combined, Terumo earns approximately $6 billion USD per year from their revenue segments, or about what JNJ’s medical tech segment makes in a quarter. While Terumo’s $20 billion market cap pales in comparison to JNJ’s $430 billion market cap, both companies have delivered similar growth and returns over the past 30 years, and this will be the basis of my analysis moving forward.

Terumo Investor Presentation

JNJ 3Q22 Earnings

Historical Support

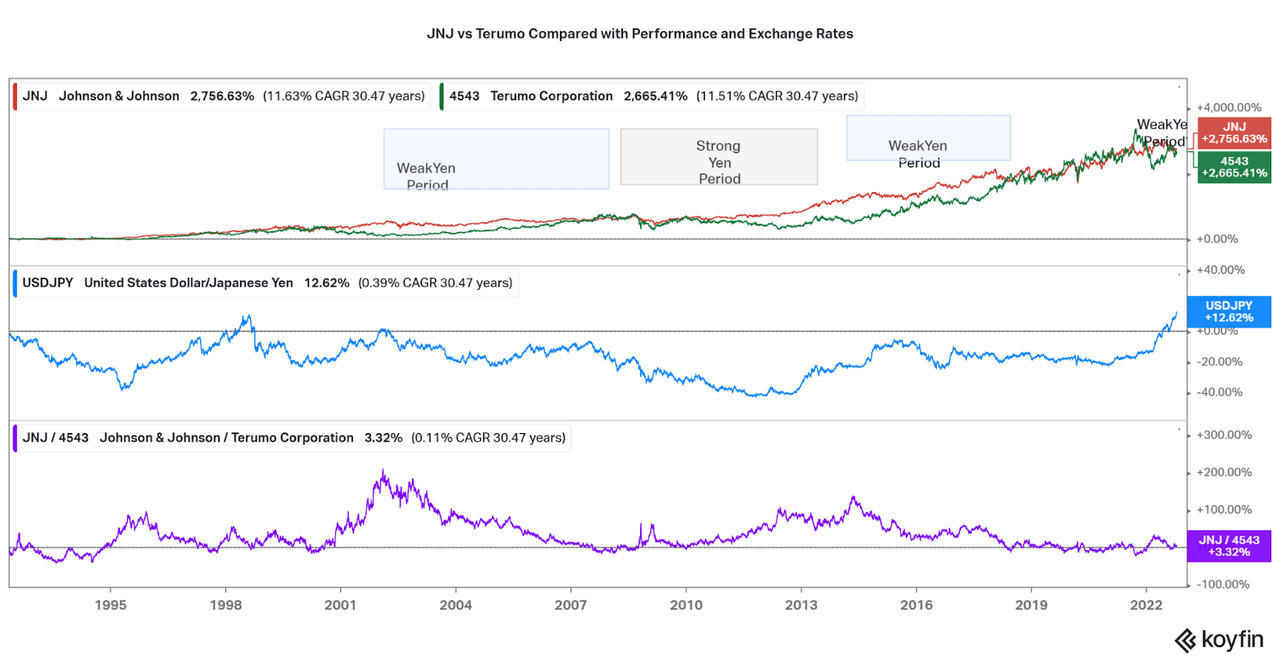

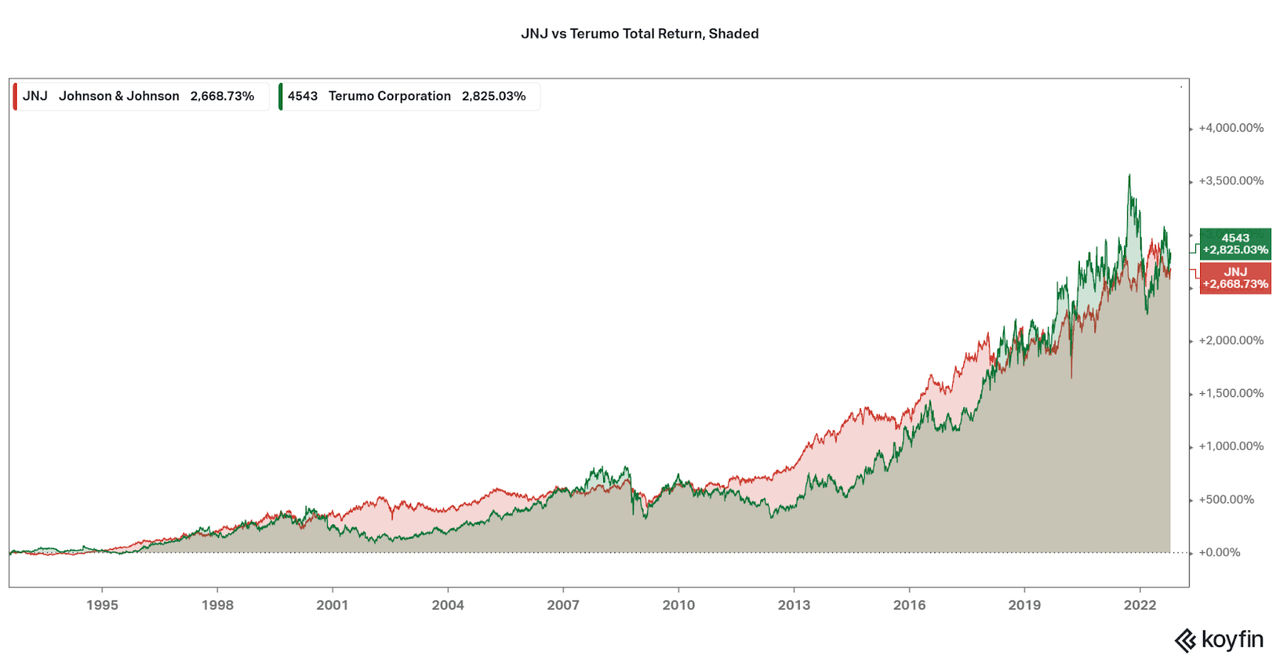

Along with the fact that both names are quite different, currency effects may seem minimal or only temporary, which is true to a degree, but there are significant investor implications to consider. We can track the influence of historical forex cycles with these two companies by comparing the total returns of each alongside the respective USD to yen exchange rates. Tracking data from the late 90s until today allows us to see support for the forex thesis with three major time periods.

-

From 2002 until the financial crisis, the yen was weak. This caused JNJ to underperform and Terumo to outperform.

-

From 2009 to 2014, the yen was able to strengthen and JNJ outperformed.

-

By 2015, the Yen returned to weak levels and Terumo was able to catch up in terms of total return.

JNJ has underperformed for almost 10 years as the yen weakens, and current exchange rates suggest that the effect will be even more pronounced in the coming years. Forex factors also seem to be more influential than impacts from product launches, operational changes (M&A or spin-offs), or market cycles, as both Terumo and JNJ balance each other off due to the similarities. This is why we should not expect to see meaningful impacts from the pending spin-off of JNJ’s consumer segment, although by that point investors may be able to sell some Terumo profits in exchange for a lower-valued JNJ.

Koyfin Koyfin

Conclusion

The above chart highlights that when USD:JPY sees a negative slope, Terumo will outperform JNJ. As the yen is extremely weak now, I expect that investors adding now will see strong performance as the yen slowly weakens over the coming quarters to years. At the same time, JNJ will be the underperformer, and I would hold off from adding.

This does not mean Terumo will go up and JNJ will go down. Instead, the performance of each may be positive but Terumo will climb at a faster rate and investors should take profits at some point before the cycle ends. Also, be aware both holdings can still be volatile or trade downwards, but the long-term trend will remain in favor of Terumo at the moment.

The cycle will end eventually if U.S. interest rates fall or the yen becomes a safe haven currency once again. At that point, Terumo should have sufficiently outperformed that investors can then cycle profits to JNJ. As the dollar weakens at some point down the road, JNJ will outperform and this perpetual cycle between the two names may help boost shareholder returns. We also do not know where and when exchange rates will end up in the future, and the analysis relies on the historical up and down trends. A sea change of global economics may be forthcoming, but I believe in some form of normalization in the years to come.

This investment strategy also does not take away from the fact that I am bullish on both companies in the long run, especially once JNJ gets rid of the underperforming consumer segment. I hope this strategy does offer an interesting look at a data-driven way to find more upside for those looking for a low-risk active approach. I also expect the pattern to work for most U.S.-based companies that have a similar foreign counterpart, so take a look around. We still have time to research and invest before the full extent of the current strong dollar cycle is apparent.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment