Bet_Noire

The iShares Preferred and Income Securities ETF (NASDAQ:PFF) holds U.S. dollar-denominated preferred stocks and hybrid securities. These are the preference shares whose dividend payments were prioritized over common stocks by some companies at the height of Covid-induced uncertainty in 2020. Also, in a period where dividend growth remains uncertain due to macroeconomic concerns, the stability of “preferred” starts to find some appeal.

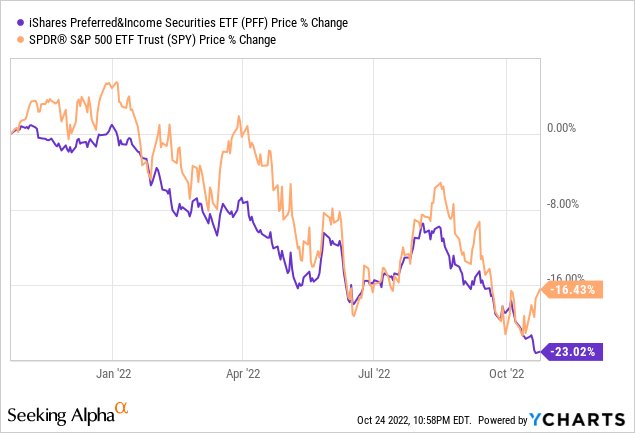

However, since holding preferreds is analogous to holding the stock of a company (as you can buy them in the same way as equities), they are subject to volatility and the ETF suffered from a one-year decline of 23% as shown in the chart below, which is much worse than the broader market represented here by the SPDR S&P 500 Trust ETF (SPY).

Still, classified as a “taxable bond”, PFF pays a decent yield of above 5% and the aim of this thesis is to assess further downside risks as well as perform a comparison with others in the fixed-income asset class.

First, I provide some insights into the current economic environment highlighting the reasons for the ETF’s appeal.

The Current Environment

This remains a challenging environment as the Federal Reserve is bent on combating inflation, even at the point of orchestrating an economic slowdown, one of the side effects of which is volatility in global stock markets since the beginning of this year.

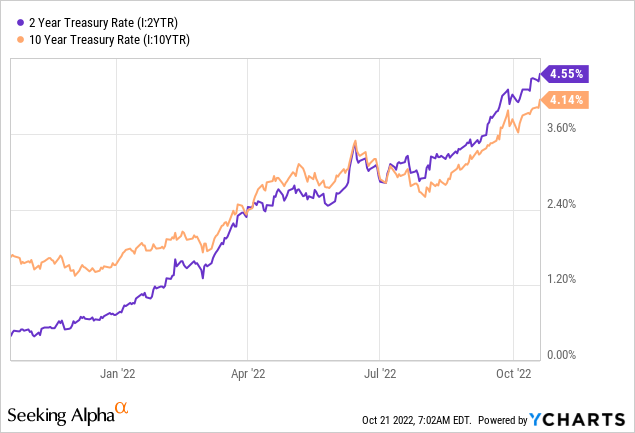

For this matter, the two and ten-year yield curves remain inverted as shown in the chart below, which is illogical given that when you lend money, (in this case to the U.S government), you should be compensated more for the long-term (10 years) in view of the higher risks premiums. Here, the fact that you get a higher interest rate for the short term (2 years) points to an abnormality that may predict a recession.

The resulting market pressure has not been limited to risk assets or equities and contaminated the bond market as well, with the iShares Core U.S. Aggregate Bond ETF (AGG) being nearly 18% down in the last year as shown in the table below.

With bond prices coming down across the board, yields have conversely gone up. Hence, credit or corporate bonds are now in competition with the U.S treasury, whereby when you lend money to the government (which is safer than lending to private corporations), you obtain yields of above 3.5% compared to less than 2% last year. One example is the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) yielding 3.28% and having to compete with the Vanguard Extended Duration Treasury ETF (EDV) which provides yields of 3.56% and charging fees of only 0.06%.

In these unprecedented conditions and for those looking for better yields, PFF which pays 5.45% starts to make sense for income-seeking investors.

Comparison between different fixed-income asset classes (Seeking Alpha)

However, in this space, preferreds compete with the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) as shown in the table above, by offering a yield of 5.24%. However, high-yield securities are also called “junk” bonds, and, depending on the severity of credit conditions, may be subject to acute market fluctuations whereby an investor is at a higher risk of default (or losing his or her investment) than higher-rated or investment-grade debt bonds.

The Risks and Mitigatory Actions

Still, investors are reminded that in case of liquidation, when assets of a company have to be auctioned off to reimburse creditors, bonds get priority over equity, even preference shares. For this reason, preferred and hybrid securities held by PFF fit into a portfolio more as a fixed-income diversifier. One example is holders of investment-grade or treasury bonds wondering where to put their money to work after the market dip.

At this point, it is important to stress that hybrid securities such as convertible bonds tend to offer a combination of debt and equity features. As a result, their value is skewed towards the price action of the stock into which they are convertible, in turn implying that there are capital depreciation risks, especially during volatile markets. Now, this can be mitigated to some extent by the PFF’s issuers using preferred for “capital treatment“, namely by not calling (redeeming) them when rates fall. This can be likened to sacrificing higher dividend yields for capital gains.

In order to illustrate my point, I make a comparison with the Invesco Preferred Portfolio ETF (PGX) which pays a higher dividend yield of 6.22% and only allows for credit rating by Fitch ranging from AAA (highest) to D (lowest). In contrast, PFF had 20.84% of unrated bonds as of October 19, which explains why SA allocates to it a less favorable risk profile than PGX.

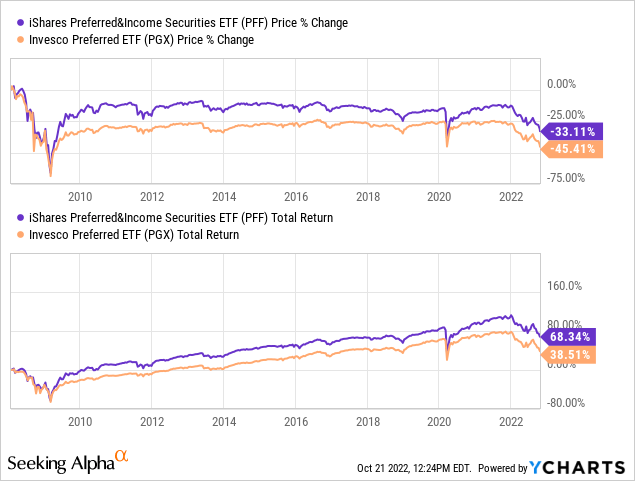

However, in practice, the Invesco ETF has been more volatile than PFF since 2008 as shown in the chart below, with this period being inclusive of the Great Financial Crisis and the Covid market crash. Thus, PGX (in orange) has underperformed PFF (in blue) by more than 12% despite its higher-quality assets.

Moreover, a comparison of the total returns which includes dividend payments in case these are reinvested and included in the price performance, shows that the iShares fund with a performance of 68.34% has beaten its Invesco peer by over 30% since 2008.

YCharts (Comparison PFF and PGX for price performance and Total Returns)

Thus, over the long term, PFF may have made lower-dividend yield monthly distributions, but, conversely, it has suffered less capital depreciation and provided better total returns.

To be realistic, investors will also note that this is not a like-to-like comparison as the two ETFs follow different indices, with PFF tracking the ICE Exchange-Listed Preferred & Hybrid Securities Index while it is the ICE BofAML Core Plus Fixed Rate Preferred Securities Index for PGX. Moreover, with assets under management of over $14.32 billion, despite being incepted only one year earlier in 2007, PFF has seen much higher levels of inflows than PGX with $5.12 billion.

Next for those interested in investing, I try to chart out the price action.

The Path Ahead

First, since preferred stocks pay dividends, their value is particularly sensitive to higher interest rates. Therefore as the U.S. Central Bank has increased rates aggressively, the attractiveness of PFF has fainted for income seekers and this is likely to continue this year as this remains a hawkish Fed with a mandate to tame inflation. Hence, from 3.08% presently to a probable target of 4.5%-4.75% by spring of 2023, it is probably futile to “hope” for any pause in hiking interest rates in 2022. However, going into 2023, global economic and geopolitical factors will increasingly play a role in determining monetary policy actions, namely as to the effect of the strong dollar on the rest of the world.

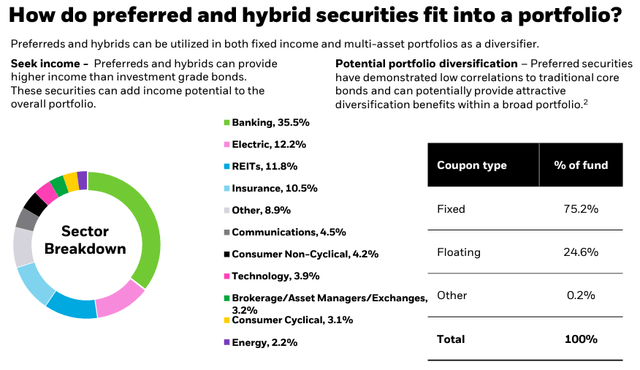

Second, the preferred and hybrid held by PFF are also influenced by the performance of the stock market. Now, the ETF is heavily weighed towards financials at 46% including banks and insurance, followed by Electric Utilities at 12.2% and REITs at 11.8% as shown below.

Sector Exposure – 6/30/2022 (iShares)

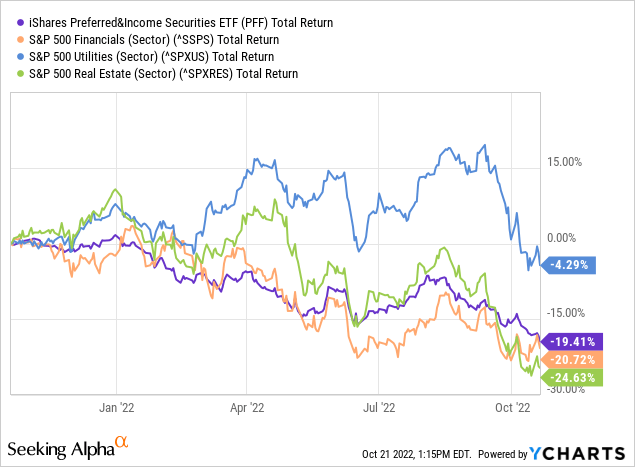

Third, with such a high exposure to Financials as shown by the orange chart below, PFF’s share price has largely been skewed to this sector as shown by the deep blue chart, but the downside was partially mitigated by exposure to the Utility sector (pale blue chart) which has been relatively spared by the market turmoil with a one-year loss of only 4.29%.

Comparison of Total Returns (YCharts)

Fourth, with the U.S. consumer remaining resilient amid slower growth, money lenders JPMorgan (JPM), Bank of America (BAC), and Wells Fargo (WFC) managed to increase revenues and profit margins in the third quarter of 2022 as they were able to loan more money to customers.

Now, higher interest rates benefit the big banks, especially those with larger retail activities, but their share prices have not been favorably impacted as the overall economic climate remains morose. Thus, analysts at Goldman Sachs (GS) are neutral on the Financials sector. Additionally, they are also neutral on Real Estate and Utility, while cutting exposure to technology.

Conclusion

Therefore, with a combined 70% exposure to the Financials, Real Estate, and Utilities sectors, PFF’s share price could get some support around the $30 level. Also, scoring a “B” for the Asset Flow metric, means that more money is flowing in than out of the fund.

On the other hand, there could be volatility with interest rate decisions scheduled for the first week of November due to the Fed’s aggressive approach. In this respect, momentum indicators show a further drop, maybe to the $28 support level last time reached in the Spring of 2020.

Consequently, taking the above points into consideration, those who primarily seek predictable cash flows as part of a fixed-income diversification strategy may choose PFF, which pays monthly distributions. Thus, for the same amount invested, PFF provides a higher income than investment grade, junk, or treasury bonds as per the above table.

Also, in contrast to common stock, PFF holdings’ have preferential claims to dividend distributions implying that in times of financial stress, you stand a better chance of getting paid. Also, with economic uncertainty, it is better to seek refuge in the stability of preferreds than hope for companies to grow dividends on common stock. Finally, the iShares ETF has a history of better preserving capital.

Be the first to comment