MicroStockHub

Introduction

The oil and gas industry has seldom provided shareholder returns as those recently but even across this landscape, the insanely high 40%+ dividend yield from Petrobras (NYSE:NYSE:PBR) stands out, although as my previous article discussed, it would be prudent to ignore this yield. Despite their share price rallying surprisingly well during recent weeks, similar to wandering the desert looking for water, investors scanning the market for income are likely to endure disappointment with their shares as their proverbial dividend oasis may end up a mirage after next month with the political situation in Brazil only looking worse with a pivotal election merely weeks away.

Executive Summary & Ratings

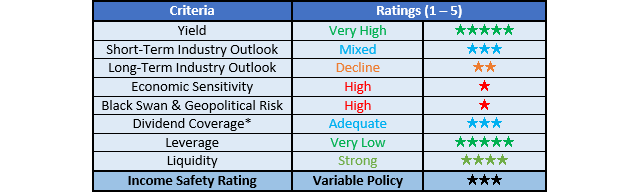

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

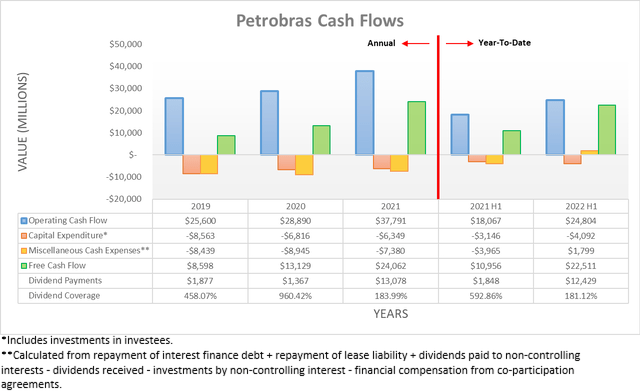

Whilst their cash flow performance during the first quarter of 2022 was very impressive at the time and easily eclipsed that of 2021, it pales in comparison to what was subsequently seen after the supercharged oil and gas prices witnessed during the second quarter of 2022. This saw their operating cash flow surge to $24.804b for the first half, thereby more than doubling their result of $10.308b for the first quarter and easily beating their previous result of $18.067b for the first half of 2021. The real icing on the cake was the amount they translated into free cash flow with their capital expenditure staying fairly restrained, as the first half of 2022 provided shareholders with massive free cash flow of $22.511b with $16.429b being generated during the second quarter alone.

By now, almost every reader already knows this saw them showering their shareholders with a dividend windfall that far exceeds anything in their history that will translate to circa $17b, depending upon the Brazilian Real to USD exchange rate as of the time of payment. At their current market capitalization of approximately $87b, this singular payment represents a very high yield of almost 20% on current cost. It seems quite likely that shareholders will remember this dividend bonanza fondly for years to come, although they should not lose sight of the future as the ex-dividend date is already in the rear-view mirror.

It could be very tempting to view their shares as a proverbial dividend oasis, although the political risks have only grown more concerning during the last few months with the Brazilian federal election now merely weeks away on the 2nd of October 2022. As a reminder for any new readers, their current president, Jair Bolsonaro is facing a very tough time winning his next term as he faces off against Luiz Inácio Lula da Silva, who himself is a former president of Brazil. When conducting the previous analysis during May 2022, the polls showed President Bolsonaro trailing Luiz Inácio Lula da Silva by a sizeable 11%, which is still the case as of September 10th, despite the gap having slightly widened in favor of the latter during the interim months. In theory, polls are increasingly accurate closer to the election date and thus this is particularly concerning for the shareholders of Petrobras, as their dividend may end up a mirage, proverbially speaking, due to a wave of higher costs forcibly imposed.

The pressure President Bolsonaro placed upon Petrobras to lower fuel prices in 2022 is not necessarily business-friendly to what investors in developed markets are accustomed to seeing but if Luiz Inácio Lula da Silva wins, his policies pose far greater risks. Apart from blocking any upcoming and future refinery divestitures, there is the risk that a government led by Luiz Inácio Lula da Silva may see Petrobras reacquire refineries that they have already divested, which currently stands at eight, as per Reuters. If this comes to fruition, it could require a sizeable amount of capital, whilst possibly not even resulting in higher medium to long-term free cash flow given his other plan to detach local fuel prices from global oil prices to help lower fuel prices, which would hinder refining margins and result in Petrobras handing over money for little to no financial gain versus their current situation.

On one hand, another term for President Bolsonaro could see privatization, which in theory should be positive for shareholders as state-controlled companies normally trade with relatively lower valuations due to their mandates mixed between profits and societal initiatives. Apart from blocking any privatization, even more concerning, Luiz Inácio Lula da Silva also plans to reverse years of cost cuts and whilst this may be beneficial to workers, objectively speaking, it is the exact opposite of creating value for shareholders.

Regardless of how an investor personally feels about social issues and the approach proposed by Luiz Inácio Lula da Silva, it does not change the fact that objectively speaking, his policies would hinder the dividends that Petrobras can provide their shareholders. It remains too early to ascertain the extent these policies would hinder their financial performance, although it magnifies the downside risks going forward now that oil and refined product prices have softened on recession fears. If these two risks coincide together, it could quickly drain their free cash flow and as a result, see shareholders taking home a mere fraction of their recent dividend cheques, which would also be accompanied by their share price sliding lower.

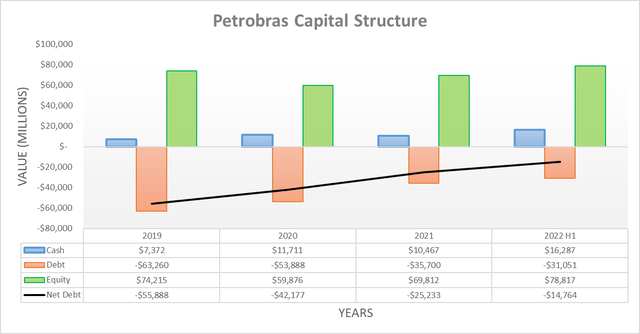

Even though their free cash flow was extremely impressive during the second quarter of 2022, the majority was consumed by their dividend payments and thus their net debt only decreased modestly to $14.764b versus its level of $18.198b when conducting the previous analysis following the first quarter. When looking ahead, this should continue into the second half given their variable dividend policy but if considering further afield into 2023 and beyond, their net debt may begin to expand if a new government forces the reacquisition of their refineries, especially if this coincides with lower oil prices and higher operating costs. Since their cash balance of $16.287b barely changed following the second quarter versus its level of $17.223b when conducting the previous analysis, it would be redundant to reassess their leverage and liquidity in detail.

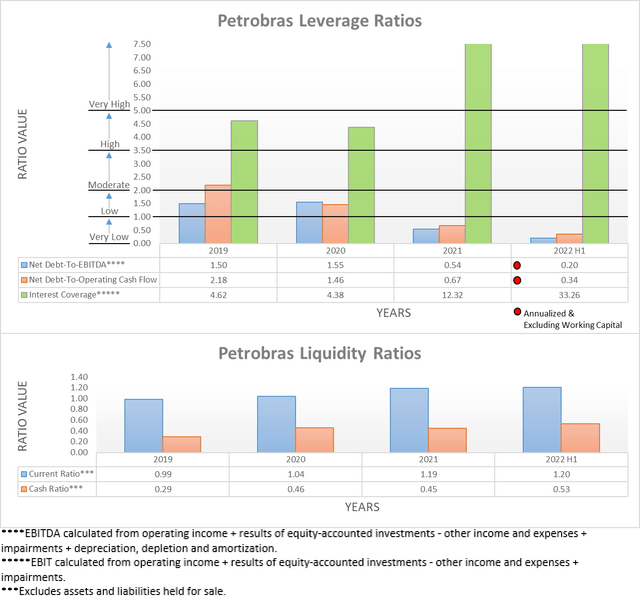

The two relevant graphs have still been included below to provide context for any new readers, which as expected, show their net debt-to-EBITDA and net debt-to-operating cash flow resting at 0.20 and 0.34 respectively. Once again similar to the previous analysis following the first quarter of 2022 when these results were 0.29 and 0.49 respectively, they are well below the threshold of 1.00 for the very low territory. Meanwhile, their respective current and cash ratios of 1.20 and 0.53 are not materially different from their previous respective results of 1.45 and 0.66 following the first quarter and thus their liquidity remains strong. If interested in further details regarding these two topics, please refer to my previously linked article.

Conclusion

It would be wonderful to continue receiving their massive dividends but alas, finding a double-digit yield is often fraught with disappointment, similar to metaphorically walking the desert looking for a watery oasis that merely ends up a mirage. Ultimately, only time will tell whom the people of Brazil elect as their president but given the polls, it seems likely that President Bolsonaro will be handing his office over to Luiz Inácio Lula da Silva, whose policies are not in the favor of shareholders with plans to reverse cost cuts and reacquire refineries, whilst simultaneously lowering fuel prices. When combined with the economic pressure on oil prices, there seems to be far more downside risk than upside potential and thus I nevertheless believe that maintaining my sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Petrobras’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment