blackdovfx

Zscaler (NASDAQ:ZS) still trades as a premium valued tech stock even after amidst a broader tech crash. The cybersecurity company has seen sustained strength even as it acknowledges some macro uncertainty. Growth is expected to come down this coming year, and guidance may be less reliable than it has been in the past. Still though, ZS is flowing cash, has a net cash balance sheet, and cybersecurity is a mission-critical product with secular tailwinds for years to come.

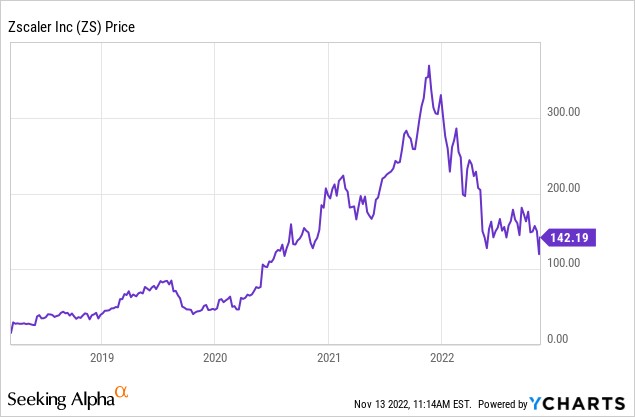

ZS Stock Price

Like most tech stocks, ZS has been clobbered since all-time highs.

I last covered ZS in June and. the stock has not moved much since then. ZS remains a richly valued stock but there’s enough to explain the premium.

ZS Stock Key Metrics

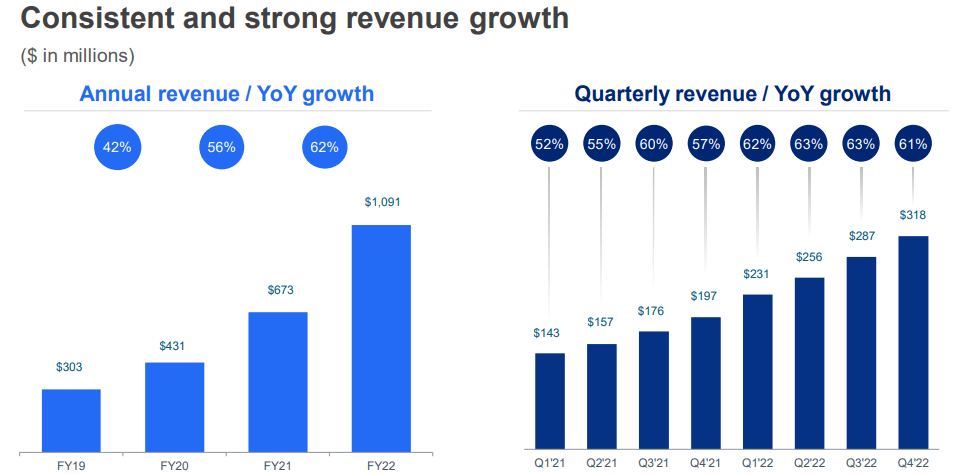

The latest quarter saw ZS grow revenues by 61% to $318 million. The company had grown revenues by 57% in the prior year and has sustained a 60% growth rate for 4 straight quarters.

FY22 Q4 Presentation

ZS also showed strong billings growth, a typical indicator of future growth. Most of the tech blow-ups first saw weakness in billings before weakness in revenues.

FY22 Q4 Presentation

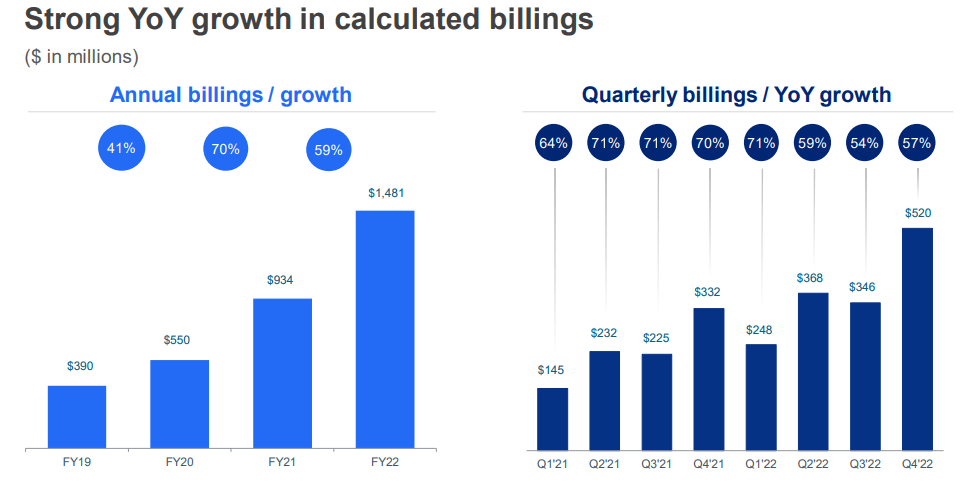

ZS has continued to invest heavily in growth, keeping its non-GAAP operating margin around 10%. Over time, I expect the company to realize operating leverage from both sales & marketing and R&D, but it is good to see the company to continue pressing forward amidst difficult market conditions.

FY22 Q4 Presentation

ZS ended the quarter with $1.7 billion of cash versus $1 billion of debt.

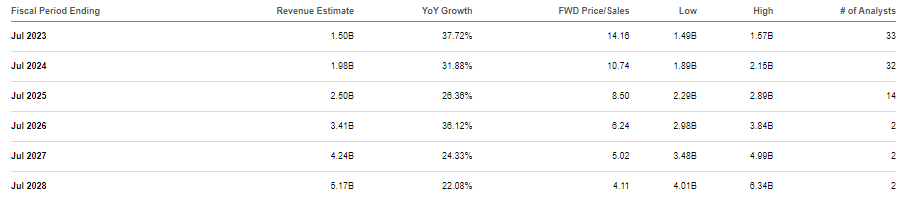

Looking ahead, ZS expects 47% revenue growth in the first quarter to $341 million and 37% growth for the full year to $1.5 billion with 157 million shares outstanding.

Is ZS Stock A Buy, Sell, or Hold?

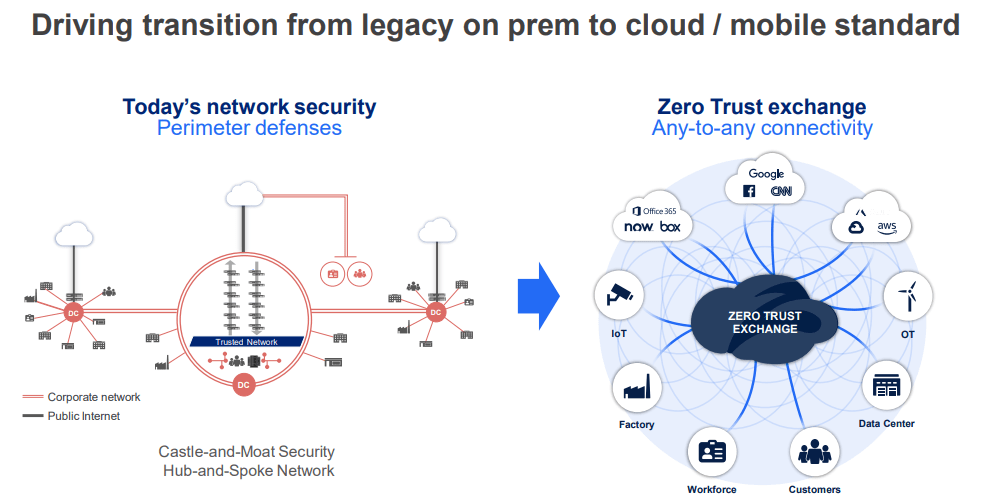

ZS offers a high-growth cash flowing thesis in cybersecurity. ZS powers the “zero trust exchange” which forms the current standard for cybersecurity.

FY22 Q4 Presentation

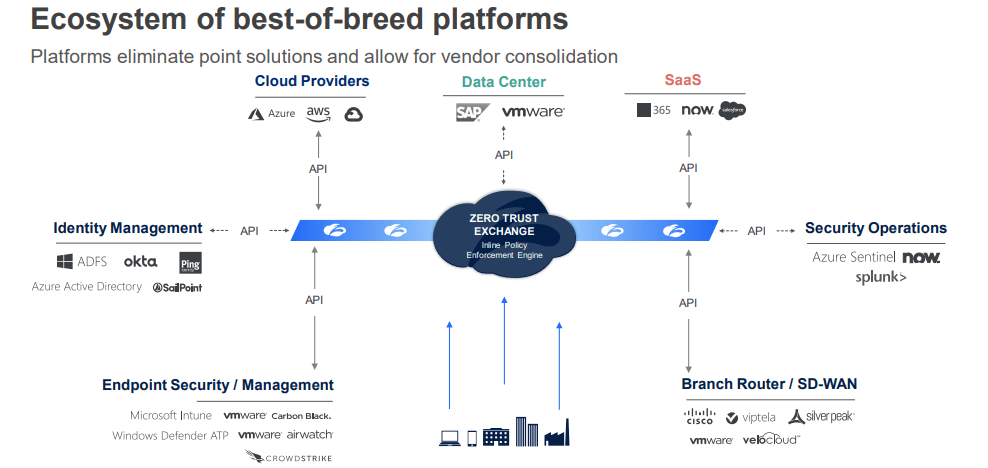

We can see below where ZS fits in the cybersecurity ecosystem. ZS protects data and applications at the user level. More well-known cybersecurity peer CrowdStrike (CRWD) protects devices and Okta (OKTA) offers identity management.

FY22 Q4 Presentation

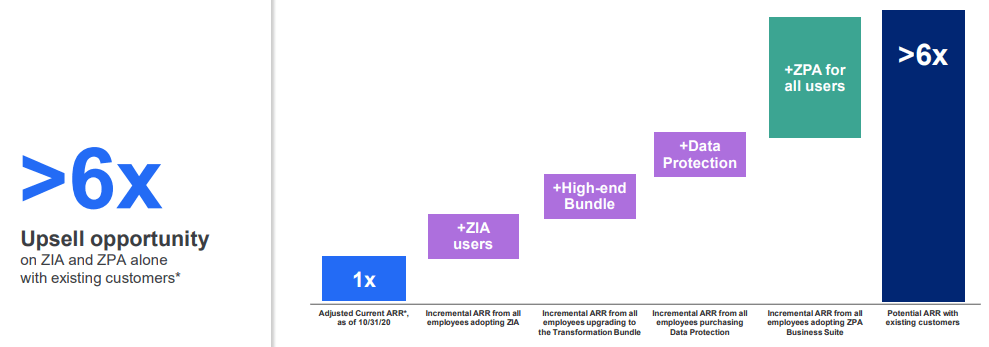

ZS has sustained a 125% net dollar retention rate for 7 consecutive quarters. The company expects to be able to drive significant growth from upselling opportunities alone.

FY22 Q4 Presentation

On the conference call, management noted that increased deal scrutiny made “business being more backend loaded,” stating:

We think it’s prudent to expect this higher level of review and scrutiny by our customers to continue given the uncertain macroeconomic outlook. While demand for the Zscaler platform remains very strong, if the business environment changes, our business model allows us to adapt quickly and to deliver on our operating profit and margin goals.

Management also noted that many of their customers have not yet set their budgets for the next fiscal year. Management expects customers to do so over the next couple of quarters and acknowledged that this may lead to increased level of uncertainty in the second half of the year. That may explain the discrepancy between the projected 47% first quarter growth rate and 37% full year growth rate. Viewed optimistically, guidance might prove too conservative. Consensus estimates are not covering a beat. The stock trades at around 14x forward sales.

Seeking Alpha

That multiple isn’t obviously cheap considering that most tech stocks nowadays trade in the low single digit multiples of revenue. But ZS is not just any tech stock. ZS is flowing cash and the cybersecurity thesis remains attractive – cybersecurity isn’t something that becomes less important during a recession. ZS continues to guide for 22% operating margins over the long term, stating on the call that investors should expect less than 300 basis points of margin expansion if the company is growing faster than 30%. That commentary does seem to imply that the company can sustain 30% growth over the medium term. Assuming a 1.5x price to earnings growth ratio and 30% long term net margins, I could see ZS trading at 14x sales, presenting considerable upside over the coming year. Those projections may ultimately prove conservative.

The most pressing risk here remains valuation. While ZS is buyable, other tech stocks trade at far more compelling valuations. Investors should be prepared for volatility. Another risk from valuation is the necessity for growth. Peers like Cloudflare (NET) have been rising – if growth slows down due to competition then I’d expect swift multiple contraction. I have discussed with Best of Breed Growth Stocks subscribers my view that a diversified basket of beaten-down tech stocks is the best way to take advantage of the tech stock crash. ZS can fit in as a high quality allocation in such a basket. I rate the stock a buy though continue to favor more compelling alternatives.

Be the first to comment