Luke Sharrett

I bought CSX Corp. (NASDAQ:NASDAQ:CSX) in mid-July for $29.72 and sold the shares about a month later at $33.41. Since then, the shares are down about 2%, and they’ve released earnings since, so I thought I’d check back in on the name to see if shares represent good value at the moment. I’ll review the earnings, and the valuation to see if I think it makes sense to buy back in, or hold off. I’ve done well with short puts as well, and so I’m champing at the bit to brag about those, too.

It’s time again for the “thesis statement” paragraph, where I offer up my thinking in a quick summary paragraph. This allows all of you to understand my thinking while remaining relatively free of the problems that come from reading my stuff. There’ll be fewer odious brags, for instance, in the thesis statement paragraph. I think CSX remains overpriced, and therefore, doesn’t represent good value at the moment. I think the company’s recent buyback was troublesome because management paid too much for the stock. In my view, a better use of this owner’s capital would have been to reduce long-term debt by about 15%. Although the shares aren’t egregiously expensive, they’re not compelling, especially in the context of a world where you can get 3.28% from Uncle Sam.

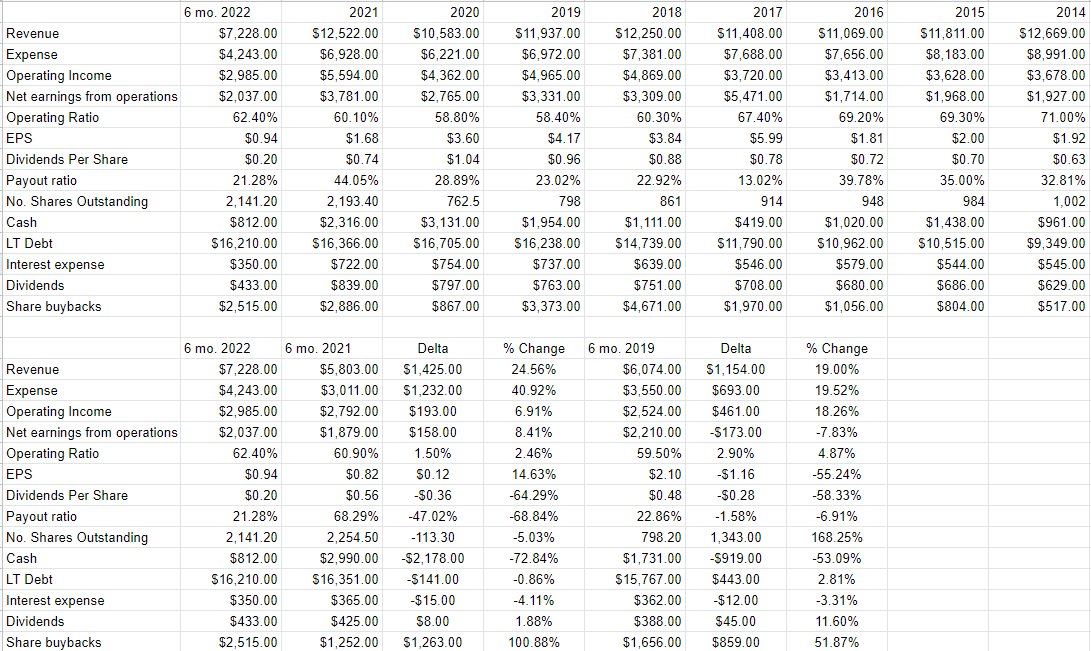

Financial Snapshot

CSX’s latest financial results have been moderately good in my view, especially when compared to 2021. In particular, revenue, operating income, and net earnings were higher by 24.5%, 41%, and 6.9% respectively when compared to 2021. The share count is down by about 113 million shares, since the company spent $2.5 billion of owner capital on buybacks during the first six months of 2022. Additionally, the capital structure improved slightly, with long-term debt down by ~$141 million, although there’s about $2.18 billion less cash on hand now than there was during the same period in 2021.

When we compare the most recent results to the pre-pandemic period, things look less rosy. Although revenue for the first six months of 2022 was ~19% higher than it was in 2019, near earnings are about 7.8% lower. Operating ratio has also deteriorated by about 290 basis points in 2022 relative to 2019. Thus, I’m of the view that the company is profitable, but it isn’t infinitely so. While I think the dividend is reasonably well covered, I’ve concluded in previous work that traffic is relatively soft this year. For this reason, I’d only buy back in if the valuation reflects this relative softness we’ve seen in 2022. This is especially the case in light of the fact that it’s currently possible to earn a relatively low risk 3.28%.

A Discussion of Buybacks

Before leaving this section, I feel compelled to write about the recent buyback activity. I’ll write at the outset that the timing of buybacks and cash spent on buybacks doesn’t line up, so these figures are approximate. For instance, we know from page one of the latest 10-K that CSX had 2,193.389,444 shares outstanding as of January 31, 2022. From the first page of the latest 10-Q, we know that there were 2,141,241,136 shares outstanding as of June 30, 2022. During the five months under discussion, then, exactly 52,148,308 shares were retired. During the first six months of the year (i.e., January inclusive), the company spent $2.515 billion of owner’s money on these buybacks. Applying the skills I had so lovingly slammed into me by the good people at Holy Spirit School many, many, many decades ago, I calculate an average of $48.22 spent per share retired. Even if the company retired a very large number of shares in January, this figure seems high to me. I decided to dig a bit deeper on this, and found that in the final quarter of 2021, the company retired 24,593,967 shares. If the company retired the entirety of these in January, that would mean they bought shares back at an average price of $32.77.

I’m going to assume that the company retired zero shares in November and December 2021, and retired all 24.593 million in January, and thus they spent an average of $32.77 on buybacks in 2022. I’ll judge the wisdom of this purchase below based on whether or not that price represents good value.

CSX Corp. Financials (CSX Corp. investor relations)

The Stock

One of the reasons I write for this forum is because I like doing my part to destroy what I consider to be myths. If the evidence from my comments section is any indication, one of the most pernicious myths that investors cling to is that you should only ever buy, and never sell a railroad because of their immense “moats.” While rails may be great investments at the right price, they certainly aren’t inevitably so. If you pay a near infinite price for very healthy growth, you’ll eventually lose money, and I think it’s obvious that rails aren’t currently experiencing anything like “healthy growth.” I drive home the point that the “business” and the “stock” are very different things in order to make the point that no business is worth an excessive price, even if it has a great “moat.”

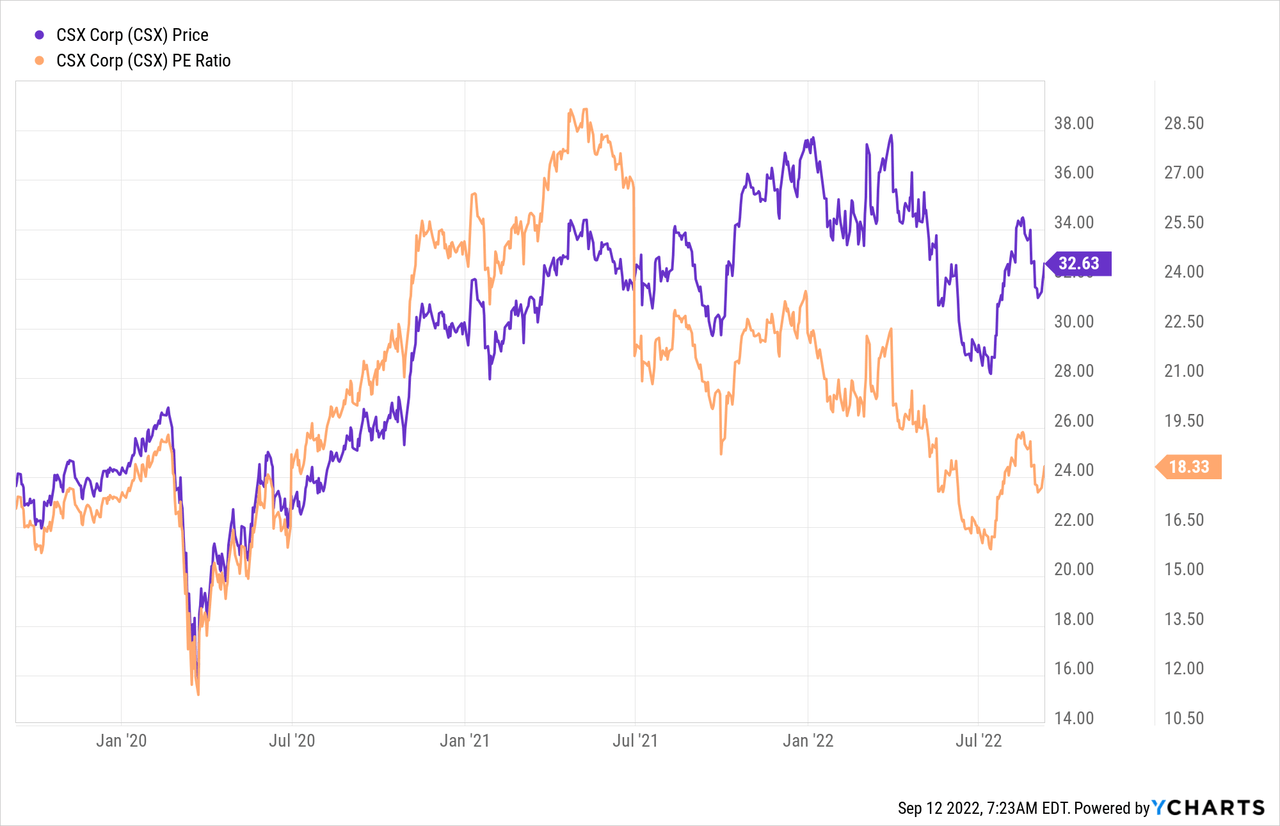

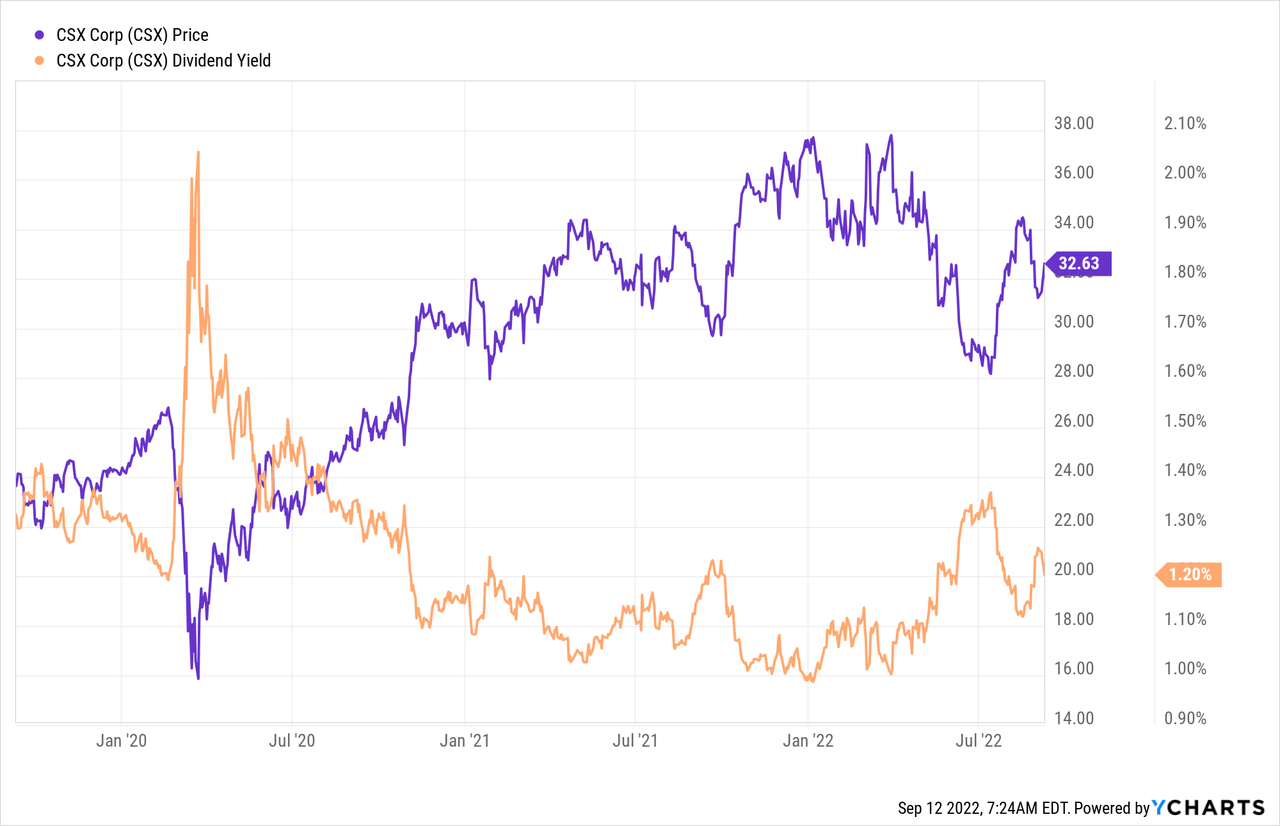

When it comes to investing in stocks, including rail stocks, I want to buy when the crowd is particularly pessimistic about the future of the business and I measure pessimism in a few ways, ranging from the simple to the more complex, and I publish some of those measures on this forum. On the simple side, I look at the ratio of price to some measure of economic value like earnings, free cash flow, the dividend yield and the like. I want to see a stock trading at a discount to both the overall market and its own history. To refresh your collective memories, I bought when the shares hit a PE of ~16.5 and “detrained” when that measure hit 19. At the moment, things are neither the cheapest nor the most dear they’ve ever been, per the following:

While shares are neither cheap nor dear, the dividend yield is near the mid-range of the recent past. Put another way, the dividend yield, like the valuation, is uninspiring at this point. This is especially so in light of the fact that it’s possible to generate well over twice the income from a 10-year Treasury Note.

Verdict on Buyback

If we continue with the assumption that the company only retired shares in January, then they bought back at an average price of $32.77 so far this year. That lines up with a valuation that I’d characterise as “uninspired.” I think that even if (and that’s a colossal “if”) the company bought back all 76.742 million shares this year, they still spent too much in my view. I think this $2.515 billion of owner capital would have been better spent elsewhere. Management could have reduced long-term debt by about 15%, for instance. This would reduce future interest expenses, and lower overall risk, which would be more valuable to shareholders than a mediocre buyback in my view.

Options Update

Previously, I sold 10 January 2023 CSX puts with a strike of $27.50 for $1.54. This brought my total premia earned on CSX put options to $18.34. These puts last traded hands at $0.91, so I think this trade’s worked out well so far. I write this to brag, obviously, and also to highlight the yield-enhancing, risk-reducing potential of put options. Just because I don’t want to buy back in at current prices, doesn’t mean that I’m not willing to buy back at what I consider to be the right price.

The problem from my perspective is that the premia on offer for puts aren’t sufficient at the moment. For instance, the February 2023 puts with a strike of $27.50 are currently bid at $0. Thus, it’s not worth the effort, in my view. It seems that we have to wait for the market to become nicely pessimistic again before selling put options.

Conclusion

It’s hard to be patient sometimes, but I think it pays off. I don’t want to go on about it too much, but I did well on this stock by insisting on buying at a very decent price. Actually, that’s a lie. I totally want to go on about it too much. The point is made, though. You do well waiting for what Buffett described as the “fat pitch.” At the moment, I think CSX stock is “high and outside” and I think swinging at it now would lead to suboptimal results.

Be the first to comment