Dimple Bhati

Perimeter Solutions (NYSE:PRM) shares have been hit hard thus far in 2022, falling 43%. While part of the share price decline is likely related to the overall decline in equity prices and former SPACs falling out of favor (Perimeter came public via a SPAC called Everarc in 2021), I suspect the biggest reason shares have declined is because CA wildfire activity is near the lowest it has been in the past 20 years.

The bulk of Perimeter’s revenue and EBITDA coming from selling firefighting chemicals for use in California. With fire season nearly over and acreage burned in California far below 2020-2021 levels, I believe that 2022 EBITDA will come in significantly below 2021’s record results. While shares have fallen considerably, I see more downside to come and recommend investors remain on the sidelines.

2022 California Wildfire Acreage burned is 85% below 2021

While Perimeter posted record results in 2021 on the back of a near record fire season which saw nearly 2.6 million acres burn, as we approach the end of fire season, thus far in 2022, less than 400,000 acres have burned, 85% below 2021 levels (and over 90% below 2020 levels).

While this is fantastic news for Californians, history suggests we could see a significant decline in Perimeter’s revenue and EBITDA.

How has Perimeter performed in the past during mild California wildfire seasons?

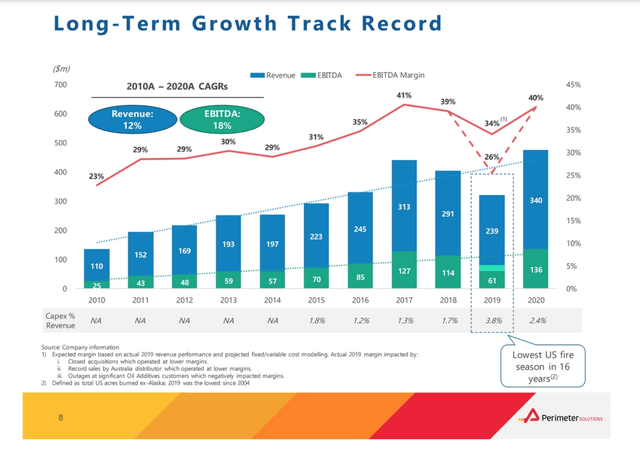

While Perimeter has been able to maintain profitability even during periods of limited fire activity, the company has suffered a significant decline in results. Below I show Perimeter’s results from 2010-2020. As you can see in 2019, the business suffered a 45-50% decline in EBITDA versus 2017-2018 levels (similar to the current situation, 2019 acreage burnt was ~87% below 2018 levels).

Historical Results (Perimeter Solutions Investor Presentation)

Estimating 2022 Results

While I expect 2022 results to be significantly below 2020-21, I don’t think we will see the full 50% decline in EBITDA that we saw from 2017 to 2019. The main reason I think Perimeter will fare better is that I expect management to be more aggressive pushing price.

Perimeter’s Board of Directors is co-Chaired by Nick Howley, the former CEO of TransDigm (TDG) which aggressively increased prices throughout his tenure. Given that Perimeter believes it has limited ‘real’ competition in the space, I expect that the company will be aggressive in raising prices.

Assuming that Perimeter boosts sales prices 7-8% which seems reasonable given limited competition and an inflationary backdrop which facilitates an easier conversation with customers, I expect that the fire segment business will see a drop in EBITDA of about 40%. This brings me to $72 million in estimated EBITDA.

Adding in $33 million in EBITDA contribution from the oil additives business (which is seeing a boost from higher fuel prices), I get total EBITDA of $105 million which is -30% versus 2021 record levels.

Factoring in D&A, interest and taxes brings me to EPS of just $0.25 per share. This puts the shares at 32x current year EPS. Of course, this is a relatively bad year (bottom quintile of fire damage by acreage burnt in the past few decades).

Conclusion

Since looking at the current year’s EBITDA/EPS is likely too punitive given the circumstances (little acreage burnt), it is important to consider what Perimeter earns in a year with lots of burnt acreage. Using last year’s EBITDA (lots of fires, top quintile of fire damage), EPS works out to about $0.42 per share. At $8/share, this puts the stock at a P/E of about 19.5x peak-ish earnings.

Taking the midpoint of 2021 and 2022 earnings (one year with lots of fires, with few) and assuming this to be ‘normalized’, I get $0.34 EPS. Applying a 20x P/E multiple (reflective of leading market position/limited competition/long-term growth), I get a fair value of $6.80 which is 15% below the current price. As such I recommend investors wait for a better entry point.

Be the first to comment