Drazen_/E+ via Getty Images

Investment Thesis

Coupang (NYSE:CPNG) has found some support last week. The stock got crushed to a pulp in the year post-IPO, but lately, analysts have turned a positive eye towards the stock highlighting its positive risk-reward.

Coupang had previously declared that it would reach EBITDA profits in late 2022. However, as I previously argued in my bullish analysis, Coupang’s core segment, its eCommerce and Fresh offerings, turned EBITDA positive in Q1, meaningfully ahead of schedule.

There are two bearish considerations and one bullish aspect to this investment. Coupang’s revenues are slowing down is the main headline risk. The other overhang is that Coupang is an eCommerce business with some side growth initiatives that are masking its profitability.

That being said, management is very much aware of investors’ concerns and has taken its foot off the pedal to focus instead on profitable growth.

Revenue Growth Rates Slow Down

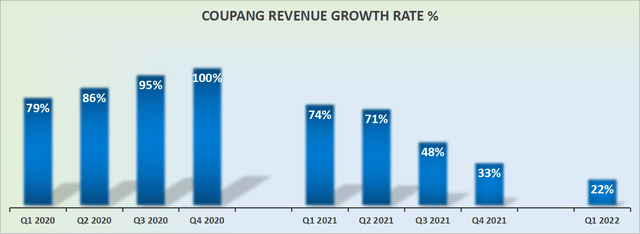

Here’s the bear case. Coupang’s growth rates are slowing. Not only is 22% paltry for a leading eCommerce player, but this marks a substantial deceleration over the previous 5 quarters.

Then, to even further complicate matters, its financials are in USD. This means that its financials have around a further 10% headwind to contend with.

Altogether, this is less than great.

That being said, the fact that its growth rates have suddenly substantially slowed down, is the reason why the business has now pivoted towards focusing more intently on its underlying profitability.

Coupang’s Near-Term Prospects

Coupang is a Korean eCommerce player. Coupang aims to be the fastest e-commerce delivery service in Korea.

Coupang has two segments, Product Commerce and Developing Offerings. The Product Commerce segment accounts for more than 96% of the business’ revenues.

While it’s Developing Offering, what used to be called Growth Initiatives holds Coupang Eats (a food delivery service), Video, and International and Fintech initiatives. As we’ll touch on soon, Coupang’s Developing Offering is masking the profitability of the underlying business.

Now, turning back to its Product Commerce opportunity, Coupang estimates that its,

[…] oldest active customers are spending on Coupang over 60% of their total estimated online spend today.

If you think about the logistics infrastructure required to capture such a high proportion of active customers’ online spending, this speaks to the moat around Coupang’s operations. Getting this level of consumer wallet share isn’t an easy feat. Or perhaps, more importantly, displacing this level of spending on Coupang won’t be easy for competitors.

Profitability Profile in Focus

Before going further, we should keep in mind that Coupang carries approximately $2.5 billion of net cash. This is not a needle mover on the investment thesis. But when the business is burning cash flows, you need to be sure that the business has enough dry powder to come out the other side. And Coupang clearly does.

What’s more, as I alluded to in my previous article, at the surface level, Coupang is still unprofitable, with its EBITDA margins at negative 1.8%.

However, the devil is in the detail.

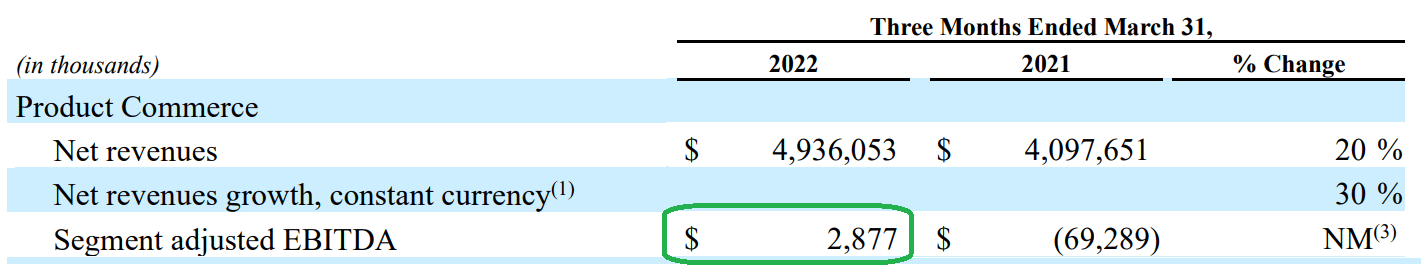

Coupang Q1 2022 results

As you can see above, its core Product Commerce segment reported $2.9 million of EBITDA. This was a massive swing from the negative $69.3 million in the same period a year ago.

Recent Analysts’ Reports

And this level of improvement was something that didn’t go missing from Credit Suisse’s upgrade on Friday.

As you can see, both Credit Suisse and Morgan Stanley’s reports point out the same things that I’m discussing here.

Both houses note a ”bottom line turnaround” story, with Morgan Stanley’s analysts declaring” [Coupang] narrows its focus on reaching consistent profitability”. This is essentially the same as I’m noting, just doing so more succinctly.

Meanwhile, Credit Suisse put more emphasis on Coupang’s Growth Initiatives being ”underappreciated by the market”.

While I do not believe that is where the needle mover is likely to come from, it nevertheless does not detract from my own bullish analysis here.

CPNG Stock Valuation – 1x Sales

If we presume that Coupang continues to grow at 20% CAGR this year, this levels the stock priced at 1x sales.

Compared with other foreign eCommerce players, Coupang is priced at very similar multiples. For example, JD.com (JD) is now priced at around 0.5x sales, and Alibaba (BABA) is priced at 2x sales.

Consequently, it’s not all that shocking that Coupang is priced at 1x sales.

What’s more, keep in mind that Coupang’s revenue growth rates appear to be slowing down, as it’s on target for $22 billion in revenues this year. Indeed, note that Coupang’s foreign eCommerce peers have managed to keep 25%-30% CAGR up until they reached a massive scale. Something Coupang is far from reaching.

The Bottom Line

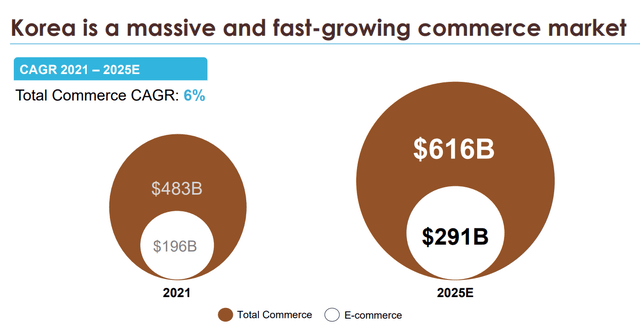

Coupang is the leading eCommerce player servicing a huge market opportunity.

Many investors, myself included, are worried that Coupang’s platform is reaching market saturation. And while that is undoubtedly a risk factor, and something we must keep an eye on.

However, we should also keep in mind that Korea’s eCommerce market is estimated to grow in the double digits, second only to China, and meaningfully ahead of other developed nations.

The other risk factor that I highlight is that Coupang’s revenue growth rates, reported in USD, are slowing down.

All that being said, I believe that with the stock down 65% from its former highs, a lot of enthusiasm for the stock has now washed out.

Be the first to comment