ewg3D

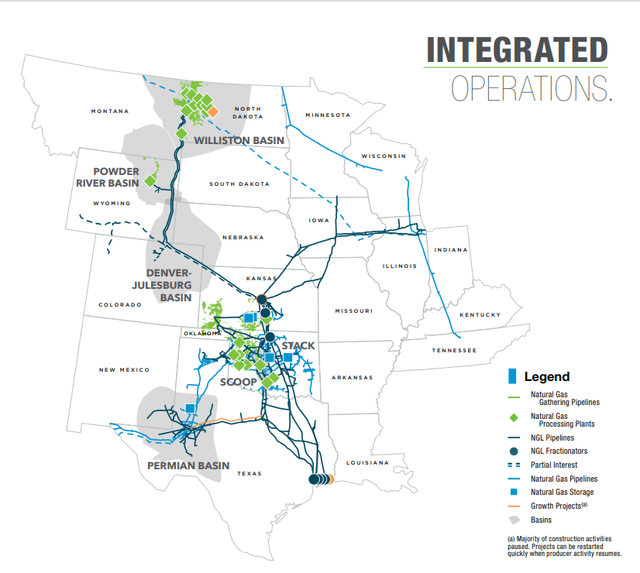

ONEOK (NYSE:OKE) doesn’t get the attention it deserves as the investment community seems to be more focused on Energy Transfer (ET), Enterprise Products Partners (EPD), Kinder Morgan (KMI), and MPLX LP (MPLX). OKE is one of the nation’s premier natural gas transportation companies as it connects the Williston, Powder River, and Denver- Julesburg basins to critical infrastructure that moves natural gas to critical markets across the United States. Unlike many popular energy infrastructure companies, OKE is a C-corporation that provides a Form 1099-DIV for tax reporting rather than issuing a K-1 at year’s end.

OKE is a quintessential income investors stock, as it has a distinguished history that can be traced back to 1972 for paying dividends; its current yield is 5.61%, and it’s a member of the S&P 500. When I look at OKE, I am not viewing it as a premier midstream operator, I view it as a critical piece of American infrastructure that can command a lofty premium in an acquisition. I want to be very clear; I do not have knowledge of a takeover, but OKE is one of the few infrastructure companies that connects critical basins, and its asset base can fill a gap and complement any of the larger midstream operators. On its own, OKE is a well-oiled machine that has grown its dividend to an enticing level while continuing to drive its revenue, net income, and EBITDA higher. OKE is in the right place at the right time as there is an overwhelming demand for natural gas, which is unlikely to subside. OKE’s revenues are protected by 90%+ fee-based structures making this an enticing investment on its own. I think OKE represents a buying opportunity as the large dividends will continue to flow into investor’s accounts while there is potential for future capital appreciation and maybe even a premium due to an acquisition through consolidation within the industry.

ONEOK

I love midstream operators due to their infrastructure base being close to irreplaceable

Every morning when you wake up and turn the lights on, you just expect them to go on and if there is a power outage, think about how that impacts your day. Natural gas impacts our lives more than we think about, as it’s responsible for general electricity, heating, and feedstock for fertilizers, just to name a few uses. So why have I been hot on midstream operators with large exposure to natural gas? Natural gas is proving to be a bridge fuel, and the global economy is reliant on it. Look at what is happening in Europe, especially France and Germany, due to the lack of supply. Anybody can raise seed capital, hire some engineers, create a technology company, and compete in the sector. If they are successful is a different story, but the barrier to entry isn’t immense. You can’t just raise seed capital and start a midstream operator. The combination of acquiring the land, passing zoning regulations, getting the permits approved, building the required infrastructure, and securing the necessary contracts is next to impossible for a startup. When is the last time anyone has seen a new midstream operator enter the space? Not to mention competing with OKE, ET, EPD, KMI, or MPLX. Berkshire Hathaway (BRK.A) proved it’s much easier to acquire existing assets. This was demonstrated when Berkshire Energy acquired over 7,700 miles of pipelines with 20.8 billion cubic feet per day of capacity from Dominion Energy (D).

BP

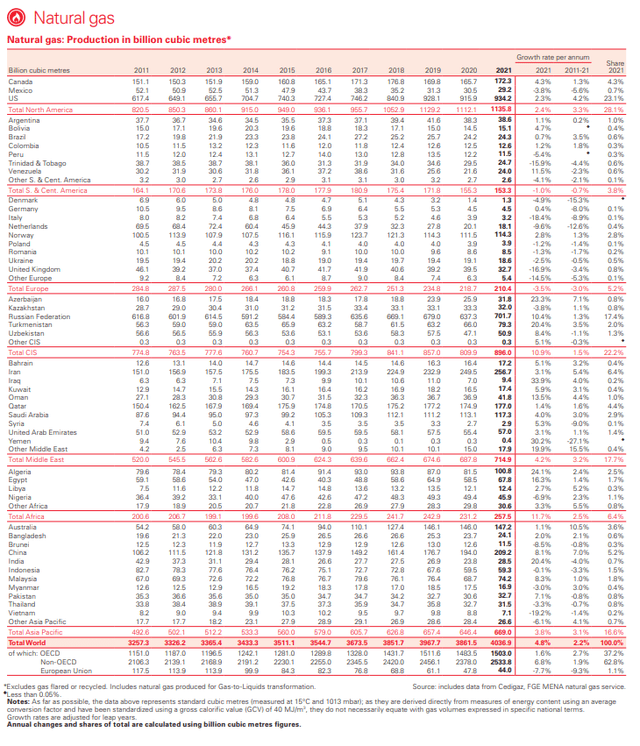

The United States is the larger producer of Natural Gas as we produced 23.14% of the global supply in 2021. More long-term deals are being inked as ET announced on Wednesday that it signed a 20-year agreement with Shell to supply 2.1M metric tons/year of liquefied natural gas from its Lake Charles LNG export project in Louisiana. Countries in Europe and Asia are scrambling to secure natural gas as supply is tightening compared to the growing demand. This is great for American exploration and production companies, but in my opinion, even better for midstream operators. Regardless of which company is extracting natural gas and spending the CapEx to increase production, there will always be a need for transportation and storage.

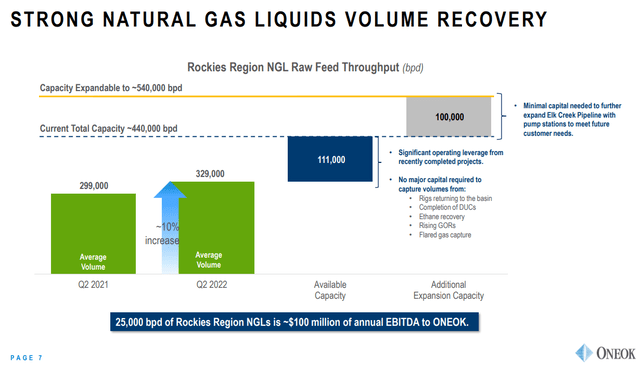

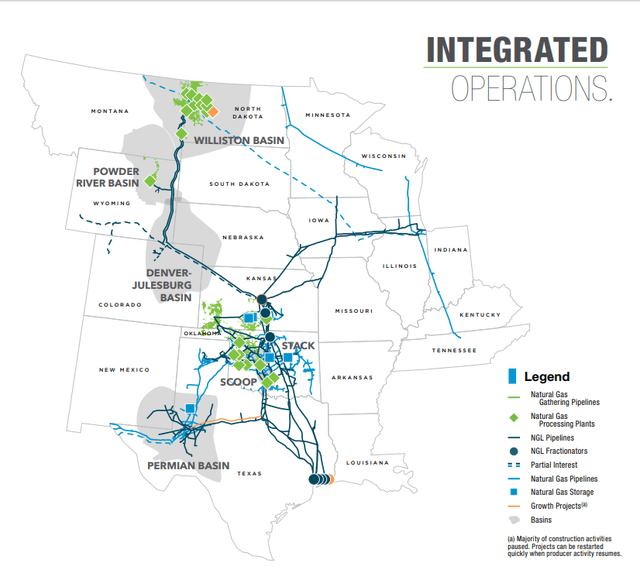

OKE operates in 3 sectors, natural gas liquids (NGLs), natural gas gathering and processing, and natural gas pipelines. OKE has 37,600 miles of pipeline with more than 30MMbbl of NGL storage capacity and 53Bcf of natural gas storage capacity. OKE has 985,000bpd of fractionation capacity for NGLs, and 22 natural gas processing plants with 2,900MMcf/d of capacity. In the TTM, OKE has generated $3.46 billion of adjusted EBITDA. NGLs accounted for $2.09 billion, while gathering and processing generated $922.1 million, and pipelines generated $446.4 million. OKE has the current capacity of 440,000 bpd of NGL throughput and can increase this to 540,000 bpd with minimal capital. An additional 100,000 bpd of throughput would be worth an additional $400 million of annual EBITDA to OKE. As demand for natural gas increases and more shipping contracts are signed, OKE could find itself in a position where it needs to expand its capacity to 540,000 bpd.

ONEOK

Operationally, OKE is firing on all cylinders. In Q2, the Rocky Mountain region’s NGL volumes increased 10% YoY and 5% QoQ. In the mid-continent region, NGL volumes increased 4% QoQ. In the Permian Basin, NGL volumes increased 10% YoY and 4% QoQ. OKE completed a 25,000 Bpd expansion on a portion of its West Texas NGL pipeline to support continued expected volume growth. OKE’s fractionation capacity is fully utilized to the point where OKE has had to work with its peers to secure additional fractionation and storage capacity. In the natural gas and processing segment, OKE’s Q2 processed volumes averaged more than 1.2 billion cubic feet per day, and in July, volumes increased to pre-storm levels of 1.4 billion cubic feet per day.

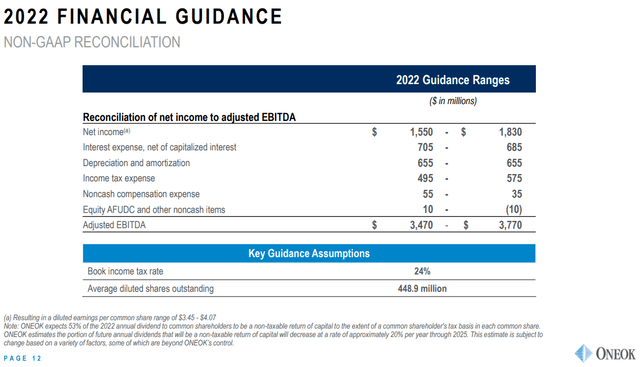

2021 was previously a record year for OKE as it generated $16.54 billion in revenue. From its top line, OKE was able to produce $3.19 billion of EBITDA and $1.5 billion of net income. In the TTM, OKE has already generated $21.4 billion of revenue, $3.27 billion of EBITDA, and $1.58 billion in net income. OKE is projecting they will produce between $1.55 and $1.83 billion of net income and $3.47 – $3.77 billion of EBITDA in the 2022 fiscal year.

ONEOK

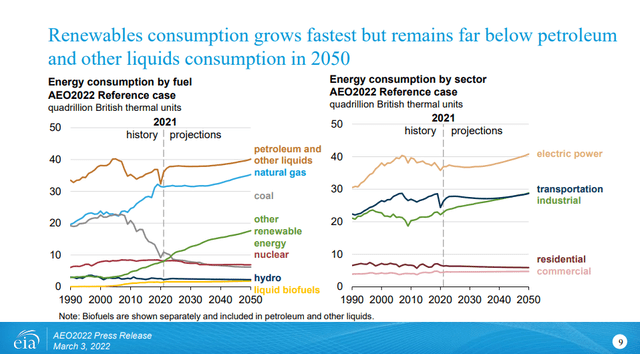

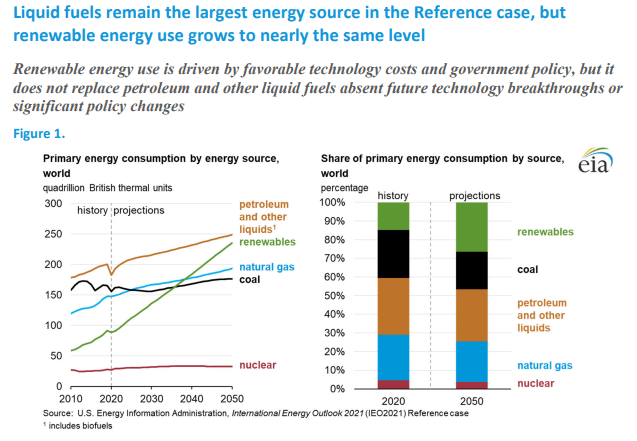

Since the close of 2012, natural gas production in the United States has increased by 266.8 Bcf (41.1%), going from 649.1 Bcf to 915.9 Bcf. On 3/3/22, the EIA released its 2022 Annual Energy Outlook and concluded that petroleum and natural gas remain the most consumed sources of energy in the United States through 2050 (1st slide below). The EIA publishes its international energy outlook every 2 years, and the last one was published prior to the war in Ukraine. In 2021, on a global scale, the natural gas consumption rate will increase by roughly 18% by 2050 per the EIA’s projections (2nd slide below). Their next report is slated for 2023, and it will be interesting to see how things have changed due to the growing demand for natural gas overseas.

Over the past decade, OKE’s revenue has increased by $11.21 billion (110.11%), and its EBITDA has increased by $2.11 billion (183.46%). The future sets up well for OKE as its infrastructure base will be critical to not just the growing demand for natural gas domestically but the growing international demand. OKE also has one of the most extensive asset bases throughout the Rockies that connects critical basins to the domestic natural gas network. As production increases, companies will need to increase their capacity contracts on OKE’s system, which will drive revenue and EBITDA.

EIA

ONEOK

OKE has been an income investors dream, and it should continue to be that way

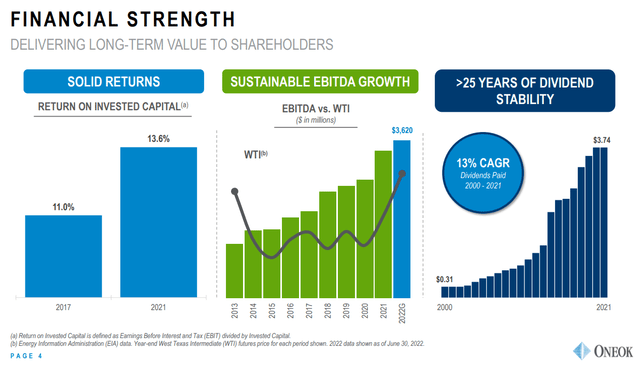

When I look at a potential income investment’s dividend, I was to see a long track record of paying dividends, stability, and growth. The ability to maintain or increase the dividend through a crisis such as the pandemic or the financial crisis is a huge plus. OKE has been paying a dividend for 50 years, as it can be traced back to 1/25/72. Today, OKE pays a dividend of $3.74 per share which is a forward yield of 5.77%. This is one of the largest yielding companies in the S&P 500, and investors have received a windfall of dividend increases over the past 22 years. While the dividend has remained at $3.74, OKE has increased its annual dividend by 1,106.45% ($3.43) per share since 2000.

OKE has driven its EBITDA higher over the years, which has led to larger dividends. From 2000-2021 OKE had a 13% CAGR on its dividend. OKE’s dividend represents stability and scalability. Income investors have been feasting on OKE’s dividend for years, and there is still time for the BOD to commit to a dividend raise in 2022, extending its track record of consecutive annual increases. OKE should continue to see its EBITDA increase due to global energy demand expanding, and this is a good setup for investors as it could lead to future dividend increases.

ONEOK

ONEOK could be the target of an acquisition

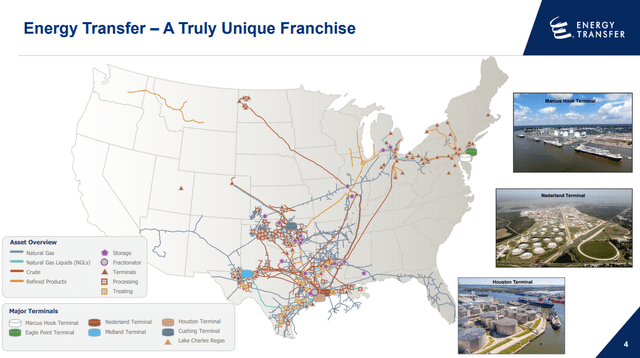

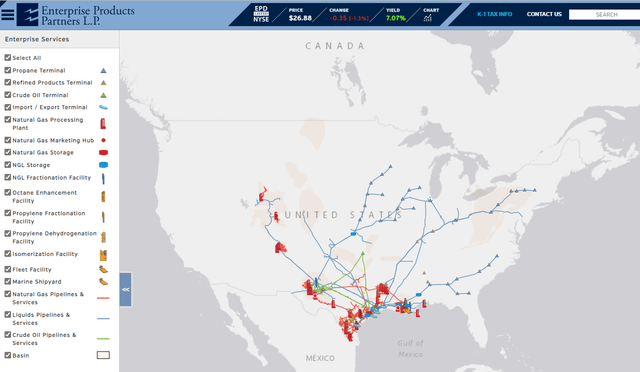

Below are the asset maps for ET and EPD.

Energy Transfer

EPD

ET and EPD are two of the largest midstream operators, as ET has generated $81.76 billion of revenue in the TTM, while EPD has generated $51.27 billion of revenue. When I look at their vast asset base, their infrastructure capability in the Williston, Powder River, and Denver-Julesburg Basins is scarce. ET has some terminals and takeaway capacity in the Williston Basin, but its takeaway capacity goes directly to Illinois, and there isn’t a direct link to the mid-continent or Gulf Coast regions, which is the epicenter of the energy industry. EPD infrastructure in the Williston and Powder River Basins is non-existent, and its takeaway capacity out of the Denver-Julesburg Basin is limited. OKE’s assets would be a bolt-on acquisition for both companies, increasing their processing capacity, takeaway capacity and connecting additional basins throughout their infrastructure. When you look at their system maps, then OKE’s, OKE would significantly fill a void in both company’s systems.

OKEOK

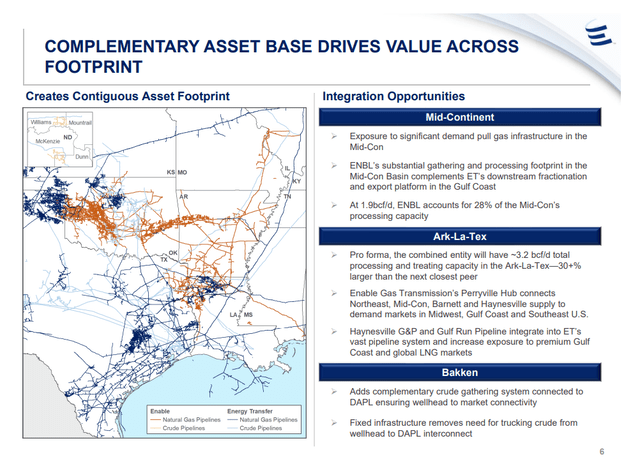

ET recently acquired Enable Midstream as Enable’s asset base complemented ET’s in the Mid-Continent region and is driving value throughout ET’s infrastructure. ET has grown into the United States largest energy infrastructure company organically and through acquiring existing companies. I am sure some shareholders would of ET and EPD would disagree with this idea, but I believe further consolidation in the industry will occur, and both ET and EPD stand to gain from acquiring OKE if the price is right. For EPD, it gains infrastructure in a region they aren’t exposed to, it puts their pipeline mileage back in the mix with KMI and ET, and it expands their NGL significantly. Currently, EPD has a 15.99% EBITDA margin from its revenue ($8.2 billion / $51.27 billion), and this would slightly decrease on the surface to 15.78% as their revenue would increase to $72.67 billion and EBITDA to $11.47 billion, but after synergies and cost savings I would think they could get past a 16% ratio. On the other hand, this makes sense for ET for similar reasons, but off the bat, it increases ET’s EBITDA margin. ET has an EBITDA margin of 13.93% ($11.39 billion/ $81.76 billion), and if OKE’s revenue and EBITDA are added, ET’s EBITDA margin will increase to 14.2% ($14.66 billion/ $103.16 billion) prior to synergies and cost savings being factored in. As the demand for energy continues to grow, we could see consolidation, and since OKE serves an underserved area compared to the Mid-Continent and Gulf-Coast regions, it could be high on the list for several companies to consider for an acquisition.

Energy Transfer

Conclusion

Oil and natural gas are not disappearing anytime soon. On the contrary, their position in the global energy mix will continue to increase on a consumption basis. This means exploration and production will need to increase, and as a direct result, the need for transportation, storage, processing, and fractionation will increase. The future energy landscape sets up well for OKE, and there should be an overall increase in revenue and EBITDA going forward. OKE has been an income investor’s dream, and its currently yielding 5.77%, with the potential of a future dividend increase due to increased EBITDA. I believe OKE will do well in the coming years, the dividend has the potential to grow, and its share price could appreciate. I also believe OKE could be a target for acquisition if there is further consolidation in the midstream space.

Be the first to comment