IGphotography

REIT Rankings: Malls

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 29th.

After showing renewed signs of life following a solid earnings season, Mall REITs are again the worst-performing major property sector in 2022 as recession concerns have offset modestly-improving fundamentals. For the REITs that managed to survive the pandemic intact – Simon Property (SPG), Macerich (MAC), Tanger Outlets (SKT) – foot traffic returned to pre-pandemic levels by mid-2022 as record-low store closings since 2020 have helped to stabilize fundamentals and restore some modest pricing power. For the lower-tier mall segment – the focus of Pennsylvania REIT (PEI), CBL Properties (CBL) and Washington Prime – a return to the pre-pandemic trend isn’t going to cut it and will require a favorable secular shift in retail industry dynamics or face an endless loop in-and-out of Chapter 11 restructurings and exchange de-listings.

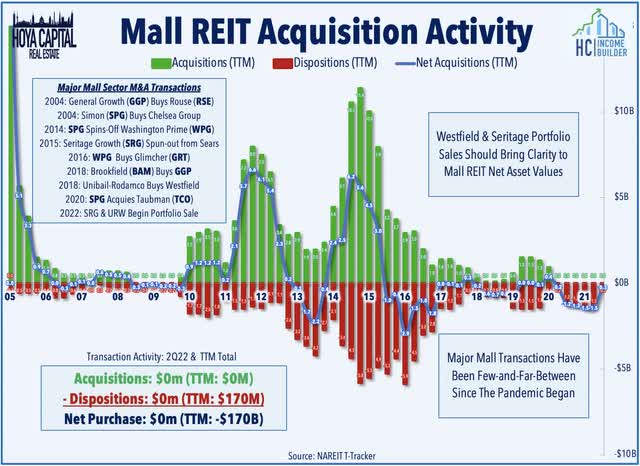

The mall sector remains highly-concentrated with these six REITs owning the majority of regional malls in the United States – and the sector could become even more contracted as a pair of firms head for the exits. Seritage Growth (SRG) – which emerged from the Sears bankruptcy and now owns 161 properties in primarily Class B and C mall locations – announced in July that its board has recommended a plan to liquidate its properties and return the proceeds to shareholders. Seritage’s announcement came several months after it announced that it will no longer elect to be a REIT. Other major U.S. mall owners include France-based Unibail-Rodamco-Westfield (OTCPK: UNBLF) – which also announced earlier this year that it intends to sell most of its two-dozen U.S. properties by the end of 2023. Canada-based Brookfield Asset Management (BAM) is the other major player following its acquisition of General Growth Properties in 2018 – formerly a U.S. listed REIT.

Mall asset sales have been few-and-far-between over the past decade – particularly when excluding the trades and mergers between REITs – so the Westfield and Seritage portfolio sales should be a very illuminating valuation read-through for these mall REITs. Last week, Unibail-Rodamco-Westfield announced that it sold the Westfield Santa Anita mall in California for $540m to an unnamed buyer at a sub-6% cap rate – the largest mall transaction since 2018. The deal closed at a 10.7% discount to the asset’s December 2021 appraisal – a relatively modest discount compared to the 35% decline in mall REIT shares this year. Back in April, URW unveiled a plan to sell its 27 malls in the U.S. – most of which are A-rated malls that operate under the Westfield brand – as it seeks to shore up its balance sheet and pivot its focus back to European assets. The Santa Anita mall is an “A-” rated mall with tenant sales PSF of $611 – towards the lower-end of Westfield’s portfolio – shy of the $750+ average in malls owned by Simon and Macerich.

Retail Fundamentals: ‘Haves’ & ‘Have Nots’

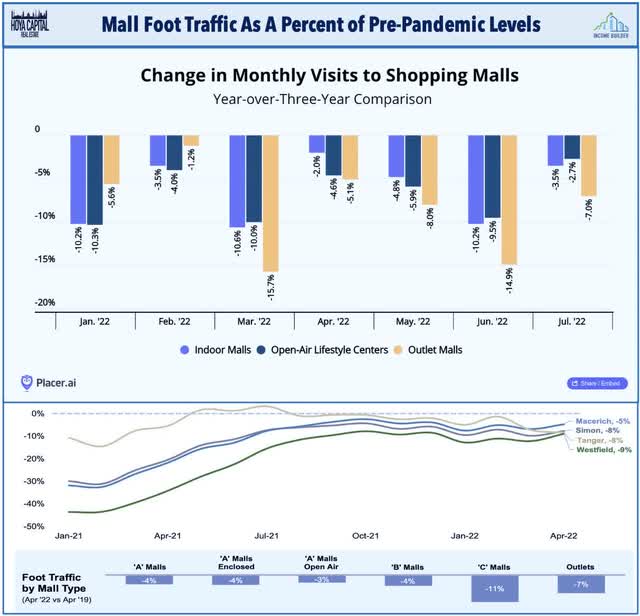

A microcosm of broader retail trends, mall sector dynamics remain a story of “haves and have not” and while a deep recession would be a death-blow for many lower-tier malls, higher-tier malls are no longer teetering dangerously on the edge. Consistent with the reports and commentary from theses REITs in recent quarters, according to data from Placer – which uses phone geolocation and proximity data to track foot traffic – foot traffic at upper-tier indoor U.S. malls rebounded to within 5% of pre-pandemic levels this summer. These indexes analyze data from more than 300 Class A and B indoor malls, open-air lifestyle centers, and outlet malls across the country, in both urban and suburban areas. Traffic at lower-tier malls, however, remains more than 10% below pre-pandemic levels – no doubt hurt by persistently high inflation which has been a crushing tax on middle- and lower-income earners, in particular.

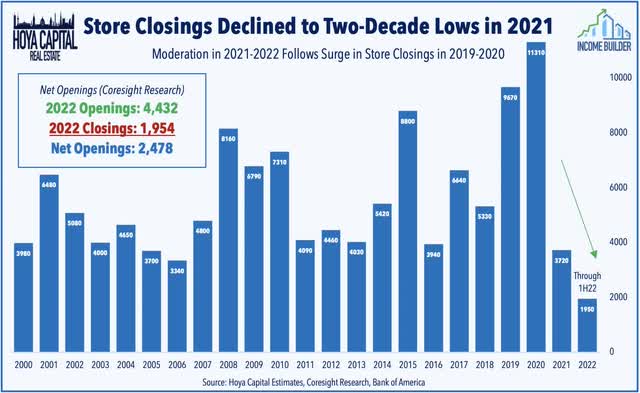

Powered by the robust stimulus-fueled boom in retail spending in 2021 and the solid rebound in store foot traffic, retailers have been opening far more stores than closing them down over the past eighteen months – reversing a dismal trend that peaked in 2019 and 2020 in which over 20,000 retailer locations closing their doors. According to data from Coresight Research, closings declined to the lowest levels in at least a decade in 2021 with openings outpacing closings for the first time since 2014. So far this year, retailers in the U.S. have announced 4,432 store openings, compared with 1,954 closings for a net of 2,478 openings. With openings outpacing closings and with almost zero new retail development, CBRE noted in its Q2 retail report that the availability of retail space at all types of properties including malls in the U.S. hit a 10-year low in the second-quarter. CBRE notes that a mix of factors have fueled the improved trends, including online brands looking to expand by opening up brick-and-mortar locations and the “thinning-out” of the Class C and D malls that have pushed retailers to focus on upper-tier locations.

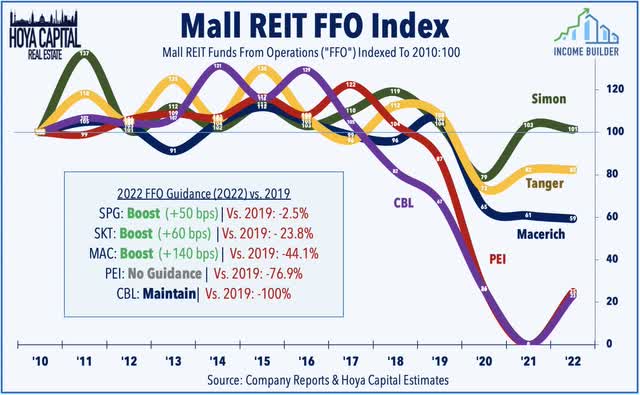

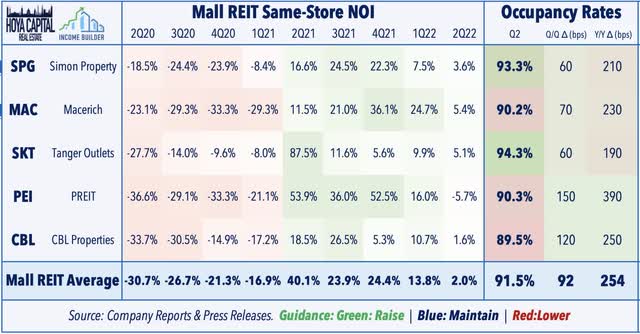

Mall REIT Earnings: Step in Right Direction

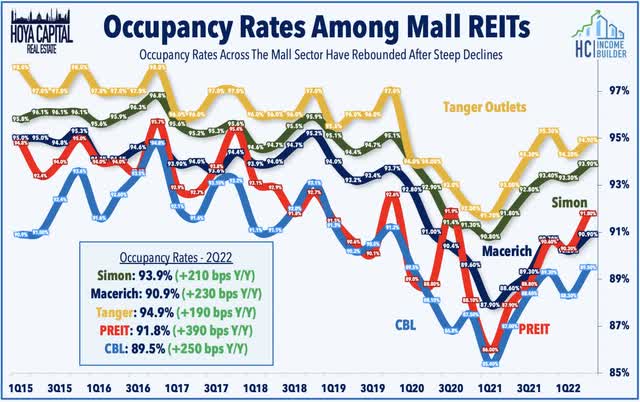

As discussed in our REIT Earnings Recap, mall REITs earnings results were actually quite solid, fueling a 20% rebound for the sector from mid-July through mid-August. Simon raised its full-year outlook and hiked its dividend for the fourth time in the past year. Citing “extremely strong” demand for its space that drove a third-straight quarter of increases in its average bases rent, SPG raised its full-year FFO growth target by 50 basis points. Occupancy rates increased to 93.9% – up 210 basis points for the year – but still below its pre-pandemic rate of roughly 95%. Tanger reported decent results as well, raising its full-year NOI and FFO growth outlook by 60 basis points, but to levels that are still 24% below 2019-levels. Macerich posted in-line earnings results, and slightly raised the midpoint of its full-year adjusted FFO outlook, but to levels that would still be more than 40% below its pre-pandemic 2019 full-year FFO.

For the pair of lower-tier mall REITs that remain – both of which entered and emerged from Chapter 11 over the past year – a return to pre-pandemic FFO remains unlikely, but second-quarter results were at least a small step in the right direction. PREIT reported similar trends of improving occupancy rates and rental spreads, but investors have been unimpressed by the pace of its asset sales as it seeks to raise capital to pay down its substantial debt load CBL, meanwhile, also reported decent Q2 results, highlighted by a 250 basis point increase in portfolio occupancy from the prior year, but rental rates remain under pressure with renewal spreads dipping another 11.2% – in part due to a shift towards higher use of “percentage rent” in lease agreements.

Encouragingly, occupancy rates appear to have stabilized and halted a multi-year downtrend – at least for the moment – as each of these five REITs reported a sequential improvement in same-store occupancy led by PREIT and CBL. Helping to juice these occupancy figures a bit, however, has been the increased use of shorter-term lease structures and temporary “pop-up” stores which would also likely be quick to vacate the space if we are indeed heading for a recession. Improving tenant sales were also a highlight in the second-quarter with all five REITs reporting that sales per square foot were back above pre-pandemic levels in Q2. CBRE’s most recent Retail Outlook noted, “Existing retail space is more efficient, with sales per sq. ft. improving due to few new stores being built and rising retail sales. From 2010 to 2020, retail sales grew 42%, while retail supply grew just 4%… Despite growing vacancy in lower-classed properties, foot traffic data suggests an underestimated resilience within regional and super-regional malls.”

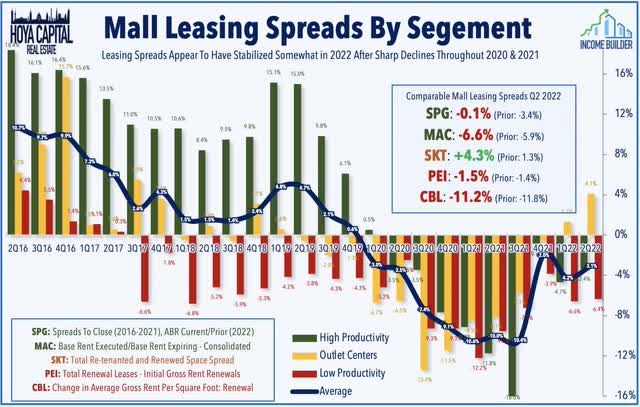

In addition to short-term rental agreements, landlords have also made increased use of “percentage rent” deals which can result in higher rent payments when times are good, but sharper declines in rent during downturns. Leasing spreads – perhaps the best leading indicator of future same-store NOI – have shown some signs of stabilization following a period of sustained deceleration from 2015 to 2019 and outright declines from early 2020 through early 2021. Of note, Tanger recorded a 4.3% increase in blended rental rate on renewed leases, the second-straight quarter of positive spreads following a twelve-quarter streak of negative rent spreads dating back to Q1 of 2019. While SPG no longer provides leasing spreads, the change in average base rents have started to stabilize after two years of declines. Recent commentary suggests that the pricing environment has improved with David Simon noting last quarter, “We are in a better position today to negotiate a fair deal for us than the last couple of years.”

Simon also owns a retail brands portfolio alongside its property portfolio. Through its 50/50 joint venture with Authentic Brands on the SPARC Group – and a separate partnership with Brookfield – SPG has accumulated a portfolio of brands with value that extends beyond the immediate benefit of keeping these tenants in business. This vertical retail integration strategy is consistent with our long-held view that mall REITs would actually benefit if they performed more like retailers – which have substantially outperformed their REIT landlords across most measurement periods. We see value in Simon’s potential position as the “last man standing” in the sector combined with its ample access to capital, which we believe will translate into accretive consolidation of higher-productivity assets from lesser-capitalized peers.

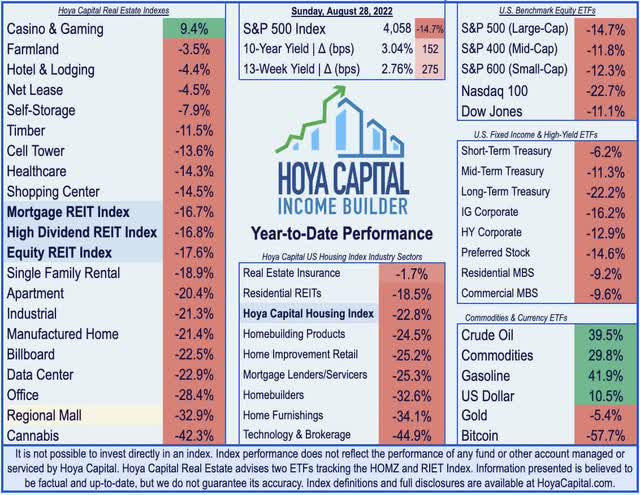

Renewed Pressure After Post-Earnings Rally

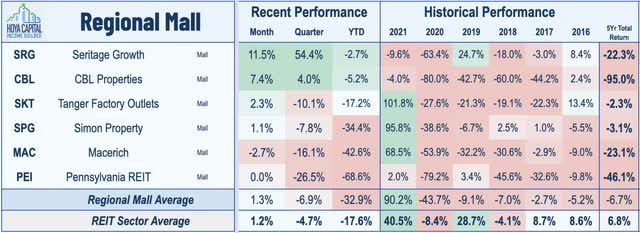

Despite the encouraging trend in mall fundamentals seen over the past several quarters, slumping consumer confidence, rising gas prices, and recession concerns have weighed on malls throughout 2022. After a quick 20% rally during second quarter earnings season, mall REITs are back near their 52-week lows – now off by 32.9% this year, significantly underperforming the 17.6% decline on the broad-based Vanguard Real Estate ETF (VNQ) and the 14.7% decline on the SPDR S&P 500 Trust ETF (SPY).

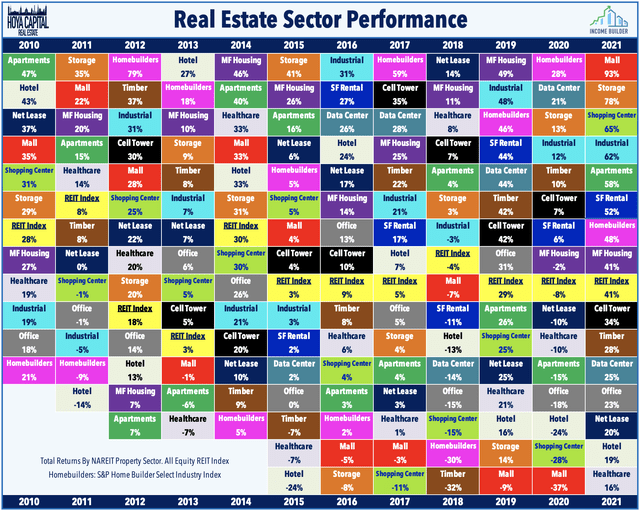

Mall REITs did manage to snap their dreadful six-year-long streak of underperformance in 2021, however, delivering the strongest returns in the REIT sector with total returns of over 93%. Before the rebound last year, mall REITs had underperformed the REIT sector average in each of the prior five years and had not recorded a year of positive returns since 2015. Amazingly, no other REIT sector has seen more than 2 consecutive years with negative total returns since the end of the last recession. Between 2015 and 2020, mall REITs produced an annualized average total return of -10.6%, the worst among major property sectors.

Seritage Growth – which is technically no longer a REIT – has been the upside standout this year, recovering all of 50% declines earlier in the year after announcing that its board approved a plan to sell all of the company’s assets and then dissolve. SRG – which was formed in the mid-2010s to own former Sears and Kmart properties – has posted dismal returns since its public listing in 2015, encumbered by the strong headwinds faced by lower-tier malls. Pennsylvania REIT has been the laggard, continuing a slide that began in mid-2021 as the clock is ticking for the troubled landlord to raise capital through asset sales to pay down its substantial debt load. After nearly doubling last year, Simon and Macerich are each off by more than 30% for the year. Also of note, a year after delisting from the NYSE, CBL Properties is back on the big board as of last November after shedding $1.6B in debt and preferred obligations through its Chapter 11. Washington Prime appears less likely to reemerge as a public company after delisting last September.

Mall REIT Dividend Yields

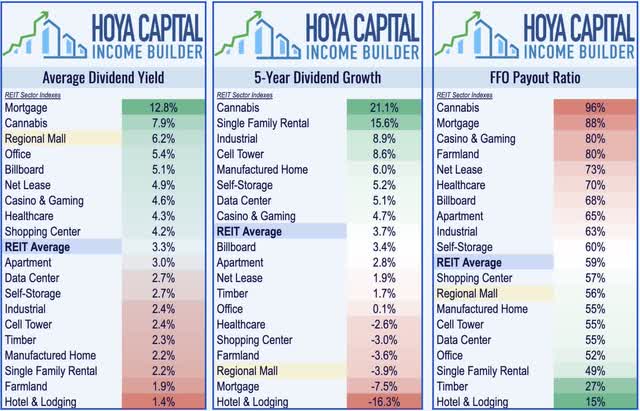

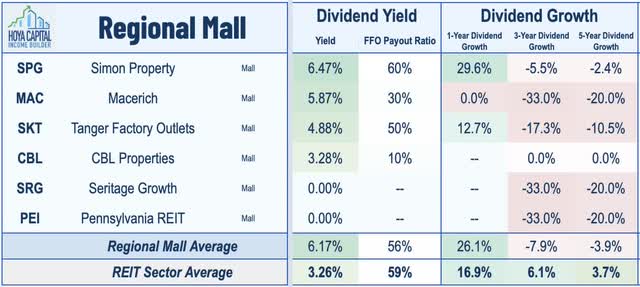

Helped by a series of dividend increases from the higher-tier mall REITs this year, malls have now become one of the higher-yielding REIT sectors with an average yield of 6.2% – well above the REIT sector average of 3.3%. Helped by the large weighting of Simon Property and Macerich which have relatively low payout ratios, mall REITs appear to have plenty of dividend-paying capacity remaining as the sector distributes less than 60% of their FFO.

Four mall REITs – SKT, WPG, CBL, PEI – eliminated their dividend in 2020 while two others – SPG and MAC – reduced their dividend during the pandemic. The tide has turned – at least for the higher-tier mall REITs – since mid-2021 as Simon has raised its dividend six times over the past eighteen months while SKT – which was formerly a so-called “dividend aristocrat” – resumed its dividend in 2021, as did MAC. Both REITs, however, continue to pay dividends well below their pre-pandemic rate and mall REITs remain near the basement of the REIT Rankings on 3 and 5-year dividend growth.

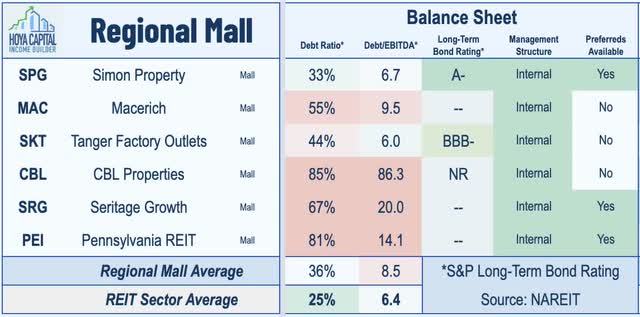

Balance sheet quality is a key determinant of dividend-paying capacity and future dividend increases. Mall REITs entered the pandemic with elevated debt ratios, which subsequently surged to nosebleed levels during the worst of the drawdown with all mall REITs besides Simon reporting debt ratios above 80% in mid-2020. Improving fundamentals have stabilized balance sheets, particularly for Simon Property – which still owns one of the few coveted A-ratings from S&P on its long-term debt and completed a very timely, $1.2 billion note offering earlier this year at a 10-year fixed rate of just 2.65% while it also refinanced seven mortgages for a total of $1.1 billion at an average interest rate of 2.92%. Elsewhere, Tanger’s balance sheet has essentially been fully-repaired after seeing its debt ratio spike in 2020, but Macerich still has work to do. The situation is far more urgent for the lower-tier mall REITs – CBL and PEI – which operate with debt levels above 80%.

Takeaways: Story of ‘Haves’ & ‘Have Nots’

After showing renewed signs of life following a solid earnings season, Mall REITs are again the worst-performing major property sector in 2022 as recession concerns have offset modestly-improving fundamentals. A microcosm of broader retail trends, mall sector dynamics remain a story of “haves and have not.” High-end mall occupancy rates and foot traffic returned to pre-pandemic levels by mid-2022 as record-low store closings since 2020 have helped to stabilize fundamentals and restore some modest pricing power. A deep recession would be a death blow for many lower-tier malls, but the higher-tier malls are no longer teetering dangerously on the edge. Consistent with our “4 Critical Cs of Brick & Mortar Competition” framework, we believe that well-located high-productivity malls that have the critical mass and “network effects” to offer a value-added retail experience can remain relevant as retailers value a physical presence in the digital retail environment.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment