Lobro78

Thesis

The excitement is building up for Apple Inc.’s (NASDAQ:AAPL) biggest launch event of the year at “Far Out” on September 7. Analysts have gone gaga over Apple’s impending iPhone 14 launch, as Apple bull, Wedbush’s Dan Ives sees it as the “pivotal moment for Tim Cook and his team as they seek to keep the gravy train running.”

TF Securities’ Ming-Chi Kuo also fanned more interest as he suggested that Apple’s iPhones would eventually support satellite communications, even though the timing remains unpredictable. Still, Bloomberg’s Mark Gurman stoked further enthusiasm, suggesting that Apple’s rumored satellite communications partner, GlobalStar, “has spent much of this year laying the groundwork for a major new initiative.”

Therefore, the excitement among Apple fans and investors has been palpable, as AAPL outperformed the SPDR S&P 500 ETF (SPY) from its June lows to its recent August highs.

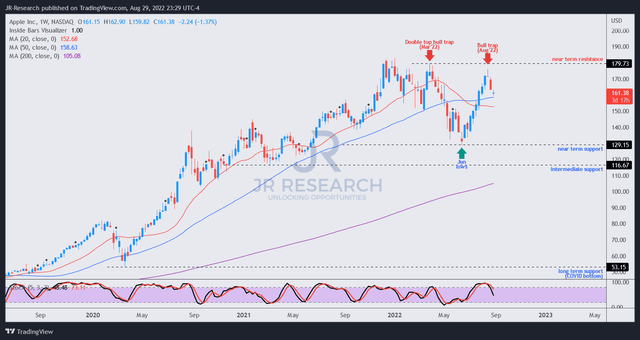

However, we believe it’s another timely reminder for Apple investors not to get carried away from our thesis that AAPL’s high valuation is unlikely to support its sustained buying upside moving ahead. Furthermore, we noted that AAPL’s upward momentum at its August highs failed at a critical juncture, with another bull trap price action (indicating the market denied further buying upside decisively) in position. Also, the rapid surge from its June lows is likely unsustainable, which we posit has reflected the near-term upside for AAPL.

Therefore, we urge investors to avoid adding AAPL as it heads into its most important launch event for 2022. In addition, we encourage investors to leverage the recent momentum spike to cut exposure and rotate to well-beaten down tech stocks, given AAPL’s unsustainable valuation.

As such, we reiterate our Sell rating on AAPL.

Don’t Get Carried Away By Apple’s iPhone 14 Launch

Apple’s ability to launch its iPhone 14 in early September, slightly ahead of its expected schedule, lifted the Street’s sentiments. Analysts suggested that it demonstrates CEO Tim Cook & team’s prowess in navigating its recent supply chain troubles. Apple also indicated its enthusiasm on the shipment forecasts for iPhone 14 to its supply chain partners, upgrading its shipment forecasts to 95M, ahead of its prior estimates of 90M.

Furthermore, the Cupertino company is also expected to benefit from an average selling price (ASP) uptick, with its high-end iPhone 14 Pro Max expected to lift its profitability. Susquehanna also highlighted in a recent commentary, as it articulated:

We believe iPhone 14 Pro/Pro Max accounts for 55-60% of overall iPhone 14 build in [September quarter], which combined with the upside from iPhone 13 Pro/Pro Max should help Apple with a higher blended ASP. – Seeking Alpha

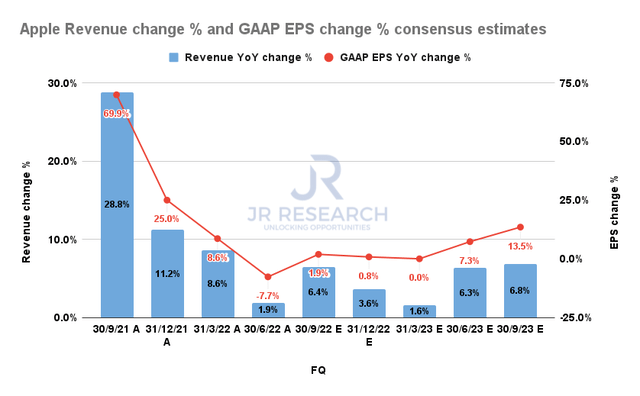

Apple revenue change % and GAAP EPS change % consensus estimates (S&P Cap IQ)

Credit must be given to Apple for navigating probably its most-challenged quarter ended June, as Apple registered revenue growth of 1.9%, with a broad-based slowdown across its revenue categories.

But, the revised consensus estimates (bullish) indicate that Apple’s revenue and EPS growth could continue improving through 2023. Apple is projected to increase its revenue by 6.4% in its FQ4 and 3.6% in its FQ1’23 (quarter ending December).

Given Apple’s robust revenue visibility and solid execution, we are confident that these estimates are credible. Furthermore, easier comps moving forward against a challenging FY22 should see Apple improve its recovery cadence further in FY23. However, investors need to ask whether the uplift from Apple’s iPhone 14 momentum could be sufficient to justify the high valuations demanded by the market.

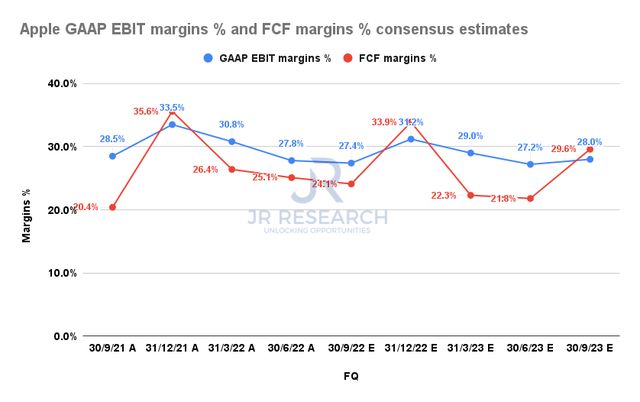

Apple GAAP EBIT margins % and FCF margins % consensus estimates (S&P Cap IQ)

Furthermore, Apple’s EBIT and free cash flow (FCF) margins are not expected to be lifted decisively upward to justify its valuation. As a result, investors need to be wary about ascribing higher valuation multiples despite the strength seen in its higher-margin services segment.

We posit that Apple’s services segment should continue to mitigate the slowing growth cadence in its iPhone segment. However, even a rapidly growing advertising vertical is unlikely to move the needle for Apple. eMarketer projects that Apple’s ad revenue could double between 2021 ($3.05B) and 2024 ($6.16B), indicating a CAGR of 26.4%.

Therefore, we should continue to see share gains by Apple against the digital advertising behemoths Meta (META) and Google (GOOGL) (GOOG) moving ahead. Furthermore, Apple has also been hiring more aggressively for AppleTV+, leveraging the platform to further build its ad revenue growth cadence.

But, we need to remind investors that even a doubling of ad revenue growth to $6.16B by 2024 is unlikely to move the needle against Apple’s TTM revenue of $387.5B. Hence, investors need to remain focused on its most important growth driver, iPhone 14, which suggests that Apple remains positioned as a hardware company and should be valued accordingly.

Oh yes, Mark Gurman also highlighted that the launch of Apple’s AR/VR device in 2023 has been moving well, with trademark filings suggesting Apple could use “Reality” for its naming conventions. But, before anyone gets carried away with the hype surrounding AR/VR, we would like to remind investors that the market leader, Meta’s Reality Labs, remains a colossal money burner. As of Q2’22, Meta recorded segment profitability of -$2.81B against revenue of $452M. Revenue for Reality Labs grew 48% YoY in Q2, but the losses also represented 25% of what Meta earned from advertising.

So, is Apple ready to compete aggressively with Meta, which still boasted a 29% quarterly EBIT margin in Q2 despite Reality Labs’ losses? Unless the Cupertino company is willing to sacrifice its much-vaunted profitability health? We think likely not. Until Apple telegraphs how it intends to approach its go-to-market motion for its AR/VR device against Meta’s leadership, we urge investors not to throw caution to the wind.

AAPL’s Valuations Are Unsustainable

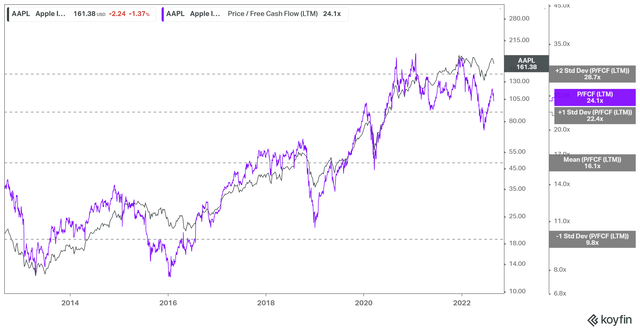

AAPL TTM FCF multiples valuation trend (koyfin)

AAPL’s TTM FCF multiples have found significant resistance at the two standard deviation zone above its 10Y mean, as seen above. While the recent pullback in June brought it back to the one standard deviation zone, we posit that AAPL remains expensively configured. Therefore, it should be pretty clear that AAPL could struggle to gain buying momentum from here, given its high valuation.

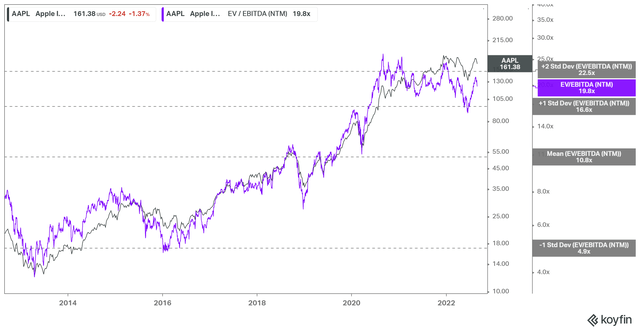

AAPL EV/NTM EBITDA valuation trend (koyfin)

Similar observations were gleaned from its NTM EBITDA multiples. As seen above, AAPL last traded close to the two standard deviation zones above its 10Y mean. Also, AAPL has struggled to find buying support above that zone, reminding investors it’s critical to assess AAPL’s high valuation.

Is AAPL Stock A Buy, Sell, Or Hold?

AAPL price chart (weekly) (TradingView)

Also, investors need to be very cautious when parsing the rapid surge from its June lows, as the market bottomed out. Therefore, we believe its near-term upside has already been reflected, even as Apple prepares itself for its upcoming iPhone 14 launch event.

Furthermore, such rapid surges are often not sustainable. Coupled with a bull trap price action at its August highs, we postulate that a much deeper pullback could occur moving ahead. Therefore, we exhort investors not to rule out a potential re-test of AAPL’s June lows in the medium-term as the market finally wakes up to the reality of AAPL’s unsustainable high valuations.

As such, we reiterate our Sell rating on AAPL. We urge investors to use its recent rally and momentum spike to cut exposure and rotate to well-beaten growth and tech stocks.

Be the first to comment