Mary Wandler/iStock via Getty Images

Introduction

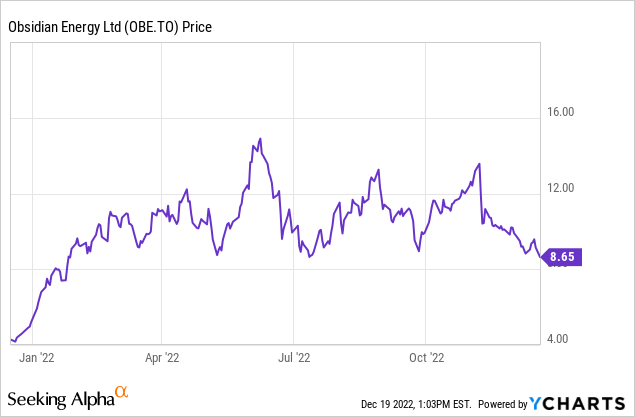

The recent pullback in the oil price makes some of the smaller and mid-tier oil producers rather attractive again. I’m not interested in having a strong torque on the oil price, I just want stories that perform well at $70-75 oil. Obsidian Energy (NYSE:OBE) (TSX:OBE:CA) has been on my short list for quite a while, and although the share price is clearly feeling the impact of the lower oil price, I think there’s still plenty of value.

Q3 was excellent with in excess of $100M in funds flow from operations

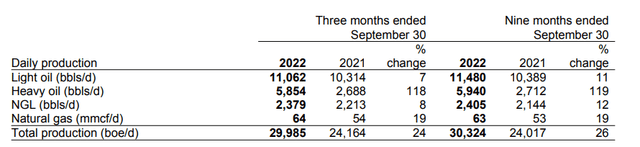

During the third quarter, Obsidian produced just under 30,000 barrels of oil-equivalent per day, of which almost 40% consisted of light oil while about 20% of the oil-equivalent barrels came from the production of heavy oil. Although Obsidian primarily is an oil producer, the natural gas production is relevant as well as it contributes about a third of the oil-equivalent production rate.

Obsidian Energy Investor Relations

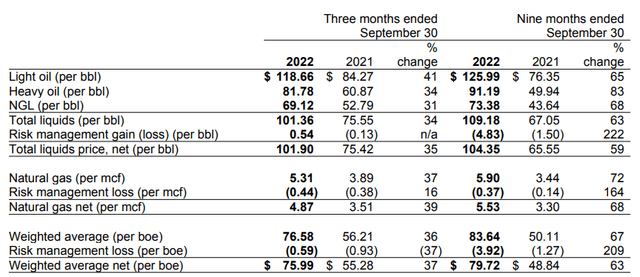

The average realized price for the oil was pretty high, thanks to the average WTI price of in excess of $90/barrel. And despite the hedging loss on the natural gas production, the average realized natgas price still came in at C$4.87 thanks to Obsidian’s exposure to non-AECO delivery points. The realized prices below are expressed in Canadian Dollar.

Obsidian Energy Investor Relations

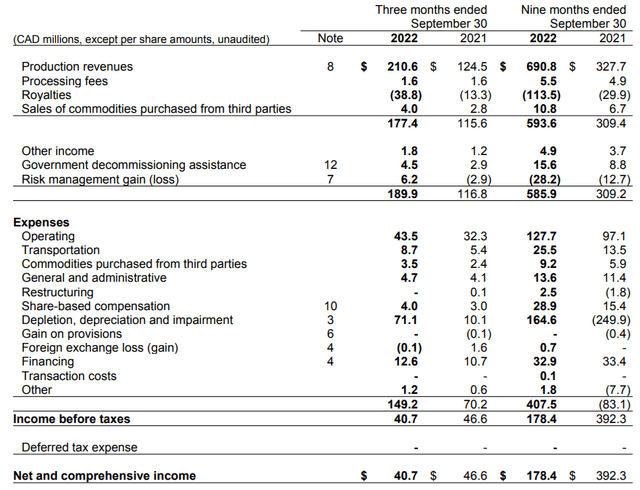

The total revenue in the third quarter was approximately C$211M and almost 80% of the revenue was generated through oil sales. And although natural gas represented about a third of the oil-equivalent production rate, its sales represented just 15% of the total revenue.

The total net revenue after including the royalty payments and the government subsidies as well as the total hedging gain of C$6.2M was just under C$190M. The total amount of operating expenses came in at C$149M, and as you can see below, almost half of those expenses are related to the depletion and depreciation expenses. An additional C$4M was earmarked for share-based compensation which also is a non-cash expense.

Obsidian Energy Investor Relations

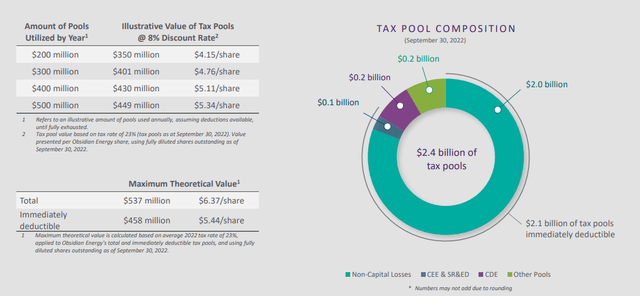

The net income was C$40.7M for an EPS of C$0.50 per share. No income tax was due as Obsidian still has a deferred tax asset of almost C$400M (with total tax pools of in excess of C$2.4B), so the company won’t have to pay taxes in the foreseeable future. And that likely is one of Obsidian’s main features.

Obsidian Energy Investor Relations

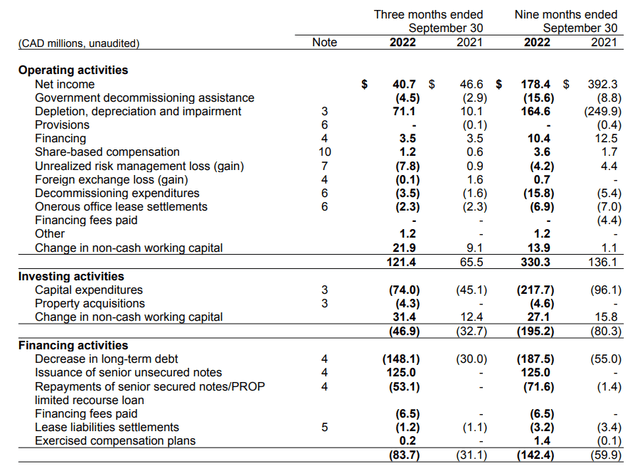

The total operating capex was approximately C$121.4M but as you can see below, this included C$21.9M in working capital benefits while it also deducted a C$7.8M unrealized hedging gain (which means the cash flow result still includes a C$1.6M realized hedging loss. The company has more hedges in place and provides a detailed breakdown in its financial report).

Obsidian Energy Investor Relations

We also should deduct the C$1.2M in lease payments, but I’m “ignoring” the C$6.5M in financing fees paid: Although this definitely was an outgoing cash payment, it’s a non-recurring item and I wanted to check Obsidian’s normalized cash flows excluding these non-recurring items.

This means the adjusted operating cash flow was approximately C$98.5M, and after deducting the C$74M in capex (excluding acquisitions), the underlying free cash flow result was C$24.5M. There are currently 82.4 million shares outstanding, resulting in a free cash flow of approximately C$0.30 per share.

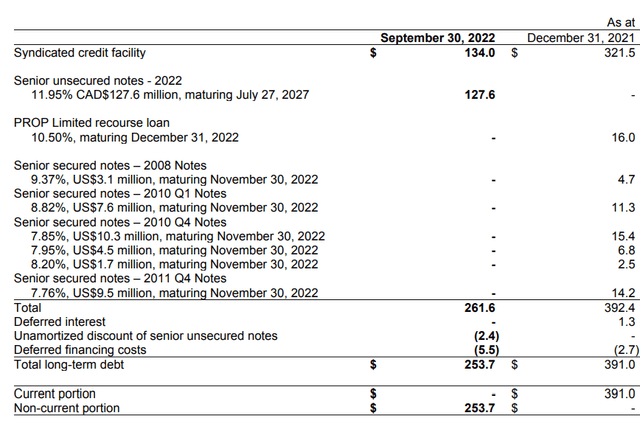

The majority of the free cash flow on a YTD basis was used to refinance the company’s debt profile. The net debt level decreased fast, and as of the end of the third quarter, Obsidian only had C$254M in long-term debt outstanding (including deferred financing costs).

Obsidian Energy Investor Relations

Fortunately Obsidian will be able to retire a portion of the 11.95% debt in the summer of 2024 although it remains questionable if the noteholders will take Obsidian up on its repurchase offer (OBE has to make an offer to repurchase notes based on its free cash flow generation, but noteholders are not required to tender into the repurchase offer). The most important feature for Obsidian is the option to redeem the bonds at 105.975% from July 2024 on, 102.988% from July 2025 on and at 100% of the par value from July 2026 on. I expect Obsidian to call these notes at its earliest convenience as it can use its existing cash flow and the credit facility to retire the 11.95% notes.

The preliminary guidance for 2023 was delayed

Just last week, Obsidian announced it was delaying its 2023 budget “given the considerable optionality of our asset base coupled with results from drilling programs that are still in progress.” This makes it a bit tough to figure out what the company is planning on doing next year, and what this would mean for the cash flow.

The FY 2022 capex program of C$320-330M contained investments in growth and given the decline rate of 21%, I would estimate the sustaining capex to be approximately C$150-200M. I expect the company to continue to pursue moderate production growth but we’ll have to wait until 2023 to see the actual budget and plans.

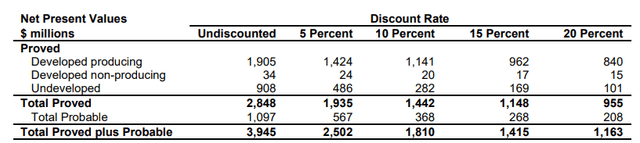

I’m also looking forward to see Obsidian’s updated reserve calculation and PV10 value. At the end of 2021, Obsidian’s PV10 for the 1P reserves was C$1.44B with an additional C$368M earmarked for the probable reserves for a combined total of C$1.81B. No taxes should be owed given the massive tax pool available, and after deducting the net debt, the NAV10 of Obsidian should be around C$18/share. Any additions to the reserves can further boost the NAV.

Obsidian Energy Investor Relations

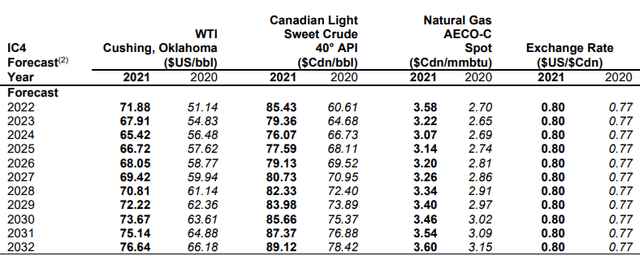

And just as a side note, the oil and gas prices used for this PV10 calculation were very reasonable, as you can see below.

Obsidian Energy Investor Relations

Investment thesis

Although the underlying free cash flow is “hidden” by the investments in production growth, Obsidian Energy appears to be relatively cheap. Sure, the oil price was lower in Q4 and will be lower in 2023. But fortunately Obsidian did the right thing in the past few quarters by rapidly reducing its net debt. With plenty of tax assets available and a NAV/share of in excess of C$18 (and likely C$20 in the upcoming reserve update), there’s plenty to like here.

I haven’t bought any shares yet but I have started to write put options on Obsidian Energy (P5 in USD for February) and I will likely continue to do so.

Be the first to comment