Andrea DiCenzo

Introduction

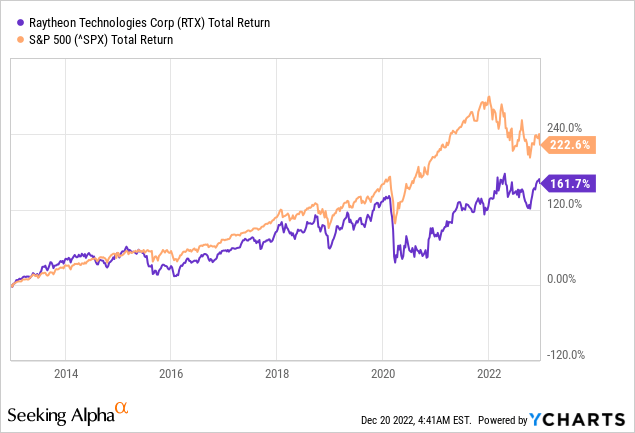

Shares of Raytheon Technologies Corporation (NYSE:RTX) are currently in demand because of the war between Ukraine and Russia. Year-to-date, shares are already up 16%, while the S&P 500 (SP500) is down 19%. The war with Ukraine and Russia is a strong catalyst for Raytheon as the company ramps up production. Goldman recommends buying Raytheon; Raytheon is less expensive compared to other aerospace and defense companies.

Many Contracts Have Been Awarded To Raytheon

Raytheon Defense Products (Raytheon 2Q22 Investor Presentation)

The war between Ukraine and Russia is doing Raytheon good. In less than a month, Raytheon has won contracts worth more than $2 billion. The following contracts have been won or are expected.

1. The company is increasing production of Javelin anti-tank missiles to replenish U.S. supplies. The Pentagon has supplied Ukraine with several thousand Javelins to repel Russian ground forces.

2. On Nov. 30, Raytheon was awarded a $1.2 billion firm-fixed-price contract to purchase National Advanced Surface-to-Air Missile Systems, associated equipment, services and spare parts to support efforts in Ukraine. The estimated completion date is Nov. 28, 2025.

3. Pratt & Whitney, Raytheon’s engine division, has been awarded a $115 million contract for F135 engine upgrades (engine core upgrades). This engine core upgrade provides the fastest, most cost-effective and lowest risk path to Block 4 for all global F-35 operators.

4. Raytheon Missiles awarded a $171.19 million modification project to a previously awarded contract. The modification exercises an option to procure 111 full rate production Block V Tactical Tomahawk All Up Round Vertical Launch System missiles as follows: 50 for the Army, 48 for the Navy, and 13 for the Marine Corps. The completion date is in November 2025.

5. Ukraine can soon expect the advanced Patriot system as air defense. U.S. Secretary of Defense Lloyd Austin could sign it this week, after which President Biden will approve the final request. The Patriot is a defensive system, and President Biden softened his stance on providing the system. Other non-defensive systems were dismissed. The likelihood of the Patriot being approved is high.

6. Raytheon Technologies was awarded a $619.07 million fixed-price modification, with a fixed-price incentive and cost reimbursement, on a previously awarded contract. The modification increases the scope of procurement of long-term materials, parts and components for Lot 17 F135 propulsion systems in support of the F-35 Lighting II Joint Strike Fighter for the Air Force, Marine Corps, Navy, partners outside the U.S. Department of Defense (DOD) and Foreign Military Sales (FMS).

Revenue is expected to increase by an average of 8% per year and earnings per share by 12% per year over the upcoming years. The war between Ukraine and Russia is a strong catalyst for Raytheon, as the company has won many contracts.

High Dividend And Buy Back Yield Of 4%

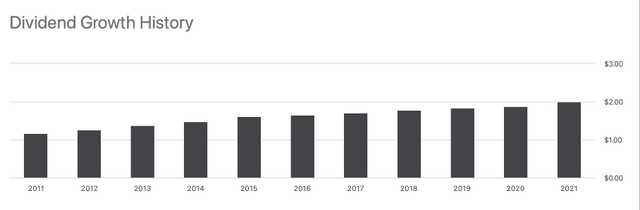

The company manages to grow its dividend per share well; over the past decade, the dividend per share has grown at an average annual rate of 5.6%. The dividend rate is $2.20 (dividend yield of 2.2%).

Dividend Growth History (Seeking Alpha RTX Ticker Page)

The dividend payout has been rising steadily for years. In addition to distributing dividends, the company buys back shares, allowing the dividend per share to grow further.

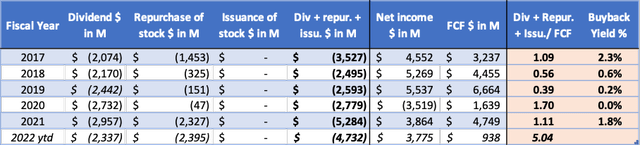

From 2017 to 2020, share repurchases gradually declined, but from 2021 the company is buying back a lot of shares. For fiscal 2021, the company returned more cash to shareholders than it generated in free cash flow, and the buyback yield was high at nearly 2%. Year-to-date, the company has returned even more cash to shareholders, as free cash flow fell sharply in the first quarter of this year due to higher capex spending.

Raytheon’s Cash Flow Highlights (SEC and Author’s Own Calculation)

Looking forward, the company announced a new share repurchase program to buy back $6B of shares. At a market capitalization of $145B, this represents a high buyback yield of 4.1%.

Share repurchases reduce supply while increasing demand when shares are repurchased in the open market. Buybacks can greatly increase the stock price as well as earnings per share and dividends per share. Raytheon’s large share repurchases are a strong catalyst for further share price appreciation.

Raytheon Is Favorably Valued

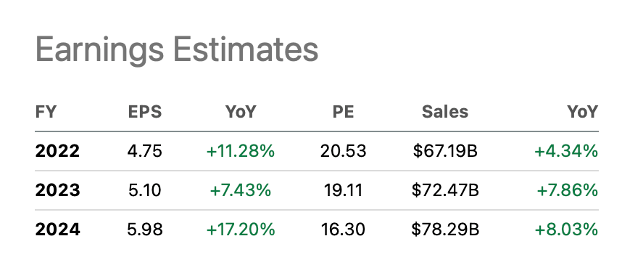

From the Seeking Alpha Raytheon ticker page, 13 analysts have revised earnings estimates upward. Earnings per share are expected to rise 12% annually over the next few years to $5.98 for fiscal 2024. Revenue is also expected to rise sharply.

The P/E ratio is a common metric to gain insight in the stock’s valuation. The expected stock price is determined by multiplying the average P/E ratio by the expected earnings per share. Raytheon’s 5-year average non-GAAP P/E ratio is 19, and fiscal earnings per share for 2024 is $5.98. We arrive at a share price of $113.62 for the end of fiscal 2024. Investors can expect an average share price return of 7.9% per year. Including dividends of about 2.2%, we arrive at a solid pre-tax return of 10.1% per year.

Raytheon’s Earnings Estimates (Seeking Alpha RTX Ticker Page)

Conclusion

Raytheon has been awarded many contracts during the war between Ukraine and Russia. In less than a month, Raytheon has won contracts worth more than $2B. Shares are already up 16%, while the S&P 500 is down 19%. Revenue is expected to grow by an average of 8% per year, and earnings per share by 12% per year over the upcoming years. The dividend per share is growing steadily at an average of 5.6%. The company announced a large share repurchase program worth $6B, representing a 4% buyback yield. The share repurchases should drive the stock price higher. Raytheon Technologies Corporation stock is favorably valued, and total pre-tax returns are estimated at 10% per year for the next few years. Raytheon Technologies stock is worth buying.

Be the first to comment