Cristina Moliner/iStock via Getty Images

Investment Thesis

JD.com (NASDAQ:JD) has seen its stock fall out of favor with investors. There are too many near-term worries plaguing Chinese stocks. From a slowing economic backdrop in China to the potential delisting of some Chinese companies, as well as geopolitical tensions between the two superpowers.

Hence, the analogy that I find appropriate here is to a balloon. Read more to see why I believe this is an apt comparison.

Chinese Stocks, Balloons

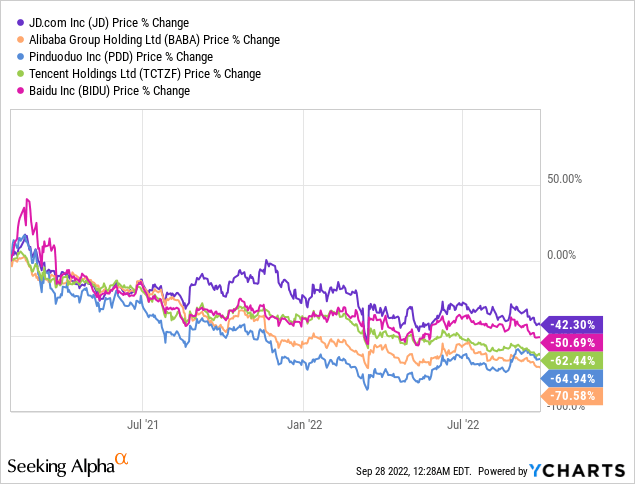

Since February 2021, risk assets have been selling off. So although today the financial community finds themselves talking about the bear market that we find ourselves in, the fact is that Chinese stocks, like other risk assets, have been selling off for more than 18 months.

In fact, I believe that it’s fair to say that the pace of Chinese stocks selling off has been slowing down. And that’s not so surprising, given that a lot of the sell-off was front-loaded.

The way to think about it is as a very full balloon. The air comes out of the balloon very rapidly at first but the level of deflation towards the end is very slow.

And there have been plenty of reasons to point out for Chinese stocks selling off.

For one, Chinese equities are seen as “foreign investments”. This label practically ensures that they don’t trade at a premium to US stocks. Furthermore, given the global events of 2022, there are even more reasons for foreign assets not to trade at a fair valuation.

Then, of course, there are ongoing tensions about the accounting of Chinese stocks and whether some bad apples will get delisted.

All these worries are well known and have been amply discussed already. Yet, what I’ve always found alluring about Chinese companies is that they are so profitable.

The way that Chinese companies have tended to operate is to seek out profitable growth, rather a growth at all costs, and take a wait-and-see approach to profitability.

Next, we’ll turn our attention to a valid bearish argument.

Revenues Growth Rates Dip Lower, This Complicates Matters

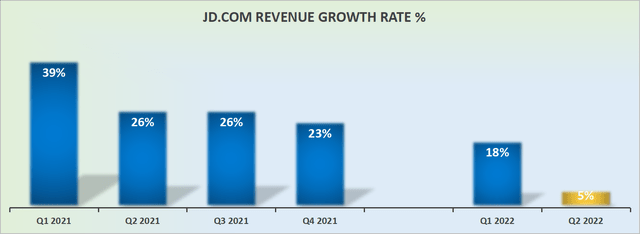

JD.com revenue growth rates

Above I’ve used JD.com’s constant currency revenue growth rates. These will differ from the as-reported figures. As you can see above, JD.com revenue growth rates were very stably growing at +20% CAGR throughout 2021.

One could easily make the bull case that JD.com was a +20% CAGR business and perform valuation assumptions off of that figure, as I did.

Yet its most recent results look nothing short of alarming. These recent growth rates are a substantial departure from what investors had become accustomed to, even throughout previous Covid lockdown cycles.

Investors have now been forced to rethink whether or not there’s enough of a secular growth story at play. Or whether it’s the case that as long as China has rolling lockdowns in place, JD.com’s pace of growth will be substantially muted?

Not All Bad News

On the other side of the argument, consider that JD.com now has 580 million annual active users. These are not small figures by any stretch. What’s more, JD.com states that its newest cohorts are spending more on the platform from the start than older cohorts did.

We’re also pleased to see that our new users have more appreciation and trust in JD, with a notable increase in ARPU and record high shopping frequencies for the past three years.

Moving on, where I believe JD.com may outperform Alibaba (BABA) is that JD.com’s focus has been on lower-tier income groups and rural villages. Essentially consumers that are in the lower income bracket.

Consumers that need merchandise but haven’t got ample means. Consequently, given that China is now entering a period of economic slowdown, I believe that JD.com, the low-cost e-commerce platform will gain market share relative to competing alternatives.

Low-cost business models may not thrive in a period of abundance but are able to increase their intrinsic value throughout the cycle, something that in time investors will return to reward.

Profitability Profile in Focus

As alluded to already, JD.com has always been zealously focused on improving its profitability profile.

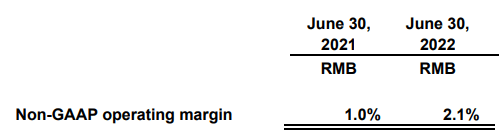

JD.com Q2 2022

As you can see above, Q2 2022 saw its non-GAAP operating margin increase from 1.0% to 2.1%. As noted already, given that JD.com is always attempting to be the lowest cost operator and pass savings onto the consumer, this makes JD.com very difficult to be outcompeted against, hence providing a moat around its value proposition.

JD Stock Valuation – 20x Trailing Free Cash Flow

JD.com is being priced at 20x free cash flow. On the surface, this isn’t that cheap, if the business was to continue growing in the mid-single digits CAGR.

But on the other hand, if one believes that JD.com will continue to gain market share in retail e-commerce and that sooner or later the Chinese economy bounces back from its malaise, then 20x free cash flows is a fair entry point.

The Bottom Line

In sum, what I find particularly surprising is that JD.com is able to still deliver some revenue growth as it comes against tough comps and a challenging Chinese economic backdrop. All the while, the business still makes substantial free cash flows.

If JD.com can deliver improving operating margins against this most onerous environment, what’s likely to happen when the environment actually turns favorable?

The thing with stocks is that nobody rings a bell letting you know when the bottom is in. Also, stocks don’t stay at the bottom for too long. The bounce from the bottom is quick.

This is my concluding thought. Even though JD.com is still growing in intrinsic value as measured by any indicator, its stock is down over the past two years. A little air in this balloon and it will soon fly away.

Be the first to comment