Ninoon

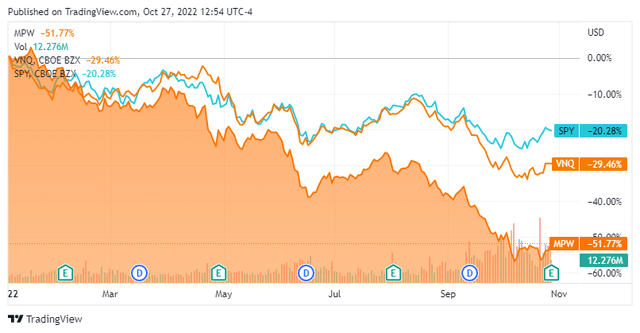

Medical Properties Trust (NYSE:MPW) has been a destroyer of capital in 2022, falling more than -50% YTD, while the Vanguard Real Estate ETF (VNQ) fell -29.46%, and the SPDR S&P 500 Trust (SPY) has declined -20.27%. Short interest in MPW has climbed past 12%, while the decline in share price has led to an inflated yield that exceeds 10%. MPW just reported its Q3 earnings, and after reading through the press release, I am planning on dollar cost averaging again. MPW isn’t a profitless tech company or a meme stock, yet shares have been disregarded as if there is something fundamentally wrong with the company. After Q3 earnings, MPW looks much more like a broken stock rather than a broken company, and I believe these levels represent a long-term opportunity for capital appreciation and income generation.

MPW’s Q3 earnings should have eased the fears throughout the investment community as clarity around its operations was delivered.

Prior to earnings, MPW had announced it would be selling 3 Connecticut hospitals to Prospect Medical Holdings and 11 of its facilities to Prime Healthcare. As part of the transaction with Prime Healthcare, MPW was repaid $30 million in financing. In early September, MPW sold 9 general acute hospitals and 2 related medical office buildings to Prime for net proceeds of $360 million. On October 6th, MPW announced that it would sell 3 Connecticut hospitals to Prospect Medical Holdings. The agreement establishes an aggregate sale price of $457 million. These sales were expected to reduce short-term debt in Q3 and has sourced over $1 billion in immediate liquidity.

In the new press release from MPW Edward Aldaq, MPW’s Chairman and CEO, stated that performance at MPW’s facilities improved during Q2 and Q3 and is a testament to the resilience of well-underwritten hospitals. MPW has sourced approximately $1.8 billion in cash from capital recycling transactions year-to-date throughout its deal-making, the partnership transaction with Macquaire Asset Management, and the proceeds from loan repayments. MPW is also expected to receive more than $650 million in proceeds in 2023 from other agreements which are currently binding.

Steward has been a sore spot when discussing MPW, and a thesis bears were unwilling to relinquish. During Q3 Steward completed its repayment of $450 million in Covid related advances and collected $70 million from the Texas Medicaid Program from past due reimbursements. The bear thesis around Steward should lose steam as its positive revenue trends, and annual savings from Stewards cost structure are projected to generate sustainable free cash flow (FCF) moving forward. This should reduce the level of fear regarding the hospitals within Stewards network and their ability to pay MPW moving forward. As a previous pain point, an obstacle has been taken off the table, and in my opinion, the level of risk some had speculated about has been mitigated when it comes to MPW’s operational portfolio.

MPW’s numbers don’t reflect the possibility of a dividend cut as their funds from operations haven’t declined

MPW’s actual earnings were a mixed bag, but more positive than negative. MPW generated $352.34 million of revenue in Q3, which was a miss of $36.68 million from the consensus estimate. Funds From Operations (FFO) which is the main number income investors who invest in REITs care about, didn’t decline, as they came in at $0.45 per share, in line with the consensus estimates. MPW’s net income in Q3 was $222 million or $0.37 per diluted share, which is a 27.59% increase YoY compared to $171 million or $0.29 per diluted share in Q3 2022. MPW provided guidance that should help the bull thesis as MPW increased its net income estimates per share in 2022 to $1.99 – $2.01. MPW is also closing the gap on its NFFO forecast of $1.78 0 $1.82 to $1.80 – $1.82, making a tighter range for their year-end results.

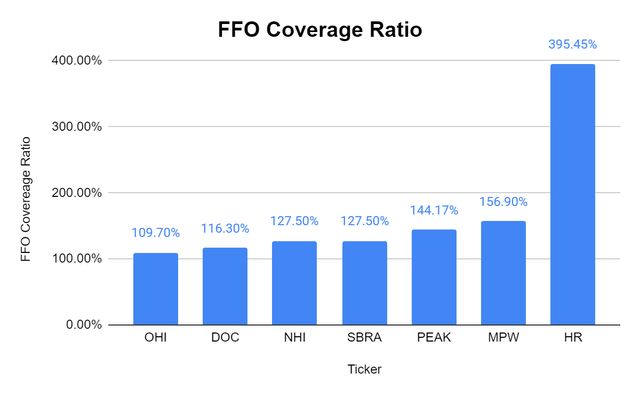

MPW pays a dividend of $1.16 per share, which is $0.29 per quarter. Over the trailing twelve months (TTM), MPW has generated $0.43 of FFO in Q4 of 2021, $0.47 in Q1 2022, $0.46 in Q2 2022, and $0.45 in Q3 2022, for a total of $1.81 of FFO per share. This is $0.65 of FFO per share above its current annual dividend, creating an FFO payout ratio of 64.09%. The bearish sentiment around MPW’s dividend is unwarranted. I think MPW’s dividend should be looked at as durable as MPW was able to generate more than enough FFO during a difficult year to fulfill its dividend obligations and retain a substantial amount of FFO after dividends were paid.

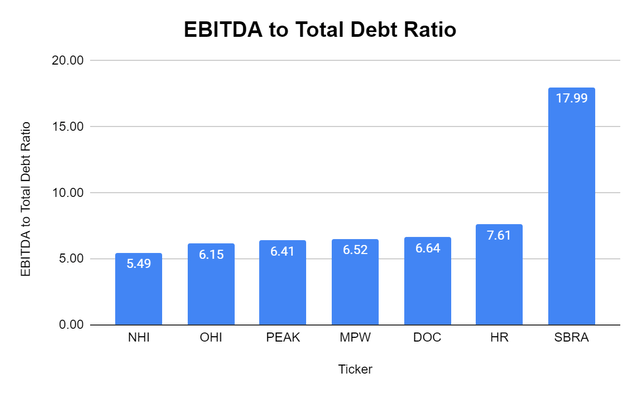

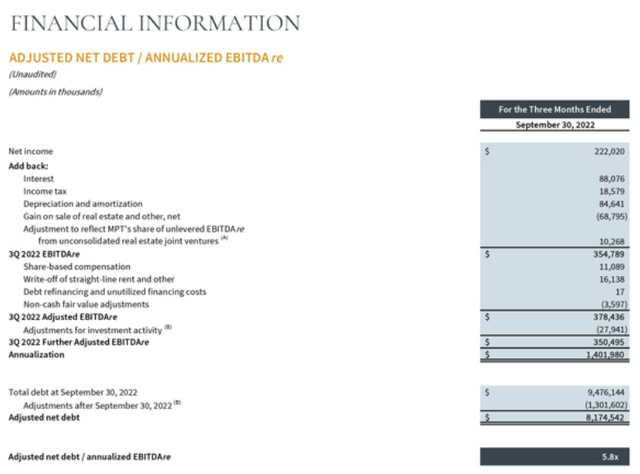

The other aspect that investors should pay attention to is MPW’s debt position. MPW decreased its total debt position at the close of Q3 to under $10 billion. MPW has $1.3 billion being allocated toward its debt from its deals in Q2 and Q3, which puts its adjusted net debt at $8.17 billion once all of the proceeds are collected. This keeps MPW’s EBITDA to total debt ratio in line with its peers at 6.52x, and once the adjustments are made to MPW’s net debt, this ratio drops below 6x.

MPW’s valuation is still dirt cheap due to what I believe is an unwarranted sell-off throughout 2022.

To provide an accurate view I will compare MPW to the following healthcare REITs:

- Healthpeak Properties (PEAK)

- Healthcare Realty Trust (HR)

- Physicians Realty Trust (DOC)

- National Health Investors (NHI)

- Sabra Health Care (SBRA)

- Omega Healthcare Investors (OHI)

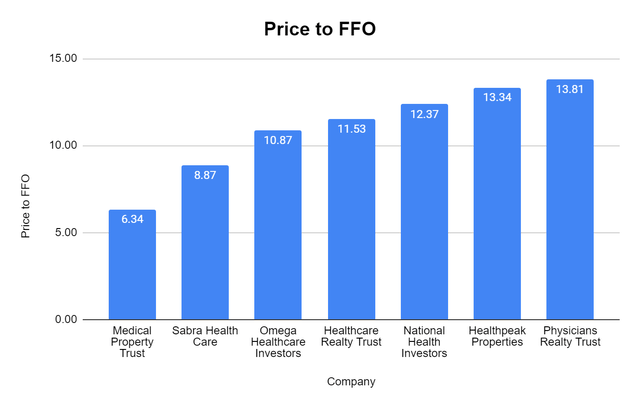

When I compare REITs, I look at the price to FFO I am paying and how a REIT trades compared to its respective peers. MPW is still trading at a discounted valuation, as its price to FFO is 6.34x compared to its peer group average of 11.02x. As there hasn’t been an impact to MPW’s FFO, it looks undervalued when compared against others REITs in the healthcare space.

Steven Fiorillo, Seeking Alpha

MPW has $9.48 billion of total debt, and I am using this figure as the adjustments have not gone into effect. MPW is rangebound and doesn’t pose a leverage liability the way SBRA does. MPW’s 6.52x EBITDA to total debt ratio is more than adequate when looking at its peers and once the adjustments go into effect, this will drop below 6x.

Steven Fiorillo, Seeking Alpha

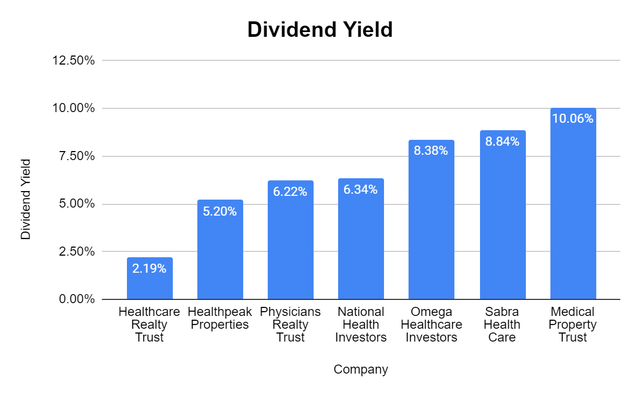

Shares of MPW are trading at a level where its yield has exceeded 10% and is the largest in its peer group. MPW also has the 2nd largest FFO coverage ratio at 156.90%, indicating that its dividend is secure and stronger than many of its peers. From a dividend perspective, MPW offers a large yield and fully covered dividend which should reassure investors that this isn’t a yield trap on the verge of a dividend cut.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Conclusion

MPW’s Q3 earnings provided additional reassurances to the news reported throughout the quarter. I believe Mr. Market is incorrect and MPW is a broken stock, not a broken company. MPW delivered on its FFO, and continues to retire debt. The issues Steward was facing seem to have been alleviated going forward as MPW is concerned, as its operations will be generating positive FCF. I think MPW trades at a deep discount to its peer group, and I plan on adding more to my position to lower my price per share and increase the amount of income generated from this position. I think we could see shares of MPW climb past $15 through the remainder of 2022, and get back to a more reasonable valuation in the first half of 2023.

Be the first to comment