Matteo Guedia/iStock via Getty Images

The FY2022 report was published on November 15, and in this article I will highlight the aspects that I consider most important, while also adding personal comments. Overall, it was not a bad year for Imperial Brands (OTCQX:IMBBY), but its growth raised some concerns for me.

Comments on FY2022

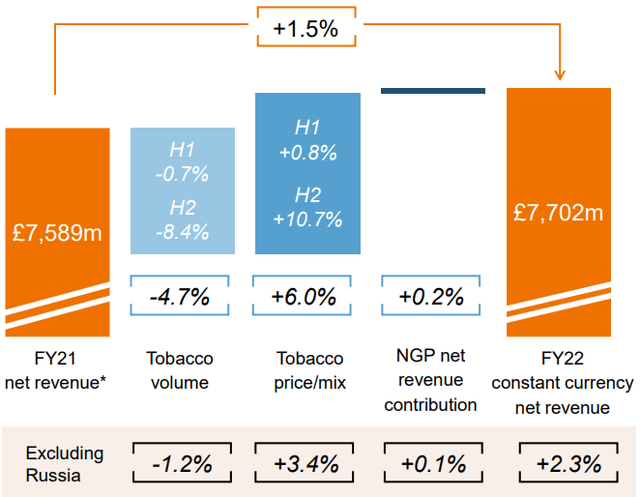

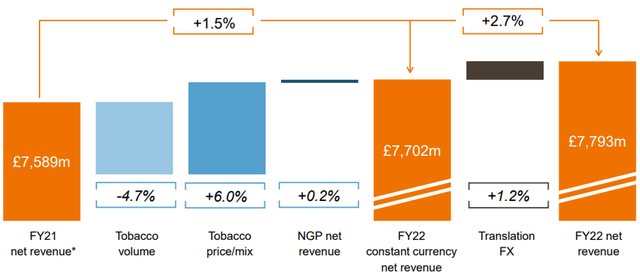

Considering net revenues in constant currency, there was an increase of 1.50% over FY2021. If we excluded the closure of trade relations with Russia, the growth would have been 2.30%.

H2 in terms of volatilities was significantly higher than H1 as there was both a reduction in the volume of tobacco sold of 8.40% (due to the Russia issue) and an increase in price/mix of 10.70%. Inelastic demand for tobacco allowed Imperial Brands to increase the price of its products and cover losses due to decreasing demand.

Positive changes also include an increase in NGPs (E-Cigarettes, next generation oral nicotine) net revenues by 0.20%. Regarding this aspect, I was quite puzzled by how little the impact on revenue growth was from what appear to be the “products of the future”. Several times within the report the importance of making a gradual transition from more harmful tobacco products to less harmful ones was mentioned, yet the results still show too much backwardness in my opinion. An increase of 0.20% YoY is too little to become less dependent on tobacco sales. Tobacco consumption has been declining for decades especially in America and Europe; therefore, relying too much on what has been the main revenue component so far could be harmful in the long run.

Regarding the impact of FX on net revenue there was a positive change of 1.20%. The devaluation of the pound especially in H2 2022 positively affected exports to Europe and America.

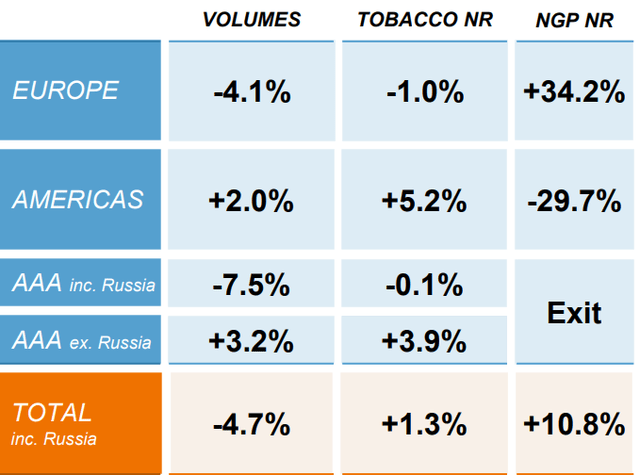

Going into more detail, here is how Imperial Brands performed in the various geographies. In this table, the most important aspect is the divergence between NGPs net revenue growth in Europe (34.20%) versus the decrease in America (-29.70%). In Europe, growth was driven by both the rising price of NGPs and increasing demand. In America, the exact opposite occurred as there was great uncertainty about the myblu® vaping device after the marketing denial order issued in early April by the FDA.

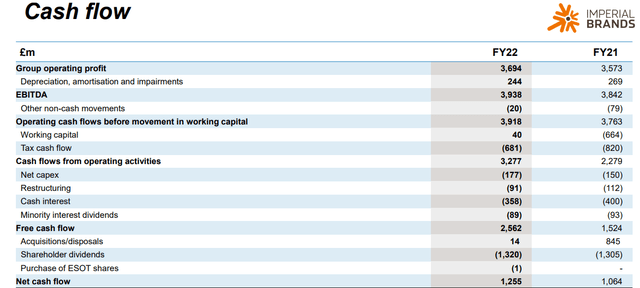

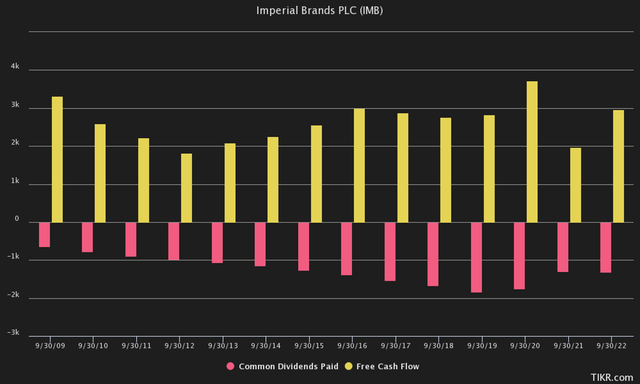

Cash flows from operating activities had an improvement of £998 million, mainly due to negative working capital in FY2021 and lower tax cash flow in FY2022. Free cash flow in FY2022 was £2.56 billion, well above the £1.32 billion distributed through dividends. The current dividend yield is 6.84%, so we can consider Imperial Brands to be a company that issues a high and above all sustainable dividend. However, it is important to point out that the sustainability of the dividend is only about the short to medium term, since in the long term I have several doubts.

The reason for my concern stems from the fact that free cash flow has been stagnant for more than a decade. It is true that the dividend now is high and sustainable, but if free cash flow does not begin to achieve gradual growth the dividend issue will be an unknown. Some years it might be higher, some years it might be lower. If I were to buy a dividend company, rather than Imperial Brands, I would opt for one that can improve its free cash flow to sustain an increasing dividend.

In conclusion, the company also released the outlook for FY2023.

- Net revenue growth between 1% and 2%.

- Adjusted operating profit growth at lower end of mid-single digit range.

Both figures should be considered in constant currency. In addition, the company announced a £1 billion buyback plan that will be carried out throughout FY2023.

Brief summary

This FY2022 was positive overall if we compare it to the previous year, but still subdued if we consider the long-term trend. Free cash flow continues to be stagnant and the sale of NGPs is struggling to take off. Fundamentally, the core business is solid as the company is established internationally in tobacco sales, the problem is that the prospects for growth in this market are nonexistent as fewer and fewer people smoke cigarettes/cigars. Imperial Brands may continue to perform well in this market phase full of uncertainty due to its steady cash flows and high dividends, but from a long-term perspective my view is that free cash flow is unlikely to change its trend unless the company changes its strategy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment