honglouwawa

Broadcom (NASDAQ:AVGO) is a semiconductor designer, developer and manufacturer worldwide with $213.8 Billion in market cap and is headquartered in San Jose, CA. It is hoping to acquire VMWare for $61 billion but has yet to close the deal which is still pending from May of this year.

Price

Yahoo Finance shows a suggested average valuation of $644.80 with a range of $540 to $775 from 22 analysts.

The price today, November 17th is ~ $509.43.

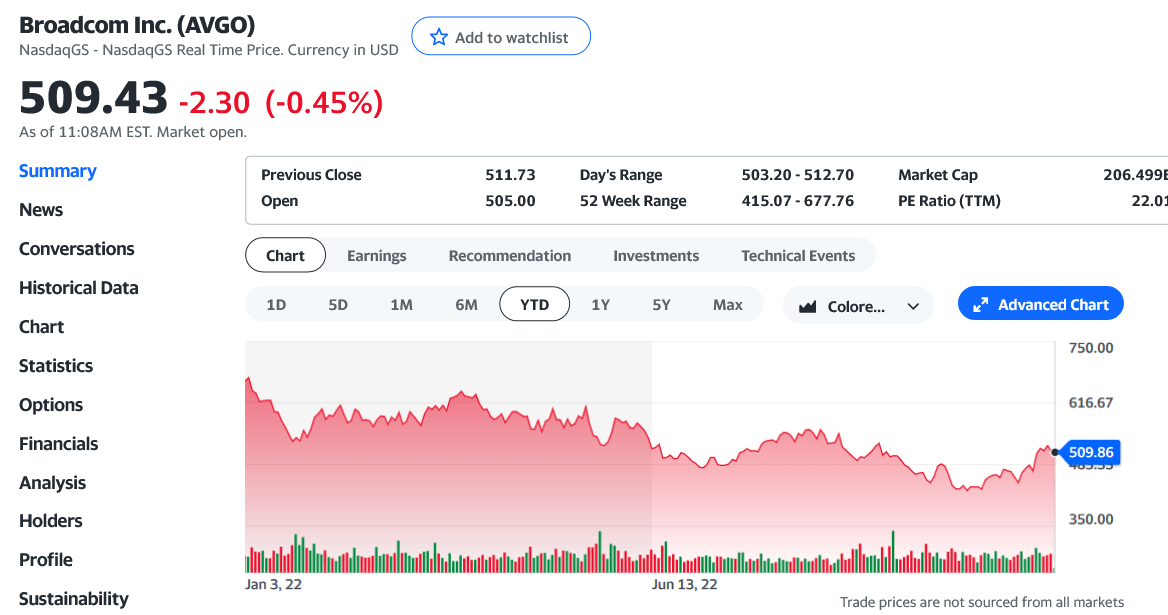

Below is a YTD/ year to date chart for AVGO from Yahoo Finance.

Broadcom Year to date Price movement (Yahoo Finance November 17th, 2022.)

Morningstar suggests a fair value of $624 and a low valuation to buy price of $436. It actually came extremely close to that cheap buy price just recently, so it can happen again.

Value Line analyst suggests a midpoint future price of $614 and offers a range out 18 months of $402 to $822.

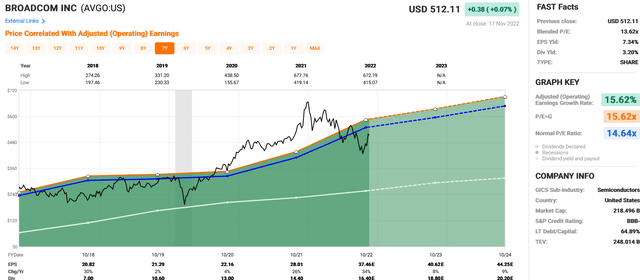

FASTGraph – ”FG”

I subscribe to the Chuck Carnevale paid service “FG” where it shows technical analysis for earnings, dividends and price in one look. Below is a 5 year + 2 year estimate (dotted lines) look at AVGO.

The black line is price, white line represents the dividend and the blue line is normal P/E. The dark green area is a show of earnings which are rising just like most all else except for that varying price line.

Note the blue box on the right shows numerically the normal P/E is 14.69. At the price shown below AVGO is selling at 13.61x which is a bit under that normal.

The orange line P/E = G represents the average P/E from the popular Graham model average.

All numbers at the top and bottom are shown by year for high price, dividends, earnings and even % earnings change. Great news, all positive for AVGO.

It has a nice 7.35% earnings per share yield “EPS” Yld which I desire to be greater than 6.5% to be above average.

AVGO Technical FASTgraph Nov 18th (FASTGraphs Chuck Carnevale)

Dividend Growth

The 5 year DGR for AVGO is 34.1%. The last 2 years are slowing but still at 12.3%

The next dividend raise will be coming sometime in February and FG estimates the dividend / year to be $18.80 from $16.40 this year, which would represent a 14.6% raise. The 2024 raise is a lower estimate but still 7.4%.

How does Apple compare?

Apple Price

Yahoo Finance 41 analysts suggest an average price of $178.15. The range is $122 – $214.

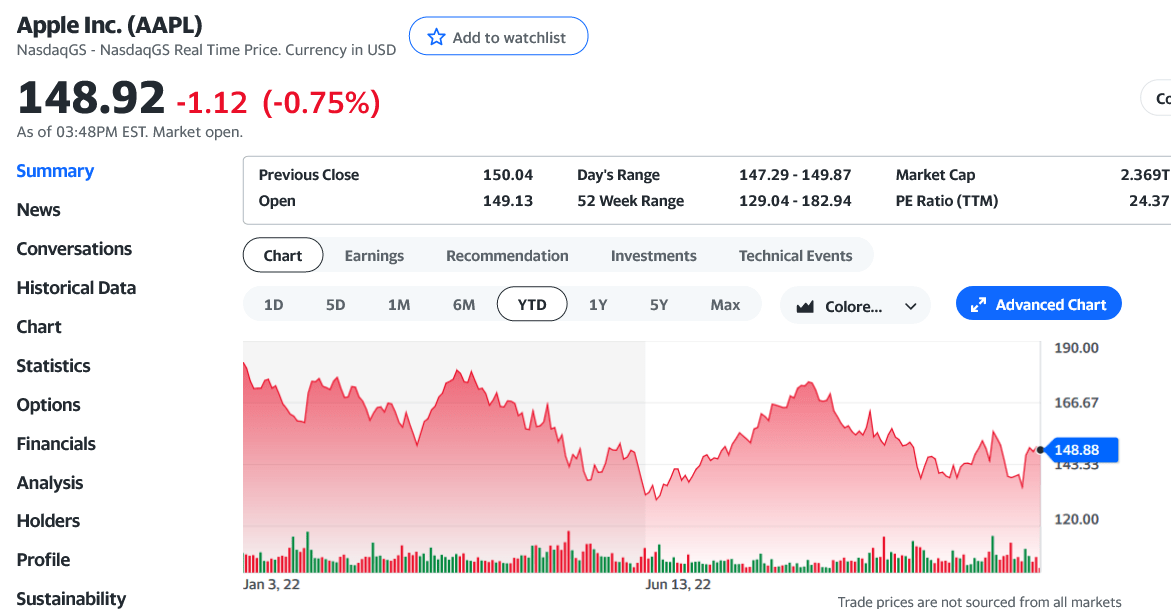

The price today is $148.92. The chart below is a YTD chart from them.

YTD Apple price chart 11/17/22 YF (Yahoo Finance November 2022)

Morningstar has a fair value of $130 and to buy cheaply at $78.

Value Line has an 18 month out price target of $186 and a range of $132- $260.

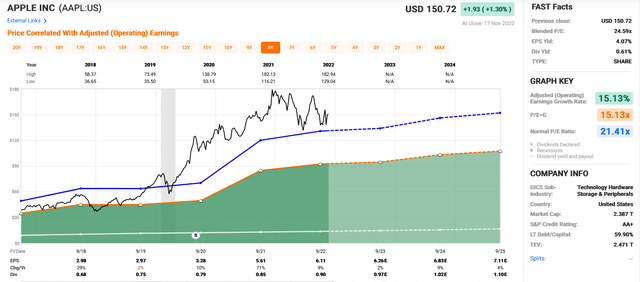

Apple is selling at a P/E of 24.28x which is over the normal P/E blue line of 20.47x. Graham average normal P/E would be 16.04x. This indicates over valuation as it has been for many years, but that is forgiven with hopefully good price appreciation, which has not occurred at least this year.

Apple FASTgraph Nov 18th (FASTGraphs Chuck Carnevale)

Dividend Growth

Apple had a 41.3% 10 year dividend growth rate… Nice ! The 5 year DGR is 8.5%.

The last 2 years that has slowed to 6.4. This year looks to be 5.9% and next year estimate is up 7c from 90c to 97c or ~7.7%, and 2024 looks to be 5c to $1.02 and ~ 5%.

All in all that might seem nice to get 6.4% on average for the last few years and maybe the future, but take notice the yield is 0.6%.

Also note it has a low 4.12% EPS Yield that also is not encouraging at least at its current price.

Summary/Conclusion

Broadcom offers price appreciation, great dividend growth and a nice yield of over 3.1% and would be a great buy on any price dip.

Apple would need to dip extremely to that low $78 price to offer nice future price appreciation and a much higher dividend yield to make it a candidate for more due diligence and technical analysis to own it in my opinion. It has had a delightful past and hopefully the future will be bright for both of these stocks.

Long AVGO and no position in AAPL nor the desire to start one at this time.

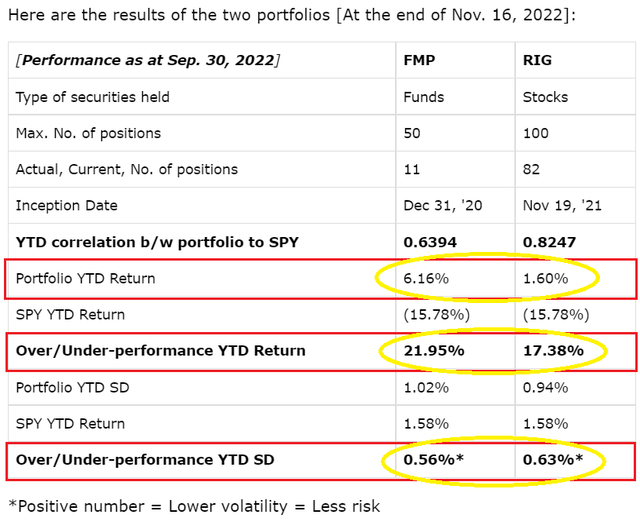

Just some quick results about my own portfolio “RIG” Rose’s Income Garden, which owns AVGO, and the FMP at The Macro Trading Factory where they both are found. Please see the marketing bullet for more information.

Macro Trading Factory YTD Results (MTF / The Macro Teller Nov 16, 2022)

Happy Investing to All !

Macro Trading Factory is a macro-driven service, run by a team of experienced investment managers.

The service offers two portfolios: “Funds Macro Portfolio” & “Rose’s Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.

Be the first to comment