gguy44/iStock via Getty Images

Introduction

Sometimes, you get it wrong. And sometimes, you get it really wrong. Back in February, I switched my stance on Canadian silver miner Alexco Resource Corp. (NYSE:AXU) from bearish to bullish and the share price has fallen by over two-thirds since then as ramp-up delays led to a suspension of milling operations.

Overall, I think that the company could have enough cash in the bank until milling is restarted and cash flow becomes positive, so this could be a good time to open a small speculative position. However, I’m staying away as I don’t like giving second chances, especially in the mining sector. Alexco is off of my shortlist. Let’s review.

Overview of the recent developments

In case you haven’t read any of my previous articles on Alexco, the company owns most of the Keno Hill Silver District in Canada’s Yukon Territory, which has produced over 200 million ounces of silver since 1913. Alexco opened a mine there in 2011, but it was closed in 2013 due to low silver prices.

Alexco Resource Corp.

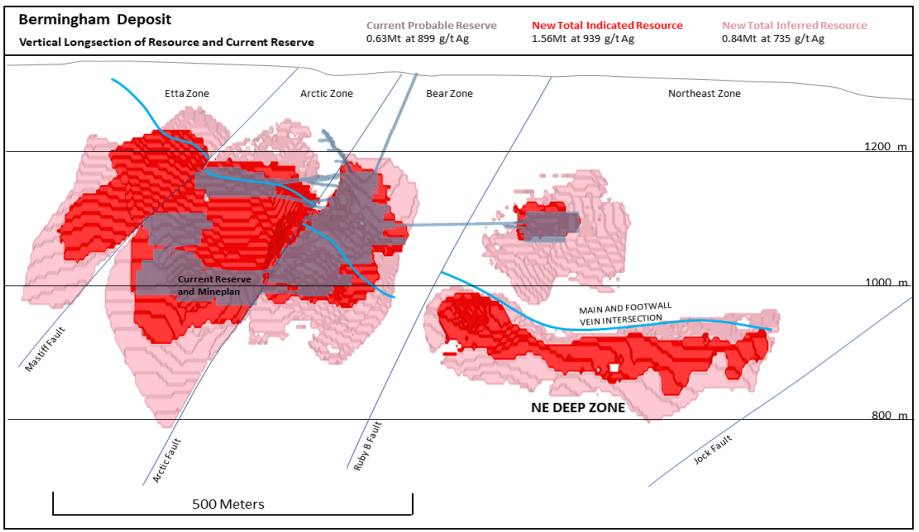

However, Alexco kept drilling on its property and eventually, it discovered 2 high-grade silver deposits. The more important one is named Bermingham, and it currently has indicated resources of 47.2 million ounces of silver at an average grade of 939 g/t. Those are bonanza grades which means that the margins have the potential to be very high. Grade is king.

Alexco Resource Corp.

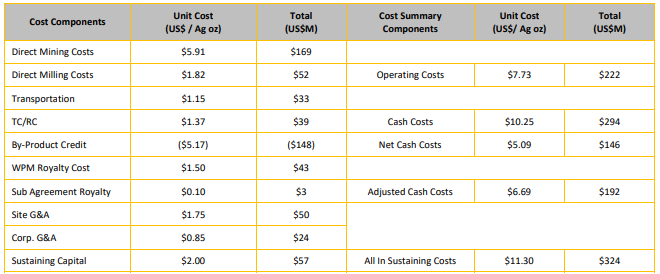

Before the indicated resources at Bermingham increased from 33 million ounces of silver, a pre-feasibility study showed that average life-of-mine all-in sustaining costs (AISC) were estimated at $11.30 per ounce of silver.

Alexco Resource Corp.

In my view, resources are likely to increase by a substantial amount in the future as Alexco has explored only around 15% of the district. In 2022, the company plans to complete a 15,000-meter surface exploration drilling program near Bermingham.

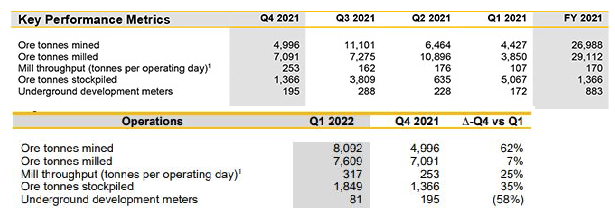

Turning our attention to the financials, the latest pre-feasibility study forecast that the initial CAPEX would be C$23.2 million ($18 million) and that there would be a ramp-up period of 5 months. The mill is already there thanks to the old mine, and a total of C$18.9 million ($13.9 million) of the initial CAPEX was earmarked for mine development. This is an underground mine after all, but it’s here where the issues started. In Q4 2021, ore mined declined significantly due to workforce availability as a result of COVID-19 restrictions. This was just when Alexco transitioned to the Bermingham deposit. There was an improvement in mining rates in Q1 2022 as 4,575 ore tonnes were mined from Bermingham. However, underground development continued to lag, and the ore needed to feed the 400 tpd at Keno Hill just wasn’t there.

Alexco Resource Corp.

And on June 22, Alexco announced it would suspend milling for 5 to 6 months. Ore extraction and milling are expected to restart in January 2023 and the company plans to achieve cash self-sufficiency in Q1 2023. Alexco had C$23 million ($17.9 million) as of May 2022 and considering expenditures on mineral properties, plant and equipment stood at C$10.8 million ($8.4 million) in Q1 2022, the company might have just about enough cash until restarting milling operations. However, I think that a capital increase before reaching positive cash flow is likely, and this could lead to significant stock dilution unless the share price increases over the coming months.

Overall, I think that Keno Hill is a compelling project. According to the pre-feasibility study, it has an after-tax net present value (NPV5) of C$154.3 million ($119.7 million) at silver prices of $22.09 ounces, and this was before the resource update at Bermingham. The exploration potential looks good, and most of the CAPEX needed to restart production has been already spent. It could be a good time to open a small position at these depressed share price levels as Alexco is trading at about 0.5x NAV.

However, I prefer to stay away from this stock. Yes, the company is cheap, but I’ve lost faith in the current management, which leads me to doubt the forecasts that the restart of milling will take place in 5 to 6 months. You see, many investors didn’t see the suspension of milling operations coming. In March, Alexco said that it estimated that Q2 2022 silver production would range between 450,000 ounces and 550,000 ounces before increasing further in the second half of the year. And this is what the company had to say in May, just over a month before suspending milling operations:

We had previously anticipated providing formal guidance for the balance of 2022 as part of this release. But we are deferring that until we have more confidence in our projections. In the meantime, we’re evaluating a number of production and operating scenarios, which will drive our overall assumptions for underground development rates. With more clarity and confidence on how best to advance our development, we will then be in a better position to guide, when we will achieve our targeted 400 ton per day mill throughput. – source here

It just didn’t seem that a suspension of milling activities was in the cards, and this is evidenced by the fact that the share price crashed by more than 40% the day it was announced. In my view, the credibility is gone, and this is why the market valuation has dropped so low. I don’t think that Alexco will be able to achieve its stated goals without another long ramp-up period and more stock dilution.

Investor takeaway

Alexco was supposed to be producing around 4 million ounces of silver per year using its 400 tpd mill, but the restart of Keno Hill hasn’t gone according to plan. There have been a series of delays and now milling operations are suspended, which many investors didn’t see coming.

Overall, Alexco looks cheap at the moment as the exploration potential of Keno Hill is great and the NPV was around $120 million even before the resource upgrade at Bermingham. However, I’ve lost faith in the management, and I have doubts that Alexco will be cash-flow positive by Q1 2023. In my view, there could be more delays which would make significant stock dilution inevitable. I’m avoiding this stock.

Be the first to comment