RiverNorthPhotography/iStock Unreleased via Getty Images

Holding Up Well

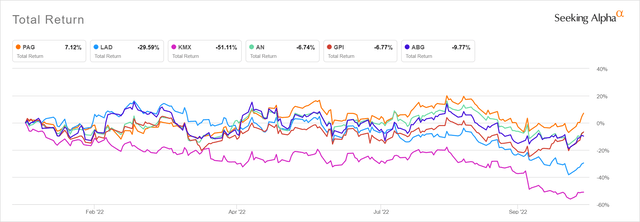

Penske Automotive Group (NYSE:PAG) stock is still leading its competitors and delivering a positive total return this year. Since my last review in July, the stock pulled back about 10% but recovered that drop following its 3Q earnings release.

Penske’s diversification with truck sales and leasing, international operations, and growth plans for traditional dealerships and used car superstores have earned it a higher P/E than peers. PAG has gone from second cheapest of the group to second highest-valued on a trailing P/E basis. CarMax (KMX) is not shown on this chart as its P/E is much higher than the others.

Penske continues to surprise with its capital return to shareholders. In June, the company ended its long-standing dividend policy of increasing the payout by $0.01 per share each quarter and instead raised it $0.03 each quarter. Rather than stick with this policy for a while, Penske already raised the dividend by another $0.04. A $0.57 payout is now scheduled for 12/1/22. It’s uncertain if the company will continue quarterly raises at this pace, but if it did, PAG would have a forward yield of 2.3%. Penske also continues to reduce share count, which is now down by 7.2% in the past year. The company bought back another 0.9 million shares in October (about 1.2% of shares outstanding). It also has another $268.2 million of buyback authorization which would reduce share count by another 3.3% when completed.

Penske has delivered these results in spite of continuing same store sales volume declines and foreign exchange headwinds with 29% of its sales in the UK and 7% in other countries outside the US. However, Penske continues to grow the car business overall through acquisitions and new-build dealerships. Penske bought 19 dealerships and opened 2 new ones so far this year. The truck sales and service business, or PTG and the truck leasing business (PTS) are both holding up better than the car business. Penske is also growing the truck sales business through new deals, with 4 Canadian dealerships bought this year. The new acquisitions will add $550 million of sales this year and $1.3 billion annualized, or about 4.7% of Penske’s total sales.

Penske is a well-run company and has held up well through unstable economic conditions over the past 2-3 years. Nevertheless, the entire industry could now see weakening demand from an economic slowdown even as some of the supply constraints are relieved. This would be a double whammy to profits, putting an end to the rapid growth of 2020-21. Penske remains in good shape to make it through a recession, but the stock will likely get hit along with the rest of its peers. PAG is a good long-term hold, but I still think overall macro concerns could weigh on the industry over the next year which would not make me a buyer here.

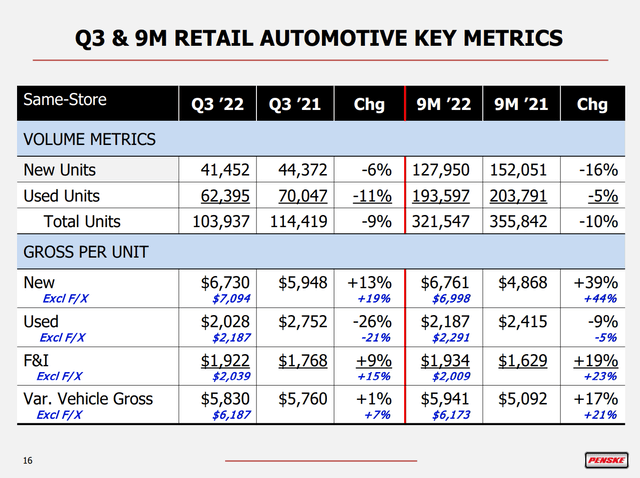

Lower Volumes And F/X Headwinds

Penske sold 114,400 cars in their auto dealerships in 3Q 2021. Since then, volumes have come off considerably on a same-store basis as a result of supply issues. Cars sold from dealerships less than one year old remained at 6,000 cars in 3Q 2922. This only gets total sales up to 110,000 which is still 4,800 lower than a year ago and about 5,000 lower sequentially. High demand and short supply for new cars allowed the company to still achieve higher gross margin per unit on new car sales and financing and insurance. Still, foreign exchange headwinds knocked about 6% off the margin growth.

Used car gross margins remain in decline due to low supply as fewer new car sales means fewer used car trade-ins. CarShop used car superstores, while still growing year-to-date, had lower sales volumes and revenues than a year ago.

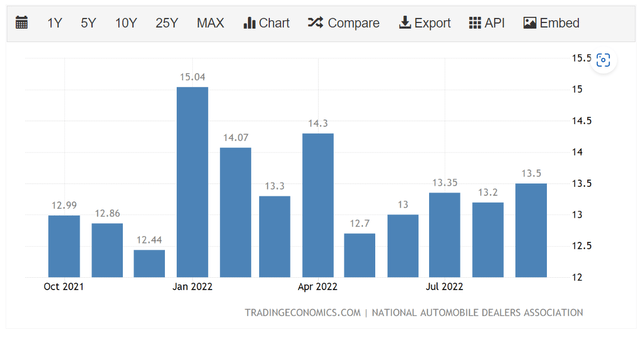

On the bright side, overall industry monthly US car sales have ticked up from when I wrote three months ago, but they still lag behind the strong monthly number seen in 1Q. This could be from gradually improving supply chain issues, but the risk of a recession knocking these sales down is still a possibility.

United States Total Vehicle Sales (Trading Economics)

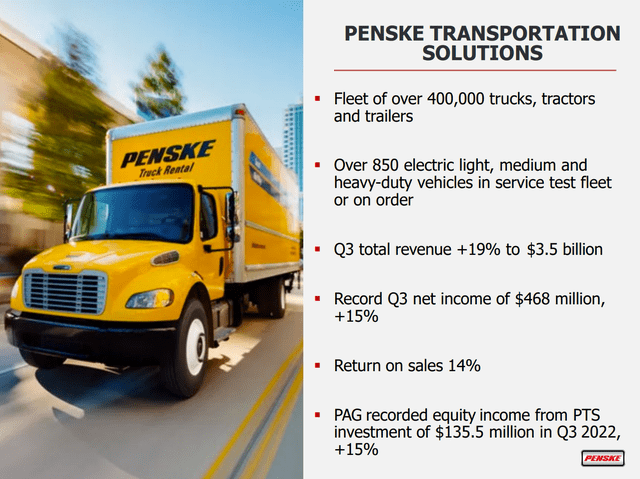

Truck Sales And Leasing Still Doing Well

Penske’s commercial truck dealerships still contribute only about 11% of Penske’s pretax earnings sales remain strong. PTG sold 25% more trucks on a same-store basis in 3Q, same as the YTD volume growth. Gross margin per truck is up 14% from last year for both periods. The service and parts business, which makes up the most of the unit’s profitability, also has strong growth.

The truck leasing business (PTS) is another business unique to Penske, PAG owns 28.9% of PTS and accounts for its share of PTS income by the equity method. This income is up 15% from last year to a record $468 million in the quarter. PTS now makes up and even bigger share of PAG’s pretax earnings, at 31% in 3Q.

Capital Management

Year-to-date, Penske has generated $1.01 billion of free cash flow, a decline from $1.17 billion in the first 9M of 2021. The company increased its spending on acquisitions this year to $393 million. They also paid dividends of $114 million and did $585 million of share buybacks, nearly triple the 2021 level. The company added a small amount of long-term debt this year, $186 million on a mortgage against a dealership. This data is visible on the cash flow statement on Form 10-Q. Leverage remains low at 0.8 times net debt/EBITDA, an increase of only 0.1 from last quarter. (Net debt excludes short-term floor plan debt, which is used to finance vehicle inventory.) Vehicle inventories in day of sales have not changed much from last quarter. Floor plan interest did more than double compared last year due to higher interest rates, but total debt including floor plan remains well-covered by operating income at 11.4x.

I still think Penske can maintain its best-in-class growing dividend, even with higher floor plan interest and eventual inventory build as supply chain pressures ease. With leverage currently about the lowest of its peer group, Penske has room to increase debt if needed without hurting its credit rating. Worst case, the company has room to cut buybacks to keep on growing the dividend.

Conclusion

Penske Automotive stock trades at a slight valuation premium to most of its peers, reflecting the company’s growth, diversification and balance sheet strength. PAG is still rare among its peers with a positive total return year-to-date. The valuation still looks cheap at a trailing P/E of 6 but this reflects concerns about peaking sales and margins as a recession that could be on the way.

The racetrack is still under a yellow flag with Penske in the lead. Its strengths should allow it to maintain this lead, but an economic downturn would impact the shares of every company in the industry. Penske is a well-run company, but the stock is still a hold. A recession would allow new buyers to get in at better prices.

Be the first to comment