NicoElNino

Investment Thesis

Palantir Technologies (NYSE:PLTR) focuses on developing software to serve customers from various industries, including automobile, healthcare, and government. All these software help customers manage their data effectively and increase operational efficiency. The company has recently partnered with Concordance, HSI, and Hyundai Heavy Industries Group, which I believe can significantly accelerate the company’s growth. It has also signed contracts with government bodies which can also contribute to its growth in the long term.

About PLTR

PLTR mainly focuses on building software to empower organizations by effectively integrating their decisions, data, and operations. The company’s software is used by more than 50 industries globally. The company consists of three main software platforms: Gotham, Foundry, and Apollo. The Gotham platform facilitates users to identify specific patterns hidden within datasets which range from signals intelligence sources to reports from confidential informants. It lets the analyst use the platform to pass information between operational users so that operators can respond to threats identified in the platform in real time. The company provides Gotham to its commercial customers, including customers from the financial service industry, that helps them in fraud investigations. Foundry deals in transforming organizational operations by designing a central operating system for their data. It enables the individual to integrate and analyze data in one place. Foundry has commercial as well as several government customers. The Apollo platform ensures continuous and smooth software delivery whenever the customers are on-premises, in the cloud, or in rugged environments. It offers a single control layer to coordinate the continuous delivery of new features and platform configurations. The company’s customer base is divided into two groups: Commercial and Government. The company generates 42% of its revenue from commercial customers, while 58% comes from government segment customers.

New Partnerships

1) Partnership with Concordance

Supply chain issues are currently the biggest challenge in the healthcare industry, and it is mainly caused due to lack of adequate data management. The Global Covid-19 Pandemic has exacerbated these issues by causing shortages, back orders, and growing demand for specific products. These issues highlight the lacking visibility between healthcare and supply care partners. The company recently announced a partnership with Concordance, a healthcare distributor headquartered in Ohio, to address this crucial need. As per the partnership deal, both companies will come together to build an ecosystem to manage diverse data sets and ERP tools. This ecosystem can be accessible by any healthcare manufacturer, supplier, provider, distributor, or government health agency with a license. Time-consuming issues such as product back orders and substitution can be easily solved in minutes reducing the time required by the frontline staff. Despite being one of the most challenging issues in the healthcare industry, it has yet to be addressed and efficiently managed, which shows a lack of competitive participants in these markets. After considering all these factors, I believe this acquisition can benefit the company by catering to this substantial unaddressed demand and creating its strong position. This new ecosystem can significantly benefit the healthcare industry by looking at its time-saving features, improving patient care, and reducing healthcare providers’ burden. These benefits of this ecosystem can increase demand for the product, which might increase PLTR’s customer base and market share in the coming years.

2) Renewal of Partnership with HSI

PLTR has renewed its partnership contract with Homeland Security Investigations to provide them with Investigation Case Management (ICM) software. This contract is made for five years and is worth $95.9 million. This partnership benefits HSI in combating human trafficking and child exploitation, dismantling drug trafficking organizations, and preventing identity fraud by leveraging the capabilities of ICM software. As HSI has been an existing customer since 2011, this reflects the customer retention abilities of the company. I believe renewing such partnerships can highly benefit the company to maintain its minimum fixed revenue and market share. The business is subject to seasonality. Such deals can help the company reduce seasonality’s impacts by generating fixed income.

3) Partnership with Hyundai Heavy Industries

The shipbuilding market has been evolving recently and focusing more on data-driven technologies. The leading companies in this industry are investing heavily in digitization which has created significant opportunities for software companies to grow. Identifying this opportunity, the company has expanded its partnership with Hyundai Heavy Industries Group, one of the leading shipbuilders in South Korea, as well as on global levels. This contract was made for five years and was worth $20 million. As per the partnership, the company will help Hyundai to improve production quality, make data-driven decisions, and facilitate data analysis for standard safety procedures. The company is already in an existing partnership with Hyundai’s subsidiaries, contributing a total of $25 million to the contract. By collaborating with leading shipbuilders, the company can significantly diversify its portfolio geographically. This partnership can create its presence in this industry and attract new customers as South Korea is an important country for this industry in Asia-Pacific. This partnership 5-year-long partnership can help the company to generate stable and fixed income in the coming years.

Multiple New Contracts

The company has recently expanded its operations by making three deals and contracts. The company has announced an expansion of federal cloud service, which has received DoD Impact level 6 PA (security and compliance standard) from the Defense Information Systems Agency (DISA). It expanded its cloud capabilities to this new DoD IL6 Secret region, leveraging its unparalleled experience developing operational software solutions for all classification levels. It also provides the foundation for Joint All-Domain Command and Control (JADC2), offering complex global cloud-based solutions that will address national security concerns over the next decade. Recently, the company announced that it had been selected by the US Army Materiel Command to support and maintain its supply chain optimization efforts. This will help them to increase their operating capabilities and facilitate data-driven decisions by integrating high-volume maintenance, sensor, and supply data. This deal totals $85.1 million for a period of five years. The third contract is made with US Army Research Laboratory (ARL). As per the deal, the company will support all Armed Services branches, special forces, and joint staff. Across all phases of AI/ML research and development within the Department of Defense, Palantir’s software will continue to support the needs of warfighters, data scientists, and commercial AI companies. This contract has a time span of 1 year and a worth $229 million. I believe all these contracts can accelerate the company’s growth by widening its portfolio across various industries. It can also give a competitive advantage against its competitors by dominating the majority of government-owned bodies by transforming them digitally & earning additional market share. The payment risk is low for these contracts as all the contracts are signed with government bodies.

Financials

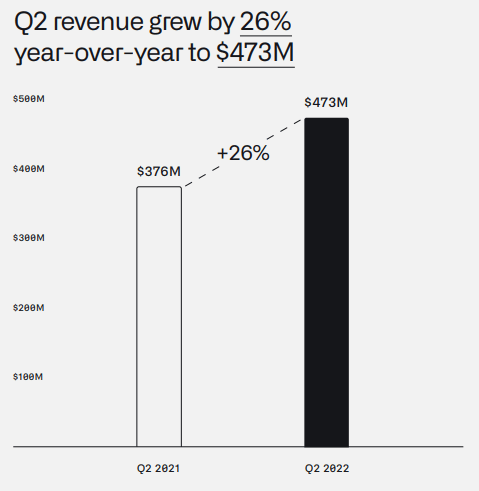

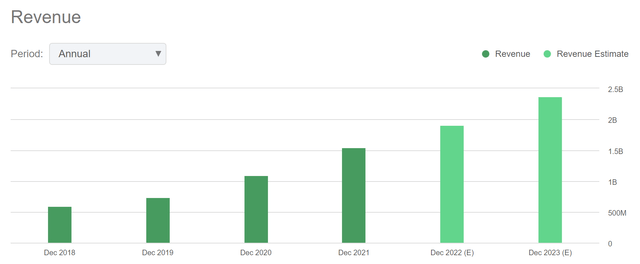

PLTR has managed to achieve strong revenue growth in the last four years. The revenue has grown from $595.41 million in FY2018 to $1.54 billion in FY2021 resulting in a solid 4-year CAGR of 26.82%. The company is experiencing the same level of growth in the current years. PLTR delivered solid Q2 results, outperforming revenue and market share expectations. The company recorded revenue of $473 million in the second quarter, a healthy 26% YoY growth compared to $375.6 million. This growth was mainly driven by an increase in USA Commercial revenue, which surged 120% from $200 million in Q2 2021 to $290 million in the second quarter.

Q2 Revenue Growth (Investor Presentation: Slide no. 19)

The number of US commercial clients climbed 250% year over year, from 34 in the second quarter of 2021 to 119 in the second quarter of 2022. The US Government revenue also experienced strong growth as it has grown by 27% YoY. The company has recorded a gross profit of $0.37 billion. The strong growth has expanded the gross margin from 76% to 78% in the last 12 months, increasing by 200 bps. This growth has been fueled by increasing efficiencies in supporting revenue growth. PLTR recorded a GAAP net loss per diluted share of $0.9 in the Q2 FY2022, which was due to negative global recessionary pressures.

This was all about the income statement. Now let’s discuss the balance sheet. The company ended its third quarter with $2.4 billion in cash and cash equivalents, which is 14.02% of the current market capitalization. The company recorded no outstanding debt balances, which can ultimately reduce its interest expense, representing its healthy position in the market.

After the consecutive strong results, I am estimating strong coming quarters for the company, and even the management is very optimistic about the third quarter. For Q3 2022, the company estimates revenue of between $474-$475 million and adjusted income from operations of $54-$55 million. It has estimated full-year revenue of between $1.9- $1.902 billion and adjusted income from operations of $341-$343 million. I believe the company can exceed estimates for the third quarter as, generally first and second quarters are considered weak due to seasonality, and still, it has managed to deliver strong results. I estimate revenue for the third quarter between $505 million due to the company’s continuous and vigorous expansion activities. I think this revenue can further grow in the fourth quarter, which recent partnerships and new contracts can drive by the company. I estimate the full-year revenue can surpass the company’s guidance and might reach $2.1 billion. Though the EPS has seen a downfall in this quarter, I believe it can bounce back in the coming quarters as the company is on a growth spree. After considering all these factors, I estimate the third quarter non-GAAP EPS can be $0.03 per share, and the full-year EPS can be $0.08 per share.

What is the Main Risk Faced by PLTR?

Adverse Economic Conditions

The financial health of the company’s present and potential clients and the overall demand for technology determine its business. Additionally, using PLTR’s platforms and services is frequently optional and necessitates a large investment of money and other resources. The industries to which PLTR sells its platforms and services have in the past and may do so in the future being affected by a further economic downturn, global political and economic uncertainty, a lack of credit, a decline in business confidence and activity, a reduction in government or corporate expenditures, public health issues or emergencies, financial market fluctuations, and other factors. Customers of PLTR might have reduced operational budgets, which might lead them to postpone or avoid buying the company’s platforms or services. Additionally, rivals may slash prices to steal clients from PLTR, and the higher rate of industry consolidation may decrease overall expenditure on the company’s products. Longer sales cycles, lower prices for the company’s platforms and services, material default rates among the company’s customers, or a downturn in the technology sector or any sectors in which PLTR’s customers operate are just a few examples of how uncertainty about global and regional economic conditions. A downturn in those sectors, or a reduction in information technology spending even in stable economic conditions, could negatively impact the company’s business, financial condition, and results of operations.

Valuation

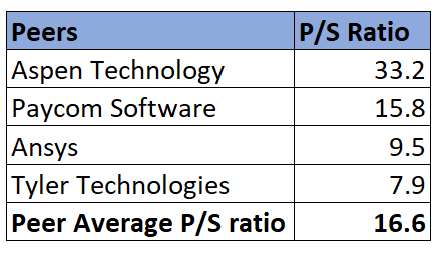

Recently, the company has entered into many new partnerships and signed multiple contracts. All these factors can drive growth for the company in the coming years. After considering all the above factors, I am estimating that the company can achieve revenue of $1.90 billion in FY2023 giving revenue per share of $0.92. At the current price, revenue per share gives the forward price/sales ((P/S)) ratio of 9.35x. After comparing the forward P/S ratio of 9.35x with the peer average of 16.6x, I think the company is undervalued.

Peer Average P/S Ratio (Value Quest)

Conclusion

PLTR deals in developing software that enables its customers to integrate their data, operations, and decisions more effectively. The company operates in a highly competitive industry. It has recently entered into partnerships with Concordance, HSI, and Hyundai Heavy Industries Group. All these companies operate in highly developing industries where demand is rapidly growing. I believe all these partnerships can accelerate the company’s growth by generating additional revenues and strengthening its position in the market. It has also signed contracts with the US government bodies, which can contribute to its growth by increasing its market share and creating its dominance in the US-based AI and software market. After analyzing all the above factors, I assign a buy rating for PLTR.

Be the first to comment