DNY59

Flow Traders (OTCPK:FLTDF) profits from volatile situations in the financial markets. It often earns the most on the worst days in the market as volatility spikes. The company offered a good hedge in the past. It grows through the cycle as it expands its reach into more markets and products.

I believe it’s impossible to predict what will cause the next volatility spike. Hence I don’t know when such a spike would happen. There are many scenarios that could cause distress such as an invasion in Taiwan, further escalation of the war in Ukraine, or a rougher recession than the markets anticipate.

Flow Traders is a Dutch company and its figures are in EUR.

Business Case

As a liquidity provider of financial products, Flow Traders makes money on the small difference between the bid and ask prices and market mispricing between financial markets. It reduces the spread of financial products while providing liquidity. It sounds complicated, but it’s actually pretty simple if you think about it. Flow Traders improves the market and profits from tiny anomalies in the market.

As it earns more money during volatile times, it’s a bit of a hedge against financial market turmoil with high volatility. It’s not the same as hedging against the market as Flow Traders also makes money during normal times.

Growth

Flow Traders’ YoY and QoQ growth are hard to catch. Its revenue and profits swing a lot depending on volatility. Its results are also tough to predict. This ‘black box’ effect isn’t liked by analysts as its earnings often differ far from their expectations. Periods with extremely high volatility like March 2020 guarantee rocketing earnings. Recent volatility spikes were a lot lower and didn’t fuel outstanding earnings.

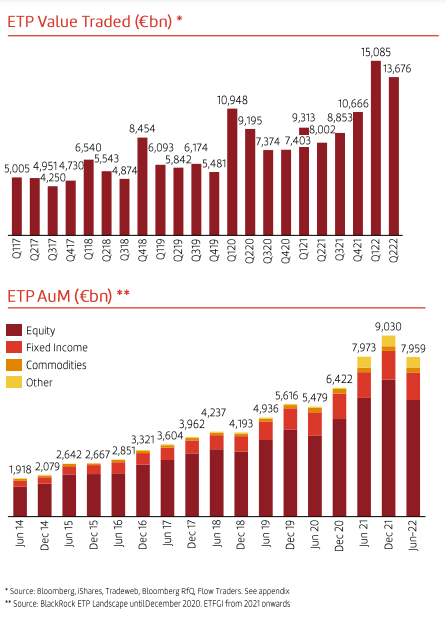

The long-term growth of Flower Traders is measurable through the ETP AUM (Exchange Traded Products Assets Under Management) evolution and the ETP value traded.

Flow Traders Investor Relations

These graphs show a steady increase throughout the years. The strategy of adding new markets and trade products works for Flow Traders. It enhances its coverage of fixed-income products, currencies, and cryptocurrencies. Its value traded tripled since 2017 (31.7% CAGR growth) and ETP AUM increased by 22.5% since 2014.

Net trading income grew slower than value traded since 2017 at a CAGR of 23.5%. Still impressive.

Future Growth

The overall outlook for Flow Traders looks positive. Its potential markets expand quickly.

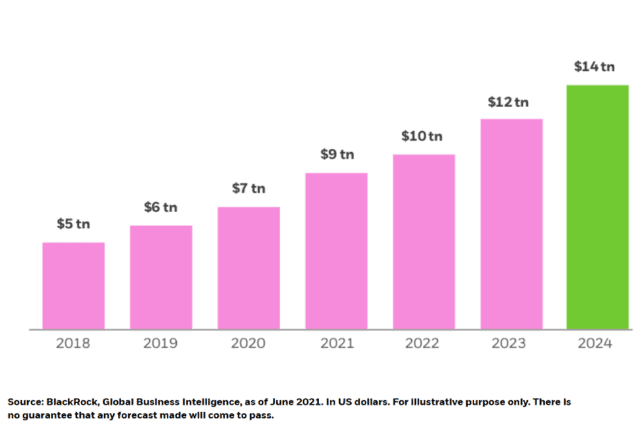

BlackRock

The trends for Flow Traders are positive. ETFs AUM is expected to grow by 40% in just two years. The drivers behind this strong ETF growth are simple: costs, efficiency, liquidity, and almost endless investment-style possibilities.

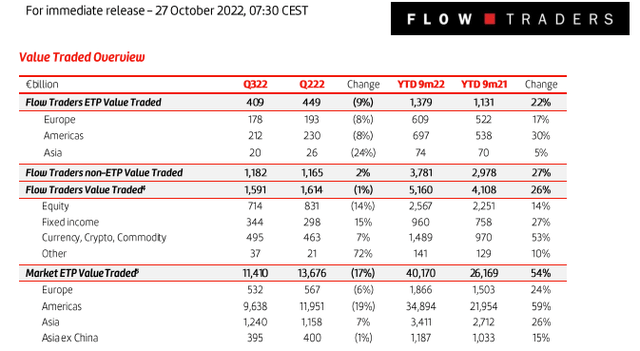

Flow Traders’ latest ETP and non-ETP value traded shows the differentiation into fixed income and currency, crypto, and commodity products works.

The steep reduction in ETP value traded in Q3 was partially compensated by its non-ETP value traded.

Free Cash Flow And Shareholder Returns

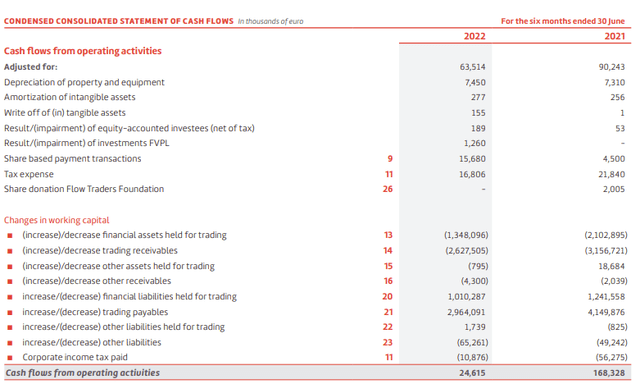

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash. Flow Traders produces positive free cash flows that are on average in line with its net profits.

The first half of 2022 was rather weak compared to the €63.5M net profit with €24.6M operating cash flow and €21M free cash flow. I expect the company to increase free cash flow again in the next six to twelve months.

Dividend And Buybacks

Flow Traders pays a half-yearly dividend in May and August. It reduced its payout ratio to 51% since Q4 2021 to retain capital for trading opportunities and growth activities. It makes sense as fixed-income markets see a revival. It wasn’t appreciated by shareholders who didn’t expect the payout reduction. The previous payout ratio was 60% to 80%.

It also regularly uses buyback programs to return cash to shareholders. Its latest program of €25M just increased to €40M. €30.9M remains available for repurchases. The program converts to a ~4% buyback yield.

The TTM dividend yield looks good too at ~5%. It’s clearly a shareholder-friendly management with consistent returns to stockholders.

Looking forward, the dividend yield could easily remain above 5% with the 51% payout ratio. A total dividend of at least €1.31 can be expected with the current 2022 EPS (excluding Q4).

Valuation

As I’ve indicated earlier, the black-box nature of Flow Traders’ results makes them hard to predict. This probably causes a discount that won’t fade soon. Still, the company increased its AUM impressively and doesn’t trade much higher than in 2017.

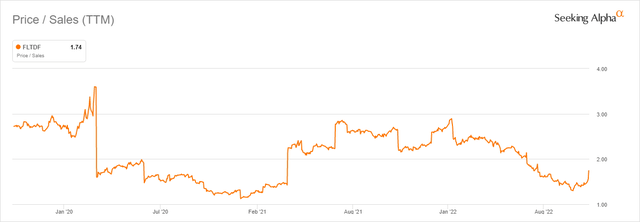

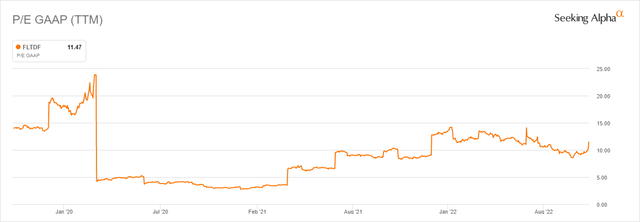

Flow Traders’ PS and PE ratio was only lower in 2020 when it earned phenomenally during the covid crash. Such extraordinary results deform the valuation as it isn’t sustainable. Today, its earnings are what can be expected during normal times.

Flow Traders is cheaply valued. It earned €2.67 EPS over the first nine months of 2022. Even if the fourth quarter doesn’t add any earnings, it would trade at an 8.8 PE ratio. It earned €2.63 EPS in 2021, it now trades at 8.9 times 2021 earnings.

Conclusion

The stock is cheaply priced but often took a beating on results over the past few quarters. The last quarter caused an upward spike again and could be a turn in sentiment.

Almost every earnings release is a volatile event for Flow Traders. This makes it a tough stock to hold for a lot of investors. I’ve personally taken some profits in 2021 and repurchased these shares recently. I expect the earnings volatility will remain as both analysts and investors don’t like the unpredictability.

I see a long-term opportunity to partially hedge my portfolio against black swans and coinciding volatility spikes. I don’t mind the fluctuations in earnings. In the meantime, the company pays a decent dividend in May and August.

The Flow Traders’ stock on the U.S. market has low liquidity. It’s preferable to trade on Euronext Amsterdam.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment