AndreyPopov/iStock via Getty Images

Investment Thesis

Despite impressive full-year financial results, DocuSign’s (NASDAQ:DOCU) stock is down 22% after the release of the report due to lackluster management guidance. Soon the shares bounced back as the CEO bought $5M in company shares. The market seems to have forgotten about the recent disappointment. Nevertheless, in our opinion, investors’ initial fears were not unfounded. Several alerts signal that the pace of revenue growth may slow down significantly more than the Street currently expects.

Although the company has become significantly more profitable, the current price does not provide a sufficient margin of safety. We are neutral on the DOCU.

Bright Results, Grim Expectations

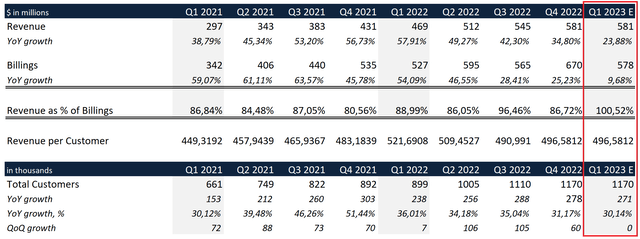

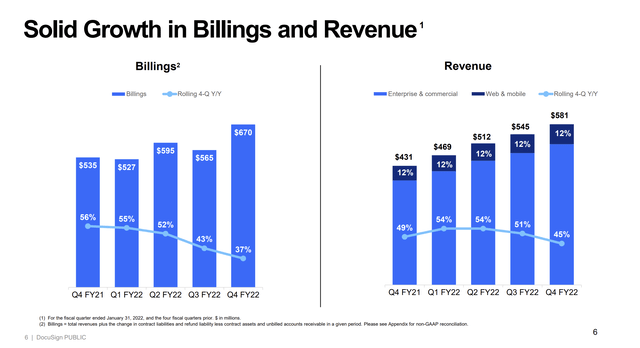

DocuSign ended fiscal 2022 with strong growth across all operational and financial metrics. Revenue increased by 45% to $2.11 billion, billings grew 37% to $2.35 billion. However, we see a clear quarterly decline in growth that signals a return to pre-pandemic levels.

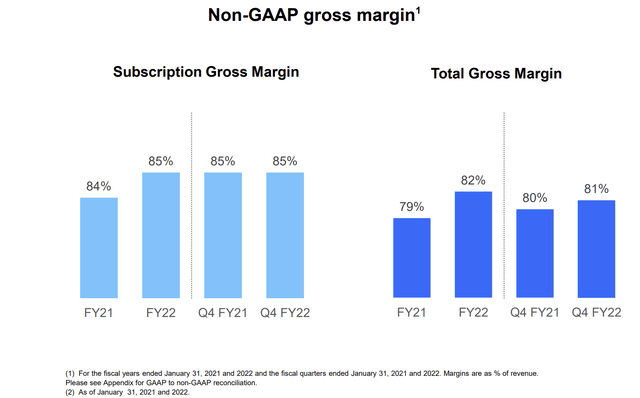

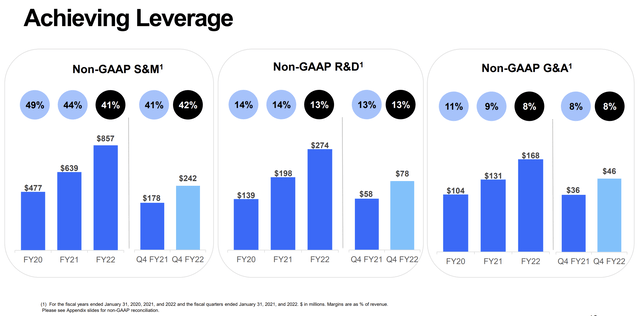

In addition, DocuSign has become a much more efficient company. Non-GAAP gross margin for the year has increased by three percentage points to 82%, operating leverage has also improved significantly.

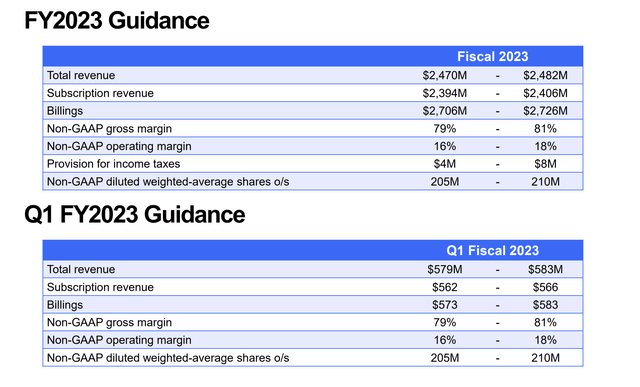

Company’s Presentation Company’s Presentation

The tectonic shift in consumer behavior in the context of a global epidemic has become the most important driver of growth, for which Software as Service companies are forced to pay with a huge settlement base in the post-pandemic world. In other words, declining growth rates are a common and expected problem for SaaS companies, and the market was ready for it. Anyway, investors were disappointed with the company’s guidance for the first quarter and the entirety of fiscal 2023. Shares corrected 22%, but a solid purchase of shares by the CEO made the market forget about the bleak forecasts.

In the last article, we noted that despite the natural decline in revenue growth, the growth rate of the customer base remains high. This is important because DOCU benefits from the so-called network effect: the more clients a company has, the more counterparties can get a free user experience and become new DocuSign clients by signing documents. Here we see several alerts that may indicate that the company is having trouble attracting customers.

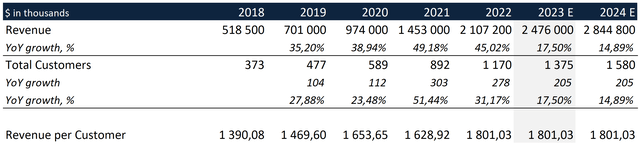

This is simple arithmetic. By the end of Q4 2022, revenue per client was $496.6. DOCU’s guidance suggests that in the first quarter, revenue will grow to $579 – 583 million, that is, by an average of 23.88% year-over-year. Thus, with mid-range revenue of $581 million and comparable revenue per customer, the number of customers would be 1,170, unchanged from the previous quarter. Over the past four years, there has not been a single quarter with zero quarter-over-quarter growth of client base.

Created by the author, based on the company’s data

By the end of FY 2023, management expects revenue of $2,470 – 2,482 million, or $2,476 million in the middle of the range (+23.88% YoY). If DOCU maintains annual revenue per customer at its current level of $1,801, the number of customers will reach 1,375 when the target is reached, making an absolute increase of 205 customers, the lowest in three years. However, this absolute increase is still higher than before the pandemic. If DocuSign shows the same absolute increase in customer base in FY 2024, with comparable revenue per customer, the expected total revenue could rise by 14.9% YoY to $2.845 million, well below the Wall Street consensus of $2.930 million. If the absolute growth of the customer base declines to pre-pandemic levels, the financial performance will disappoint the Street even more.

The bulls can make two counterarguments: a) DocuSign can increase revenue per customer and exceed market expectations; b) management may be too conservative with revenue guidance.

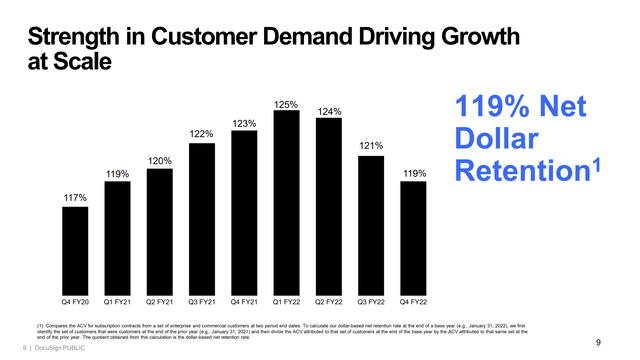

Firstly, indeed, revenue per client has grown significantly over the past five years, and by the end of 2022, it reached its maximum. However, we see a permanent decline in the net dollar retention rate as the impact of the pandemic subsides, which means that future revenue per customer may be even lower than now. In addition, DocuSign operates in a highly competitive market.

Secondly, Dan Springer told investors on the last earnings call that the company is hiring a new sales head and bringing on executives from Oracle and Salesforce. While management may be conservative in its guidance, it clearly sees some challenges in attracting customers.

Valuation Update

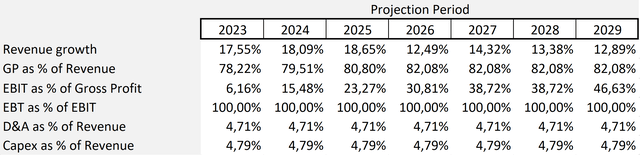

Our DCF valuation is based on several assumptions. We assume that revenue will rise in line with the Wall Street consensus. Over the past six years, the gross margin has grown by an average of 1.29 percentage points per year due to the realization of economies of scale, and we expect this trend to continue shortly. We use a similar methodology when forecasting the future operating margin, which has grown by an average of 7.5% percentage points per year over the past six years. The D&A expenses and Capital Expenditures as a percentage of the revenue forecast are based on averages over the past five years. The terminal growth rate is 5%. Our assumptions are presented below:

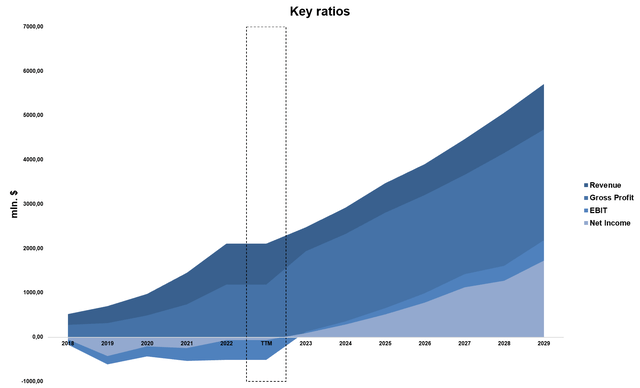

Based on the assumptions, the expected dynamics of key financial indicators are presented below:

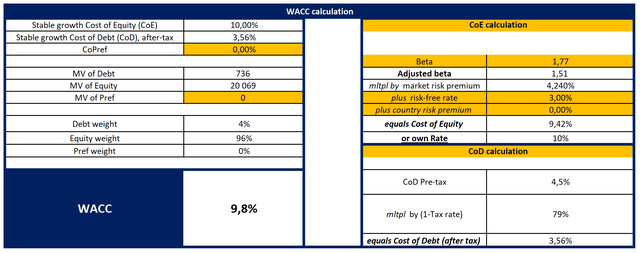

With the cost of equity equal to 10%, the Weighted Average Cost of Capital (WACC) is 9.8% as DocuSign has low financial leverage.

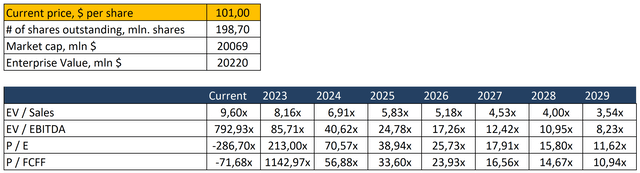

With a Terminal EV/EBITDA of 13.19x, the model projects a fair market value of $20,033 million, or $100.82 per share. Thus, DocuSign is trading near our estimate of fair value.

You can see the model here.

At current and forward multiples, DocuSign also looks quite expensive.

Conclusion

Despite solid financial results for the year, the market’s negative reaction to the forecast looks reasonable. The key question for a growth company is how long it can sustain that growth. We’re seeing signs that DocuSign is having trouble getting new customers. And while the company has become significantly more profitable lately, it trades as a growth company, not a value one. We are neutral on DocuSign.

Be the first to comment