Alex Wong/Getty Images News

On Wednesday, Treasury Secretary Janet Yellen testified in front of the house of financial service committee and warned that the world would suffer “enormous economic repercussions” from Russia’s invasion of Ukraine.

She explains that the recent atrocities committed by Russian troops in Bucha will only lead to more sanctions as they represent an “unacceptable affront to the rules-based, global order.”

These sanctions have a significant impact on Russia, but also on the rest of the world as they cause severe disruption to the supply chains of food, energy, and other important natural resources. Here is what Yellen commented on this topic (emphasis added):

We think it’s a price that’s important to pay to punish Russia for what it’s doing in Ukraine. But energy prices are going up, the price of wheat and corn that Russia and Ukraine produce are going up and metals that play an important industrial role – nickel, titanium, palladium – the cost of those things are going up. This is going to escalate inflationary pressures as well.

This is especially worrisome since inflation is already at a 40-year high, and Yellen is warning that inflation is likely to only accelerate from here.

At the same time, economists are now downgrading their growth forecasts for 2022, and some, including Goldman Sachs (GS) analysts, are even warning that there is high risk of a recession over the next year.

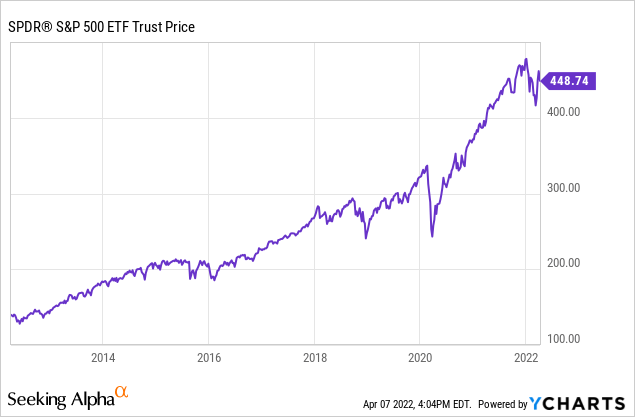

Meanwhile, the S&P500 (SPY) is trading at near all-time-highs as if everything was just fine.

High inflation… coupled with high risk of a recession… and high valuations… is a perfect mix for poor stock market performance going forward.

Where can you seek refuge as an investor?

Some investors are going into cash, preparing for a bear market. Personally, I am not a big fan of this approach because timing the market isn’t possible, and with inflation at such high levels, you are quickly losing your hard-earned money.

Others are going into cryptocurrencies like Bitcoin (BTC-USD) and Ethereum (ETH-USD) in an attempt to hedge their portfolios. My fear here is that cryptos could suffer a major setback in the near term because Russia is using them to circumvent sanctions.

Then some are taking cash out of the market to buy gold (GLD) and silver (SLV). I prefer this option, but I still wouldn’t commit much capital to medals because they are non-productive assets that are unlikely to produce returns materially above inflation in the long run.

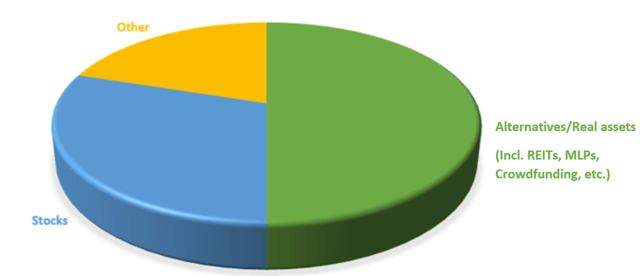

My favorite solution is to invest in defensive, income-producing real assets like apartment communities, industrial warehouses, farmland, and energy pipelines through REITs (VNQ) for the most part, and in some select cases, also through MLPs (AMLP). Today, I have as much as 50% of my portfolio invested in the Top Picks highlighted at High Yield Landlord.

My portfolio allocation (Author)

The reason why I invest so heavily in these specific investments is that they enjoy superior recession resilience, higher inflation protection, and more reasonable valuations.

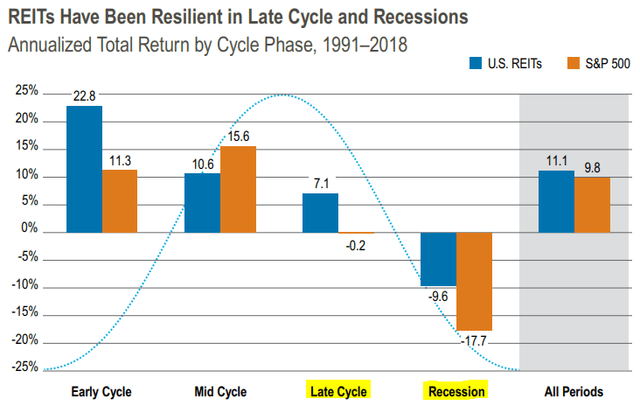

From the below chart, you can see that REITs have historically provided nearly 2x better downside protection than the S&P500 during most recessions. This is actually logical since real estate investments enjoy long leases in most cases, and therefore, the cash flow does not change much during most recessions.

REITs outperform during recessions (Cohen & Steers)

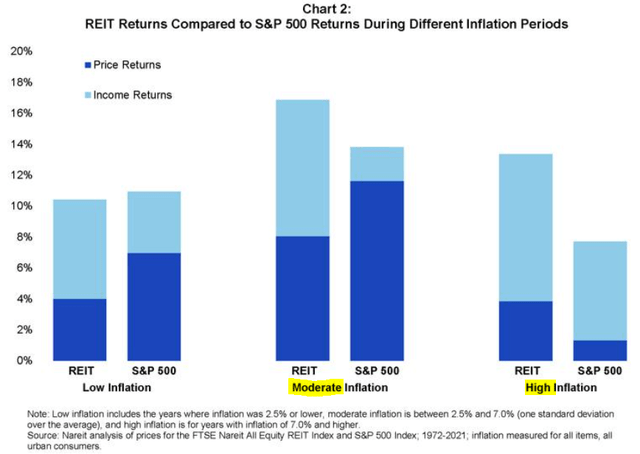

Moreover, they are exceptionally good hedges against accelerating inflation because they use fixed-rate, long-dated debt to finance real assets that are essential and limited in nature. As a result, inflation causes the debt to lose in real value even as its assets grow in value. The impact on the equity is exponential.

REITs outperform during times of high inflation (NAREIT)

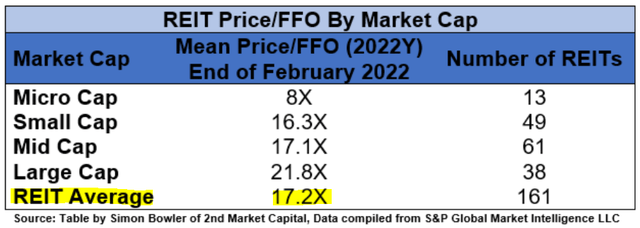

Finally, REITs are today historically cheap, trading at just 17x FFO, which represents a large discount relative to the S&P500’s 26x earnings. The 17x FFO multiple is particularly low when you consider that REIT balance sheets are the strongest they have ever been and cap rates have compressed considerably over the past years. Relative to the value of their underlying properties, REITs are also discounted because real estate has appreciated a lot faster than REIT share prices ever since the beginning of the pandemic.

REITs remain undervalued (Simon Bowler)

This makes me confident that these investments will not only outperform, but also provide better downside protection going forward.

In today’s environment, you need investments that are resilient to both, recessions and inflation. In what follows, we will highlight a few of our Top Picks that we hold in our Core Portfolio at High Yield Landlord.

VICI Properties Inc. (VICI)

VICI is the largest casino REIT in the world. It owns trophy assets like the Caesars Palace and the Venetian on the Las Vegas strip.

Caesars Palace (VICI Properties)

Here you might wonder: how can casinos be considered to be recession-resilient or even inflation-proof? Aren’t they heavily reliant on discretionary spending?

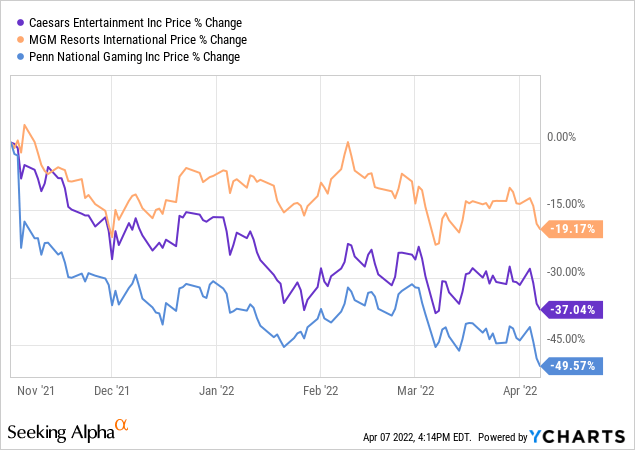

Well, yes the business of operating casinos is quite cyclical and they also suffer from rising labor and other costs. This explains why casino operators like Caesars Entertainment (CZR), MGM Resorts (MGM), and Penn National (PENN) have been dropping lately.

However, the business of being a casino landlord is much more resilient, and VICI has structured its leases in a way to protect it from recessions and inflation.

Its leases are 15+ years long and therefore, it will earn pre-determined rent checks, regardless of what happens to the broader economy. Its tenants may suffer temporarily but because they enjoy nearly 3x rent coverage, they should still make enough money to pay for their rent.

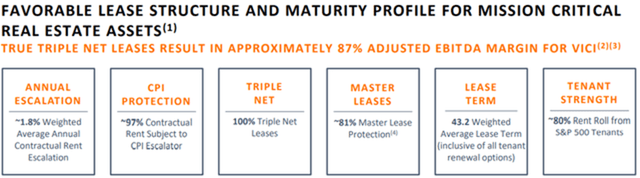

Moreover, VICI is also well-protected against inflation because of three key reasons.

- No property expenses: Firstly, it does not pay for any property expenses or even maintenance. According to its leases, the tenants are responsible for all the expenses.

- Rent hikes and CPI adjustments: Moreover, its rents rise automatically each year. About 40% of its leases have uncapped CPI adjustments, and the rest has fixed rent hikes and capped CPI adjustments. Since VICI doesn’t pay for any property expenses, this is real growth.

- Fixed-rate debt: Finally, VICI has financed about 40% of its properties with fixed-rate, long-dated debt that’s now being inflated away even as the value of its assets continues to rise.

VICI is well protected against inflation (VICI Properties)

In case you are still suspicious of VICI’s recession and inflation hedging benefits, just consider that it hiked its dividend by 11% in 2020 and another 9% in 2021. That’s despite the pandemic, which was the worst possible crisis for casinos.

You would expect such a recession and inflation-resistant investment to be priced at a high valuation in today’s environment, but contrary to all logic, it isn’t.

Currently, VICI is priced at just around 14x FFO and it pays a 5.2% dividend yield. That’s not much to pay for a company that has resilient fundamentals and a clear path to growth in an uncertain world.

We estimate that its fair value is closer to 18x FFO, which would unlock 30% upside from today’s share price. While you wait, you earn a generous and rapidly rising dividend.

We think that the risk-to-reward is very compelling and this is why VICI is one of our largest holdings at High Yield Landlord.

Farmland Partners Inc. (FPI)

If you want a REIT that’s even more resilient to inflation and recessions, then you may want to consider Farmland Partners (FPI). It is the largest farmland REIT by acreage.

Row crop farmland (Farmland Partners)

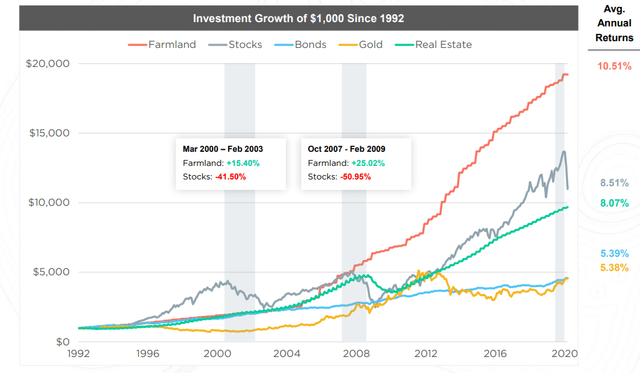

Farmland is highly resilient to recession because of the simple fact that people need to eat, regardless of what happens to the economy. Moreover, since the global population keeps on growing, but its supply of farmland is limited, farmland values remain stable even during most recessions.

Farmland is resilient to recessions (FarmTogether)

Its inflation hedging benefits are also among the best of all asset classes.

This is especially true today, because food prices are surging as a result of Russia’s invasion of Ukraine. The war in Ukraine is causing significant disruption to food supply chains because Ukrainian farmers are busy fighting for their lives and Russia is being cut off from the rest of the world.

Since these countries are two of the largest food exporters, the void needs to be filled by others. It is causing US farmland to experience rapid price appreciation.

Farmland is rising in value (Seeking Alpha)

According to the latest estimate of the Federal Reserve Bank of Chicago, US farmland is up 20% year-over-year, and since FPI is 50% leveraged, this essentially means that its net asset value has grown by ~40%.

FPI’s share price has begun to rise, but we think that this is just the beginning. Right now, it is still priced at a slight discount to net asset value and we expect this discount to turn into a large premium once investors pill in to benefit from FPI’s recession and inflation hedging benefits.

FPI’s closest peer, Gladstone Land (LAND), is actually already priced at a 70% premium to NAV. For FPI to be priced at the same valuation, it would need to nearly double in value. That’s not what we expect, but it just shows that it has significant upside potential going forward.

Bottom Line

At High Yield Landlord, we are repositioning our portfolio in light of the recent events because they are likely to cause even more inflation and potentially also a recession.

We are mainly investing in discounted real assets that are recession and inflation-proof. VICI and FPI are two examples that we own in our 24-position portfolio.

Be the first to comment