Robert Way/iStock Editorial via Getty Images

Investment Thesis

Since our last writeup was published in August 2021, Luckin Coffee Inc. (OTCPK:LKNCY) has successfully addressed all the issues related to the accounting scandal while maintaining positive momentum of its core business, yet its stock has drifted substantially lower, trading at only 2X Price to Sales (P/S) and $0.5 million per store.

We believe that this deep valuation gap vs its peers is not sustainable and a relisting to a main exchange is imminent. Upon a successful relisting, LKNCY’s stock will have at least 3x upside from the current level even assuming a discount for ADR delisting concerns.

Valuation

We have updated LKNCY’s valuation analysis with the latest information. Not surprisingly, it remains significantly undervalued based on both the trading multiple and per store valuation. Its P/S ratio has compressed over 50% during the past 8 months due to higher revenue and a lower share price. Its per store valuation also has dropped by half during the same period as the company has opened more new stores on a net basis while the market capitalization has shrunk.

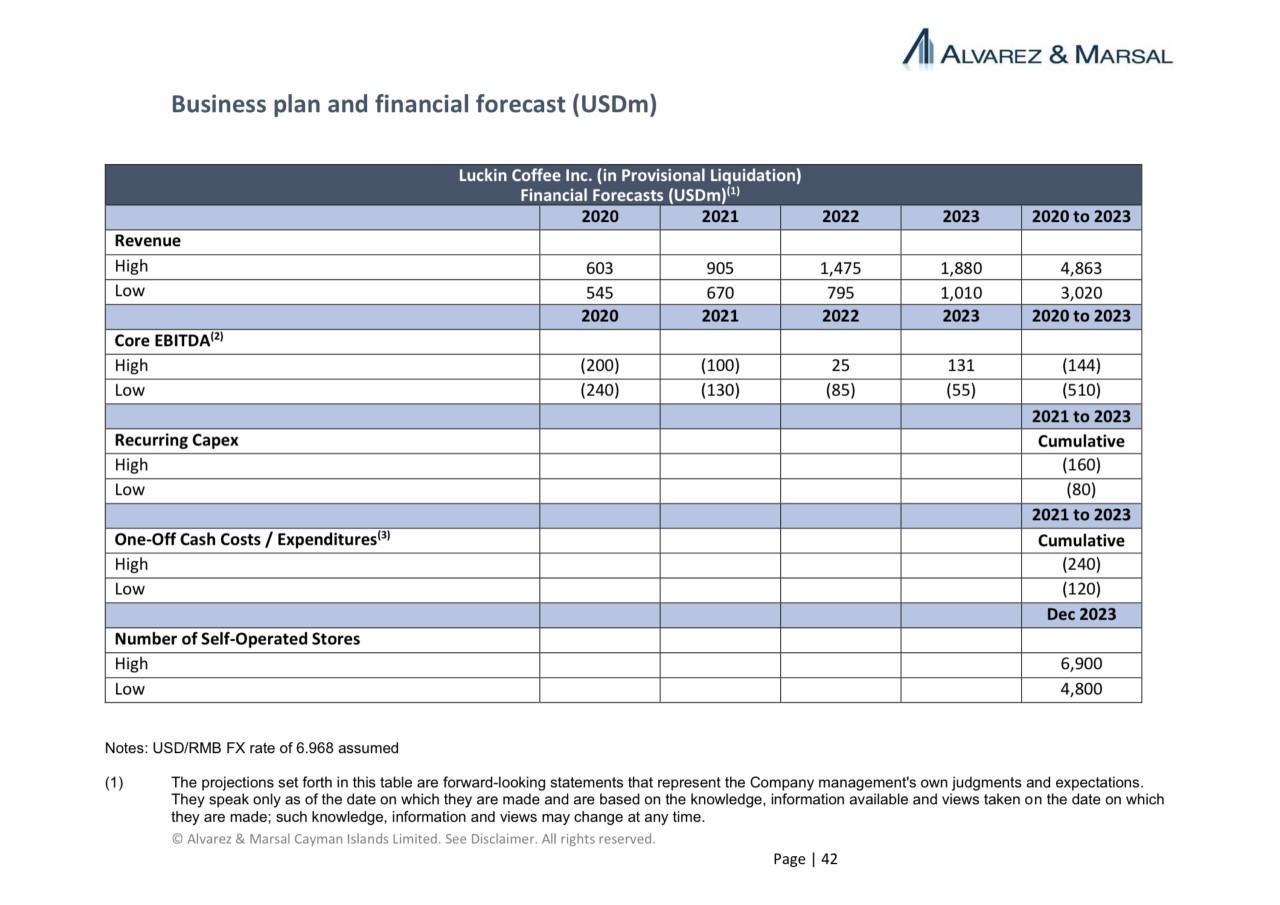

LKNCY released its 2021 unaudited financial results on March 24 th, 2022. Its full year revenue in 2021 was up 97.5% from last year to $1,249.9 million which is also 38.1% higher than the high end of the company’s forecast range for 2021 in the JPLs first report (see table below).

JPLs first report.

Source: JPLs first report.

If we use 2021 actual revenue and a projected growth rate of 63% in the same JPL report, LKNCY would generate a revenue of $2,037.3 million in 2022. As of April 1, 2022, LKNCY’s market capitalization was $2.3 billion, implying a P/S ratio of 2.0x for 2021 and 1.3x for 2022. All of its industry peers trade at a significantly higher P/S multiple (see table below).

Price/Sales Multiple

|

Companies |

Market Cap |

Price/Sales |

|

Starbucks (SBUX) |

$105 billion |

3.6x 2021 Sales 3.2x 2022 Sales |

|

Dutch Bros (BROS) |

$9 billion |

18.9x 2021 Sales 13.2x 2022 Sales |

|

Tim Hortons China (SLCR) |

$2 billion |

17.9x 2021 Sales 7.6x 2022 Sales |

|

Luckin Coffee Inc (OTCPK:LKNCY) |

$2 billion |

2.0x 2021 Sales 1.3x 2022 Sales |

Notes: The trading multiples are as of April 2, 2022 except SLCR which is calculated based on the info of its recent SEC filing.

On per store basis, LKNCY is also undervalued by a very wide margin compared to its publicly traded comparables. It is worth mentioning that the store count of LKNCY has now surpassed SBUX which has over 5,500 stores in China, but valuation per LKNCY store is only one sixth of a SBUX store.

Per Store Valuation

|

Company |

# of Stores* |

Market Cap ($ bn) |

Valuation ($ mm)/Store |

|

Starbucks (SBUX) |

34,317 |

$105 |

$3.1 |

|

Tim Hortons China |

410** |

$1.9 |

$4.6 |

|

Nayuki Tea (2150 HK) |

817 |

$1.0 |

$1.3 |

|

Luckin Coffee (OTCPK:LKNCY)*** |

4397 (only self-operated stores) 6024 (including partnership) |

$2.3 |

$0.5 $0.4 |

*Number of stores in China except Starbucks which is worldwide store count.

**Company store count as of 1Q 2022

***LKNCY store count is as of December 31, 2021

Source: Bloomberg.

Based on these two valuation methods, we are still of the view that the valuation gap will most likely be closed by a relisting onto the main exchange. LKNCY stock price could have at least 3x upside from the current level and we would not be surprised if it rallies 5x given the current price discount against its peers.

Relisting or Delisting

With both legal and restructuring issues well addressed, relisting is the next key catalyst to close LKNCY’s valuation gap with its comparables. We still believe that the company will seek a relisting on one of the primary US exchanges, most likely the NASDAQ, as it would be more difficult and time consuming for a company with a tainted history to get listed in either mainland China or Hong Kong.

Also since the company is currently majority-owned by a private equity firm, it is reasonable to assume that the private equity firm will need to generate a positive IRR during 2022 from this big position (hint: fees). Relisting will certainly help accomplish that goal with huge alpha potential. Another motivation factor that we had mentioned in our writeup last year, is that per an article in the Wall Street Journal, the fund had to put its $2.5 billion new raise on hold after the untimely LKNCY blowout. The eventual turnaround and a successful relisting of LKNCY will regain the credentials the fund needs to relaunch its paused capital raise.

Unfortunately, relisting has recently been overshadowed by the delisting concerns for all Chinese ADRs. We believe the delisting overhang is way overblown and has actually created a good buying opportunity for LKNCY. The reasons are as follows:

1) Solution is on the way. According to a recent Bloomberg report, The China Securities Regulatory Commission (CSRC) and other national regulators are in the process of drafting a framework that could potentially allow the U.S. regulators full access to audit papers of most Chinese ADRs as early as mid-year. Though there are still uncertainties on whether this will eventually materialize, delisting should no longer be a significant overhang for LKNCY anymore.

2) LKNCY is not an intended primary target. LKNCY is currently still an OTC listed company and should not be the primary target of delisting which seems to focus more on the first tier ADRs listed on the NASDAQ and NYSE.

3) LKNCY is more than ready and capable of handling delisting-related auditing compliance to avoid the delisting. Even if the OTC listed Chinese companies were also included in the delisting review, in theory LKNCY should be more than ready and capable of handling the delisting related compliance process and not being delisted given that it just successfully completed a more complicated and rigid court-mandated forensic investigation as a result of its accounting scandal.

4) Forced delisting driven by political tension is possible but a very low probability. Though delisting should be a regulatory process, more recently it is also driven by geopolitical factors. Even if the auditing requirement is met, the US government can still delist a US listed Chinese company for political reasons with a recent example being China Mobile. That said, it will take a full blown bilateral confrontation and subsequent indiscriminate delisting (even OTC listed companies) by the government for LKNCY to be really impacted. That would be a very low probability event.

Accelerated New Store Opening

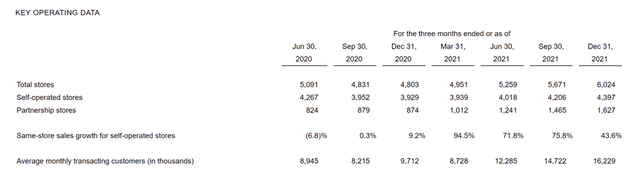

In the press release dated March 24 th, 2022, LKNCY also disclosed the key quarterly operating data till the end of 2021 (see table below).

Source: Company filing.

Further analysis on the data shows the following trends:

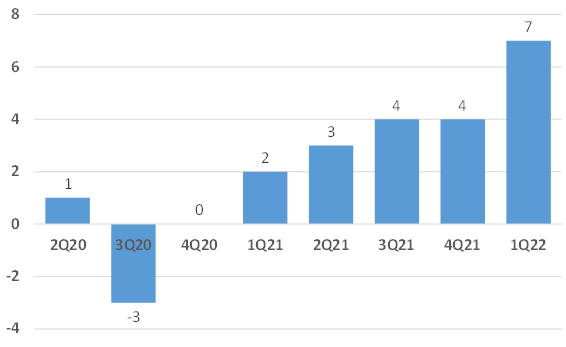

1) The pace of new store opening has accelerated over the last four quarters. Immediately after the accounting scandal, LKNCY suspended new store opening and actually closed some underperforming stores. No net new stores were opened until the first quarter of 2021. The pace of new openings, measured by average new store openings per day, has jumped from 2 per day in 1Q 2021 to 4 per day in 3Q 2021 and further to 7 per day in 1Q2022 (see chart below).

Average New Store Openings per Day

Company filing and wechat channel

Source: Company filing and webchat official channel.

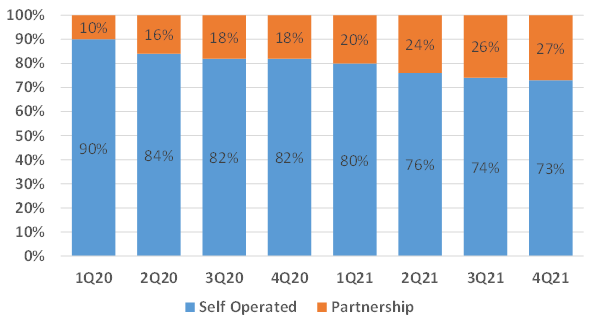

2) Partnership stores have been taking an increasingly higher share in the total store mix. LKNCY has two types of stores, self operated stores and partnership stores (i.e. franchised stores). The partnership stores are typically located outside the first and second tier cities, which used to be LKNCY’s core markets for growth. As the core markets became saturated, the company started to shift its focus to the third and fourth tiers cities via opening franchised stores to minimize the capital outlay. Partnership stores have increased from 10% of the total stores in 1Q 2020 to 27% in 4Q 2021, i.e. almost 3X in two years (see chart below).

Partnership Stores as % of Total Stores

Company filing

Source: Company filing.

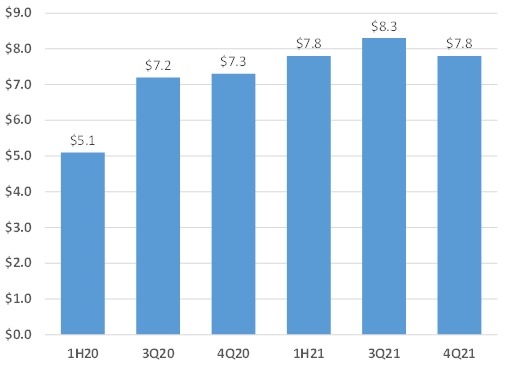

3) Average revenue per transacting customer (ARPTC) has been steadily increasing. We derive the number simply by dividing the quarterly revenue by average monthly transacting customer number*3. This could be a good proxy for average ticket size per customer. During the 18 months from the end of June 2020 to year-end 2021, ARPTC increased 53% from $5.1 to $7.8 (see chart below). We have to admit that this is NOT the most ideal method as the calculation assumes that each transacting customer only made one transaction per month for three months, but it is good enough to check the growth trend.

ARPTC Growth Chart

Company filing and wechat channel

Source: Company filing.

To keep ARPTC of $7.8 (equivalent of 50 Yuan in local currency) in perspective, we have asked our local contact in China to check what 50 Yuan could buy in a Luckin store. It turns out quite a lot, including one of its most popular drinks – coconut latte, one ham cheese croissant, one green tea cheesecake, one tiramisu cake, and one mocha red bean roll (see screenshot below).

What 50 Yuan Can Buy at Luckin Store

Company mobile app

Source: Company mobile app.

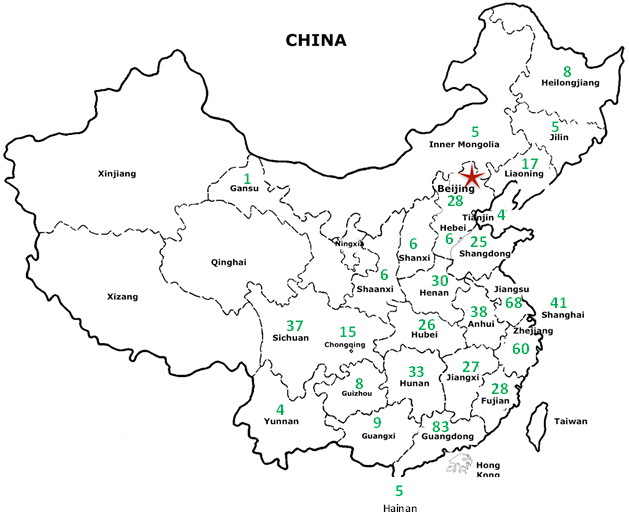

Every week LKNCY releases a new store opening update via its webchat official channel which includes the number and location of the new stores opened during that week. We aggregated all 1Q 2022 weekly new store opening data and then grouped them by province on a map of China (see below). One key observation from this exercise is that during 1Q 2022 LKNCY has opened new stores in almost all the Mainland provinces except four (Xinjiang, Tibet, Qinghai and Ningxia) which is understandable as all four have very unique local drinking habits due to cultural and religious reasons. This “full coverage” approach is consistent with the company’s strategy to focus future growth more towards the third and lower tier cities as the top tier cities are getting saturated and more competitive.

New Stores Opened in 1Q 2022

Company filing and wechat channel

Source: Company wechat official channel.

What the map could not show is the new store breakdown by the city tiers. The cities in China are divided into five tiers based on several factors such as geographic size, GDP, population etc. The tiers are as follows:

1) 4 first tier cities: Beijing, Shanghai, Guangzhou and Shenzhen

2) 15 new first tier cities: Chengdu, Chongqing, Hangzhou, Wuhan, xi’an, Zhengzhou, Qingdao, Changsha, Tianjin, Suzhou, Nanjin, Dongguan, Shenyang, Hefei and Foshan

3) 30 second tier cities

4) 70 third tier cities

5) 90 fourth tier cities, and

6) 128 fifth tier cities

The table below regroups the data by these city tiers and shows that 45% of LKNCY 1Q 2022 new openings are in third or lower tier cities. We would assume that the majority of the stores in those 45% are partnership stores, i.e. shares of the partnership stores in the total mix at the end of 1Q 2022 is highly likely to be higher than 27% at year-end 2021.

LKNCY New Store Openings by Cities

|

Number of New Stores in 1Q 2022 |

% of Total |

|

|

First Tier Cities |

88 |

15% |

|

New First Tier Cities |

127 |

21% |

|

Second Tier Cities |

114 |

19% |

|

Third, Fourth & Fifth Tiers Cities |

264 |

45% |

|

Total |

593 |

100% |

Source: Company wechat official channel.

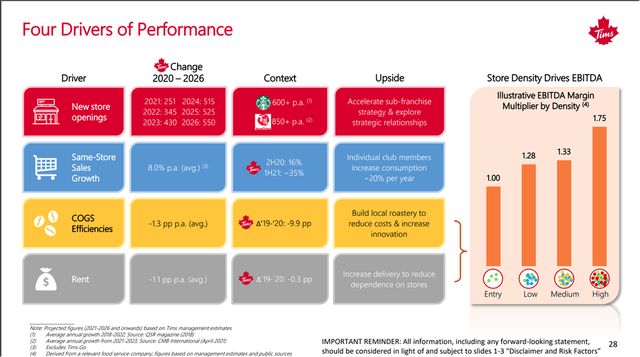

How will the accelerated store opening impact LKNCY’s financials? Tims China (SLCR) shares a very practical framework (slide 28) in its investor presentation: four drivers of performance (see the graph below).

Tims China Performance Drivers Framework

Source: Company filing.

The four drivers are new store openings, same store sales growth, COGS efficiencies and rent, essentially two top line growth drivers and two cost drivers. Using LKNCY 2021 full year financials as an example (see table below), why was the revenue up 97.5% from 2020 while store units “only” increased by 25.4% during the same period? The answer is growth in average monthly transacting customers, i.e. 55.2%. We can simplistically estimate the revenue growth by using the following formula (1+25.4%)*(1+55.2%)-1 =94.6%. The actually growth is 97.5%, close enough. We can also use same stores sales growth for this exercise, but since the disclosed number is for self-operated stores, it may inflate the estimate.

LKNCY 2021 Top Growth Highlights

|

Store Unit YoY Growth |

25.4% |

|

Same Store Sales Growth (Self Operated) |

69.3% |

|

Average Monthly Transacting Customers YoY Growth |

55.2% |

|

Revenue YoY Growth |

97.5% |

Source: Company filing.

We can apply this forecast method to 1Q 2022. LKNCY’s store unit sequential growth is 10% and if we assume that average monthly transacting customers growth is 10%, the same as the 4Q 2021 level, the total revenue could be up 21% sequentially from year-end 2021. And at this pace, the full year revenue could be potentially up at least 80%. Again, this is just a back-of-the-envelope type of estimate of the potential impact of new store openings, should not be a basis for investment decisions.

Key Risks

1) COVID lockdown in China. This is a clear and present risk as this Omicron outbreak has already locked down Shanghai, the largest city in China. This will certainly negatively impact LKNCY’s business, though it should be just a temporary hit. During 1Q 2021, several cities were partially locked down due to the Delta outbreak, and LKNCY’s average monthly transacting customers dropped by 10% sequentially, but immediately bounced back after lockdowns were lifted and were up 40% in 2Q 2021. Another natural mitigation for LKNCY is that a majority of its revenue is from delivery which can still operate during a lockdown as long as delivery platforms such as Meituan remain operational.

2) An economic slowdown or recession in China. If either happens (most likely will), LKNCY will be hurt due to shrinking consumer spending. However, it is highly likely that the Chinese government will have to start a new round of stimulus measures, including interest rate cuts and spending coupons which basically gives cash directly to the consumers, etc. The Shanghai lockdown will only accelerate the release of these stimulus measures. So any negative impact for LKNCY from the upcoming slowdown could be softened by these stimulus measures.

3) China regulatory risk. One of the potential regulatory risks for LKNCY could be data security as the company will handle a lot of the consumer data on a daily basis. Tims China has set an example to address this concern by setting up an independent company to safeguard the data security and to be in compliance of any related regulatory requirement. We do not see this as a big risk for the company’s relisting process.

Conclusion

For LKNCY, the only event we are waiting for at this point is the relisting. The stock is currently deeply undervalued and a successful relisting will be the catalyst to close the valuation gap. The delisting overhang on Chinese ADRs is more noise than reality, especially for LKNCY, which is still OTC listed. The potential upside of LKNCY is at least 3x from the current level.

Be the first to comment