KuntalSaha/iStock Editorial via Getty Images

Published on the Value Lab 5/4/22

Safran (OTCPK:SAFRF) (OTCPK:SAFRY) is an impressive business. With prolific platforms and notable service revenue giving it resilience even during the initial pandemic outbreak, we see the appeal of the business to investors. They have now fully resumed the dividend and the outlook is quite good. However, we still think civil exposures should be avoided in aviation given the range of opportunities on the market. While things are getting better for Safran with the civil recovery, the valuation is quite dear given the risks of future variants and on flight hours, which is their main operational metric. We like the business, but give it a pass at this valuation.

Looking at the FY Results

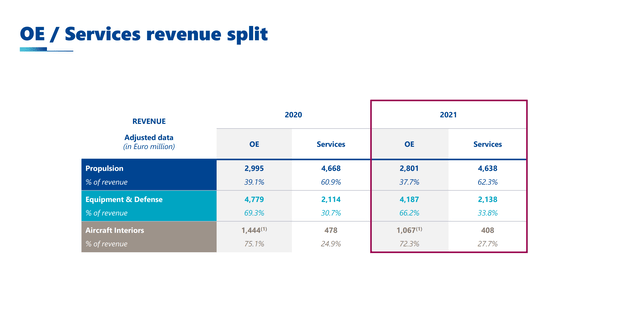

A good place to start is to look at the revenue mix and then within that the OE and service mix to understand the different types of cash flows.

OE and Service Split (Safran FY 2021 Pres)

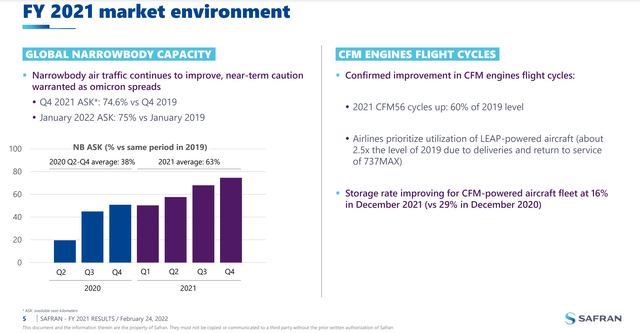

The propulsion segment includes the M88 engines that go into Dassault Aviation (OTCPK:DUAVF) Rafales, and this part of the propulsion segment has contributed to the growth we are seeing in OE as Dassault signs contracts with UAE, Greece, Croatia and Indonesia for lots more jets. Perhaps with military spending increasing in Europe on account of the Ukraine war, more business might come Safran’s way from Dassault. Otherwise, the CFM engines are what’s really driving propulsion. While a recovery in builds for civil aviation has been a help for the OE revenues in this segment, generally depressed investment cycles for new aircraft is affecting OE revenues still and new sales of civil platforms.

Regarding OE, apart from LEAP and Rafale engines, deliveries were down, notably in CFM56, high-thrust engines and helicopter turbines.

Pascal Bantegnie, CFO of Safran

But the beauty of the CFM is that there are over 24k engines in the installed base, so the service revenues here are substantial. While newbuilds for aircraft might not impress, flight hours are more sensitive to a recovering environment and the opening up that’s happening as a consequence of Omicron’s relative mildness compared to previous variants. The propulsion segment proved flat in growth thanks to the resilience of its platforms.

In Equipment and Defense we are seeing some declines. The revenues here are exposed to newbuilds and servicing of the 787. Decline in 787 sales has been an issue for this segment and the idiosyncratic problems with Boeing’s (BA) platform is working against Safran meaningfully here with some OE products for the 787 down over 60% YoY. Other Airbus (OTCPK:EADSF) platforms are selling more consistently, and service, especially of landing gear, is looking good an even comparable to pre-COVID levels as flight activity recovers, but the equipment sales are suffering from the 787 in particular, but also depression across the investment cycle for new aircraft. The defense systems that Safran sells here are resilient, but not contributing growth. Overall, this segment only declined 6%.

The last segment of aircraft interiors is doing badly due to exposure to widebody platforms which have been slower to recover from the pandemic. Moreover, there is also quite a lot of 787 exposure here. While it’s a smaller segment, it declined in revenues by 20%.

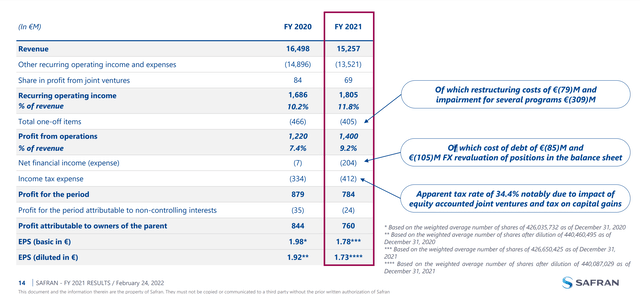

While revenues declined overall, EBITDA grew quite nicely. This is all on the side of cost control, which has been a focus for the company, as well as decreases in headcount associated with tight labor market on the temp worker side. Moreover, strength in service revenue on the CFM platform has been an important margin contributor.

Financial Snapshot (FY 2021 Safran Pres)

With further recoveries expected in the civil segment as we go forward, and also with Dassault contracts meaning a lot of forwarded cash, both from further EBITDA growth driven by higher revenue and favorable mix but also from cash effects, free cash flow should also improve further in the coming quarters.

What’s Next for Safran?

The outlook involves greater commitments, including from Dassault contracts, growing CAPEX by 40%. Moreover, the company expects that the depressed market for newbuilds will recover, with narrowbody sales being a major source of recovery and a source for a lot of profitable business. Currently these sales are at 70% of 2019 levels, and with a recovery to even beyond 2019 levels possible, the financial outlook is very rosy.

The problem is that on current EBITDA, the company is trading at a valuation close to 16x EV/EBITDA. The only way this multiple is attractive is if you take as a given the guidance and assume that EBITDA will grow 30% in 2022 and bring the multiple down to 13x, which is still quite high. When all of this depends on a strong recovery in newbuild jets, and when even in a strong case scenario of beyond a 2019 recovery you are still buying in at a 13x multiple, we worry about how unpredictable developments with the virus could derail that outlook. It seems things are getting better, but a new variant could change things up substantially if it is more severe than prior variants. We simply don’t want to take the risk of civil woes related to a virus which has repeatedly stumped markets while the multiples remain high. The valuation is elevated in our opinion, so we pass, especially when Dassault Aviation is still dirt cheap.

Be the first to comment