Suriyapong Thongsawang

Teekay Tankers (NYSE:TNK) is one of the largest global mid-size tankers operators and it is a company publicly traded on the New York Stock Exchange. In this article, I will provide an overview of the company and I will explain my Buy thesis. If you are particularly interested in tanker companies, you can have a look at my previous article about International Seaways.

Teekay Tankers Overview

Headquartered in Vancouver, Teekay Tankers was spun out of its parent company – Teekay Corporation – almost fifteen years ago, in 2007. Throughout the years, the company was able to grow from a fleet composed of 9 Aframax to the current fleet composed of the following 45 owned and leased vessels:

- 25 Suezmax tankers

- 11 Aframax tankers

- 9 LR2 product tankers

In addition, Teekay Tankers also owns a 50% stake in a VLCC tanker and in 4 additional chartered-in tankers (3 Aframax tankers and 1 LR2 product tanker). Most of the vessels are operated in the spot market enabling Teekay Tankers to benefit from the current macroeconomic and oil-trade environment. The average age of the fleet is 13 years.

Teekay Tankers is owned 31% by the former parent company – Teekay Corporation – that, thanks to Class A and B shares, still has 55% of the voting rights.

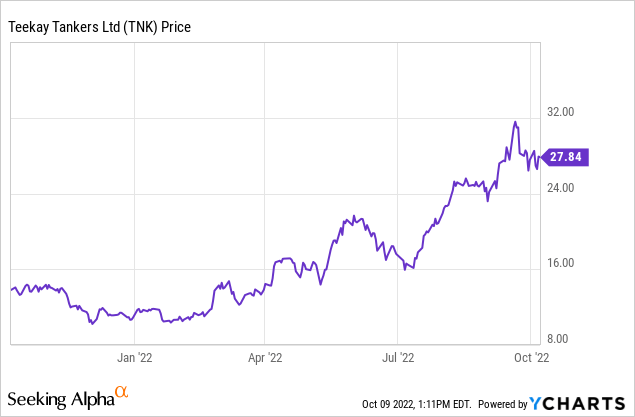

Teekay Tankers Stock Price

The stock is currently trading at $27.84/share, equivalent to a market cap of $943M. Teekay Tankers is up 155% year-to-date and 98% year-on-year with the 52-week maximum being $31.58/share (September 20th, 2022) and the 52-week minimum being $10.22/share (December 3rd, 2021).

Teekay Tankers Financials

During H1-2022, Teekay Tankers generated $416M in revenues, 56% more than the first half of 2021 ($140M) mostly due to record-high spot tanker rates and a lower number of dry dockings.

Total operating expenses pre-write down were $391M, 26% higher than in H1-2021: the largest expense item is represented by the voyage expenses (bunker fuel and port expenses) that were $228M and increased more than proportionally if compared to revenues (+62% year-on-year). The other relevant cost item is the vessel operating expenses which amounted to $78M and were 9% less than H1-2021 due to higher operating efficiency.

Looking at the total operating expenses (i.e.: after write-downs), H1-2022 showed a 2% cost reduction due to the lack of write-downs that had impacted H1-2021 with an $85M write-down relating to three Suezmax, one Aframax and three LR2s.

Overall, net income was positive at $13M versus the $152M loss of H1-2021.

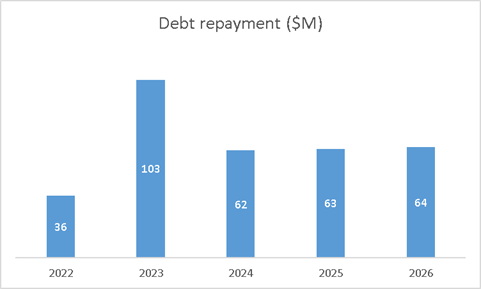

Moving to the cash flow statement, cash generated from operations was $1.8M since H1-2022 was affected by an increase in operating assets that reduced cash generation. Cash from financing activities was negative at -$20M with different initiatives carried out, among which:

- Early repayment of long-term debt for $222M

- Early repayment of short-term debt for $84M

- Sale and leaseback of vessels for a total of $288M

Cash flow generated from investing activities was positive at $31M mostly due to the divestment of an Aframax vessel. Overall, the cash balance at H1-2022 is almost $72M while the net debt is $552M.

Teekay Tankers’ data

Oil Tankers Demand/Supply Dynamics

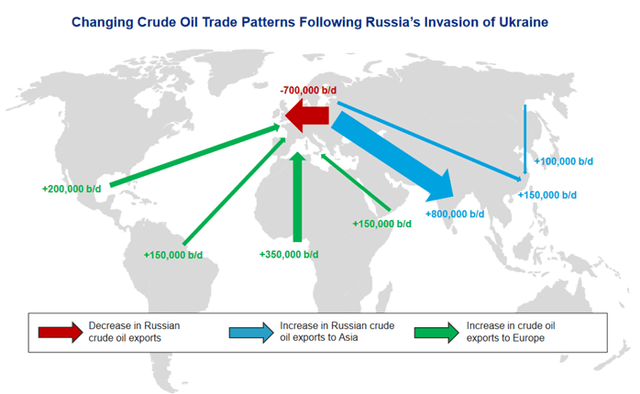

Trade patterns for crude oil have abruptly changed after the Russian invasion of Ukraine with crude oil exported from Russia to Europe that decreased by almost 700,000 barrels per day. This reduction is expected to become even more significant when the EU ban on Russian crude will come into force in December 2022. As one would expect, the 1.8 million barrels per day that were being imported from Russia to the EU will need to be sourced from elsewhere, with all possible locations being at much farther distances from the EU (US, Africa, Middle East, LatAm). At the same time, Russian crude will likely be exported to other countries further away than the EU such as China and India. The direct implication of this disruption is that oil tanker operators, such as Teekay Tankers, will benefit from longer average voyage distances needed to import oil to the EU and to export oil from Russia. Moreover, the rise in average voyage distance is expected to generate a 10% increase in demand for oil tankers since delivery times will increase.

Teekay Tankers Q2-2022 results

However, the growth in oil tankers demand is not likely to be followed by a growth in oil tankers supply. Indeed, tanker orders in H1-2022 were at a historical low with zero new Suezmax and VLCC being ordered since June 2021 and delivery dates for recent new orders are towards the end of 2024 for Suezmax and Aframax while for VLCC the first delivery dates are in 2025. In other words, there is a lag between the increase in demand and the availability of tankers to adjust supply. This scarcity of tankers is likely to drive daily rates up as it is already happening in the last months.

In this context, Teekay Tankers is well positioned to benefit from these medium-term demand/supply dynamics: its 45-vessel fleet operated in the spot market gives Teekay flexibility to capture the highest rates maximizing voyage revenues and, consequently, free cash flows. In addition, the increasing average voyage distance will contribute to reducing the average time spent docked in port without generating income.

Risks

One of the main risks associated with Teekay Tankers (and its business) is represented by the potential oil demand drop. Indeed, lower oil demand implies a reduced need for tankers with supply that could become higher than demand leading to a subsequent decline in daily rates. Teekay Tankers is quite exposed to this risk because it operates its vessels in the spot market without long-term contracts that could, instead, help to capitalize on the current high rates scenario. However, Teekay Tankers has shown a remarkable operating efficiency that should enable the company to safely sail through a lower daily rates scenario: assuming that voyage expenses are variable, Teekay Tankers will be able to maintain a positive EBIT even in the case of a 15% rates reduction.

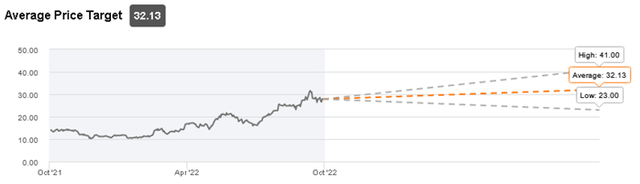

Teekay Tankers’ rating

According to Seeking Alpha’s Wall Street Ratings, six analysts have rated the company in the last 90 days: one analyst issued a “sell” recommendation while the other five analysts issued a “buy” or “strong buy” rating. The average target price is $32.13/share which would represent a 15% upside versus the current price and would also be the 52-week maximum.

Seeking Alpha’s Wall Street Rating

Conclusion

Overall, Teekay Tankers is a profitable company with a strong balance sheet and a sound FCF generation. Its 45-vessel fleet enables the company to benefit – as it is already happening – from more long-haul movements of medium-sized cargo. This trend is likely to be accelerated in December with the EU ban on Russian crude. The current stock price of $27.84/share is a good entry point for investors with a medium-term investment horizon.

Be the first to comment