Vesnaandjic

Investment thesis

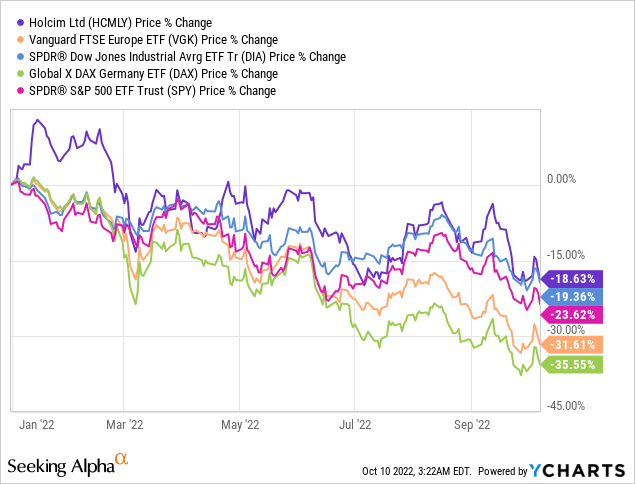

Holcim’s (OTCPK:HCMLF) shares have outperformed YTD and the interim results were firm. Despite being a global leader in the building materials sector, Holcim is not immune to cost pressures from inflation and increasing borrowing costs. Whilst there may have been no real concern raised by management at H1 FY12/2022 earnings, we believe circumstances have changed and rate the shares as a sell.

Quick primer

Holcim is a global leader in building materials and construction solutions and is active in four key business segments: Cement, Aggregates, Ready-Mix Concrete, and Solutions & Products. Solutions & Products is seen as the growth area for the business, selling more value-add materials such as roofing tiles and specialty materials; this area is being built via M&A activities. It has also been optimizing its portfolio, divesting companies primarily in the legacy cement business.

Europe is the key market making up around 30% of total sales, followed closely by North America and the Asia Pacific region with around 20%. Cement remains the key earnings driver, contributing nearly 80% of total group EBIT in FY12/2021.

Construction materials are a sensitive topic for investors with ESG mandates, as 30% (page 34) of the world’s CO2 emissions are linked to building materials.

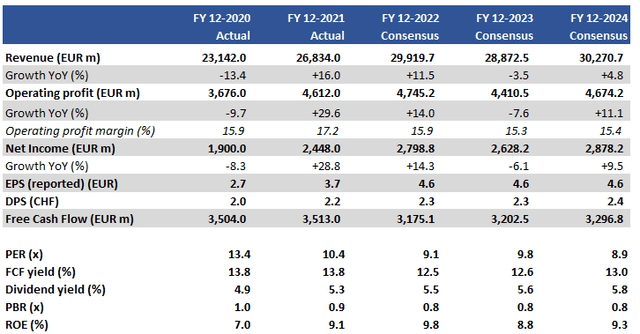

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

Holcim shares have fallen around 18% YTD and have outperformed most of the key global indexes, and have a favorable rating from the sell side. We want to assess whether investors should be long this name given rapidly changing macroeconomic conditions.

A balancing act with inflation

Holcim’s H1 FY12/2022 results announced in July 2022 were firm, and management was confident regarding business prospects saying that demand was broad-based, order books were healthy, and stated that ‘we don’t see a slowdown’ in the conference call (time 17:30 minutes). However, it may not come as a surprise that the call was dominated by comments as well as questions over ‘price’ and ‘inflation’ (mentioned 29 times).

What Holcim demonstrated in H1 FY12/2022 was its high pricing power. In the Cement business, like-for-like sales grew 12.2% YoY driven by a price increase of 12.4%. Essentially, underlying demand was flat which does not look hugely positive. The strategic shift to the Solutions & Products business appears to be working well, with like-for-like sales growing 25% YoY through a mixture of volume and pricing, but the contribution to earnings remains (under 15% of total EBIT) limited due to limited scale. Holcim also demonstrated good management over its energy suppliers, stating that although global power costs increased 40% YoY, compared to increases in market rates it was in an advantageous position with its long-term contracts.

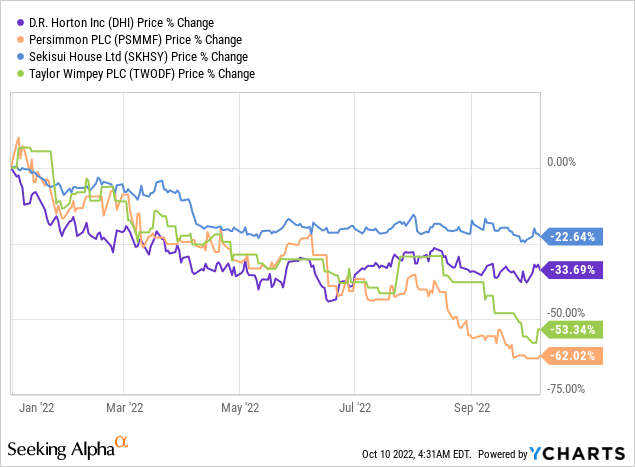

Whilst the order book is said to see limited impact from delays and cancellations, we believe this is regarding non-residential construction based on long-term contracts that are initially insensitive to an economic slowdown. However, we would expect to see a greater influence on residential construction exposure which is more economically sensitive, pointing to areas such as roofing tiles in the strategically important Solutions & Products segment. With increasing borrowing costs and raw material pricing, we expect end-customer demand to start turning down. This is beginning to be reflected by some key listed housebuilders such as D.R. Horton (DHI), Persimmon (OTCPK:PSMMF), Sekisui House (OTCPK:SKHSY), and Taylor Wimpey (OTCPK:TWODF).

Our concern is that in the not-so-distant future, Holcim will be unable to offset a drop in underlying demand with price hikes in order to maintain a sales growth trajectory. When deceleration sets in, we believe a key implication from inflation will affect the shares, namely credit risk.

Credit risk under scrutiny

With global central banks all aiming to curb inflation by tightening monetary policy, access to cheap funding is significantly curtailed, which in turn lowers the demand for housing and construction. Another negative factor relates to Holcim and its credit profile. As an indication of increased market awareness of the business environment becoming less conducive, the market price for its credit default swaps has more than doubled since the beginning of January 2022.

Holcim default 5-year CDS price chart (in orange), also showing inverse equity share price (in purple)

Holcim default 5-year CDS price chart, also showing inverse equity share price (in purple) (Refinitiv)

There are a few caveats to discuss. Firstly, CDS prices are what market traders are quoting and do not strictly reflect the real current credit profile of Holcim. Secondly, Holcim is not alone in seeing CDS prices spike under current market conditions and is by no means an outlier. However, what the movement in CDS prices illustrates to us is that the construction cycle (be it residential or non-residential) is about to see a major slowdown in growth, which in turn will have a negative influence on how the sector will service its credit as well as seeing its fundamentals weaken as customers becoming less active. After two decades of loose monetary policy, the construction sector is about to experience some major bumps on the road.

How is Holcim positioned for such an eventuality? The company is said to have secured liquidity of more than CHF9 billion/USD9 billion in cash and unused committed credit line, there do not appear to be major issues in terms of immediate funding (net financial debt stood at CHF13.3 billion in H1 FY12/2022). However, plans for future M&A activity, increasing financing costs for future bond issuance, higher working capital requirements with inflating inventory, and a higher chance of customer bad debts will all need to be considered, all acting as a reason to discount the shares.

Valuation

Current consensus forecasts (see Key financials table above) appear to be pricing in a slightly negative growth profile into FY12/2023 given macro conditions, followed by a recovery from FY12/2024. Given no real indication of when macro conditions will start to improve, we believe the outlook may be too positive and too dependent on M&A.

We do not believe there is any need to have exposure to the building materials sector. Given the current credit risk profile, we rate Holcim as a sell.

Risks

Upside risk comes from a change in market appetite towards non-defensive sectors such as materials. This could come from price inflation coming under greater control, and borrowing costs beginning to normalize. Announcement of major government infrastructure projects could allow Holcim to navigate a tricky economic environment more favorably than its peers. A growing shareholder register of activist investors may result in more positive governance.

Downside risk comes from more institutional investors tactically exiting the materials sector due to concerns over price inflation. A slowdown in M&A activity will dampen growth prospects.

Conclusion

Holcim’s shares have outperformed YTD and the interim results were firm. However, we do not see the company being immune from inflation, be it on the impact on costs, demand, or its own creditworthiness. With major challenges into H2 FY12/2022 and for the foreseeable future, we see no reason to be investing in a building materials business. We rate the shares as a sell.

Be the first to comment