shaunl/iStock via Getty Images

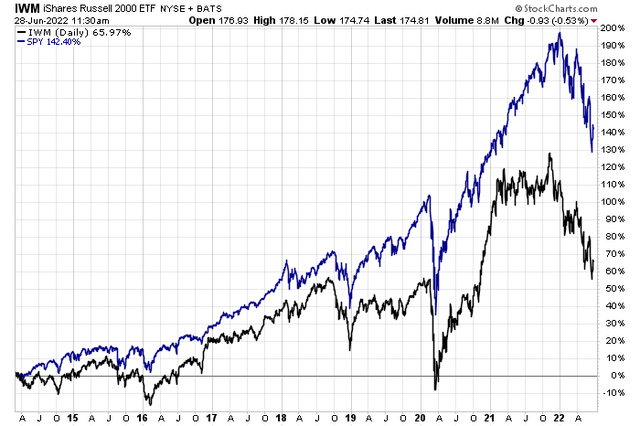

Going from the top-down, U.S. small-cap stocks have been a severely underperforming group for several years. Since early 2014, the iShares Russell 2000 ETF (IWM) is up just 66% (total return) while the S&P 500 is up 142% (dividends included). Negative alpha among the smallest of stocks has been sharp since early 2021, too. That’s when the peak in trading speculation gripped markets.

IWM put in a bearish false breakout as the S&P 500 rose last year. By early this year, small-caps were already at 52-week lows. Today, the fund is at the same performance level as about 18 months ago.

Small-Caps’ Big Underperformance

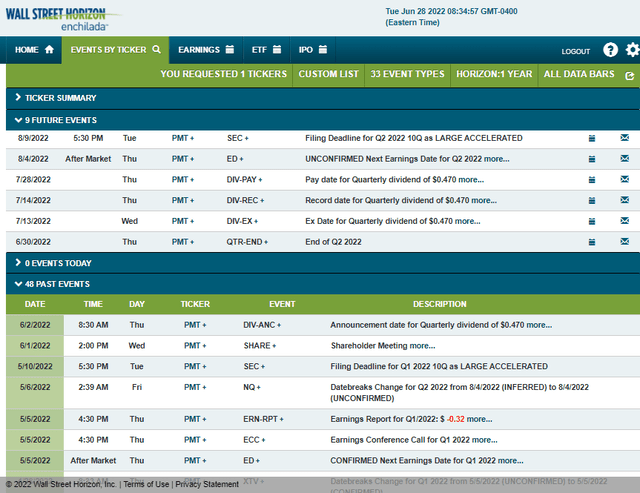

PennyMac Mortgage Investment Trust (NYSE:PMT) is a $1.3 billion small-cap real estate investment trust (REIT), according to Fidelity Investments. It primarily invests in domestic mortgage-related assets. PMT sports a whopping 13.4% dividend yield, according to The Wall Street Journal. Investors can expect the next ex-dividend date on July 13, 2022, so be sure to own the stock before and through the ex-date to be eligible for that payout.

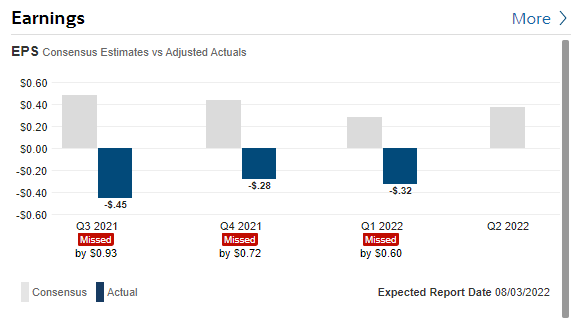

The California-based REIT in the Financials sector has a poor earnings history. The three most recent quarterly results were worse than analysts’ expectations. This is an important trend heading into its Q2 2022 unconfirmed earnings date of Thursday, August 4 AMC, according to data provider Wall Street Horizon.

PennyMac Earnings History: A String of Misses

Fidelity Investments

PennyMac: Corporate Event Calendar

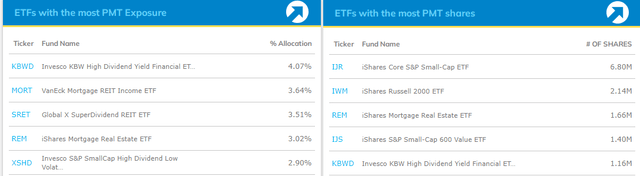

PMT is a common holding in several financials and high-dividend ETFs. It’s also found in REIT funds. A small-cap value stock, PMT shares are a holding in both IWM and IJS, according to ETF.com.

PennyMac’s ETF Presence

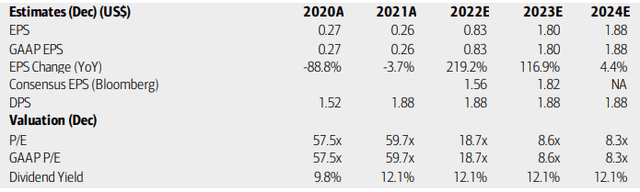

Digging into the valuation and fundamentals, the company has been challenged by higher funding costs due to rising interest rates. Moreover, a flatter yield curve presents problems regarding investment spreads for the REIT. Overall, the capital markets are much tougher today versus a year ago, which has contributed to the underperformance of late. The most recent quarterly results showed a book value per share that was down 6% along with a GAAP EPS miss. On the upside, the company increased its forward four-quarter profit outlook, according to Bank of America Global Research.

BofA’s EPS forecast shows profitability should be on the rise through 2024. As a result, GAAP earnings should turn positive, and its P/E ratio would turn attractive if shares continue to trade near $14. The dividend yield is expected to continue running remarkably high at 12%+ and that is obviously a major reason many investors own PMT shares.

PennyMac: Earnings, Valuation, and Dividend Forecasts

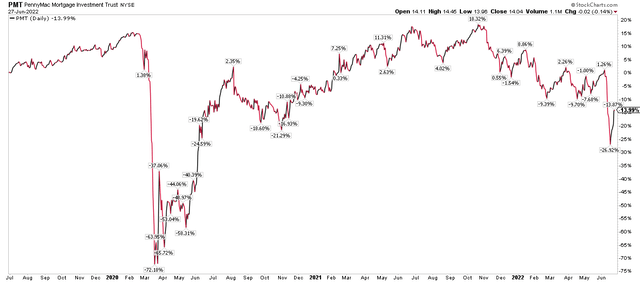

While profitability improves in the quarters ahead and the dividend remains robust, the chart suggests investors must tread cautiously. Consider that PMT shares, even with dividends included, are down over the last three years. The stock’s absolute and relative performances are poor. While being paid to wait for shares to climb, PMT has been a significant opportunity cost compared to the broad market.

PMT Performance Chart (Dividends Included): Negative Return From Three Years Ago

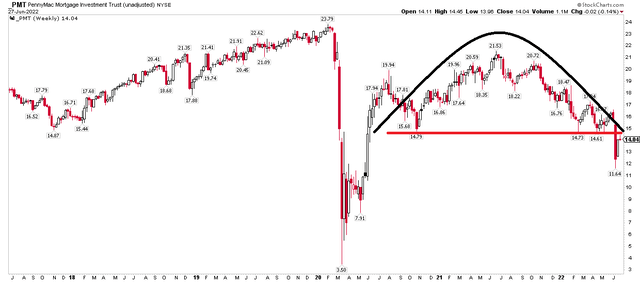

The Technical Take

And that’s born out in the technical chart, which does not include dividends. The stock failed to make a new high last year as the S&P 500, REIT index, and financial sector ETF all climbed above their early 2020 highs. The chart below shows a clear bearish rounded top and a break below a key support line just under $15. If PMT climbs above that level, a bullish thesis can be made from a technical perspective. I would avoid it under $15, however.

PMT Technical Chart: Bearish Rounded Top, Shares Break Below $15 Support

The Bottom Line

PMT is a dividend favorite. Its 13% yield is no doubt attractive, but investors should consider its earnings history. The profitability outlook is optimistic, but the technical picture is bearish right now. I’d be a buyer to collect that juicy dividend only if the stock can hold above $15.

Be the first to comment