Keystone/Hulton Archive via Getty Images

Thesis

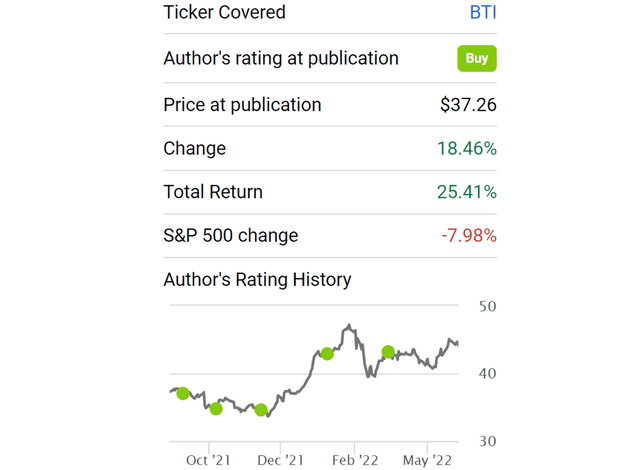

I’ve been a long-time bull for British American Tobacco (NYSE:BTI). I published my first bullish thesis on it back in August 2021 arguing for its very attractive and asymmetric risk/return profile. Since then, indeed the thesis has worked out nicely. Its price at publication was $37.26 and has delivered a total return of more the 25.4%, against the backdrop of an almost 8% loss in the S&P 500 index.

Some readers asked if the bull thesis needs to be changed given the sizable price appreciation. And my answer is a definite no. This article will reiterate my bull thesis based on the following considerations

- Its new category has drastically accelerated and is well-positioned to drive growth for years to come

- Its strong cash generation enables it to deleverage its balance sheet and engage in sizable share repurchases of about $2.7 billion at the same time.

- Its valuation is still very attractive both in absolute terms and also in relative terms when compared to peers. The above share repurchases at such accretive valuations will be potent to boost total shareholder returns.

- Finally, BTI also serves as an exemplary case study to illustrate our patience test, a test that has served us well in the past as long-term investors. And we will start illustrating this test immediately below.

Seeking Alpha

BTI and our trick of patience

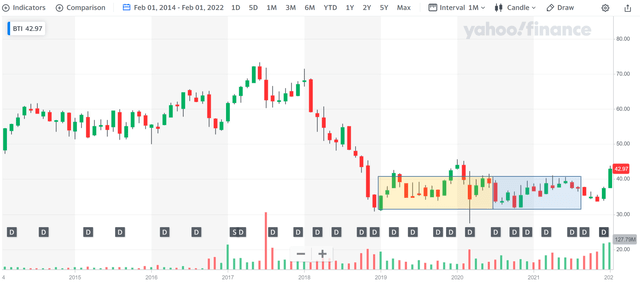

As long-term investors, we have been served well by a “trick of patience”. And we thought BTI is a good example to share our reflections on this “trick” or in essence, the role of patience and a good understanding of business fundamentals. BTI first caught our attention in 2018 when it lost almost half of its stock price as you can see from the chart below. However, we did not react immediately. We researched and waited – for more than a year (as shown in the yellow window in the chart)! And finally, we started accumulating shares in the second half of 2020 (the blue window shown in the chart) after we feel very confident about the fundamentals.

At turbulent times like this, we feel urged to share this trick with so many knives falling lately. It is OK to catch a falling knife, but it is desirable to catch as few as possible and be sure that we only catch the good ones. The so-called consolidation window (the yellow and blue windows shown below) is a good test. I love seeing good stocks caught in that window. Ideally, we want to see it stuck here for at least a year.

We want to emphasize that this is not “chart-reading”, and we have no ability to read technical charts. We are not suggesting you buy every stock that has been trapped in a consolidation window. We are suggesting taking your time – taking advantage of the time offered by this long window – to understand the fundamentals while being opportunistic.

Now we will move onto the fundamentals of BTI.

Yahoo Finance

New category acceleration

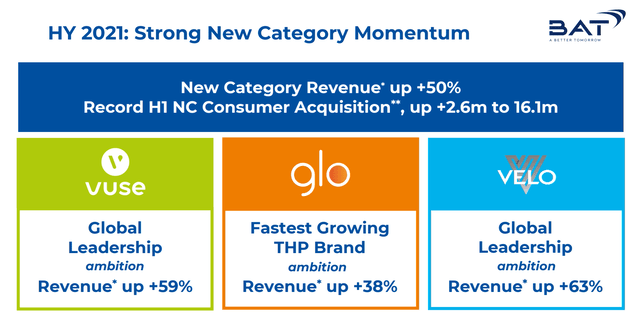

One of the most crucial fundamental aspects to me is its New Category. For readers new to this stock, its New Category products mainly include vapor products, tobacco heating goods, and oral nicotine pouches. And I am seeing BTI turning a corner in recent quarters. First, management is/has been acutely aware of the health issues and secular decline of its traditional products. Thus, they have been very actively encouraging consumers to their new products with lower health impacts. During its last interim report, the company announced drastic acceleration in its New Category business. That new category segment reported revenue growth of over 50% last year and also strong traction with consumers. BTI added 2.6 million consumers in H1 2021 alone to its new category products, its highest addition ever. The segment is not profitable yet. But it’s the first time that the segment has reported reduced losses. As CEO Jack Bowles commented (the emphases were added by me),

I am delighted that our established consumer-centric multi-category strategy has delivered excellent growth in the first half of 2021. New Category revenue was up 40% at current rates and 50% at constant rates. We added 2.6 million New Category consumers in H1, our highest ever increase, to reach 16.1 million consumers of our non-combustible products. This was driven by our powerful global brands, Vuse, glo and Velo, underpinned by strong innovation. We are leveraging our existing strengths and new digital capabilities in the business, and towards consumers.

BTI earnings report

Deleveraging and shareholder returns

Thanks to its strong cash generation, after aggressively investing in its new products, BTI still has plenty of cash to deleverage its balance sheet and reward shareholders. It decreased its long-term debt by over $6 billion last year, and it also announced a plan to repurchase roughly $2.7 billion worth of shares. As its Group Finance & Transformation Director Tadeu Marroco commented (abridged and emphasis added by me)

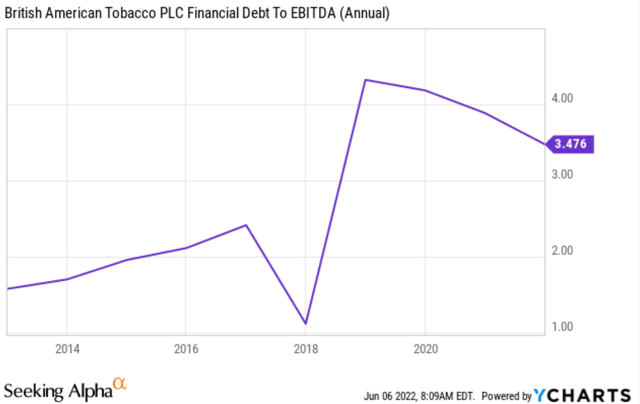

Together with the value from combustibles this has enabled further investments to accelerate New Category revenue growth in H1. We remain confident in reducing the losses from New Categories by the full year with a clear pathway to profitability by 2025. Cash generation remains a top priority as we continue to invest in the business and deleverage the balance sheet. We are on track to reach around three times adjusted net debt to adjusted EBITDA by year-end.

To anchor the above comments under a broader background, the following chart shows its debt to EBITDA ratios over the past decade. As you can see, the leverage peaked around 2019 above 4x. And it then has been in decline steadily. Currently, it is at 3.47x, and I share management’s optimism that it will reach 3x by the end of the year given its robust cash flow.

Seeking Alpha

Valuation and potential returns

At a single-digit FW PE, BTI is very attractively valued both in absolute and relative terms given its quality business and growth potential. In absolute terms, a 10x PE implies terminally stagnating businesses. Yet, BTI has plenty of growth potential thanks to its new category products.

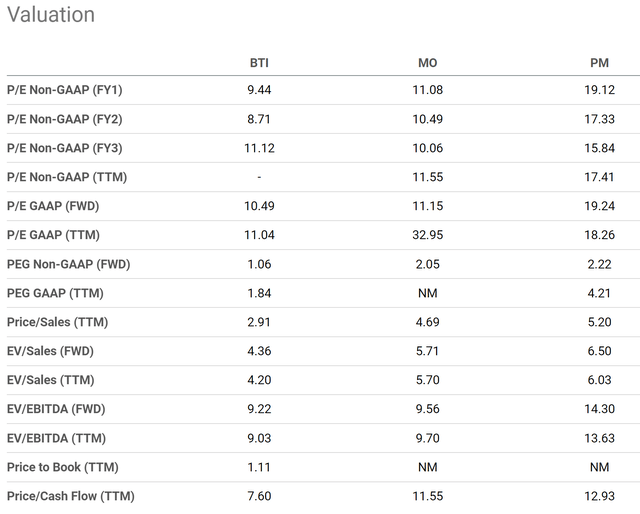

In relative terms, let’s see compared to its peers like Altria (MO) and Philip Morris (PM). As you can see, despite the variance across different metrics, BTI’s valuation is about the same as Altria but at a substantial discount from PM. Its FY1 PE of 9.44x is about 14% lower than MO and less than half of PM. When adjusted for its relatively high leverage, the picture does not change too much. In terms of FW EV/EBITDA ratio, it’s valued at 9.22x, about 4% lower than MO and almost 1/3 below PM.

Given the valuation discount and the potential with its new category products, I am still seeing BTI as an attractive investment with very asymmetric risk/reward profiles. I am projecting almost 100% total return in the next 5 years, or a 15% annualized return as detailed in my earlier article.

Seeking Alpha

Final thoughts and risks

This article reiterates my bull thesis on BTI after a 25%+ return since I first wrote about it. I am still seeing BTI as an attractive investment with very asymmetric risk/reward profiles, with 100% total return potential in the next 5 years or so. Key catalysts include the dramatic acceleration of its new category, strong cash to support further brand building, sizable share repurchases at accretive valuation, and expansion of valuation multiples.

Lastly, in turbulent market times like what we are going through now, we feel urged to share our reflection on our “patient test”. Take advantage of the time offered by the consolidation window typically observed after falling knives to understand the fundamentals and be opportunistic.

Finally, risks. The long-term risk is the secular decline of its traditional combustible products. BTI has been demonstrating the pricing power to keep profits stable even when its volume decreases. It’s unclear how long this business model can work. In the shorter term, as a global business, BTI is exposed to foreign currency exchange risks. And currently, it is seeing a substantial risk on this front as its Group Finance & Transformation Director Tadeu Marroco commented (abridged and emphasis added by me):

The FX headwind on both group and new category revenue was significant at around 9%. Based on current exchange rates, we would expect a headwind to revenue of around 8% on a full year basis. Our portfolio transformation is accelerating. 15% of our revenue in developed markets is in non-combustibles.

Be the first to comment