mattjeacock/iStock via Getty Images

Comstock Resources (NYSE:CRK) should be able to return a significant amount of capital to shareholders over the next year or two. Comstock is projected to generate over $2 billion in positive cash flow between H2 2022 and 2023 at current strip prices. Comstock’s 6.75% notes due 2029 aren’t callable until March 2024, so Comstock has the ability to return close to $1 billion to shareholders by then, while still having enough cash to then redeem those notes in March 2024.

The 2023 natural gas strip has improved by $0.85 since I looked at Comstock in May, boosting free cash flow expectations, since its 2023 collars have very high (close to $10) ceilings. Comstock also noted that it expects to reinstate its dividend in Q4 2022, confirming part of what it will use its free cash flow for.

The reduction in Nord Stream 1 gas flows to Europe over the last couple of months shows the importance of alternate gas supplies and should support further development of LNG export terminals near Comstock’s acreage. I’d estimate Comstock’s value at $21 per share in a long-term (after 2023) $4.00 NYMEX gas environment, and $25 per share with long-term $4.50 NYMEX gas.

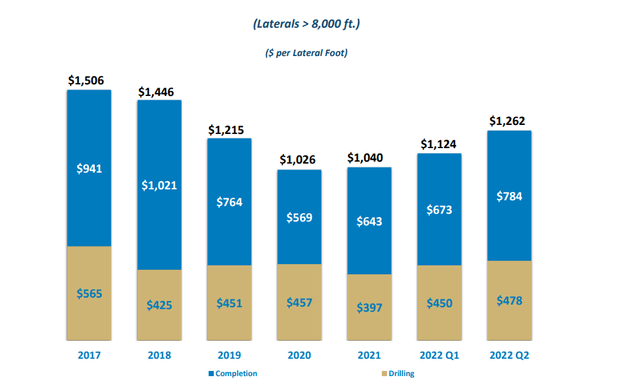

Effect Of Higher D&C Costs

Comstock noted that its D&C cost increased to $1,262 per lateral foot in Q2 2022. This was a 12% increase compared to Q1 2022 and a 21% increase compared to its 2022 average.

Comstock’s D&C Costs (comstockresources.com)

Although this is a significant increase, Comstock still sees a large net benefit from higher natural gas prices. A 20% increase in D&C costs compared to 2021 has the approximately same impact on Comstock’s unhedged cash flow as a $0.30 per Mcf decrease in natural gas prices. Meanwhile, H2 2022 natural gas prices are above $4 higher than H2 2021 levels and 2023 strip is still quite high (around $1.75 higher than H2 2021 levels)

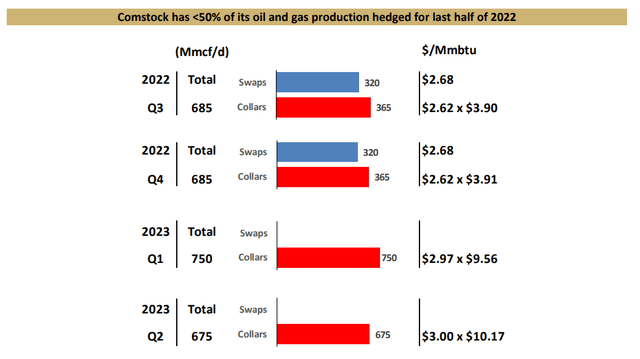

Notes On Hedges

Comstock is on track to incur massive realized hedging losses in H2 2022, as it is close to 50% hedged for H2 2022. Based on current strip, NYMEX gas prices may average around $8.90 during H2 2022. This would result in Comstock’s realized hedging losses adding up to an estimated $702 million for H2 2022. Comstock already realized $375 million in hedging losses in H1 2022, so this would push its total realized hedging losses for 2022 up to around $1.077 billion.

Comstock’s Hedges (comstockresources.com)

For 2023, Comstock’s hedging situation improves considerably. It still has hedges covering around 50% of its natural gas production for H1 2023. These hedges are 100% collars though, with an average of ceiling of $9.56 for Q1 2023 and $10.17 for Q2 2023. Thus, at current strip prices, these hedges have very close to neutral value, with only the January 2023 contract (at $9.60) marginally above the collar ceiling.

2023 Outlook

I have modeled potential 2023 results for Comstock below based on current strip prices (approximately $6.50 NYMEX gas). I have assumed that Comstock grows production in the low single digits for 2023 with a $1.1 billion capex budget (including leasing capex).

I’ve also assumed that Comstock’s natural gas differentials widen slightly to negative $0.35 to NYMEX.

This results in a projection that Comstock can generate $3.292 billion in revenues after hedges.

|

Type |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Revenue ($ Million) |

|

Oil (Barrels) |

80,000 |

$82.00 |

$7 |

|

Natural Gas [MCF] |

534,245,000 |

$6.15 |

$3,286 |

|

Hedge Value |

-$1 |

||

|

Total |

$3,292 |

Comstock is projected to generate $1.629 billion in positive cash flow in 2023 at current strip prices before the impact of cash taxes. If Comstock’s tax rates for 2023 are similar to its 2022 guidance, it may end up with around $1.5 billion in positive cash flow after cash taxes.

|

$ Million |

|

|

Lease Operating Expense |

$123 |

|

Production and Other Taxes |

$92 |

|

Gathering and Transportation |

$160 |

|

Cash G&A |

$30 |

|

Cash Interest |

$140 |

|

Series B Preferred Dividends |

$18 |

|

CapEx and Leasing |

$1,100 |

|

Total Expenses |

$1,663 |

This would push Comstock’s net debt down to around $200 million at the end of 2023, excluding further spending on acquisitions or return of capital to shareholders.

Return Of Capital

By the end of 2023 Comstock should have close to $2 billion in cash on hand and no credit facility debt. This doesn’t include the effect of any spending on acquisitions or the return of capital to shareholders.

Comstock can redeem its 6.75% notes due 2029 starting in March 2024 for approximately $1.265 billion. After factoring in the free cash flow, it could generate in early 2024, Comstock appears capable of returning $1 billion in capital to shareholders (between now and Q1 2024) and still have enough cash on hand to redeem its 2029 notes. Comstock mentioned that it expects to reinstate a shareholder dividend starting in Q4 2022.

Notes On Valuation

I estimate Comstock’s value at approximately $21 per share at long-term (after 2023) $4.00 NYMEX gas and approximately $25 per share at long-term $4.50 NYMEX gas.

My expectations of longer-term natural gas prices have increased due to the issues with Nord Stream 1 gas deliveries to Europe. The inability to rely on those deliveries going forward will support further development of LNG export terminals in the United States. Producers appear to be continuing to exercise reasonable capital discipline, and combined with increasing export capacity, this should support decent natural gas prices.

Conclusion

Comstock appears capable of generating over $2 billion in positive cash flow between H2 2022 and the end of 2023. Starting in 2023, Comstock’s hedges are no longer a significant negative factor.

This could allow it to return around $1 billion to shareholders over the next year and a bit, while also allowing it to redeem its 6.75% notes due 2029 starting in March 2024.

Comstock is well positioned to service growing LNG export demand through its Haynesville Shale acreage. It previously had some challenges with high debt levels, but at current strip prices it is deleveraging rapidly.

Be the first to comment